Page Contents [hide]

- What Is Capital Gain Tax on Property In India

- Short-Term Capital Gain TAX On Property

- How To Save Short-Term Capital Gain TAX

- Calculation of the Short-Term Capital Gain

- Example For Calculation of Short Term Capital Gain

- Long-Term Capital Gain Tax on Property

- How To Save Long Term Capital Gain TAX on Property

- Example For Calculation of Long-Term Capital Gain

- Difference Between Short Term Capital Gain Tax and Long Term Capital Gain Tax

- Capital Gains Deposit Account Scheme

- Opening The Capital Gains Deposits Account

- Conditions for Saving The Capital Gain Tax

- Capital Gain Tax on the Inherited Properties In India

- FAQs

What Is Capital Gain Tax on Property In India

The profit that you get by selling the property is considered as an income. And therefore you need to pay the tax on the profit or gain from selling the property. This Tax on the Capital Assets is termed Capital Gain Tax.

Real estate properties come under the category of capital assets. And therefore after selling the properties you need to pay the Capital Gain Taxes. Capital Gains Tax is categorized as Short Term Capital Gain Tax and Long Term Capital Gains Tax.

It is mandatory to pay the Capital Gain Tax on the property as per section 45 of the Income Tax Act.

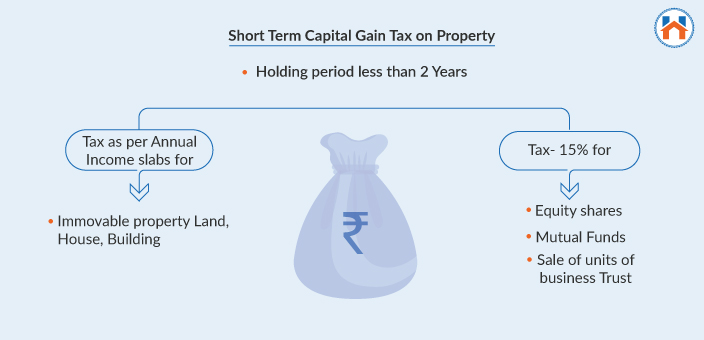

Short-Term Capital Gain TAX On Property

The profit or gain from selling the property with a holding period below 2 years is a short-term capital gain. The tax applied on this gain is called Short Term Capital Gain Tax.

The holding period for the Short Term Capital Gain for the various Assets is as follows-

| Asset | Holding Period |

|---|---|

| Immovable Properties, Land, House, Building | Less Than 2 Years |

| Listed Shares In, Stock Exchange, Mutual Funds, Debentures, Government Securities, Units of UTI, Zero-Coupon Bonds | Less Than 1 Year |

| Other Capital Assets, Unlisted Debentures, Units of Debt Fund, Other Immovable Properties | Less Than 3 Years |

“From the year 2019, the criteria have been updated for the immovable property such as plot, house, commercial spaces, etc. Currently, the Short Term Capital Gain tax is considered as a gain from holding the property for less than 2 years (24 months)”

The Tax applicable on the Short Term Capital Gains is calculated on the basis of Section 111A.

To calculate the applicable Taxes, The short term capital Gain is classified as-

- Short-term capital gains are covered under section 111A.

- Short-term capital gains other than those covered under section 111A.

| Short-term capital gains are covered under section 111A. | Short-term capital gains other than covered under section 111A. | |

|---|---|---|

| Applicable On | Equity shares, Mutual Funds, sale of units of a business trust, etc | Immovable Property such as Land, House, or Building. Items like Gold and Silver. Bonds and Government Security. |

| Applicable Tax | 15% (plus surcharge and cess as applicable). | Tax is Applicable as per the Annual Income Slab. |

| Tax Savings | You can save the taxes under sections 80C to 80U | You can save the taxes under sections 80C to 80U |

So, here we can conclude that the applicable Tax for immovable properties such as land, house, or building tax is applicable as per the annual income slab since it does not come under section 111A.

Since the gain or profit from selling the property is considered income, the tax for the Short Term Capital Gain from the real estate properties is calculated on the basis of the Annual Income Tax Slab.

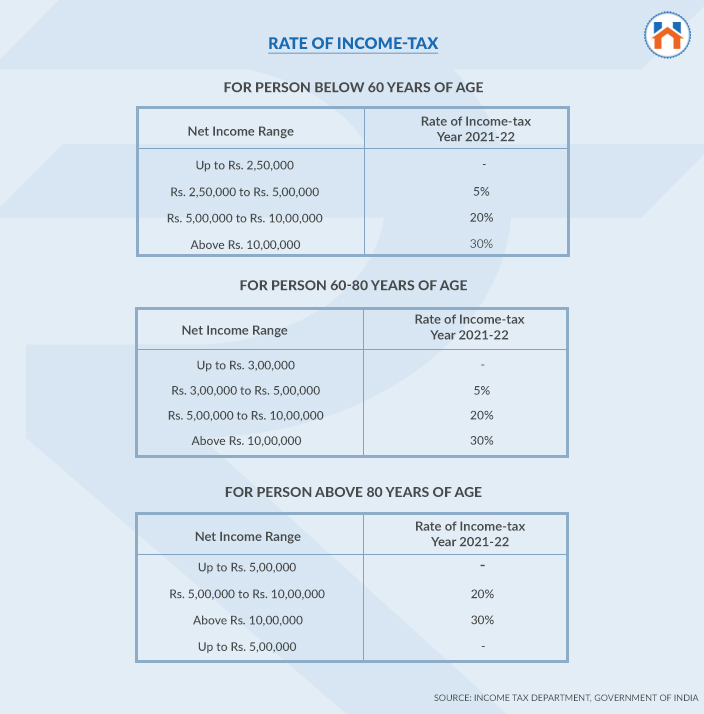

Here Are The Annual Income Tax Slabs –

How To Save Short-Term Capital Gain TAX

The taxes on the short-term gains on the real estate properties can be deducted under sections 80C and 80U.

As per section 80C, you can get the Tax Concession up to Rs 1.5 Lakh.

The 80U is for persons with disabilities, and the concession is up to Rs. 75,000/- for Normal Disability and Rs. 1,25,000 for Severe Disability.

To save the Short Term Capital Gain tax you need to reinvest the profit in some other assets as per sections 80C.

You can save the Capital Gain Tax by following investment options under section 80C

- Public Provident Fund

- National Pension Scheme

- Fix Deposit Investment for 5 Years

- Unit Linked Insurance Plan (ULIP)

You can save the Capital Gain Tax by Payments in the following options under section 80C

- Life Insurance Premium

- Home Loan Repayment

- Stamp Duty and Registration

- Provident Fund

- Deductions Under EPF

Tax Exemption Calculator designed by the Income Tax Department allows you to calculate the exact tax exemption under 80C.

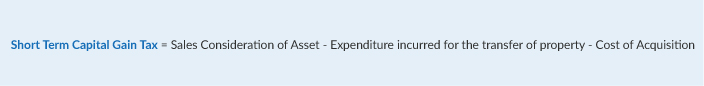

Calculation of the Short-Term Capital Gain

The formula for calculating the Short Term Capital Gain is as follows-

Where-

Where-

- Sales Consideration is the selling price of the property

- The expenditure incurred while selling the property which involves-

- The brokerage

- Advertisement expenses

- Stamp Paper and Documentation Cost

- The cost of Acquisition is the buying cost of the property

Example For Calculation of Short Term Capital Gain

Consider that you purchased a property worth Rs. 80,00,000 in April 2020 and sold it in April 2021 for Rs. 90,00,000. The holding period, in this case, is 1 year. You paid the brokerage of Rs 50,000 for selling the property. And your annual income is Rs 5,00,000.

In this case-

- The property is held for less than 2 years and hence it will be marked as Short Term Capital Gain.

- Since the short-term capital gain is obtained from the immovable property it does not come under taxation under the 111A.

- Therefore, in this case, the tax will be applicable as per the income tax slab set by the Income-tax department.

The Total Short Term Capital Gain =

[Sales Consideration of Asset – Cost of Acquisition- Expenditure incurred for the transfer of property]

= [90,00,000 – 80,00,000 – 50,000]

Short Term Capital Gain = Rs. 9,50,000.

Adding short Term Capital Gain into the Annual Income = [Rs. 9,50,000 + Rs 50,0000] = Rs. 14,00,000.

From the Income Tax Slabs, The 30% Tax is applicable for an annual income of more than Rs. 10,00,000.

Therefore, Short Term Capital Gain Tax = 30% of Rs. 14,00,000.

Short Term Capital Gain Tax = Rs 4,20,000.

On this applicable Tax amount, you can get the deductions under the 80C and 80U.

Long-Term Capital Gain Tax on Property

The profit or gain from selling the property with a holding period of more than 2 years is a long-term capital gain. The tax applied on this gain is called Long Term Capital Gain Tax.

The holding period for the Long Term Capital Gain for the various Assets is as follows-

| Asset | Holding Period |

|---|---|

| Immovable, Properties, Land, House, Building | Less Than 2 Years |

| Listed Shares In Stock Exchange, Mutual Funds, Debentures, Government Securities, Units of UTI, Zero-Coupon Bonds | Less Than 1 Year |

| Other Capital Assets, Unlisted Debentures, Units of Debt Fund, Other Immovable Properties | Less Than 3 Years |

From the year 2019, the criteria have been updated for the immovable property. Currently, the Long Term Capital Gain is considered as a gain from holding the property for more than 2 years (24 months).

The Tax applied on the Long Term Capital Gain Tax for properties is 20% (plus surcharge and cess as applicable).

The Tax on the Long Term Capital Gain of 10 % is applicable for the following cases-

- Listed Securities

- Transfer of Assets in Stock Exchange Security

- Zero-Coupon Bond

How To Save Long Term Capital Gain TAX on Property

Section 54 gives the relaxation on selling the residential property and acquiring the new residential property. Following is the complete list of section 54 and the subsections to get the concessions by reinvesting profits or gains in new assets as per section 54.

| Section | Conditions For Exemption |

|---|---|

| Section 54 | Capital Gain on residential properties is spent on buying a new residential property. |

| Section 54 B | Capital Gain on the Land or Building is reinvested for the buying of new land for agricultural use. |

| Section 54 D | The Capital Gain on the Land or Building is reinvested for buying a new Land or Building forming part of the industrial undertaking. |

| Section 54E, 54EA, 54EB | The Capital Gain is re-invested in specified bonds or debentures. |

| Section 54EC | The Capital Gain is reinvested in Fixed Income Instruments |

| Section 54EE | The Capital Gain is re-invested in Long term specified assets |

| Section 54F | The Capital Gain is re-invested in buying residential properties |

| Section 54G 54GA | On transfer of assets in cases of shifting of industrial undertaking from urban area |

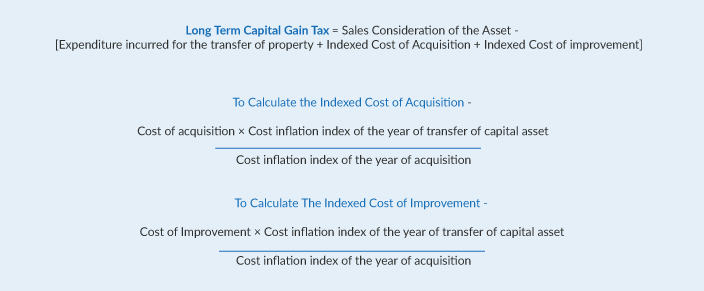

Calculation of the Long Term Capital Gain TAX-

The long-term capital gain can be calculated by using the following formula.

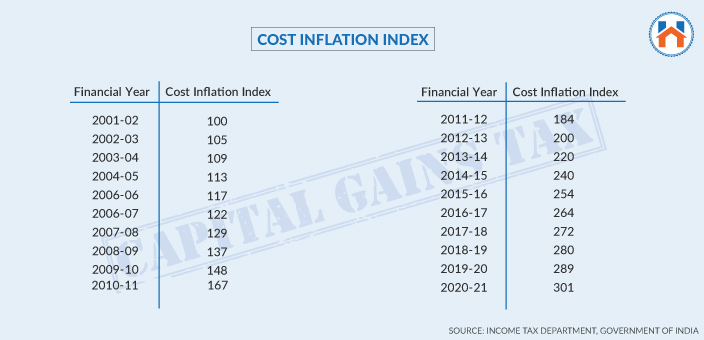

The Cost of inflation index of the particular year is important for the calculation of the Long Term Capital Gains.

The cost inflation index is set by the central government. The list of the inflation index is as follows-

Example For Calculation of Long-Term Capital Gain

Consider that you purchased a residential property in the year 2010 at Rs, 50,00,000 and sold it in the year 2020 for Rs 1,20,00,000. You paid the brokerage of Rs 20,000.

In this case-

- The property is held for more than 2 years and hence it will be considered as Long Term Capital Gain.

- In this case, the tax of 30% (plus surcharge and cess as applicable) will be applied considering the Annual Income Tax Slabs.

Sales Consideration of the property = Rs 1,20,00,000

Cost of acquisition (Purchase Price) = Rs 50,00,000

Expenditure incurred for the transfer of property (Brokerage) = Rs 20,000

Cost inflation index of the year 2010 = 167

Cost inflation index of the year 2020 = 301

To Calculate the Indexed Cost of Acquisition-

Cost of acquisition × Cost inflation index of the year of transfer of capital Asset/ [ Cost inflation index of the year of acquisition]

[50,00,000 × 301]/ [ 167]

= Rs. 90,11,976.04

Long Term Capital Gain = Sales Consideration of the Asset + [Expenditure incurred for the transfer of property + Indexed Cost of Acquisition + Indexed Cost of improvement]

= 1,20,00,000 – [ 20,000 + 90,11,976 + Not Applicable]

Long Term Capital Gain = Rs 29,68,024

Now the Long Term Capital Gain Tax = 20% of Rs 29,68,024

Long Term Capital Gain Tax = Rs 5,93,604

“The Long Term Capital Gain gets the benefit of the indexation. The Indexation takes into account the rate of inflation and hence lowers the applicable Capital gain Taxes. The Indexation is not provided under the short-term capital Gains and therefore, it is advisable to hold the properties for more than 2 Years.”

Difference Between Short Term Capital Gain Tax and Long Term Capital Gain Tax

| Short Term Capital Gain Tax | Long Term Capital Gain Tax |

|---|---|

| Applicable on the Profit or Capital Gained from holding the property for less than 2 years. | Applicable on the Profit or Capital Gained from holding the property for more than 2 years. |

| For immovable properties such as Land, building, or house the Tax applied is applicable as per the income tax slabs. | The Tax Applicable is 20% of the Capital Gain along with the surcharge and cess as applicable for properties. |

| Tax Exemptions are applicable under 80C and 80U. | The exemptions are applicable under Section 54, and 54 D, 54 B, 54E, 54EA, 54EB, 54EC, 54EE, 54F, 54G, 54GA |

| The Tax Exemption can be upto 1.5 Lakh under 80C. Where the 80U is applicable for Normal Disability: Rs. 75,000/- Severe Disability: Rs. 1,25,000/- | The Exemption is applicable only if the capital gain is less than the 2Crore. |

Capital Gains Deposit Account Scheme

To get the benefit of the Tax deductions on the Capital Gains you need to reinvest the amount within the given time period. The Capital Gains Deposit System introduced in the year 1988 allows you to park the Capital Gains till you find the suitable reinvestments as per Section 54.

The Capital Gains Deposit System Benefits You In the following Ways-

- Safeguards the Capital Gains before investing in the appropriate options as per the tax exemption criteria

- Ensures that you don’t miss the applicable Tax exemptions

- Get sufficient time to acquire new assets from the Capital Gains

- Get the interest as per the Savings Bank/ Fixed deposit rates

Opening The Capital Gains Deposits Account

You can open the Capital Gain Deposit Account in any authorized bank. There are two different types of Capital Gains Deposits options- Type A and Type B. Type A Capital Gains Deposit Account are similar to the savings account. It has a simple interest that is paid at regular intervals. Type B is similar to fixed deposits and has a maximum 3-year term.

Once you withdraw the amount from the Capital Gains Deposit Account, you need to reinvest it within 60 days. For withdrawal of the Capital Gains Deposits System, you need to submit form C.

Conditions for Saving The Capital Gain Tax

- You need to reinvest the profit or capital gain in the new assets within the 6 months from selling the property.

- These new assets must be held for at least 3 years. The tax exemptions are reversed if the property is sold before 3 years.

- The capital gain from selling the properties should not be more than the investment into the new assets.

- If you reinvest only part of the capital gain the tax exemptions are applicable only on the reinvested amount.

- To get the exemptions under 54, the new residential property should be purchased 1 year before or 2 Years after the sale of the existing property on which Capital Gain was received.

- Capital Gain should be less than the newly purchased property.

The Exemptions Limits for Long-Term Capital Gain TAX

| Age | Exemptions Limit |

|---|---|

| Below 60 Years | Rs. 2,50,000 |

| 60-80 Years | Rs. 3,00,000 |

| Above 80 Years | Rs. 5,00,000 |

Capital Gain Tax on the Inherited Properties In India

If the property is received by inheritance or gift, the Capital Gain Tax is not applicable to it. However, if you sell the property received by inheritance or gift, then the tax is applicable on the capital gain.

Here are the conditions for calculation of the Capital Gain Tax on Inherited Properties:

- The cost of acquisitions will be the cost to the previous owner of the property

- For an indexed value of the acquisition, the year of acquisitions of the previous owner is considered.

- The formula for the calculation of the Capital Gain Tax remains the same.

FAQs

The profit or gain from holding the property for less than 2 years is called the short-term capital gain. The Tax applicable on the short-term capital gain is called Capital Gain Tax. |

The profit or gain from holding the property for more than 2 years is called the Long Term capital gain. The Tax Applicable on the Long Term Capital Gain Tax is called the Long Term Capital Gain Tax. |

The Short Term Capital Gain can be calculated by using the following formula. Short Term Capital Gain Tax = Sales Consideration of Asset – Expenditure incurred for the transfer of property- Cost of Acquisition. |

The Long Term Capital Gain can be calculated by using the following formula. Long Term Capital Gain Tax = Sales Consideration of the Asset – [Expenditure incurred for the transfer of property + Indexed Cost of Acquisition + Indexed Cost of improvement] |

The short term Capital gain Tax on properties can be saved under the section 80U and 80C. The maximum amount for the exemption can be upto Rs 1.5 lakh. |

The Long Term Capital Gain Tax can be saved under section 54. The maximum amount for the exemption can be up to Rs 5,00,000 depending on the age category. |

The capital gains deposit account scheme allows you to park your Capital Gains till you find the right reinvestment options. This ensures that you don’t miss the applicable tax exemptions. |

There is no Capital Gain Tax applicable on inherited or gifted properties. However, the Capital Gain Tax is applicable on the profit from the selling of Inherited or gifted properties. |