Disclaimer:

With 11+ years of experience & expertise in the real estate industry, Homebazaar provides end-to-end property-buying solutions. Hundreds of 100% verified RERA-registered residential & commercial properties are listed on our website. We provide facilities like Zero brokerage, 360° virtual street view, quick site visit services, end-to-end property buying agreements & documentation guidance and low-interest home loan assistance. This helped us gain the trust of 55,000+ clients across India & sold 6,500+ homes of top reputed developers.

Page Contents [hide]

Meaning Of Pre-EMI Scheme On A Home Loan

Pre-EMI Scheme is termed Pre-EMI Interest which defines the interest paid for a sanctioned home loan.

Pre-EMI is a borrower choice in which the bank recovers just the interest portion of the house loan issued to the builder during the period of construction.

The home loan can be taken from a bank or NBFC (Non-Banking Financial Company) for developing the property until it is ready for possession.

After the builder hands over the keys to the property, the bank begins collecting the usual EMIs, which comprise both the principal and interest amount.

Pre-EMI period for a property may vary as per the possession time or fixed tenure which is usually 2 to 3 years. The period also varies for different banks and the terms and conditions of the home loan.

Calculation Of Pre-EMI Scheme

Pre-EMIs are paid only on the portion of the loan that has been disbursed in phases, not on the whole loan amount. Similarly, the Pre-EMI amount grows with every installment.

Because pre-EMI only includes interest, it is less expensive than ordinary EMI, which also covers the principal amount.

For eg:

If the bank disburses Rs 6,00,000 with an interest rate of 8% to the borrower initially on a loan for lacs, then the borrower will pay interest only for Rs 6,00,000 for 6 months.

After 6 months when the bank will disburse an additional Rs 6,00,000 the Pre-EMI will be calculated at Rs 12,00,000. The construction should be finished within 36 months.

| Disbursement Time | Disbursed amount | Total disbursed | Pre-EMI=(total disbursed amount * (rate of interest/12)) | Regular EMI |

| 1 month | 6,00,000 | 6,00,000 | 4,000 | 28,000 |

| 6 months | 6,00,000 | 12,00,000 | 8,000 | 28,000 |

| 12 months | 6,00,000 | 18,00,000 | 12,000 | 28,000 |

| 18 months | 6,00,000 | 24,00,000 | 16,000 | 28,000 |

| 24 months | 6,00,000 | 30,00,000 | 20,000 | 28,000 |

| 30 months | 6,00,000 | 36,00,000 | 24,000 | 28,000 |

| 36 months | 6,00,000 | 42,00,000 | 28,000 | 28,000 |

| Total | 1,12,000 | 1,96000 | ||

Save Tax On Home Loan And Pre-EMI Scheme

According to the requirements of the Income Tax Act of 1961, taking out a house loan can save you taxes.

Apart from saving money over Pre-EMI Scheme on a home loan, you can also get the benefits of tax deductions as well.

If you are currently paying installments on a Pre-EMI basis, then after the completion of construction of the building, you will be eligible for the tax deduction.

The total amount paid for Pre-EMI interest will be deducted in 5 installments as tax deductions. Section 24 allows for the deduction of interest paid in the year of building completion.

Under the following sections of the Income Tax Act of 1961, a person is eligible for a deduction in the loan amount:

| Income Tax Act | Maximum amount deductible |

| Section 80EE | Rs 50,000 |

| Section 80 C | Rs 1,50,000 |

| Section 24 | Rs 2,00,000 |

Apart from section 80EE, another section 80EEA is also applicable for adding tax benefits on the home loan.

The government established this Section 80EEA along with the goal of housing provision for all.

The housebuyers are eligible for an additional tax deduction of Rs 1.5 lakh when the property is not more than Rs 45 lakh before 31st March 2022.

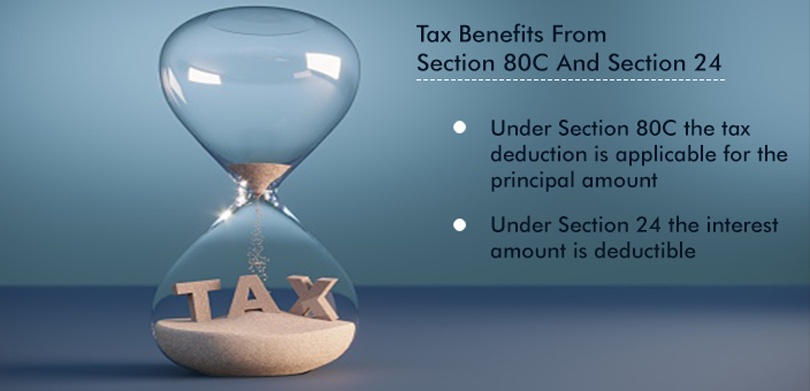

Tax Benefits From Section 80C And Section 24

Under Section 80C the tax deduction is applicable for the principal amount and the maximum deduction limit is up to Rs 1,50,000. The primary portion of the annual EMI for the year is eligible for the deduction.

However, under Section 24 the interest amount is deductible. Construction, restoration, renewal, or purchase of a residential property is eligible for the deduction of interest amount. The criteria are that the construction should be completed within 3 years.

What Is Section 80EEA

Section 80EE guidelines allow first-time house buyers to deduct up to Rs 50,000 in interest paid on loans sanctioned by a financial institution between 1 April 2016 and 31 March 2017.

However, at the start of the fiscal year 2020-21, the new Section 80EEA of the Income Tax Act of 1960 was enacted to allow for interest deductions of Rs 1,50,000.

The claim benefit under 80EEA was valid until 31st March 2022. Currently, no first-time home buyers would be able to claim the deductions.

Features Of Section 80EEA

There are specific features of section 80 EEA that must be fulfilled before claiming the deduction. They are provided in the below points:

- Eligibility Criteria of homebuyers: Individuals are the only ones who can claim the deduction under this clause. Other taxpayers are not eligible for this deduction. Hence, you can not avail of the deduction if you are a HUF, AOP, Partnership firm, company, or any other type of taxpayer.

- Deduction amount: The deduction amount under Section 80EEA is Rs 1,50,000 for interest payments. This amount will exclude the deduction of Rs 2 lakh for interest payments sanctioned under Section 24 of the Income Tax Act. Hence, taxpayers eligible under Section 80EEA can avail of the deduction of Rs 3.5L for the payment of house loan interest.

- Other relevant conditions: If you are claiming for the deduction, you must ensure that you owned any other house on the date the loan was sanctioned. This condition is similar to Section 80EE.

Conditions For 80EEA Exemption

There are certain conditions that must be followed for claiming the deductions:

- It is important to purchase a residential house property you must take a housing loan from a financial institution or an agency of home finance agency.

- The value of the stamp should not exceed the limit of Rs 45 lakhs.

- The taxpayers cannot claim the available Section 80EE deduction.

- A taxpayer must be a first-time home buyer. When the loan is accepted, the taxpayer may not own any residential real estate.

Deduction Under Section 80EEA

These conditions are specific to the memorandum to finance bill, however, these are not mentioned under section 80EEA.

- A residence’s carpet area should not exceed 60 square meters in metropolitan areas (645 square feet)

- The carpet area in any other city or municipality shall not exceed 90 square meters. (968 square feet)

- This term will also apply to low-income housing projects approved on or around September 1, 2019.

The introduction of this section 80 EEA was done by the government to encourage first-time homeowners to acquire affordable houses. Section 80EEA was enacted to expand the benefits available under Section 80EE for low-income housing.

However, to qualify for this benefit under Section 80EEA, it is important that the house loan must be sanctioned between 1st April 2019, to 31st March 2022.

During the announcement of Budget 2022, the Central Government discontinued this tax benefit for the fiscal year 2022-23.

This deduction will be provided in excess of Rs 2,00,000 under Section 24(b) of the Income Tax Act for the interest.

Difference Between Section 80EE And Section 80EEA

There are a few differences between section 80EE and section 80EEA which are explained in the below table.

| Particulars | Section 80EE | Section 80EEA |

| Value of the property | Maximum Rs 50 lakhs | Maximum Rs 45 lakhs |

| Amount of loan | Maximum Rs 35 lakhs | Maximum Rs 45 lakhs |

| Loan period covered | From 1st April 2016 to 31st March 2017 | From 1st April 2019 to 31st March 2021 |

| Maximum Concession | Rs 50,000 | Rs 1,50,000 |

| Lock-in period of the | NIL | NIL |

FAQs

| Q1: Can I receive tax benefits on a second house?

Ans: Section 80C allows for a deduction on principal repayment up to Rs 1.5 lakh. Even if you have a second home loan, you are eligible only for a deduction of Rs 1.5 lakh in principal payments. |

||||||

| Q2: What will be the tax deductions on a joint home loan?

Ans: There are different tax deductions available for a joint home loan:

|

||||||

| Q3: What is the maximum tax deduction for a home loan?

Ans: The maximum tax deduction for a home loan is provided in the below table

|

||||||

| Q4: Who will be eligible for claiming tax exemption on the home loans?

Ans: Any person who has purchased a new house and taken a home loan for self-occupation or for renting it out is eligible for a tax deduction on the loan under sections 24, 80C, 80 EE, and 80EEA of the Income Tax Act 1961. |