There are two ways of paying the PCMC property tax. One is to visit the zonal PCMC office and pay through DD, cash, or ATM cards.

The second option is to make payments online through PCMC’s official website.

The online payment of the PCMC property tax makes the process simple and offers a 5% extra discount on the General Tax slab.

Moreover, the online payment of PCMC property tax allows you to get the e-receipt, track the previous PCMC property tax bill, and check all the previous records.

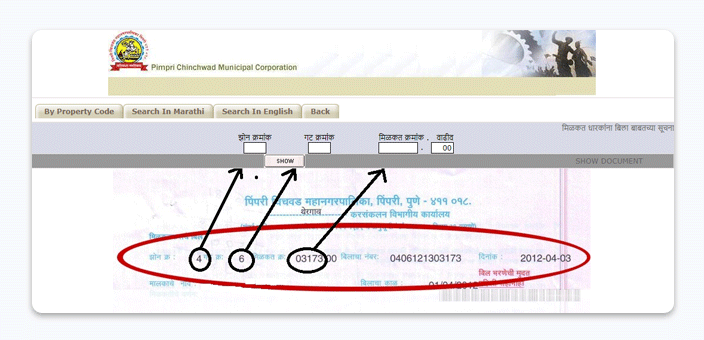

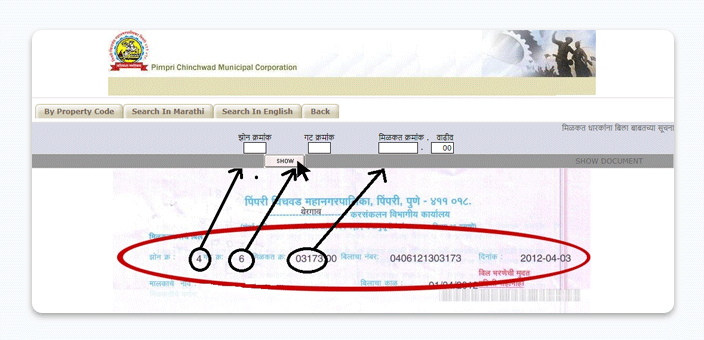

For PCMC property tax online payment, you need to have a Zone Number, Gat Number, and Income Number.

Here is a simple guide explaining how to pay the Pimpri-Chinchwad (PCMC) property tax and the important information that you should know.

Page Contents

The Step-Wise Process For PCMC Property Tax Online Payment

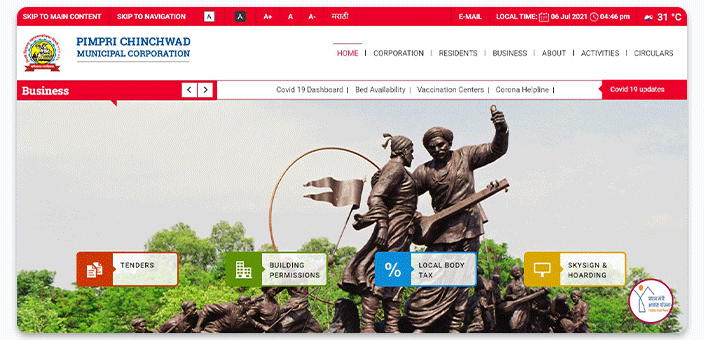

Step 1: Visit The Official Site of Pimpri Chinchwad Municipal Corporation (PCMC): www.pcmcindia.gov.in

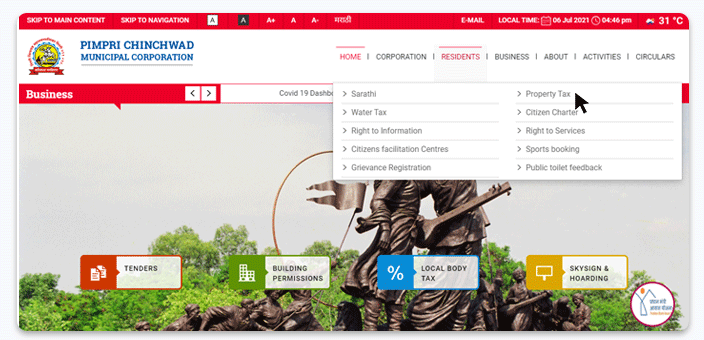

Step 2: From the Top Menu click on the ‘The Residence’. And Select Property Tax Option.

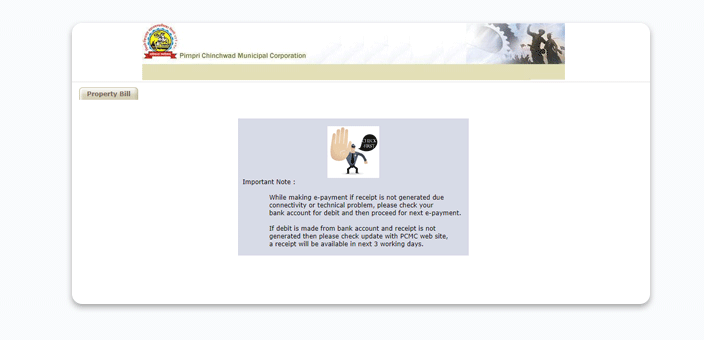

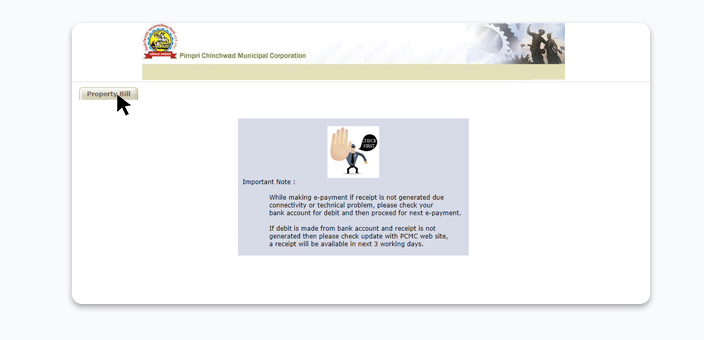

Step 3: After this, you will be redirected to the external website.

Step4: Click On The PCMC property tax bill option on the left side.

Now, you can search the PCMC property tax bill by choosing any one of the three options: By Property Code, Search In Marathi, Search In English.

Step 5: Enter Zone Number, Gat Number, Income Number And Click on Show.

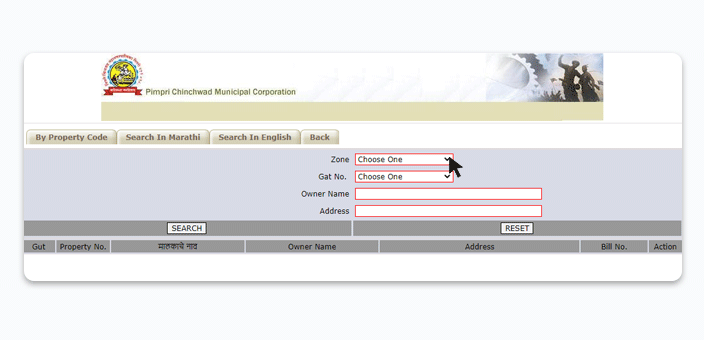

You can also search the Pimpri Chinchwad municipal corporation (PCMC) property bill by adding important details such as Zone, Gat Number, Owner Name, Address.

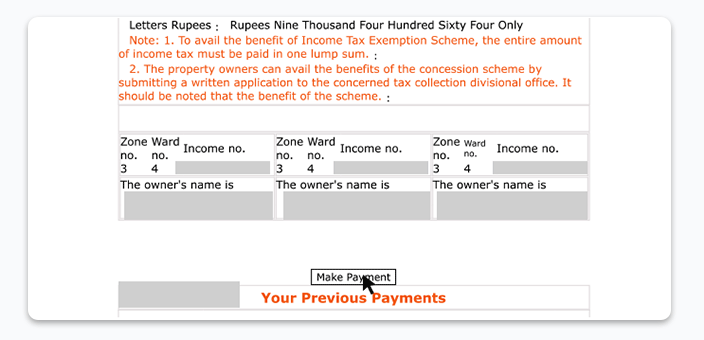

Step 6: Once the Bill is displayed on the screen, scroll down and click on the “Make Payment Option”

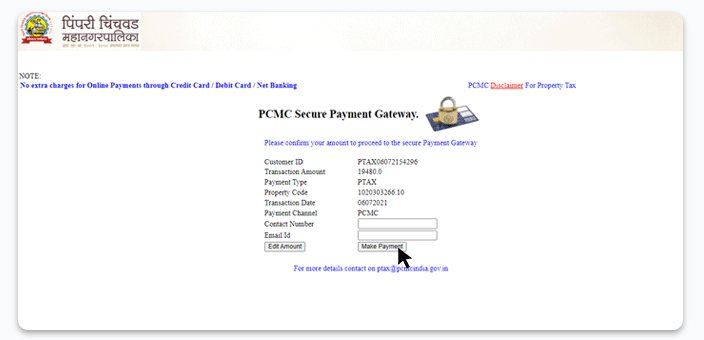

Step 7: It will take you to the PCMC secure payment gateway. Add contact details and valid email Id and click on make payment.

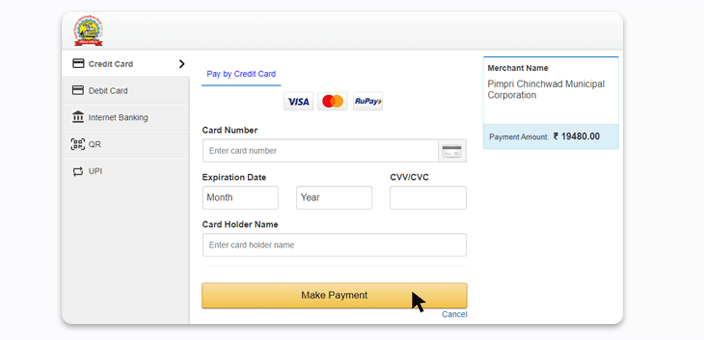

Step 8: For Payment choose the suitable option from Credit Card, Debit Card, Internet Banking, and UPI.

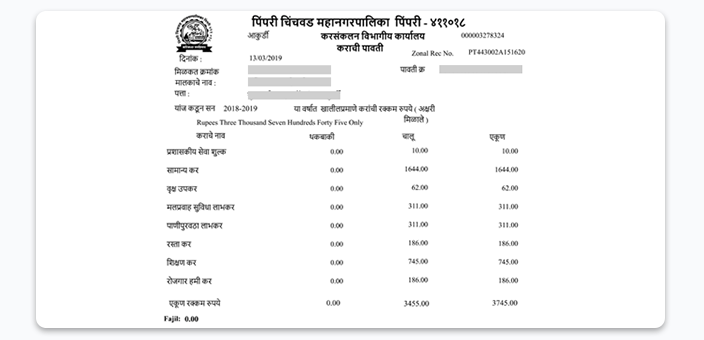

Step 9: After the successful payment, the e-receipt will be generated. You can print or download the e-receipt for future reference.

Important Points For PCMC Property Tax Online Payment:

- For PCMC property tax online payment, if the receipt is not generated due to some technical issues then it is recommended to check whether the amount is debited from the bank account.

- If the amount is not debited you can repeat the payment process.

- If the amount is debited, and the receipt is not generated, then check the status later. The receipt will be available in the next 3 working days.

PCMC Property Tax Distribution:

There are different categories of taxes applied in the PCMC property tax. All these taxes are charged as a percentage of the total taxable value.

This total taxable value depends on the type of property, location, and area.

The following table shows the different applicable taxes under PCMC property tax.

| Tax Names | % Rate Of the Total Amount Value |

|---|---|

| Administrative Service Charge | 20.00 Lump Sum |

| General Tax | 30% |

| Tree Cess | 1% |

| Sewage Benefit Tax | 5% |

| Water Supply Profit Tax | 5% |

| Road Tax | 3% |

| Teaching Tax | 12% |

| Employment Guarantee Tax | 3% |

PCMC property Tax Online Calculation:

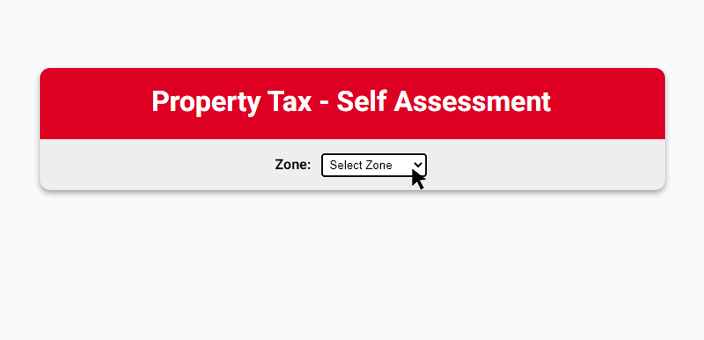

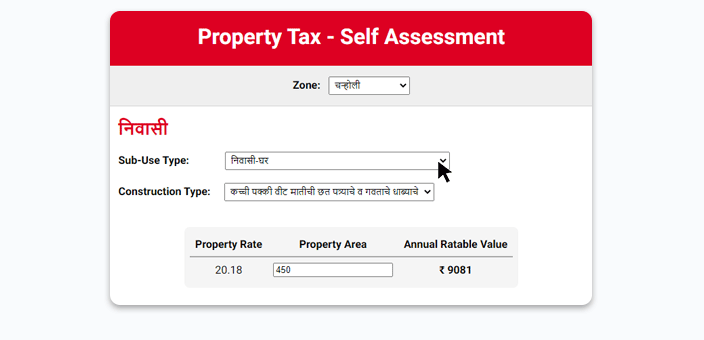

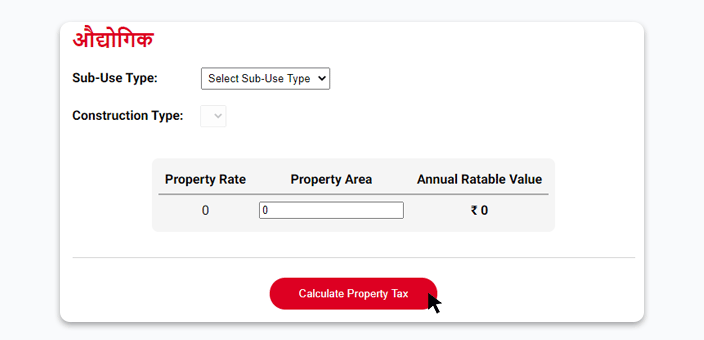

PCMC provides a property tax self-assessment online tool to calculate the tax for residential, non-residential, and commercial properties.

Here is a quick guide to calculating the PCMC property tax

Step1: Visit Property Tax – Self Assessment

Step2: First select the Zone. And Fill in the details in the appropriate section viz Residential, Non-residential, and Commercial. Select the option from the Sub-Use Type, Construction Type drop-down and add the property area.

Step 3: After clicking on the “Calculate the Property Tax” button you can check the total tax amount along with all the breakups.

PCMC property Tax Concession.

PCMC gives a 10% concession on the General Tax payment if you pay the property tax in one lump sum. Moreover, for PCMC property tax online payment you get a 15% concession on the General Tax.

Check out the following PCMC property tax payment Breakup and the applicable Discount.

Total Taxable Value: 13770.00

| TAX NAME | RATE % | TAX AMOUNT (RS) |

|---|---|---|

| Administrative Service Charge | 20.00 | 20 |

| General Tax | 30% | 4131 |

| Tree Cess | 1% | 138 |

| Sewage Benefit Tax | 5% | 689 |

| Water Supply Profit Tax | 5% | 689 |

| Road Tax | 3% | 413 |

| Teaching Tax | 12% | 1652 |

| Employment Guarantee Tax | 3% | 413 |

| Total Amount | 8145 |

10% discount for lump sump PCMC property tax payment: 10% of 4131 (General Tax)

Net Payable: Rs 7732

15% discount for online PCMC property tax payment : 15%of 4131 (General Tax)

Net Payable: Rs 7525

Generally, there is PCMC property tax payment discount to 5 major categories of property holders.

There is a complete exemption for the taxes levied by the central government for ex-services men on the PCMC property tax. Only education and Rojgar Hami are applicable.

Moreover, there are considerable concessions for women property owners and persons with disabilities.

There is also a discount for advance payment of tax. It is 5% and 10% for the residential and non-residential properties respectively.

For properties classified as residential buildings, there is a 10% discount if the rateable value is Rs. 25000. And 5% discount if the rateable value is more than Rs. 25000.

Moreover, the properties that have installations such as rainwater harvesting, solar panels, and vermiculture can get a discount of 5-10%.