Page Contents

What is BBMP Property Tax?

All the owners of real estate property in Bangalore are subject to paying property tax to BBMP (Bruhat Bengaluru Mahanagar Palika) every year.

All the owners of real estate property in Bangalore are subject to paying property tax to BBMP (Bruhat Bengaluru Mahanagar Palika) every year.

To determine the amount of real estate taxes, the BBMP uses the UAV i.e. Unit Area Value (UAV) system. Depending on the property’s location and intended use, the UAV is calculated based on predicted returns.

The Division of Registration and Stamps published guiding value is used to split the BBMP’s jurisdiction into six value zones. Depending on the zone where the property is located, the tax rate will vary.

The property tax period runs from April to March whole one year of the following year, and tax is due by 30 April of the following fiscal year. The present Property tax year is 2024-25.

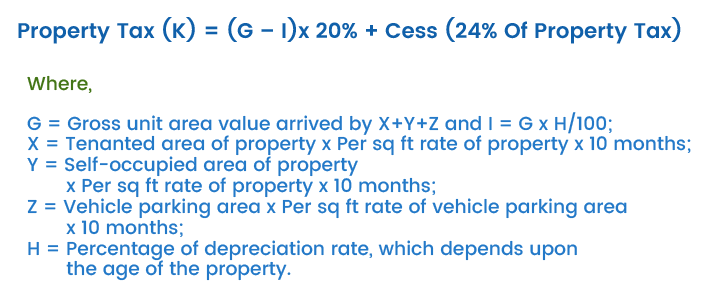

BBMP Property Tax Calculation

The BBMP property tax is calculated by the following formula,

Property tax is therefore equivalent to 20% of the overall area of the property ( self-occupied, tenanted, and vehicle parking space), multiplied by the per-square-foot rate set by the BBMP for every type of usage of the property for 10 months, lowered by BBMP-allowed depreciation, also 24% cess on your property tax.

How To Pay Property Tax In Bangalore

BBMP property tax can be paid by two methods Online and Offline. Here is the step-by-step process for BBMP property tax payment.

BBMP Property Tax Online Payment Process

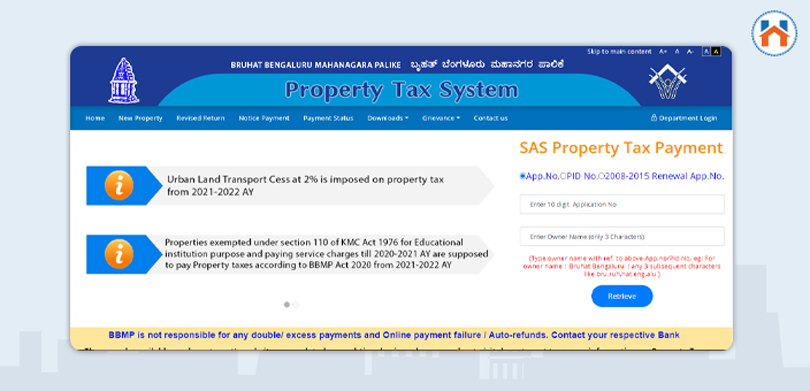

Step 1: Visit BBMP’s official website.

Step 2: Now enter the SAS 10-digit application number and owner name then click on Retrieve.

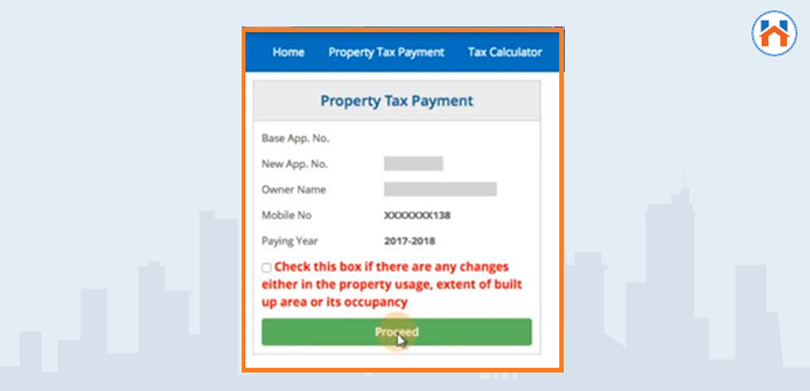

Step 3: Check the displayed details and click Proceed. Form IV will be displayed in the next window.

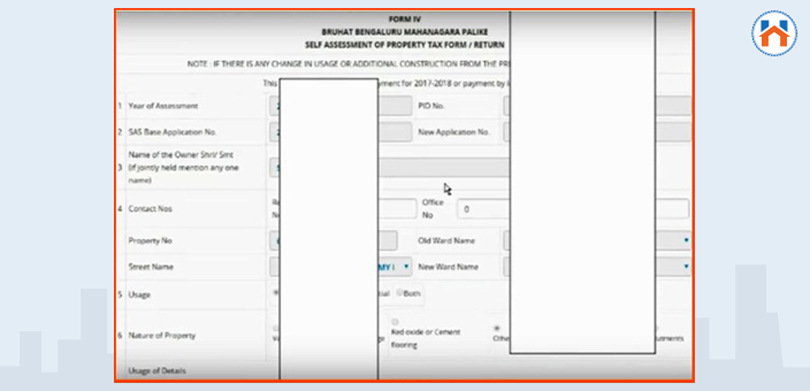

Step 4: If there are any modifications like area of property, usage or occupancy details, click on boxes and Proceed, which will take you to Form V.

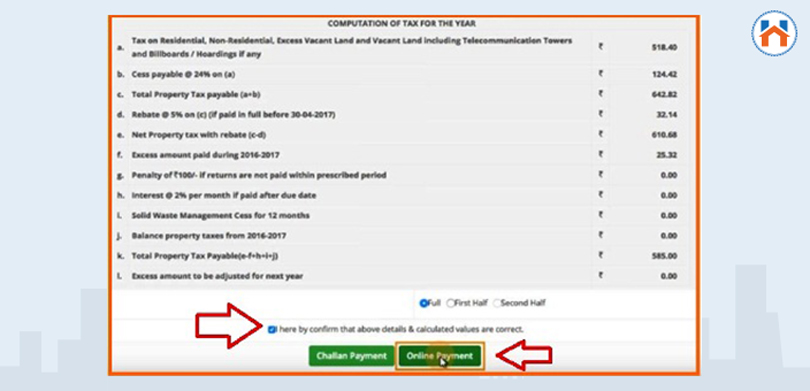

Step 5: Check the filled form and ensure all your details are right. Move on to the next window, in which the platform will display the updated computation for the property tax.

Step 6: By clicking on the payment option online next window will take you to the payment getaway where you can choose Credit/Debit card, Net banking and complete the process of payment.

BBMP Property Tax Offline Payment Process

For the offline payment of BBMP property tax follow the given process.

- For the property tax payment fill out the necessary application forms.

- Payment can be done by Demand Draft or Card.

- Visit Center 1 Banglore or the Assistant Revenue Officer’s office to pay the BBMP property tax.

How to Download Payment Receipts for BBMP Property Tax

To download the BBMP property tax receipt follow the given process.

Step 1: Visit the Official portal of BBMP.

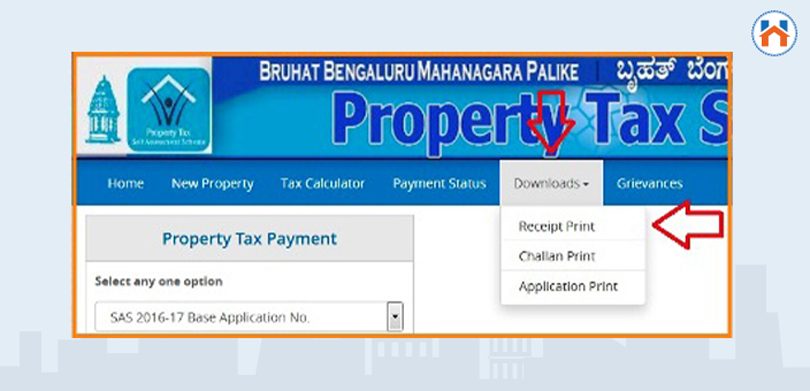

Step 2: Select the Downloads option from the menu and click on the Print receipt.

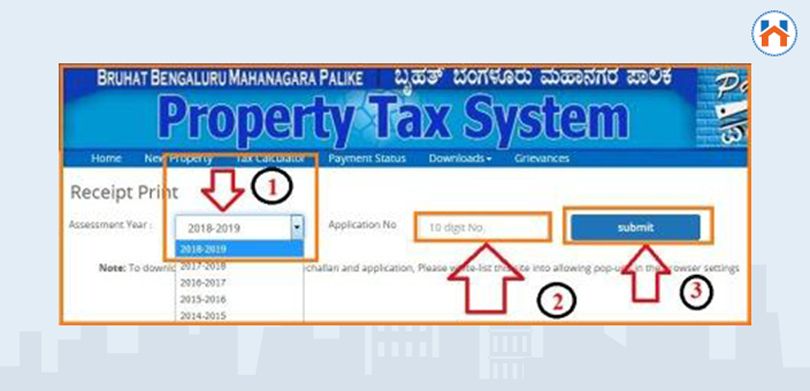

Step 3: Now select the year for which property tax needs to be paid, and enter the application number. Click on Submit.

Step 4: A receipt will be generated for your property tax payment. Download the receipt for future reference.

BBMP Property Tax Benefits

When determining income under home property in the Financial years that it is paid, the property tax paid is subtracted from the property’s (GAV) Gross Annual Value if the following criteria are met:

- The real estate property’s GAV is not zero ( self living Property)

- The owner pays the taxation.

Also, Read the Latest Stamp Duty Registration charges in Bangalore

FAQs

| How do I pay my BBMP property tax online?

BBMP property tax can be paid online at the official website. Follow the above process for the payment. |

| What is a PID number?

It is a property identification 10-digit number which is given to every property. |

| What is the application number in BBMP property tax?

A PID number is a 10-digit number that serves as an application number. |

| How do I get a SAS number?

You can get your SAS number in your previous or current property tax receipt. |