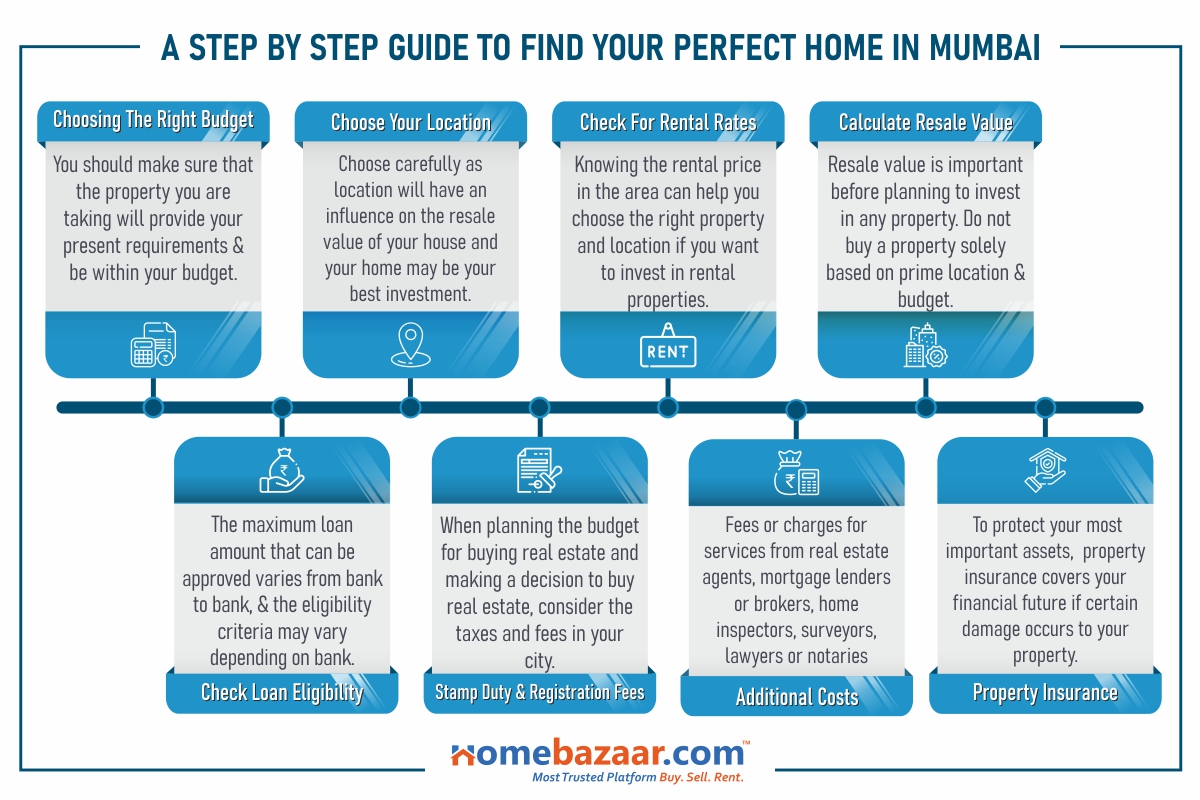

Buying a property in Mumbai is a pretty tedious and time-consuming method. Plus, knowing the property, and often extending legislative laws can take their toll on a proposed buyer. Here is a step-by-step guide about purchasing a perfect home in Mumbai which will simplify your home buying process.

Page Contents [hide]

Step 1: Choosing The Right Budget

A proper budget has to be designed to know how much cash will be saved every month to meet your payments. Understand that your first property will maybe your final home, so seek after your existing property getting requirements first, and let the long term take care of itself. You should make sure that the property you are taking will provide your present requirements and be within your budget. As a property buyer, knowing your family’s existing major needs will help you make the best decision.

Step 2: Choose Your Location

It is essential to choose to take a good look at the location and the locality. It is better to try a place nearby to the prime location of your city so that the price is not that high. The location will also have an important influence on the resale value of your house. Choose carefully and your home may be your best investment.

Step 3: Rental rates in the area: If you want to invest in rental properties, homes in high rent or high population areas are ideal. Knowing the rental price in the area can help you choose the right property and location.

Step 3: Rental Rates In The Area

If you want to invest in rental properties, homes in high rent or high population areas are ideal. Knowing the rental price in the area can help you choose the right property and location.

Step 4: Calculate Resale Value

Resale value is important before planning to invest or buy any property. Real estate buyers never consider resale value when purchasing. You make the mistake of focusing solely on a prime location or real estate budget. If the property is wrong or in the wrong location, your future sales price can always be lower than that of the other houses in your area.

Step 5:Check Loan Eligibility

Eligibility for a home loan depends on solvency, income, available loans or debts, and the age of the loan applicant. The loan company or bank provides online services, such as a mortgage eligibility calculator, to help calculate the mortgage eligibility of the borrower. The maximum loan amount that can be approved varies from bank to bank, and the eligibility criteria may vary depending on bank or RBI regulations. As housing loan interest rates rise, borrowers’ loan qualifications have become more stringent.

Step 6:Stamp Duty & Registration Fee

Like sales tax and income tax, this is a considerable expense or tax. When planning the budget for buying real estate and making a decision to buy real estate, consider the prices and expenses in your city. Use the market value to find the stamp duty that suits you.

Step 7:Additional Costs

Even if this isn’t your first experience buying a home, you’ll want to get help from a team of professionals. Fees or charges for services from real estate agents, mortgage lenders or brokers, home inspectors, surveyors, lawyers or notaries, etc. Find out what the maintenance fee is. Are parking spaces provided and do you have to pay extra for it? If your previous owner did not have a vehicle, speak to the company’s secretary and ask for parking.

Step 8:Property Insurance

Property insurance protects your financial future if certain damage occurs to your property. The cost is relatively low and will cover if you have a property problem, specific damage, or legal issue. There are many different household contents insurances with different levels of protection to choose from. When deciding to protect your most important assets, it is important to have a trusted resource to guide you along the way. Choosing the right home insurance will protect your property and make the buying process easier.