Page Contents

What Is The Role of The CIBIL Score In Getting A Home Loan?

The most prestigious credit information provider authorised by the RBI (Reserve Bank of India) is CIBIL (The Credit Information Bureau India Limited).

The CIBIL Score represents a number that has been determined using all of your credit history data up to this point.

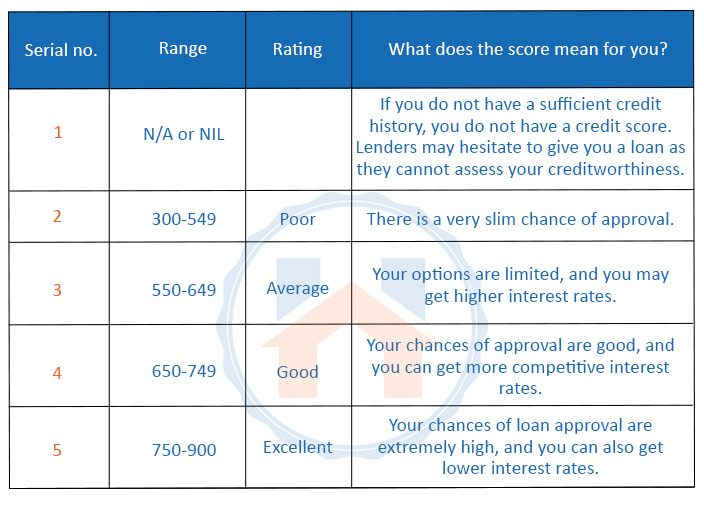

Your credit record, credit ratings, and credit reports are all summarised by a three-digit number that ranges from 300 to 900.

Furthermore, creditworthiness is determined by the range of your CIBIL score.

Your preferred lender will check your CIBIL score when you apply for a house loan to determine your creditworthiness.

Your Cibil score determines whether your home loan will get approved or not. Having a good CIBIL score helps in a home loan approval in less time and also you can get low-interest rates.

You can calculate home loan EMI using the Home loan EMI calculator.

Note:

Homebazaar serves homebuyers searching for flats in India with end-to-end services like site visits, and lower-interest home loans to property registration guidance. We provide the best price options & offers for 1 to 4 BHK RERA-registered flats, villas & penthouse properties in India. To begin a smooth homebuying journey with us, fill out the form mentioned below or on the right side.

Importance of Cibil Score For SBI Home Loan

Most people who want to buy or build a home generally apply for housing loans. Home loans are protected loans with SBI, where the home serves as collateral until the loan is fully repaid in accordance with the terms, conditions and criteria of the loan contract.

SBI considers various factors when approving a home loan application, and the CIBIL score is one of the most crucial ones.

As previously indicated, a high CIBIL score can guarantee that you may get a home loan without any difficulties. In addition, SBI will review your whole credit report, including information on previous loans, repayment capacity, etc.

What is the Minimum CIBIL Score For a Home Loan in SBI

Borrowers must have a high credit score in order to be approved for a house loan from SBI.

To qualify for an SBI Home Loan, you must have a minimum CIBIL score of 650. However, a strong 750 CIBIL score or higher will guarantee a speedy and trouble-free loan approval.

Qualifying for a house loan also depends on a number of additional variables such as ID proofs and important documents.

To check the CIBIL score visit the official website.

Benefits of a Good CIBIL Score

A good CIBIL score is an essential element if you are willing to take a home loan.

Here are the Benefits of a good CIBIL score.

- The SBI Loan Application will be approved quickly and without fuss.

- Lower rates of interest.

- Options for SBI Home Loans include enticing terms.

- Greater negotiating leverage

- An excellent working connection between SBI as well as the borrower leads to better borrower benefits.

Required Document for SBI Home Loan

A list of required documents for an SBI home loan is given below.

- Residence Proof

- Identity Proof

- Licence

- Passport Size Photo

- Receipt of Property Tax

- Bank account statement

- Loan application

- IT PAN card

- Assets statement (Personal)

- Employers salary certificate

- TDS Certificate

Reasons For Lower CIBIL Score

There are many reasons which can result in a Lower CIBIL score.

An Excessive Number of Unsecured Loans

You will have a harder time improving your CIBIL score if you have more unsecured loans than secured ones. Thus, it is essential to keep the ratio of secured loans to unsecured loans in a healthy range.

Late or missed payments

Your CIBIL score may suffer if your credit history contains information about missed or delayed payments. As a result, your likelihood of being authorised for an SBI Housing Loan lowers.

Several Loans

Having many loans open at once suggests that a person is greedy, which is another significant red sign for lenders. This further diminishes your chances of being qualified for SBI Housing Loans.

One of the key factors used by SBI and numerous other institutions to assess a loan’s creditworthiness and financial capacity is its CIBIL score.

FAQs

| Can I check my CIBIL by Aadhar card?

Though an Aadhar card is an ID proof registered on the official website, it is impossible to check the CIBIL score with it. |

| Is it safe to check the CIBIL score online?

Yes, it is safe to check online CIBIL scores. |

| How can I check my Cibil report?

Once a year, CIBIL will give you a free CIBIL Score and Report. |

| How can I download the full Cibil report?

Just on the Dashboard of the myCIBIL portal, click the “History” option in the top right corner to access your previous reports. By selecting “Download” or “Email,” you can also opt to download or send a Document of the chosen report. |

| What should be the CIBIL score for a home loan in SBI?

650 CIBIL score is a limit to getting a home loan from SBI. |