Having accurate insights before buying a new flat is critical.

Because buying a new flat involves financial, legal, and other process complications that need a careful approach.

Therefore, knowing every single factor involved in buying a new flat gives you-

- Streamlined Buying Process.

- Right Financial Management.

- Strong Legal Understandings and Backups.

- Awareness Of Fraudulent Deals.

- And You Get What’s Best For You.

So, here in this article, you will get in-depth new flat buying tips that you should know before buying a new flat.

Moreover, these 10 important points are framed as a series of questions for a better understanding of the complications involved in buying a new flat.

Note:

Homebazaar serves homebuyers searching for flats in India with end-to-end services like site visits, and lower-interest home loans to property registration guidance. We provide the best price options & offers for 1 to 4 BHK RERA-registered flats, villas & penthouse properties in India. To begin a smooth homebuying journey with us, fill out the form mentioned below or on the right side.

Page Contents

- 1. What Is your Budget, Home Loan Eligibility, And Applicable EMIs:

- 2. Which Locality is Best For You?

- 3. What Size, Area, and Configuration You Can Get Within Your Budget?

- 4. Under Construction Or Ready To Move Flat? What Works For You?

- 5. What Are The Best Options To Find The Best Property?

- 6. How To Choose The Right Builder?

- 7. What Amenities and Facilities You Need?

- 8.What Are The Different Costs Involved In Buying A New Flat?

- 9. What Are The Important Legal Aspects?

- List of the Documents to Check Before Buying a New Flat

- 10. Important Steps You Should Know Before Buying a New flat.

1. What Is your Budget, Home Loan Eligibility, And Applicable EMIs:

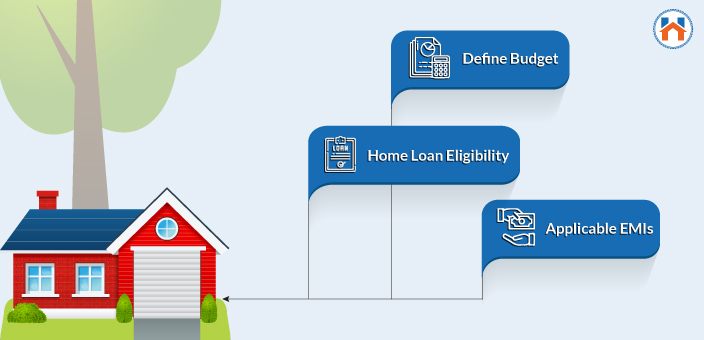

What would be an accurate budget is one of the most important things to know before buying a new flat.

Setting up the right budget comes down to two things- how much you can borrow from the bank and how well you will manage to repay. The challenge here is not to have an unbearable strain on your daily living budgets.

So, To know what’s the right budget, you can follow the simple thumb rule.

Your EMI on the home loan should not be more than 40% of your monthly income. Provided that you don’t have any outstanding debts.

This is important because most of the banks define the home loan eligibility on this criteria. Remember Banks approve loan amounts up to 80-90% of the total value of the property. This percentage depends on the Loan To Value Ratio. Currently, The RBI has allowed banks to offer up to 90% LTV for property value of 30 and up to 80% LTV for property value between 30-75 Lakhs.

Moreover, you need to make an advance payment which is 10 % of the total amount. And there are some other costs too that can shape your overall budget.

So, the following considerations are crucial to set the right budget before buying a new home

- Know your Home Loan Eligibility.

- Know the viability of your EMIs on the Home Loan.

Know Your Home Loan Eligibility:

Your net income and age are the two most important parameters that determine your home loan eligibility.

Generally, the bank sanctions the home loan as 40-50 times your monthly income. (Banks only consider the net salary/in-hand salary component for calculating the home loan amount. other allowances are excluded)

If you have a Monthly Net Salary of Rs 50,000 then the banks offer you a home loan of around Rs 2500000-3000000. This loan amount also varies depending on the bank and the loan tenure.

The General Loan Eligibility Criteria of Home Loan Is:

| Criteria | Requirements |

|---|---|

| Age | 21-65 Years |

| Income | Rs 10,000-25000 (Min) |

| Ideal CIBIL Score | 750 |

| Employment Status | Salaried/ Self Employed |

| Work Experience | 2-3 Years |

| For Self Employed | 3-5 Years Business Stability |

| Maximum EMIs | Up to 50-60% of the Monthly Income |

| Maximum Loan Tenure | 30 Years |

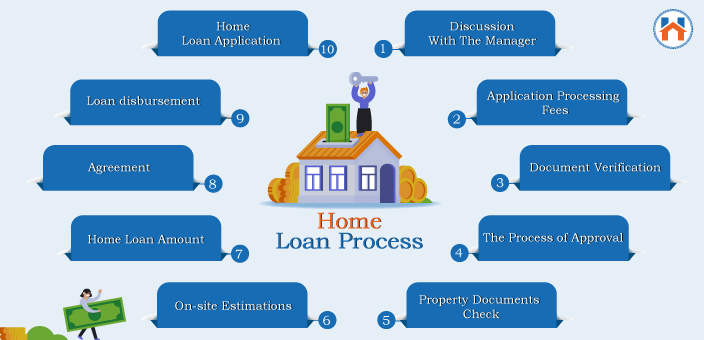

Step By Step Home Loan Process:

- Submitting Home Loan Application In the Bank

- Primary Discussion With Manager

- Payment of The Process Fees (if applicable)

- Document Verification

- The Process of Approval

- Property Documents Check

- On-site Estimations

- Calculating the applicable Home Loan Amount

- Agreement

- Loan disbursement.

Remember, the different banks have different eligibility criteria and the process for approving loans. So before proceeding it is recommended to know the detailed home loan application process for your bank.

Know the sustainability of your EMIs on the Home Loan:

Calculating the EMIs before buying allows you-

- To set up the right budget to balance the financial demands.

- You know how much to borrow from the bank.

- You are better prepared for the repayments.

The best way to calculate the EMIs is through a Home Loan EMI Calculator.

You need to specify three main components as Home Loan Amount, Interest Rate, and Loan Tenure. The HOme Loan calculator gives you breakups in the Loan EMI, Total Interest Payable, and Total Payment (Principal Amount plus the interest applicable).

Calculate the Home Loan EMI with easy home loan emi calculator here.

2. Which Locality is Best For You?

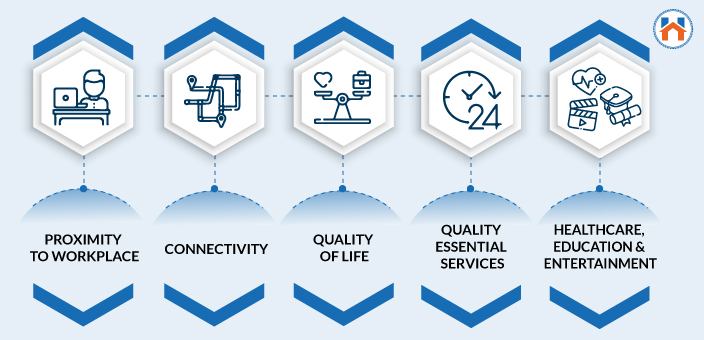

The locality is important because it decides the total price of the property. To know what will be the right locality for you, consider the following points.

- What is the Proximity to your workplace?

- How’s the connectivity and the available modes of transportation?

- What’s the quality of life in the surrounding region?

- What is the quality of the essential services such as water and electricity supply?

- How’s the access to healthcare, education, and entertainment facilities?

It is also important to know the future of the locality you are choosing to buy a new flat. Because the property prices depend directly on the growth of the region.

Therefore, also consider the following points to examine the locality for better future prospects.

- What are the upcoming infrastructure projects In the locality or region?

- What are the upcoming employment hubs in the area?

- What are the future development plans of the local authorities?

- What is the expected property price appreciation for the upcoming years?

- What are the price trends over the last few years? Any upward trend?

The best deal is to get the right locality within your predefined budget.

3. What Size, Area, and Configuration You Can Get Within Your Budget?

While deciding the right side of the flat there are two things to consider: Your budget and family requirements.

Now the key here is to have a complete balance between the two.

Over-Budgets are unbearable and compromising too much is a huge setback too.

But if the family requirements are pushing you for more budget. Then there are some different options you can try out.

Such as-

- You can try different locations. Some locations might give the perfect balance between your requirements and the budget.

- Check out the latest under-construction projects that offer exclusive offers and discounts.

- Keep researching the locations, projects, and developers for the best possible deal.

That’s the budget side of deciding the right area of the flat.

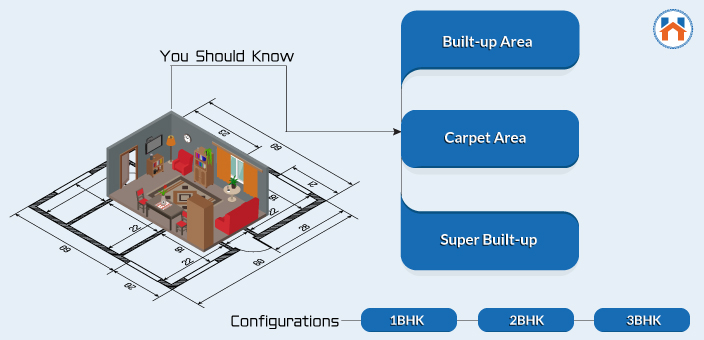

Now, to know what exactly you will get within this present budget you need to understand some basic terms related to the area and configurations, etc.

These terms are often used to set up the final prices of the flat.

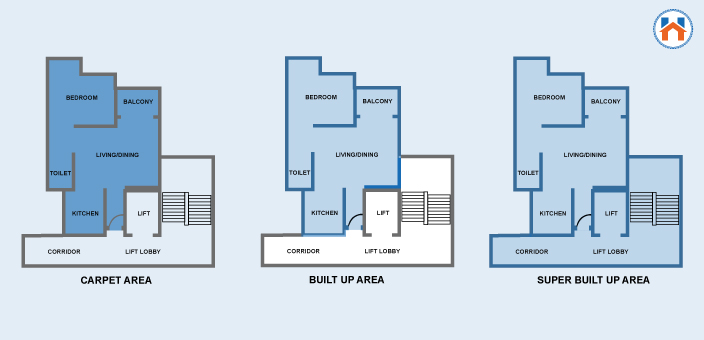

Carpet Area, Built-up Area, and Super Built-up Area:

While buying a new flat you will get the quotation on the basis of the different components of an area such as Carpet Area, Built-up Area, and Super Built-up area.

Carpet Area: The carpet area is the actual usable area that you get. Meaning, the thickness of the inner and outer walls, balcony, and corridors areas are not taken into account. The carpet Area is the most transparent way to know what exactly you will get.

Remember, RERA has made it compulsory for the developers to disclose and sell the properties only on the basis of the Carpet Area. So before buying a new flat, you should check out the carpet area from the developer.

Built-up Area: the Built-up area is the total area covered by the flat including the wall thickness and utility ducts. It is 15-30% higher than the Carpet Area.

Super Built-up Area: Super Built-up area involves the entire built-up area along with the common shared areas such as lift lobbies, staircases, corridors, etc. Super built-up areas can’t give clear transparency in the setting of the prices. Therefore, ask for Carpet Area to know what usable area you will get.

To know the detailed comparison between the Carpet Area, Built-up Area, and Super built-up Area: Click Here

1 BHK, 2BHK, and 3BHK configurations:

The average area for all three configurations of the units varies from project to project. And also depends on the city location.

For example, the average area of a 1BHK flat will be different for Mumbai, Pune, and Delhi.

Here is a brief comparison of 1BHK, 2 BHK, and 3 BHK configurations.

| Parameters | 1 BHK | 2BHK | 3BHK |

|---|---|---|---|

| Configuration | 1 Bedroom Hall Kitchen | 2 Bedrooms Hall Kitchen | 3 Bedrooms Hall Kitchen |

| Ideal For | Bachelors, Couples, Small Families | Families with moderate space requirements | Families with high space requirements |

| Cost | Comparatively lower | Moderately Expensive | Expensive |

| Advantage | Cost effective & Compact | Adequate Living & Storage Space Space | Spacious, More space for interiors & storage. |

| Market Demand | High Demand | High Demand | Demand Is Comparatively Less |

| Maintenance Cost | Low | Moderately High | High |

4. Under Construction Or Ready To Move Flat? What Works For You?

Before buying a new flat, you should know what works best for you- buying an under-construction flat or a ready-to-move.

Both of these options can affect your-

- Buying capacity

- Overall Budget

- Payment Models

- Interests and taxes

Therefore, Understanding the detailed comparison of the under construction and the ready-to-move properties is essential.

In under-construction properties, you pay the booking fees to the developer which are usually (15-20%) of the total amount. Then you need to pay the remaining amount as per different construction stages.

Check out the Advantages and Disadvantages of Under-construction properties:

| Advantages | Disadvantages |

|---|---|

| Comparatively Lower Costs | Project Completion Can Be Delayed |

| Flexibility On The Payments | GST of 5% is applicable |

| New Construction | Construction Discrepancies |

| RERA Compliance | No Immediate Reselling Is Possible |

| Special Offers and Discounts | Rental Expenses |

On the other hand, in the case of Ready to move properties you get immediate possession of the property. But you need to manage the finances in a short time period.

Here are some of the key advantages and disadvantages of the Ready-To- Move Properties:

| Advantage | Disadvantage |

|---|---|

| Instant Availability | High Cost |

| Transparency On what you get | There could be an Absence of RERA regulations |

| No GST Applicable | The age of the property could be a concern |

| Reselling and Renting Is possible |

If you are willing to wait for some years for managing the finances well, you can choose the under-construction property. On the other hand, if the rent costs you significantly in the waiting period you can opt for a ready-to-move flat.

5. What Are The Best Options To Find The Best Property?

You can do primary research about the best projects in a particular locality on the internet. You can also hire a broker or agent to find the best property for you. But you need to pay the brokerage that is around 1-2%. Of the total deal.

If you want to save the brokerage and have in-depth consultations about all the aspects of buying a new flat then you can go with professional real estate advisors who charge developers, not buyers.

So, check whether the real estate advisor you choose has a zero brokerage policy.

The best Real Estate Adviser-

- Provides you a range of options depending on your budget and requirements.

- Helps you negotiate with the other developers to ensure the lowest price possible.

- Will give you complete backup from start to end.

- Guide you on the finances and will keep you on the right track.

- Will not charge any brokerage or consultation fees.

Also, there are some best deals and offers that come and go. Keep an eye on the upcoming projects and the discount deals they offer. If anything matches your requirement you can explore more and involve the real estate adviser to offload your burden.

6. How To Choose The Right Builder?

Selecting the right builder/developer is crucial while buying a new flat. To avoid Fraudulent and unfair practices in the real estate transaction you need to have a trusted developer.

So, therefore, before making any buying decision, you should first check the credibility of the builder.

Here is a simple guide for choosing the right builder before buying a new flat.

Check Track Record Of The Builder:

The Internet can be a quality source to find the builder’s information. You should evaluate the builder’s track record on the basis of the following:

- Financial and the legal history of the builder.

- The timelines for delivering the projects.

- Quality of the projects delivered in the past and the upcoming project details.

- The transparency with which the builder handles the real estate transactions.

- Reviews and ratings received by the builder for its past projects.

- Read the fair testimonials from different real estate news and blog websites.

- Check out the real estate awards and accolades received by the builder.

The complete research on Builder’s track record helps you to shortlist the builders and choose the right one.

Check RERA Approvals:

For fair practices in the interest of the buyers, RERA was introduced in 2016. RERA imposes certain guidelines on the developers to keep the transaction more transparent and avoid any foul play.

These guidelines involve some key points such as disclosing the accurate carpet area, timely completion of the project, cap on the advance payments, rework in case of poor quality, right to information, and the comprehensive grievance redressal.

Therefore, if the builder has the RERA registration, you can be assured about fair and legal practices.

Check Ratings Of The Builder:

Ratings of the builder give a holistic overview of the Builder’s performance. These ratings are calculated on the basis of different factors such as:

- Construction Quality

- Project Financial Strength and Fundings

- Legal Compliances

- Innovation and designs

- Customer Satisfaction

To know more about the builder’s performance you can take assistance from the real estate adviser. Remember, ratings should not be the only criteria for selecting the best builder. Evaluate all the factors collectively for accurate insights.

7. What Amenities and Facilities You Need?

First up, Let’s categorize the amenities and facilities.

Amenities include the extra features that the builder provides such as gymnasium, swimming pool, children play areas, halls, jogging area, etc.

On the other hand, facilities involve security and safety provisions such as fire fighting systems, smoke detectors, and security guards. It also includes parking and storage.

Before searching or buying a new flat you must be clear with what basic amenities and facilities you might need. Because choosing a project with a lot of amenities or facilities can have a higher cost. So to be within the right budget, rethink of what facilities are a must and which are not.

So, let’s see the list of common amenities and facilities. You can further strike out if anything is not applicable to you.

| Amenities | Facilities |

|---|---|

| Gymnasium | Lifts/ Elevators |

| Children Play Area | Parking |

| Park | Fire Safety Provisions |

| Jogging Track | CCTV surveillance |

| Cafeteria | Power Backup |

| Party Halls | Security Guards |

| Swimming Pool | Waste Disposals |

Generally, the amenities and facility charges are taken at the time of buying a new flat. However, some developers charge separately or include the fees in the monthly maintenance.

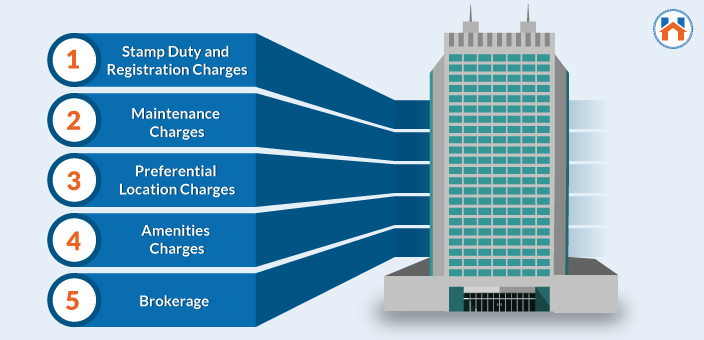

8.What Are The Different Costs Involved In Buying A New Flat?

The final price of the flat and the total cost incurred in the buying process are two different things.

Meaning, the entire buying process involves different cost components that add up significantly to the total cost of the flat.

Therefore, It is always recommended to know these possible costs before buying a new flat.

- Stamp Duty and Registration Charges

- Maintenance Charges

- Preferential Location Charges

- Amenities Charges

- Brokerage

Stamp Duty and Registration Charges:

Generally, the Stamp Duty charges are 4-5%. Whereas, the registration charges are 1% of the market value of the property.

Stamp Duty and registration charges contribute significantly to the total cost incurred in buying a new flat. For example, if the total agreement value of the flat is 1cr. Then the Stamp Duty will be 5lakh and whereas the registration charges will be 1lakh.

If you don’t pay the stamp duty or registration charges, you won’t be the legal owner of the property.

The stamp duty and registration charges are different for the different regions. So, before buying a new flat check the stamp duty and registration charges applicable and accordingly manage the overall budget.

To read Stamp Duty Charges & Online Payment Procedure In Mumbai, Maharashtra click here

Maintenance Charges:

Society Maintenance charges are usually paid monthly but in some cases, the developer takes the maintenance charges in advance for some specific years.

Considering the maintenance charges are essential as there will be a monthly deduction of the EMIs from your net salary. And you also need to bear the monthly maintenance charges at the same time.

Moreover, there are taxes applicable on the maintenance of society maintenance. If the monthly maintenance exceeds Rs. 7500.

Preferential Location Charges:

In buildings/towers, some units have the special benefits of the location. These benefits could be facing the sea, park or a road or may be located at the top or ground floors. Therefore these units are usually charged higher than the other.

The PLC charges are different for different projects. And there are no fixed regulations that control the PLCs and therefore you might end up paying higher PLC charges.

Whether the PLC charges have a significant impact on the final price of the flat?

The answer is yes.

Because the PLC is calculated generally on a per sq ft basis and the built-up area is considered for calculation which is more than the carpet area.

On average, the PLC charges are between 100-500rs per sq feet.

One of the best ways to reduce the PLC charges is to have a real estate adviser who can help you to bargain on the PLC charges and the total cost in general.

Amenities Charges:

Some developers charge amenity fees for Gymnasiums, Swimming Pools, Workout Areas, etc. While buying a new flat developers add these charges and set up the final price accordingly.

It is better to know what amenities you would like to have.

If you have a complete family living with you then opting for amenities can be a good option.

Sometimes, developers charge for the facilities such as parking spaces, security, fire safety system, etc. This can be a one-time charge or monthly charges paid along with the maintenance.

Brokerage:

If the broker/agent is involved in the buying process then you have to pay a hefty 1-2%. If the final agreement price of the flat becomes 1cr, then you need to pay 2 Lakh to the broker.

However, you can avoid the brokerage charges by choosing a real estate adviser who promises no brokerage policy.

Meaning you don’t pay anything to the adviser but get the detailed consultations for the best possible deal.

Click here to know more about the real estate advisor with no brokerage policy.

9. What Are The Important Legal Aspects?

Let’s discuss the most important legal aspects involved in buying a new flat.

The first thing is to check the legal documents, approvals, and certificates from the builder.

This is essential to avoid fraud and ensure a fair translation.

List of the Documents to Check Before Buying a New Flat

| Building Plan Approvals | Issued by Municipal Authorities to Builder |

|---|---|

| RERA Registration | The Registration Of the Builder with RERA |

| Encumbrance Certificate | Free from financial and legal burdens, Issued by Sub Registrar Office |

| No Objection Certificate | Issued by Banks and Local Authorities |

| Occupancy Certificates | Issued by Local Authority by checking the Occupancy Suitability. |

| Completion Certificate | Municipal Authorities issue completion certificates to the builder after project completion. |

| Sales Agreement | Mutually agreed clauses between buyer and the builder. |

| Sales Deed | Core legal document for ownership of the Property. Property Rights are transferred from the builder to the buyer. |

| Title Deed | Gives the status of the builders or seller’s ownership of the property. |

In the case of under-construction property, you can register the complaint against the builder to the RERA. You can register the complaint online with a nominal fee of Rs 1000- 5000. After the registration of the complaint, it takes around 45 days for RERA to proceed with the application.

Generally, it takes around a week for the final verdict on the case.

Also, Stamp Duty and registration charges are some of the most important legal processes while buying a new flat.

You are considered the official owner of the house after having the stamp duty and registration payment receipt. This document is considered valid proof in courts in case of disputes.

10. Important Steps You Should Know Before Buying a New flat.

The steps involved in buying a new flat are different for under construction and ready-to-move properties.

First, Let’s understand the complete stepwise process involved in buying the under-construction property.

In the case of the ready-to-move property, there is no waiting period. And you get immediate possession of the property.

So the general process involved in buying the ready to move property involves: