Buying a resale flat gives you some key advantages.

First, you are likely to get a better location at a relatively lower cost. And second, Resale flats are ‘ready-to-shift’, which saves your money on rents and EMIs.

But, while buying a resale flat a more careful approach is required. Otherwise, it becomes impossible to avoid the complexities later.

This ‘careful approach’ is nothing but to consider some important things and proven resale flat buying tips. This includes considering Property Valuation, Costs Involved, Approvals & Documentation, ROI, and so on.

Every factor has its own significance in deciding whether the resale property is good enough to buy. So, let’s understand the 10 Most Important Things to consider before buying A Resale Home. And check out some of the best resale flat buying tips.

Page Contents

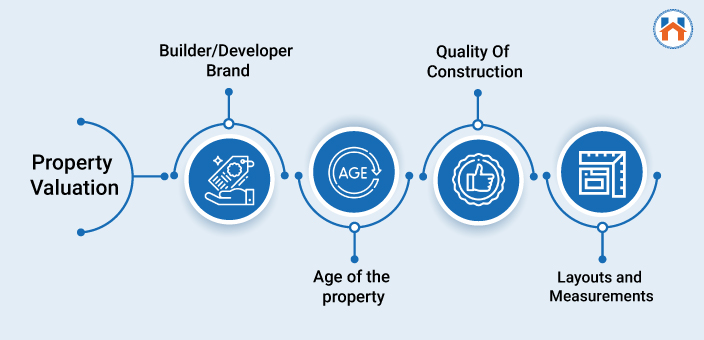

1. Property Valuation:

Property valuation is a great tool to determine the present-day value of the property.

By this, you get a clear idea of whether a resale property is a good investment or not.

The simplest way for the property valuations is the ‘Comparable Sales Method’, in which you can determine the value of a resale house by analyzing the prices of the surrounding properties. The main factors for comparison are the size, features, and location.

You can also take assistance from a Real Estate Expert if you want to offload the burden.

While doing Property valuation for the resale flat consider the following points.

Builder/Developer Brand:

It is always prudent to check the record of the builder/developer before buying the resale flat. For this, you can check the developer’s other projects and the project quality delivered.

The simple way to find the information is by visiting their website and checking out different projects. You can also check important things such as the RERA registration and their compliance with the legal processes.

Remember, an ideal developer has a good track record and a trusted reputation in the real estate industry.

Age of the property:

Buying older property should be avoided. Older properties are often associated with refurbishing and redevelopment and keep adding the costs. Generally, the average age of the residential apartment is 50-60 years.

So considering this, for a better investment deal, you should buy a property which is 1-5 years old and a maximum of 10 years old.

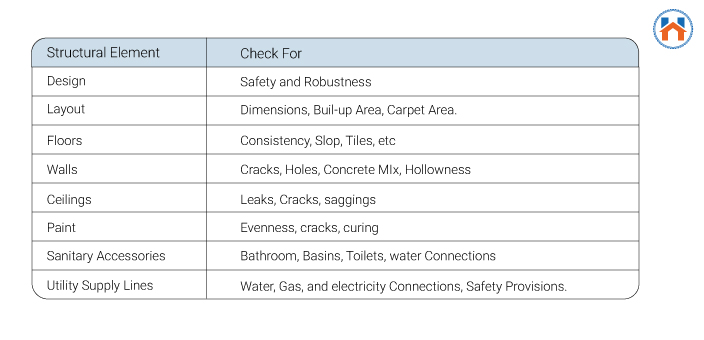

Quality Of Construction:

You can evaluate the quality of construction by checking the plasters, paints, ceilings, tiles installation, water connections, etc. Since there could be many things to check, following a resale property checklist is always a better option.

So, the resale property checklist includes.

- Start by checking the structural designs. consider efficacy and safety as the main parameters.

- Check the room dimensions as mentioned in the layout. Check the thickness of the wall as per the layout in the agreement. Test its hollowness and concrete mix by knocking and pricking.

- Check the paint for its evenness, cracks, and curing.

- Check the sanitary accessories such as basins, bathrooms, and toilets. Test the bathroom fittings for water flow and speed.

- Check the utility supply lines (Such as Gas, electricity, and water) and their locations.

- Check the door and window alignment.

Layouts and Measurements:

Layouts and Measurements:

Have a detailed housing floor plan from the seller. This layout gives you the essence of the property, its outlook, and the overall design arrangement of the house.

Once you get the detailed housing plan, check for the various parameters such as built-up area, carpet area, wall thickness, door and windows positions, etc.

The best housing layout is one that gives you an efficient and seamless flow.

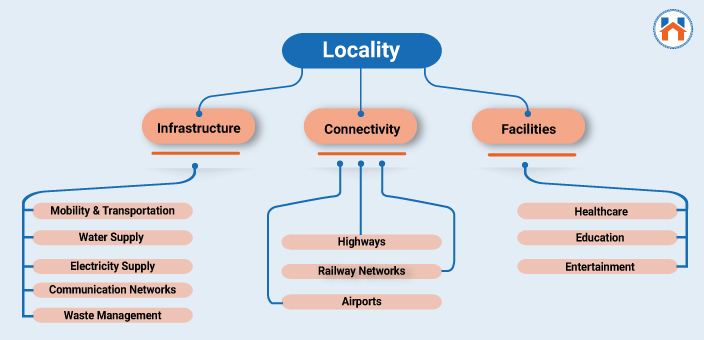

2. Locality

The locality has a great impact on the total ROI and price appreciation of the property.

You can check the performance of the locality on various factors such as Ease of Living, Economic Ability, Sustainability, Education, Healthcare, and Livelihood opportunities. One of the best sources to check the performance of the city is to check the official indexes declared by the government.

You can check the indexes and ranking of the various Indian cities here: Best Cities For Real Estate Investment In India

Let’s check out the most important factors while choosing the best locality for real estate investment.

Infrastructure Development:

Before buying a resale home check the infrastructure development in the region. Different factors such as transportation, energy, roads, water supply, government services collectively decide the quality of living in the locality.

Connectivity:

Connection is the prime growth driver in the locality. The robust road, rail, and air transportation will facilitate the ease of living for the residents.

So, while buying a resale flat check the available connectivity mediums to your workplace, schools, healthcare, entertainment facilities.

The reliable mediums of transportation will allow you to save time and money to access the life-essential services.

Facilities:

The essential facilities such as Healthcare, Education, Entertainment, and employment opportunities should be easily accessible from the property location.

Before making a buying decision, take into consideration the proximity to the essential services such as Healthcare Services Schools & Colleges, entertainment hubs and parks, and Industrial Hubs.

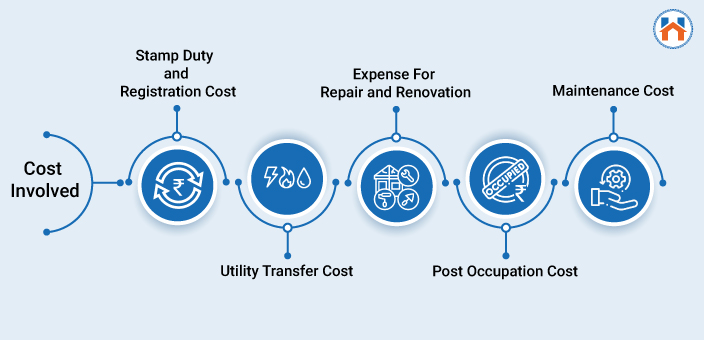

3. Cost Involved

Besides the actual selling price, there are other possible costs involved in the resale flat buying process.

knowing all these costs ensures better cost tracking and calculations as the deal progresses.

So let’s understand the different costs involved in buying a resale property.

Stamp Duty and Registration Cost:

You need to pay Stamp Duty and Registration charges while buying a resale house.

According to the Indian stamp act 1899, it is mandatory to pay the Stamp Duty on a resale flat.

The stamp duty on a resale flat is different for different regions. For Mumbai, for instance, The stamp Duty Charges are 5% of the Market Value. And the registration cost is 1% of the market value of the property.

There are three main factors that affect the stamp duty and registration charges: Market Value of the property, type of property (commercial/residential), and jurisdiction (urban/rural region).

knowing both Stamp Duty and Registration costs can help you to estimate the total cost and make the decision accordingly.

The best way to take check the stamp duty on a resale flat is to visit the website of the regional Department of Registration and Stamps.

Utility Transfer Cost:

This cost includes the registration, deposits, and transfer charges of Utilities such as gas, water, and electricity connection. In the Resale flat buying process, you can have a rough estimation of these utility costs and add them to the final budget accordingly.

Expense For Repair and Renovation:

Refurbishing and renovation can turn out costly. Therefore there is a need for the right assessment of the cost before buying a resale house. Find out the places where Repair and renovation are required and add the cost into the total cost calculations.

Post Occupation Cost:

The resale flat buying process involves considerable post-occupation costs.

Post occupation cost involves the brokerage or consultation charges, club membership charges, amenity charges, etc.

However, You can control the brokerage cost by choosing advisers or consultants with No brokerage policy.

Maintenance Cost:

You also need to consider the fixed amount of monthly maintenance charged by the co-operating society. Make sure that there are no maintenance dues pending from the previous owner’s side.

4. Safety & Security:

The must-have safety features for residential properties include fire-fighting provisions such as extinguishers, smoke detectors, and water sprinkler systems. Also, there should be provisions to tackle natural calamities such as heavy rainfalls, earthquakes, etc.

Also, the best security arrangement within the societies includes trained safety guards at the entry and exit points, CCTV surveillance, burglar alarms, and intercom systems. Ensure that the safety and security systems are in place and get updated regularly.

5. Amenities:

The common amenities you can get in a good real estate project are Club House, Fitness Corner, Kids Play Area, Swimming Pool, Gym, etc. Deciding which amenities you would need is crucial.

If you have a complete family along with the children then opting for Club House, Children’s play area, etc is a good decision.

Also, Make sure that there are good facilities for parking, power back up, and elevators.

6. Rental Potential:

Here is a strategic question that you can ask while buying a resale property: How much I would get if you rent this property?

Because, If the property has a good resale potential you can have the flexibility to move to another place in the future. while this property will ensure continuous cash flow.

To calculate the Rental Potential of the property you can do a Comparative Analysis of the surrounding rental trends and can get an idea about the possible rent you can get for the property.

The simplest way to find a rental potential of the property is to connect with the Real Estate Adviser.

7. Future Resale Value:

Estimating the Resale value or is a smart approach in buying a resale flat. In short, considering Return On Investment is the right way to enter into the deal.

The future Resale value is more or less difficult to calculate. There are many different factors that decide the future capital value of the property.

But you can still check the price trends in the region over the past few years and can have a brief idea about the possible values in the future.

The future capital value of the property depends on regional growth and development, new infrastructure projects, and policy changes which will see next.

8. Future Development:

The Future development of the area you decide to buy a resale flat is a key consideration. The regional development decides whether the property price will be appreciated or depreciate in the near future. With good development prospects, you get high Rental Potential and Resale value.

So, there are two main factors that impact the future development of the area-

Upcoming Infrastructure Projects: The upcoming infrastructure projects such as the new metro lines, domestic & international airports, bridges, industrial hubs become a game-changer for the real estate investment.

So before buying a resale house do primary research about the upcoming infrastructure projects in the areas.

Policy Changes: The government’s policies and development programs also impact the capital value of the property. Good governance and welfare policies boost the economic ability of the region and increases the capital value of the properties.

9. Documents:

The resale flat can have legal complexity as it possibly has many buyers in the past. So verification of all the essential documents, certificates, and proofs becomes important.

Ensure that you have a complete list of documents to check before buying a resale flat. So you won’t miss out on a single legal document from the seller for the verification process. And in case of any discrepancy, you can highlight this to a seller and ask for clarification.

Here is the complete list of the documents to check before buying a resale flat.

Building Plan Approvals:

Check whether the building plan is approved by the municipal authorities or not. In the case of illegal construction, it could be a huge loss later.

RERA Registration:

RERA is an authoritative body that governs and safeguards the interests of Homebuyers. RERA registration of the developers ensures accountability and compliance with ethical practices.

Therefore check the RERA registration of the project on the official website.

Also, you can see other important details such as property specifications and approvals.

Occupancy Certificate:

An occupancy certificate is issued by the concerning local government agency by examining the suitability of the project for occupancy.

Completion Certificate:

Municipal Authorities issue the completion certificate once the project is completed. This document along with the occupancy certificate is essential for legal verification.

Encumbrance Certificates:

An encumbrance certificate ensures that-

- The title of the property is clear

- It is not sold to other parties

- Mentions the Legal issues related to the property

- Confirms No Mortgage and Dues on the property.

- Displays all the transactions related to the property.

The owner of the house can easily apply for the encumbrance certificate online on india.gov.in

No Objection Certificates:

Legally, the seller can’t sell the property without giving the No Objection Certificates from the authorities. The buyer is always advised not to make any payment without checking the NOCs. The establishments such as Bank, Gas Agency, Water Board, Electricity Board, etc. Make sure that there are no dues on any of these.

Possession Certificate:

A possession certificate is issued by the developer to the first owner of the property. Os, while buying a resale flat you should collect this possession certificate from the seller.

Remember, it will only be handed to you once you get complete ownership of the house.

Tax Payment receipts:

It is important to check the last few Tax payment receipts to ensure timely payment of taxes, no fraudulent activity, and no outstanding dues.

Home Loan Clearance Documents:

Check the recent bank statement to ensure that there is no outstanding Bank loan. You can request the seller to shoe the NOC from the bank or concerned financial institution.

Title Deed:

This document signifies two important things. First- the seller has clear ownership of the property. And second, the house or flat has a marketable title. Title Deed will be primary proof of the ownership once you buy the resale flat. Make sure that it is transferred to your name.

Sales Deed:

While buying a resale unit, the sales deed is the key document to check before buying a resale flat. This core legal document will be a core proof of document ownership. Go through all the terms and conditions carefully before signing the document. You can take an advice of a legal consultant.

Share Certificate:

when you buy a house in a cooperative housing society, you need to collect a new share certificate from the society. The share certificate comprises the names of all the previous owners of the property. For this, you need to collect the original certificate from the seller and submit it to society along with the copy of the Sales Deed and collect a new share certificate.

10. Terms And Conditions:

Terms and conditions usually consist the mutually agreed clauses for payment, property inspection, legal reviews, surveys, appraisals, and other miscellaneous conditions.

Terms and Conditions are important for both the buyer and the seller. There should be a clear understanding of it from both sides to avoid a discrepancy in the later stages.

The Terms and composition are cited in the sales deed document which is the main proof of the property ownership.