When you are at the end of your home loan EMIs, you must check for all the aspects related to home loan closure.

This aspect includes marking off the checklist for home loan closure which will ensure that it is successful. It is to be noted that the home loan closure will be complete only when the lender declares the same.

Check the below points which are required to be on your checklist during the process of your home loan closure.

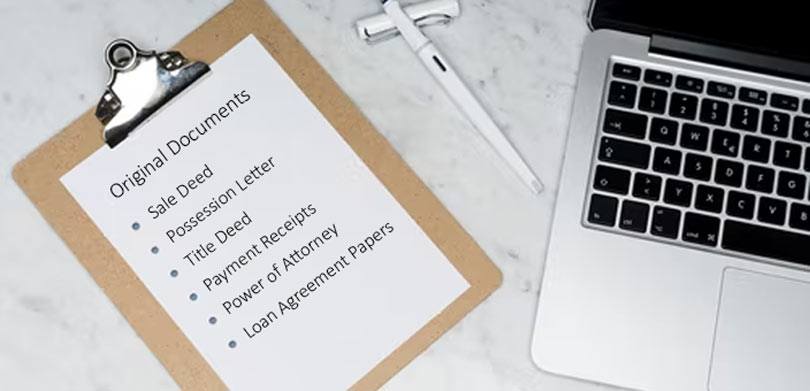

- Collecting the original documents: While applying for a home loan, it is important to submit original documents for the process. However, during the process of home loan closure, you will get back the original copies. It is to ensure that all the original copies are provided to you in a good condition. The following original documents are submitted during the process of home loan:

-

- Sale Deed

-

- Possession Letter

-

- Title Deed

-

- Payment Receipts

-

- Power of Attorney

-

- Loan Agreement Papers

- Acquiring the “No Dues” certificate from the lender: After collecting all the original documents from the lender, now it is important to collect the NOC “No Objection Certificate” from the lender. This certificate is important as it is proof that there are no dues left against your EMI and you have paid all the amount of your home loan. The lender here agrees that they no more have any legal authority over your property. You need to ensure that you are collecting this certificate right after paying the last EMI of the home loan.

- Clearing the Lien on the property: The “Lien on the property”’ means the right of the lender on your property. It is put on the property, for the purpose that if the borrower is not able to pay for the loan taken, then the property can be sold and recover the money by selling the house.

- Acquiring the modified Non-Encumbrance certificate: The non-encumbrance certificate contains every detail of the financial transactions which are linked to the property. After the home loan has been cleared, you should get the Non-encumbrance certificate updated. You need to visit the registrar’s office and submit an application for issuing this certificate.

- Updated credit score: Credit score declaration is important as it explains your creditworthiness. Once you have paid all the loan dues to your lender, you should ask them to update your Credit Score. The process of updating the credit score may take up to 20 to 30 days. Hence, you must ask your lender to update the credit score as early as possible. If there is any mistake in the credit score report, then you can ask your lender to rectify it.

- Collect modified bank statements concerning the home loan repayment: You need to collect the bank statements concerning the home loan repayment because they act as proof that your loan repayment process is completed. This also helps if there is any issue in the future related to the loan.

- Obtaining all the post-dated cheques: Most banks keep a post-dated cheque from the borrower so that if any installment is missed then the cheque can be used. However, if you have not missed any of the installments and paid all the due on time, then you can ask your lender to return the unused post-dated cheque.

FAQs

| Q1: When should I close my home loan?

Ans: There are various reasons why it is a wise decision to close the home loan like low interest will be levied on you, your cash can be utilized for some other investment, if you pay your dues early then your chance of getting other loans will increase, your credit usage will reduce, and you can enjoy your own property early. |

| Q2: Is it good to pay for the home loan early?

Ans: Yes, it is always better to pay all the installments on time so that you can save a lot of money over the loan duration. |

| Q3: What documents should I collect from the bank after I have paid all my home loan dues?

Ans: After paying all the dues of the home loan, I should collect the original documents from the bank like the Sale Deed, Possession Letter, Title Deed, Payment Receipts, Power of Attorney, and Loan Agreement Papers. |

| Q4: Which certificate is required to be collected from the registrar’s office during the home loan closure process?

Ans: The Non-Encumbrance certificate should be collected from the registrar’s office during the home loan closure process. |