Page Contents

Where To Apply For A Home Loan

A person has two options for applying for a home loan, one is a bank and the other one is NBFC (Non-Banking Financial Companies).

However, it is important to understand that banks provide home loans at a lower interest rate and NBFC provides home loans at a comparatively higher interest rate.

If you meet the qualifying requirements, a bank home loan is always advised.

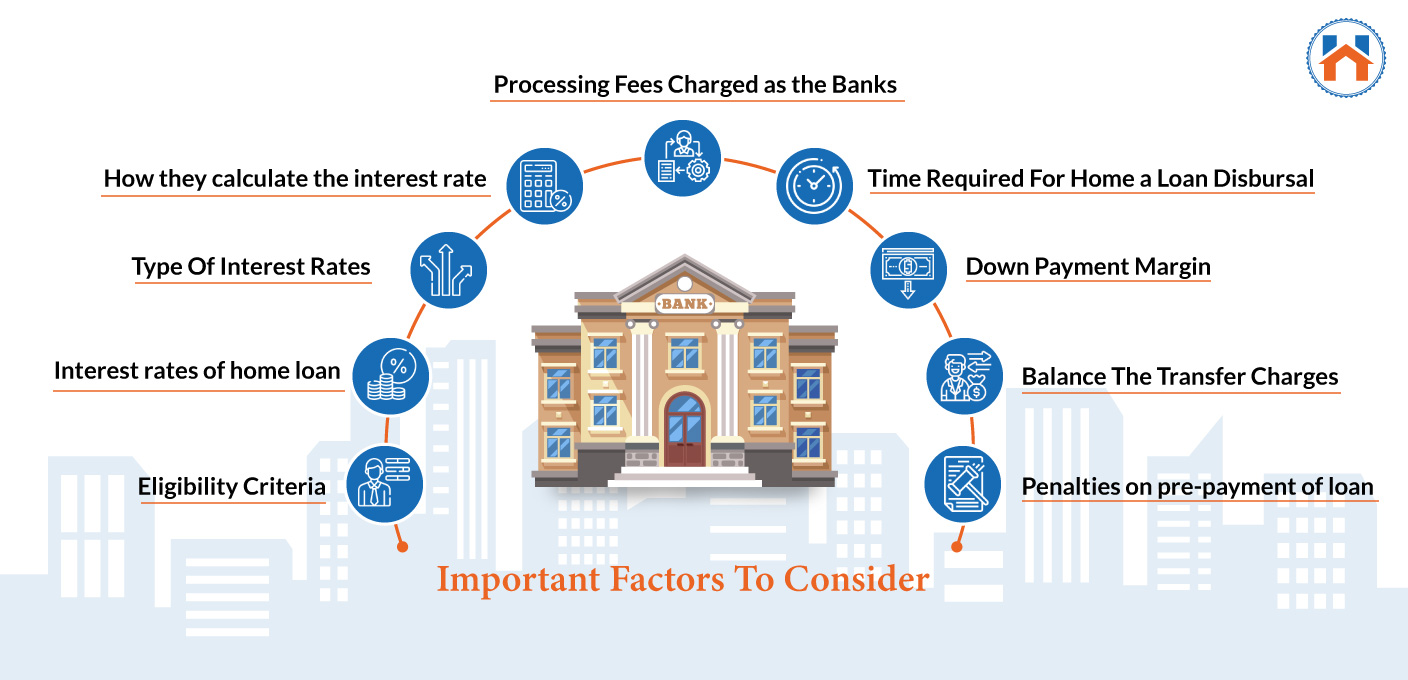

Important Factors To Consider

Some of the important factors to consider while applying for a home loan from a bank are provided in the following:

- Eligibility criteria

- Interest rates of home loan

- Type of interest rates

- How they calculate the interest rate

- Processing fees charged as the banks

- Time required for a home loan disbursal

- Down payment margin

- Balance the transfer charges

- Penalties on pre-payment of loan

Note:

Homebazaar serves homebuyers searching for flats in India with end-to-end services like site visits, and lower-interest home loans to property registration guidance. We provide the best price options & offers for 1 to 4 BHK RERA-registered flats, villas & penthouse properties in India. To begin a smooth homebuying journey with us, fill out the form mentioned below or on the right side.

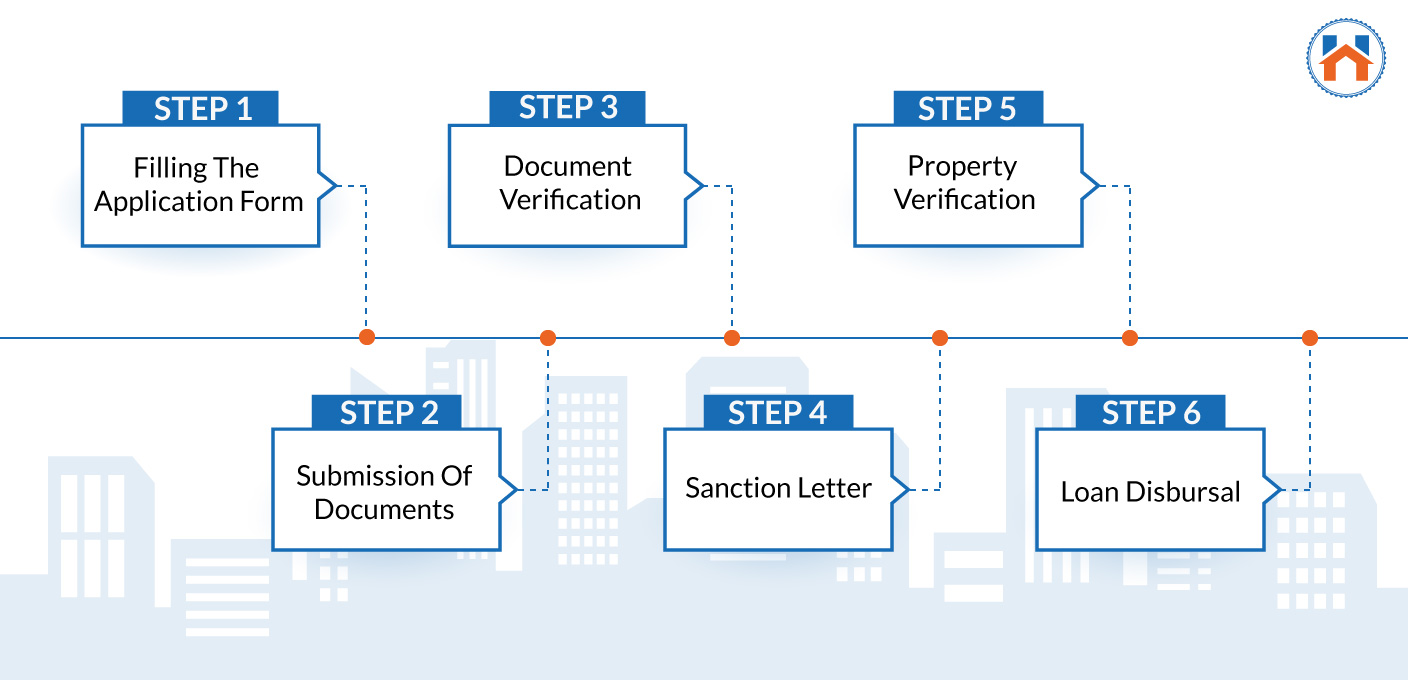

How To Apply For A Home Loan

There are 5 steps that you are required to follow to apply for a home loan successfully:

Step 1: Filing the application form

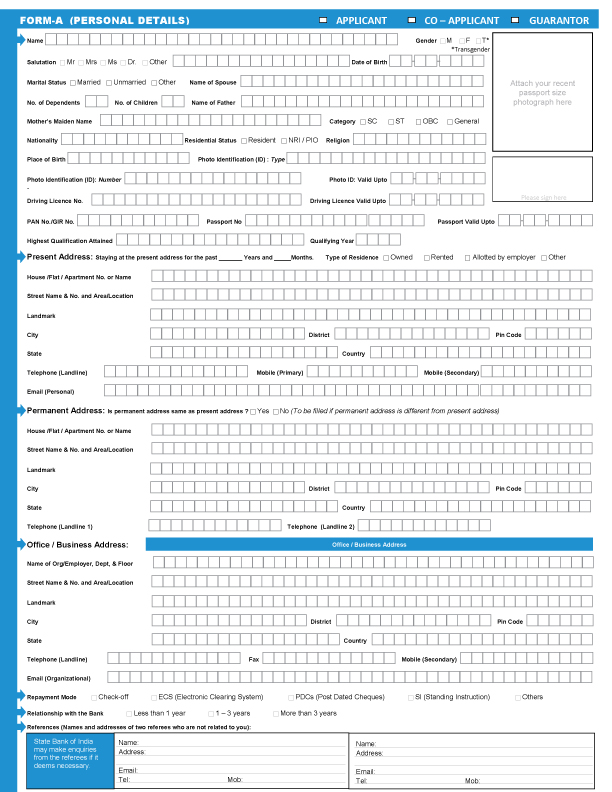

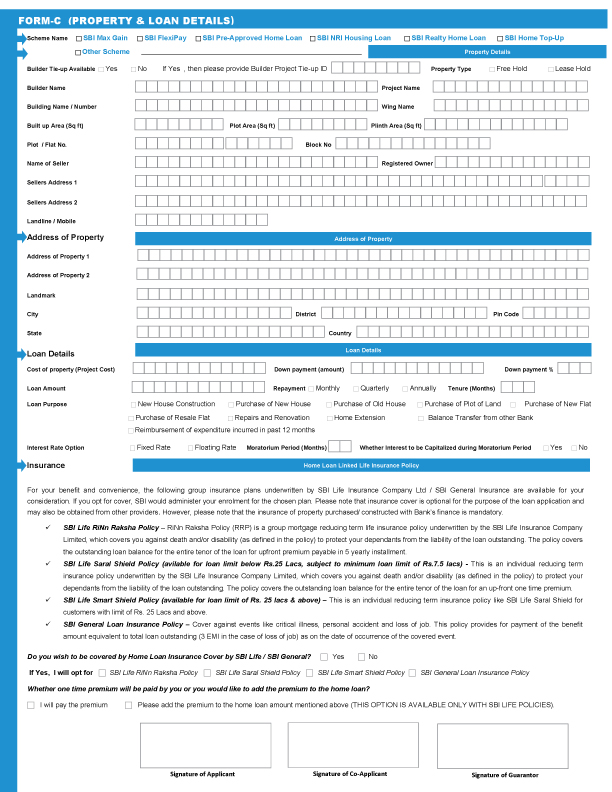

The person should provide basic information while filing the application form for a home loan such as:

| Details | |

| Personal Details | Name, PAN Number, Driving License Number, Qualification, Passport Number, Present Address, Permanent Address, Office/ Business Address |

| Employment Details | Employer Name, Employee Number, Employment Status, Total Experience, Designation, Organization Type, Industry, Previous Employment Details |

| Self Employment/ Business Details | Nature of Business, Industry, Business Name, Trade License Number, Share Holding %, Type Of Ownership |

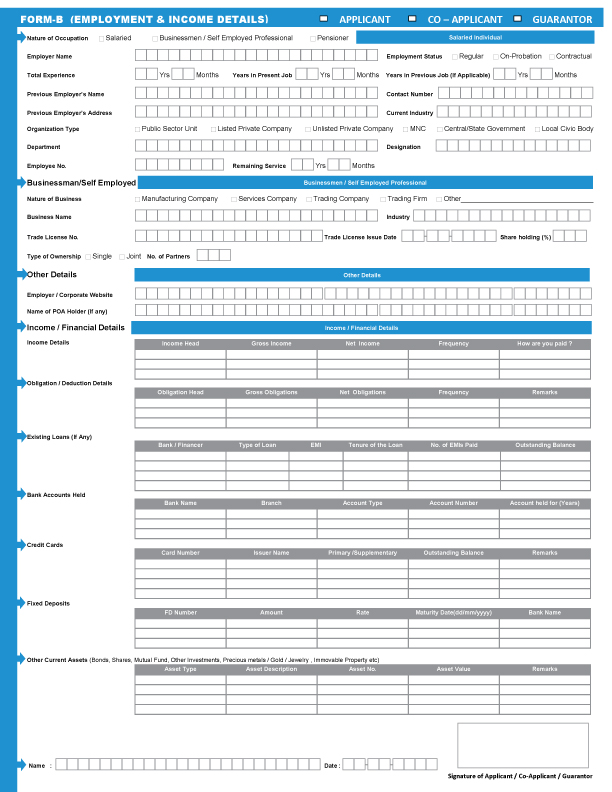

| Income Details | Income Details-Gross Income, Net Income, Frequency. Obligation, Deduction Details, Existing Loans, Bank Accounts Held, Credit Cards, Fixed Deposits, Other Current Assets |

| Property Details | Builder Name, Project Name, Building Number, Built-up Area, Name Of Seller, Address Of the Property |

| Loan Details | Cost Of The Property, Down Payment, Dow Payment %, Loan Amount, Loan Purpose, Interest Rate |

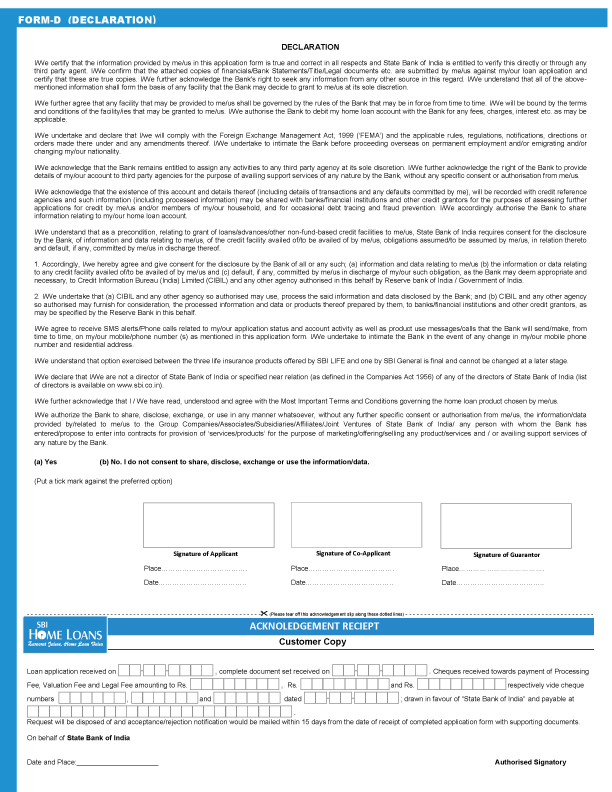

| Declaration | Dates, and Signatures |

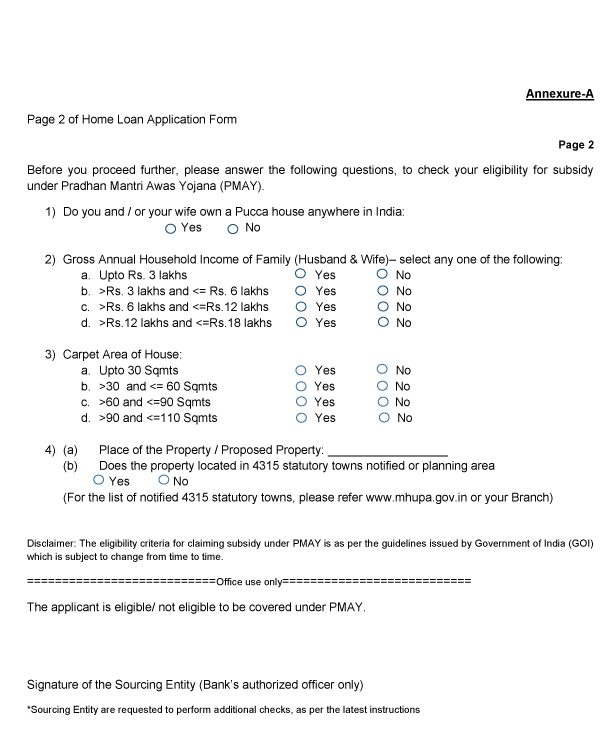

Check this sample of a home loan application form of a bank:

Step 2: Submission of documents

It is important to submit the required documents along with the filled up home loan application form. You have to pay a processing charge as well.

The amount of processing charge can be as per the percentage of the total loan amount or in a specific amount from Rs 1000-15000.

The list of required documents is provided in the following:

Step 3: Document Verification

The next process is to verify the document of the home loan application and documents. The bank officials verify each and every detail of the applicant.

Banks also verify the CIBIL score of the applicant at this step only. If your CIBIL score is high then your credit ratings will be good.

If your CIBIL score is good then you will get a lower interest rate for the home loan. The bank officials might verify your details by contacting your office or your residential place.

Step 4: Sanction Letter

When the verification process is complete, then the bank issues a sanction letter to the borrower which contains the following information:

- Applicable EMIs

- Applicable Interest Rates

- Sanctione Home Loan

- Loan Tenure

- Other terms and conditions

You will have to sign the sanction letter and keep one copy with you for future reference.

Step 5: Property Verification

There is another step of verification done before the final loan disbursement by the bank. In this process, the bank checks the following parameters for verifying the property:

For under-construction properties

- Layouts, Plans, and permissions from local authorities

- Current Status on the construction

- Work progression and construction stages

- Quality of construction

- Property valuation

For ready to move properties

- Age of the property

- Built-up area, carpet area

- Building plans and layouts

- Quality of construction

- Existing mortgage

When the verification of property is complete, the bank recalculates the sanctioned amount.

Step 6: Loan Disbursal

The bank develops a home loan agreement draft. This home loan agreement includes every detail of the sanctioned home loan.

The borrower has signed the agreement after reading all the details carefully. The loan disbursement can take around 2 to 3 days or more and this depends on the bank policies.

FAQs

| Q: Can I take a home loan for buying a house in India?

Ans: Yes, you can take a home loan for buying and constructing a home in India. However, you need to ensure that the amount taken for the home load must be used solely for the house. |

| Q: How can I get a home loan from the bank?

Ans: There are 5 steps that you are required to follow to apply for a home loan successfully: Step 1: Filing the application form Step 2: Submission of documents Step 3: Document Verification Step 4: Sanction Letter Step 5: Property Verification Step 6: Loan Disbursal |

| Q: Which properties are verified for the home loan?

Ans: For under-construction properties

For ready to move properties

|

| Q: What information are there is a sanction letter?

Ans: Sanction letter to the borrower which contains the following information:

|