Buying a home in Mumbai can be effortless if you follow a systematic approach.

Because there are multiple options to choose from and therefore, more chances for errors.

By following a systematic approach from start to end, you will narrow down the options by considering every single important factor involved in buying a home in Mumbai.

You simplify the process by eliminating the specifications that don’t work for you. And proceed only with what’s best.

This constructive process for finding the perfect home in Mumbai allows you-

- Easy to shortlist the properties on the basis of your budget and preferred requirements.

- You get precise home-buying options in the end.

- The process of buying a home becomes more efficient and cost-effective.

- No chance of making mistakes.

- Complete command over the buying process.

So, here is the Step By Step Guide for Buying a home in Mumbai in 2025.

Note:

Homebazaar serves homebuyers searching for flats in Mumbai with end-to-end services like site visits, and lower-interest home loans to property registration guidance. We provide the best price options & offers for 1 to 4 BHK RERA-registered flats, villas & penthouse properties in Mumbai. To begin a smooth homebuying journey with us, fill out the form mentioned below or on the right side.

Page Contents

Decide On The Locality:

While buying a home in Mumbai location viability is the center of consideration. This is because, in Mumbai, there are significant shifts in prices, social and economic framework from one locality to the other.

Starting with the locality, helps you to have a brief outlook on the budget. Moreover, location becomes a pivotal reference point to make the other decisions involved in buying a home in Mumbai.

While deciding the location while buying a home in Mumbai, consider two major outlooks-

- The Fundamental Outlook

- The Real Estate Outlook

The Fundamental Outlook:

The fundamental outlook is simply a consideration of the factors that determine the quality of life in the locality. This includes factors such as-

- Infrastructure Development

- Transportation & Mobility

- Employment Opportunities

- Safety & Security

- Water and Electricity Supply

- Healthcare facility and Education

- Good Governance & Socio-political Stability

Getting the right information on these fundamental outlooks of the locality is essential. The best sources of information could be the internet, detailed research reports published by the govt bodies, or directly reaching out to the local people.

Real Estate Outlook:

The Real Estate Outlook considers the factors that are closely associated with the real estate ecosystem. This includes factors such as-

- The price trends of the properties

- The best projects available in the locality

- Future scope for growth

- Favorable Policies, Tax Concessions

- Future development of the region.

Now, you can shortlist the locality first with the fundamental outlook and followed the real estate outlook.

Locality Price Trends In Mumbai:

The price trends mainly depend on supply and demand. Higher the demand more are the prices in a particular locality.

And what triggers the higher demand in the locality?

Ease of living, quality of life, employment opportunities, connectivity, and so on.

Therefore, a better locality always costs you more. But if you have a limited budget you can invest in the emerging localities which will evolve on the socio-economic landscape within a short period of time.

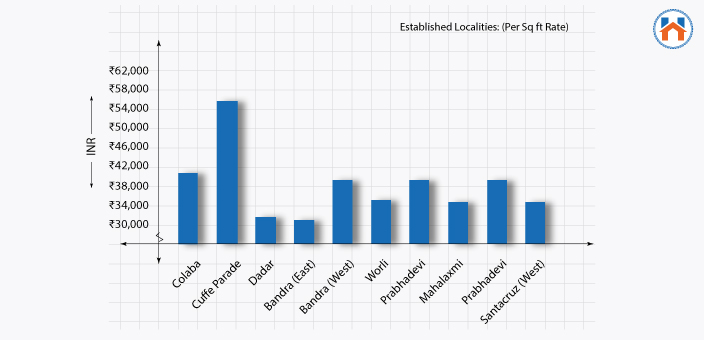

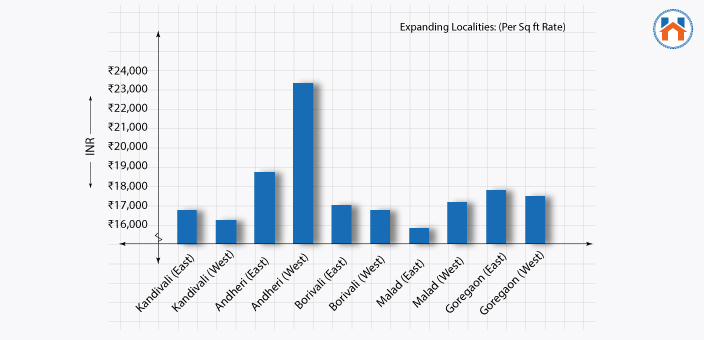

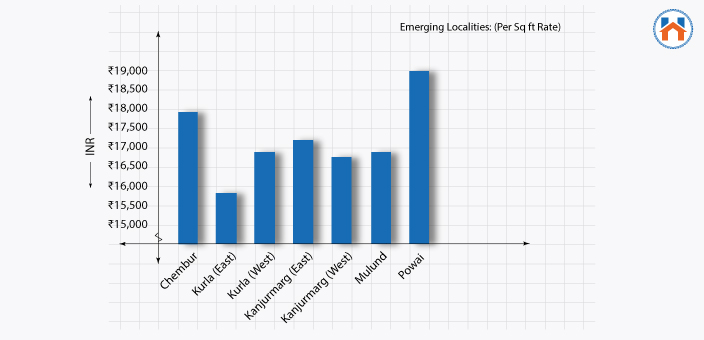

So, Let’s understand the prices of the different categories of the locality in Mumbai for the first quarter of 2022.

Established Localities:

Expanding Localities:

Emerging Localities:

Knowing The Upcoming Infrastructure Projects:

Only price trends are not sufficient to evaluate the locality. So, along with the price trends, consider upcoming infrastructure projects for the right evaluation.

The right approach will be to check whether the locality comes within the key infrastructure projects. For example, the upcoming Mumbai Metro Lines will boost the real estate in some key locations.

The best sources to find the upcoming infrastructure projects are the internet, press releases by government bodies, and real estate news.

To put it simply, you can choose the locality by considering the series of following questions:

- What’s the proximity to the workplace, schools, colleges, and nearby hospitals.

- What’s Livability, quality of life, security, and stability.

- What are the price trends in the locality? What’s affordable for you?

- What’s the future of the locality.

- Upcoming infrastructure projects, employment opportunities, and overall economic growth in the regions.

Sometimes, your budget becomes the key factor in deciding the locality. You need to find the middle ground between the best location ad the budget.

Defining The Right Budget:

Having selected the location in the first stage gives you a rough estimate of the total budget.

By this, you can calculate-

- The total amount you need to borrow from the bank.

- Applicable EMIs on the home loan amount.

- The time frame or loan tenure to repay the loan.

Ideally, the best budget allows you to meet all the expectations of buying a home in Mumbai, without an unbearable financial burden.

For this, it is necessary to be ready for every cost component you face while buying a home in Mumbai. Therefore, the following factors chiefly shape your final budget.

- Your Home Loan Eligibility

- Costs Involved in Buying Process

Your Home Loan Eligibility:

Banks sanction the home loan on the basis of your net monthly income. Generally, the total home loan amount is around 40-50 times your net monthly income.

But how much you should borrow from the bank? Is there any thumb-tule that decides the perfect EMI for you?

Through it depends from person to person for their varied income sources. Generally, the EMIs should not be more than 40% of your monthly net income. This ensures that you are not overburdened and can easily manage the daily expenses of your family.

The General Process For Loan Home Application In Mumbai is:

- Submitting Home Loan Application

- Discussion With The Manager

- Payment of The Process Fees

- Document Verification

- The Process of Approval

- Property Documents Check

- On-site Estimations

- Calculating the applicable Home Loan Amount

- Agreement

- Loan disbursement

Every bank has its own eligibility criteria and different terms and conditions. The bank asks you to provide the necessary proof such as monthly incomes, identity, property-related documents.

Read all the points mentioned in the loan agreement carefully and check out the home loan interests.

Moreover, You can calculate the applicable EMIs on the respective home loan amount beforehand.

To calculate the EMI click Here

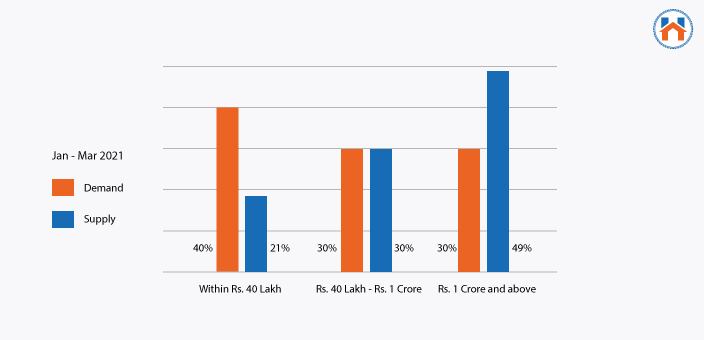

Understanding Budget Wise Supply and Demand In Mumbai:

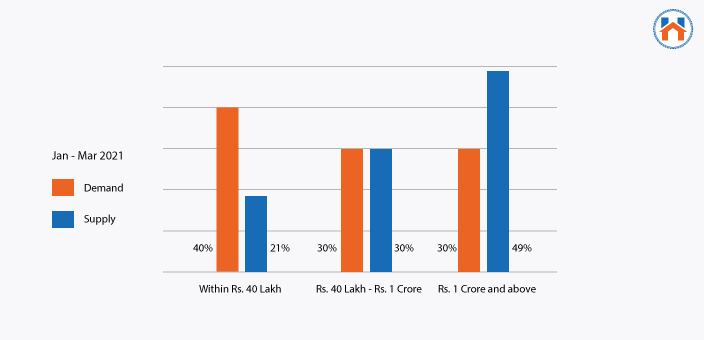

Once you have an overview of the budget, it is also essential to understand how much demand is there for houses of a similar budget range.

If there is sufficient demand, means there may be enough residential projects in Mumbai available for you. There will be more options available. But high demand may also mean a high process.

Budget Wise Supply and Demand In Mumbai Q1 2022.

Costs Involved in Buying Process:

The selling price of the flat is not the final cost. There is always a number of different cost components involved in the buying process. Some of these contribute significantly to the final cost.

Knowing costs beforehand ensures the right budget framing.

So, Here is the chart that briefly explains different cost components in buying a home in Mumbai.

| Cost Components | Key Points |

|---|---|

| Stamp Duty & Registration Charges | Stamp Duty Charges are levied by the state government and are mandatory to pay while buying a property. Stamp Duty In Mumbai: 5% of the Market Value of the property. |

| Maintenance Charges | It is either charged at the time of purchase (for the first 5-10 years) or on monthly basis. There is tax applicable if monthly maintenance is more than Rs 7500 |

| Preferential Location Charges | For a better location of the unit within the building /or tower, you need to pay an extra amount called PLC. |

| Amenities Charges | Builder developers sometimes charge separately for the Gyms, Children Play Area, Club House etc |

| Brokerage | If you choose an agent to help you out with property finding he charges 1-2% of the total deal. |

Decide: Under Construction Vs Ready To Move

In Mumbai, some buyers prefer under construction while others choose ready-to-move property. Because both of the options are suitable for their unique benefits.

Let’s understand why people prefer either under construction or ready to move in properties in Mumbai.

Why People Prefer Under Construction Properties In Mumbai:

- Mumbai is one of the expensive real estate markets. Therefore, it is not always possible for the buyer to handle the financial burden of buying a new home in Mumbai. However, under-construction properties, allow buyers to effectively manage the finances as the payments are coupled with the construction process. This payment flexibility is the main reason for preferring under-construction properties in Mumbai.

- Besides, since there is significant time between the buying and the actual possession, you get a high property appreciation during the waiting period.

- In Mumbai, under-construction properties come with hefty discounts and offers that attract most buyers.

Why People Prefer Ready-To-Move in Properties In Mumbai:

- In Mumbai, the rents are high. So, waiting for the under-construction properties involves the rent expenses along with the EMIs. Ready to move in properties in such cases provide instant possession saving the rent costs.

- Moreover, the buying process is more transparent as there are no delays and construction discrepancies.

- However, the buyers have to be prepared for the instant financial demands.

Home Size, Area, and Configuration:

Deciding on the area and the unit configuration such as 1, 2, or 3BHk is solely dependent on the budget. The area you get for different configurations could be different depending on the projects or the developers.

If you are sure with one particular configuration, then check out the availability of the new launches for those configurations.

Generally, in Mumbai, there is almost consistent and equal popularity for 1,2, and 3 BHK configurations. This means for buying a home in Mumbai you will have a variety of projects with your suitable configuration.

BHK Wise Demand and Supply In Mumbai:

Remember the following key points while buying a home in Mumbai:

- Compare different properties on the basis of the carpet area.

- Know the clear distinction between carpet area, built-up area, and super built-up area for better transparency in the deal.

- Know your requirements and keep the margins on the budget in cases if you want to increase the budget for more space.

Selecting the best Real Estate Project and Developer:

There are two types of residential projects in Mumbai. The first is a standalone project which provides quality residential housings with sufficient features. On the other hand, there are lifestyle-oriented projects which have complete end-to-end facilities and amenities.

Thus, Knowing your requirement is the first stage while selecting the best project. To find the best project of either standalone or lifestyle-oriented you can check out the list of top developers.

Here are some points that might help you to choose the right builder while buying a home in Mumbai.

- Check the Track Record of the Builder

- Check the Reviews and Ratings

- Financial Standing of the Builder

- Past Delivery Timelines

- Number of Ongoing Projects

- Approvals and Licenses

- Quality Of the Projects Delivered

- Services After the Delivery

The basic research on the builder may help you to shortlist the best ones. But the only research on the builder or developer is not sufficient. You need to check out the projects of the different developers before finalizing anything. Because there are always possibilities of good projects from the emerging developers.

So a basic comparison between different developers is a must before buying a home in Mumbai.

Here are some of the parameters to compare different residential projects in Mumbai:

| Parameter | Explanation |

|---|---|

| Location | The project which has proximity to the workplaces and other essential facilities should be preferred |

| Super Built-up Area | Super built-up area involves lift lobbies, corridors, common storage spaces, common entrances, park area, etc. Projects with higher built-up areas provide more space and features. |

| Amenities | Choose the project which has quality amenities such as Children Play Area, Gymnasium, Jogging Track, Club House, etc Also, compare the prices charged by the different developers for the amenities. |

| Facilities | Safety, Security, and Parking are the three main required facilities. Compare the quality of the faculties provided in the projects. |

| Prices | Compare the prices of the different projects only by considering the Carpet Area, Builup area, amenities, and facilities as well as the location collectively. |

| Builder | Check the track records of the builder, and the approvals from the regulatory bodies. |