Once you finalize the property, the next important phase is to apply for the Home Loan.

The Home Loan Process begins with identifying the best banks or financial institutions. And, to compare different banks for the best home loan plans, one needs a clear understanding of the various terminologies. Knowing the important factors such as Home Loan Interest Rates, Type Of Interest Rates, Processing Fees, Interest Rates Calculation, Loan Tenure, and EMIs beforehand keeps you on the right track.

Having accurate insights into the Home Loan process and a solid repayment strategy is the key to successful home buying.

Therefore, in this article, you will get a comprehensive overview of Home Loans from all aspects.

Note:

Homebazaar serves homebuyers searching for flats in India with end-to-end services like site visits, and lower-interest home loans to property registration guidance. We provide the best price options & offers for 1 to 4 BHK RERA-registered flats, villas & penthouse properties in India. To begin a smooth homebuying journey with us, fill out the form mentioned below or on the right side.

Page Contents [hide]

- Various Options To Borrow Home Loan:

- How To Compare and Select The Best Bank To Borrow The Home Loan.

- Eligibility Criteria:

- Here Is The Eligibility Criteria For Some of The Best Banks For Home Loans:

- Home Loan Interest Rates:

- Type Of Interest Rates:

- How Interests Are Calculated:

- Processing Fees Charged By The Banks:

- Time Required For The Home Loan Disbursal:

- Down Payments:

- Balance Transfer Charges:

- Pre-Payment Penalties:

- Pre-Interest EMI:

- Security Needed:

- Comparison of some of the Best Banks For Home Loans:

- Home Loan Application Process

- FAQs On The Home Loan Application Process:

- How To Pay Home Loan EMIs

- What Are Flexible EMIs

- What Is Balance Transfer:

- What If you fail to Pay The Bank Loan EMIs:

- What Are The Consequences or Penalties For Not Paying The EMIs On The Bank Loan?

- How To ensure Timely Payment Of EMI

- Home Loan Closure

- What To Do In Case Of Grievance

- Quick Links:

Various Options To Borrow Home Loan:

You can borrow a Home Loan from two types of lenders- Banks or Non-Banking Financial Companies ( NBFC). It is important to know which type of lender will be suitable for you. So, Let’s first compare these two.

Generally, banks offer Lower Home Loan Interest Rates and provide more transparency. Because the Bank interest rates are linked to the external benchmarks set up by the RBI. So, as the RBI changes its Repo Rate, accordingly Banks increase or decrease the Home Loan Interest Rates.

On the other hand, Non-Banking Financial Companies ( NBFC) do not have any external benchmarks that decide their interest rates. Therefore, the Housing Finance Companies set up their own internal parameters called “Prime Lending Rate”. Meaning they decide interest rates suitable to customers.

One thing that works in favor of the NBFSs is they do not have stringent eligibility criteria like banks. So, the lenders who are not eligible to borrow the loan amount from the bank usually go with the NBFCs even though the interest rates are higher than the Banks.

Here is a Comparison between Home Loans from Banks and Home Loans From Financial Companies:

It is always recommended to go for the Bank Home Loan if you fit in the eligibility criteria.

How To Compare and Select The Best Bank To Borrow The Home Loan.

There are certain factors that can help you compare and choose the best Home Loan Plan. This includes the interest rates, type of interest- fixed or floating, processing fees, eligibility criteria, and so on.

First, understand these factors in detail. And compare various banks on the basis of these factors. In this way, you can shortlist and select the bank that suits you the best.

Here are some of the important factors to Select The Bank For The Home Loan:

Eligibility Criteria:

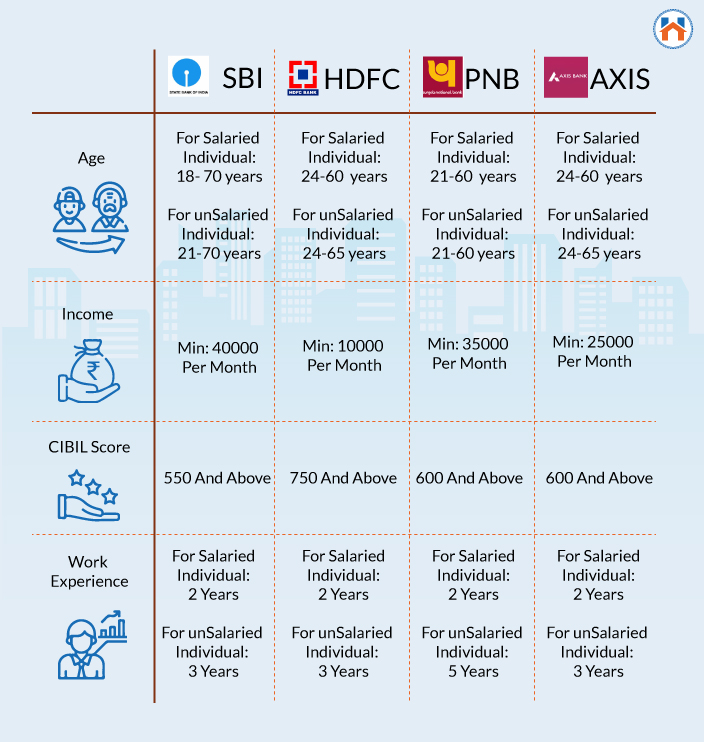

The Eligibility criteria are mostly common for every bank. However, there are some small variations depending on the Bank’s policies.

Following are the important points Banks consider in their Eligibility Criteria.

Every bank decides the eligibility on the basis of these factors. However, the conditions on these factors could be different for different banks. For example, HDFC offers a Home Loan with a minimum salary of 10,000 whereas the SBI needs a minimum of 40,000 monthly income.

Here Is The Eligibility Criteria For Some of The Best Banks For Home Loans:

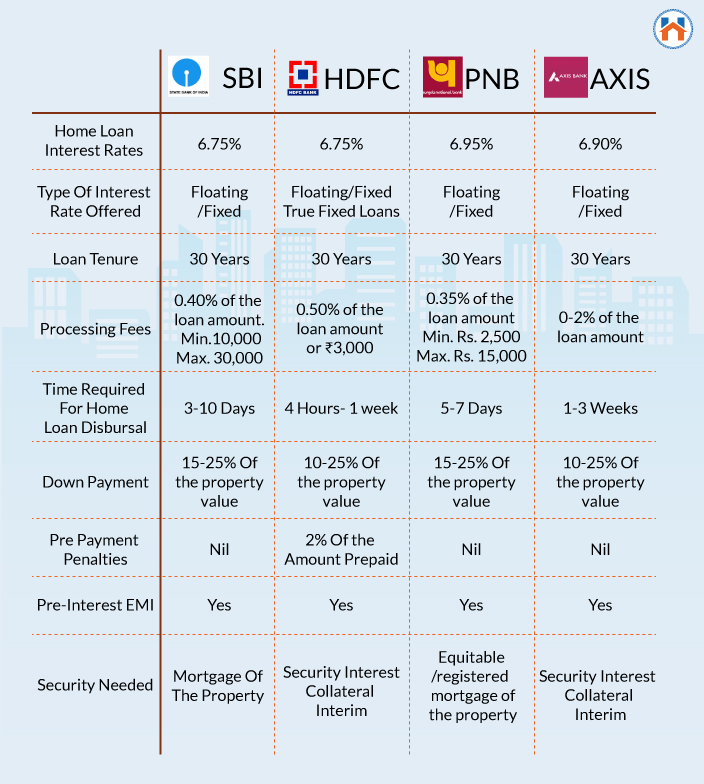

Home Loan Interest Rates:

Interest rate is one of the main parameters for selecting the bank for a Home Loan. The Home loan interest rates are linked to external benchmarks governed by the RBI. Therefore, depending on the RBI’s Repo rates, interest rates can go up or down. Currently, the interest rates have dipped to 15 years low. Banks are offering home loans with interest rates lower than 7%.

The Important Factors that influence your Home Loan Interest Rates are :

- MCLR Rates: It is fixed and monitored by RBI. Below This Banks can’t lend money to the borrower.

- LTV Ratio: LTV Ratio is also set by RBI. It defines the loan amount banks can lend with respect to the value of the property

- Credit Score: A credit score shows your creditworthiness. Banks can offer lower interest rates for higher Credit score applicants.

- Tenure Of The Loan: If the loan tenure is short, the interest rates are low. Whereas for long loan tenures, the interest rates are higher.

- Type Of Interest Rates: Depending on the type of interest rates- fixed or floating, the interest rates vary. Generally, for fixed type, the home loan interest rates are comparatively higher.

Choosing the bank only on the basis of the interest rates is not the right approach. Because the other parameters collectively decide the suitability of the bank for the home loan.

Type of the interest rate considered by the bank is also an important factor. Let’s understand the different types of interest rates considered by the banks.

Type Of Interest Rates:

There are two types of home loan interest rates- Fixed Rate Home Loan and Floating Rate Home Loan.

Fixed-Rate Home Loan:

In Fixed home loan interest rates, the home loan interest is fixed. Either for complete tenure or for a certain period of time. Therefore, In fixed home loans the EMI remains the same.

The advantage of the fixed home loan rate is that you get a contract interest rate. If the market interest rates rise you still get the interest rate at the same lower rate. However, in case if the market interest rate goes up you may still have to pay the higher interest rate.

When you opt for a fixed-rate home loan then it is necessary to inquire about the reset clause. Meaning, what will be the next interest rates applicable once the period is over?

Floating Interest Rates:

The Floating interest rates increase and decrease depending on the market interest rates. There are two things that define floating interest rates – an index and a spread. The index depends on the government securities. Whereas, the spread is added by the banks for their credit risks and profits.

Let’s compare Floating and Fixed interest rates:

In the future, You can change Floating Interest Rates to Fixed Interest Rates or vice versa.

How Interests Are Calculated:

There are three methods to calculate interest rates. And every method has a different impact on the net payable interest.

Annual Reducing Balance Method:

In this method, the principal amount is reduced at the end of each year. Meaning, you keep paying the interest for the part of the principal amount you have already paid. This results in a higher net payable interest amount.

Monthly Reducing Balance Method:

In this method, the principal amount is reduced at the end of each month. The principal amount gets deducted every month so you pay the interest on the monthly deducted principal amount.

Daily Reducing Balance Method:

The daily reducing method is the most beneficial for the home loan borrower. This method reduces the principal amount on the next day you pay the interest.

Conclusions:

- EMI is comparatively lesser in the case of the Daily Reducing Balance Method.

- Also, the net interest payable is less in the Daily Reducing Methods

- Currently, SBI is offering daily reducing balance methods to the borrowers.

Processing Fees Charged By The Banks:

There is a fee associated with the home loan process. This includes the home loan processing fees, application fees, administrating charges, extension of tenure, transferring balance loans, etc.

The processing fee can be anything between 0.4-2% of the total loan amount.

Therefore, before choosing the bank consider all the applicable fees.

There may be a chance that these fees might increase in the future. In such cases ask the reasons for the increase in the fee structure.

Time Required For The Home Loan Disbursal:

It is important to know how much time does bank takes for the loan disbursement. In general, the time taken by the banks varies from 3 days to several weeks.

For example, SBI takes around 3-10 days after the successful completion of the initial application process and the documentation.

Down Payments:

Generally, banks expect 20-30% of the property price as a down payment. Some banks can even sanction the loan for low down payments. Ask the bank about the applicable down payment for the home loan.

Balance Transfer Charges:

You can transfer the loan from one bank to another where the interest rate is low. But you need to pay the Switch overcharges or Balance Transfer Charges to the existing bank. These charges are generally, calculated as some percentage of the balance loan amount.

SBI for example charges switches over charges of 5000 plus taxes if you transfer the loan to another bank.

Pre-Payment Penalties:

You can pay the loan before the predefined schedule. However, you need to pay a pre-payment penalty to the bank. The prepayment charges vary from bank to bank. Most of the banks charge prepayment penalty charges of 2-3%.

Therefore, While choosing the bank know if there is any lock-in period.

If you are making the prepayment by taking the loan from another bank, then the prepayment penalties could be higher.

The best way to avoid the prepayment penalty is to increase the EMIs at your convenience.

Pre-Interest EMI:

If you take a home loan for under-construction properties then the loan is disbursed in various stages. If the bank gives you a pre-EMI facility, you need to pay the interest only on the disbursed loan amount.

If you are buying under-construction property choosing the bank that offers pre-interest EMIs is always beneficial.

Security Needed:

It is asking for securities while lending home loans. Some banks consider the first mortgage as security, while others consider the down payments. Banks also consider collateral securities such as insurance, bonds, and mutual funds.

Comparison of some of the Best Banks For Home Loans:

Once you finalize the bank for the Home Loan, you can proceed with the home loan application process.

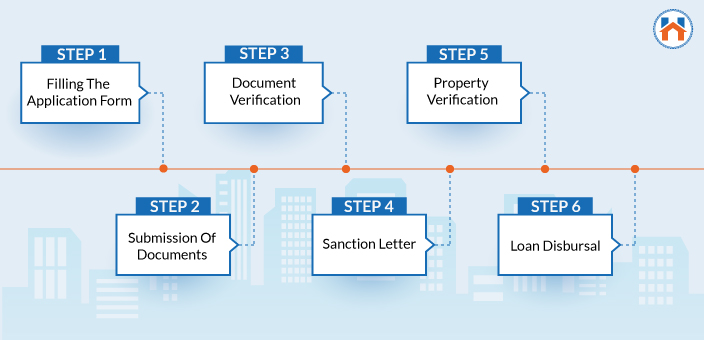

Home Loan Application Process

Before making the application ensure that you have the key information on all the factors mentioned above.

The Home Loan Application process involves the following important stages.

Filling The Application Form:

The application form required basic information such as:

Here is a sample Home Loan Form For Your Reference: SBI Home Loan Application Form

Submission Of Documents And Processing Fee:

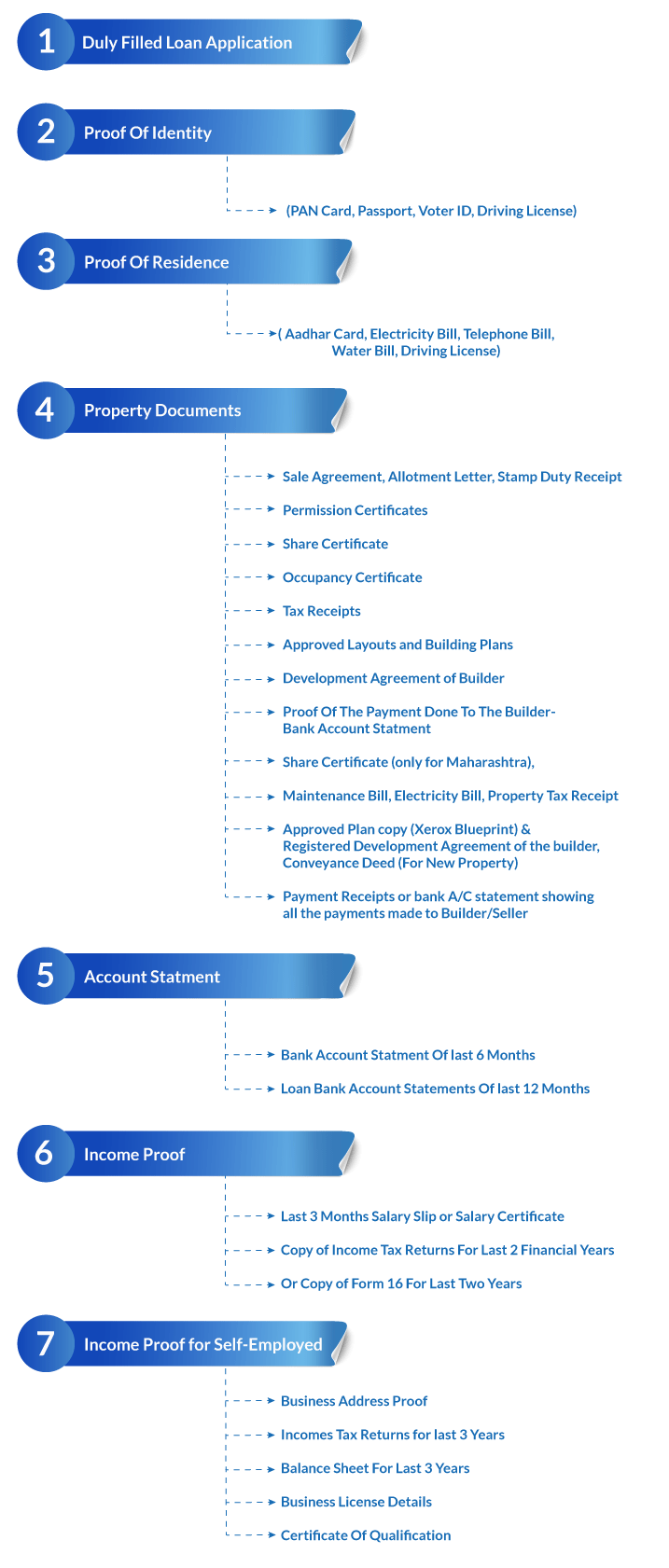

You need to submit important documents along with the Home Loan Application Form. Here is the list of the documents required for the Home Loan Application.

List Of Documents To Submit For Home Loan

While submitting the documents you need to pay the processing charges. These processing charges could be in the form of some percentage of the loan amount usually in the range of 0.4-2% or the specific amount from Rs 1000-15000.

Document Verification:

Upon the successful submission of the Home Loan Application and the documents, the bank proceeds with the document verification. In this stage, banks verify each and every detail provided by the applicant.

Banks also check the CIBIL score of the applicant. CIBIL score is a three-digit number that indicates the creditworthiness of the applicant. The score ranges from 300-900. If the CIBIL score is higher, then the credit ratings are good.

For higher CIBIL scores the applicable interest rates are comparatively lower.

For the document, the verification bank can cross-check the details by contacting the office or residential place.

Sanction Letter:

After the successful document verification, the bank issues a sanction letter that contains the following information.

- Sanctioned Home Loan

- Applicable Interest Rates

- Loan Tenure

- Applicable EMIs

- Other Terms And Conditions

Once banks issue the sanctions letter, you need to sign and keep one copy with you for future reference.

Property Verification:

Before leading the loan to the applicant, bank on-site property verification and evaluation.

In this process, banks check the following parameters for under-construction or ready-to-move properties.

Here is the list of things Banks check before sanctioning the loan.

After the property verification, the bank recalculates the applicable Home Loan Amount.

Loan Disbursal:

Post the property verification, the banks proceed to draft the Home Loan Agreement. This Home Loan agreement contains all the details related to the Home Loan.

The applicant has to read the agreement carefully and sign it.

After this bank disburses the loan amount to the applicant. The loan disbursement can take 2-3 days or more depending on the bank policies.

In the case of under-construction properties, banks disburse the loan amount as per the construction stages.

FAQs On The Home Loan Application Process:

The time required to process the Home Loan can be between 2-5 weeks |

The best way to calculate the EMI applicable is to use the EMI calculator. To calculate The EMI Click Here. |

Bank generally takes the first mortgage as the security for Home Loans. Bank can ask you to deposit the title deed of the property. |

Under Section 80C, you can avail the tax benefit up to 1.5 Lakh on the principal loan amount. Provided that property should not be sold within the first five years of possession. |

The CIBIL score between 700-900 is considered good for Home Loans. |

Bank considered EMI to NMI (Net Monthly Income) ratio to calculate the Home Loan Amount. To put it more simply, the bank sanctions the loan up to 40-50% of Monthly income. |

How To Pay Home Loan EMIs

Once the Home Loan amount is disbursed, you need to pay the EMIs for the prefixed Loan Tenure.

There are several ways you can set up your EMIs payments.

- Delayed start Of The EMIs– some banks provide this facility where you don’t need to pay the EMIs immediately after the home loan disbursement. Bank allow you moratorium period for which you only need to pay the pre-EMI interest

- Linking Home Loan To Savings Account: Some banks provide this facility where you can link the Home Loan to the saving account/ The benefit of this to you is that the home loan interest rates are calculated by considering the balance in the savings account.

- Step-up EMIs: In this type of EMI payment, you can set lower EMIs in the beginning. And once you get the financial stability you increase the EMIs.

- Step-Down EMIs: In this type of EMI payment, you can set higher EMIs in the beginning and then reduce the EMI.

Banks generally set up mandates for automatic EMI payments. However, you can choose other online and offline options for the EMI payment. The banks offer online as well as offline EMI payment options.

What Are Flexible EMIs

Some banks can provide flexibility on paying the EMI. because of this, you can plan your EMIs either as Step-up loans or Step-down loans.

In step-up loans, you pay lower EMIs initially and increase as your income increases in the future. On the other hand, in Step-dow loans, you pay higher EMIs in the beginning and then gradually reduce them.

Check out whether your banks provide you the facility of flexible EMIs.

What Is Balance Transfer:

To get the benefit of the low-interest rate you can shift your home loan to another bank.

In balance transfer loans you transfer the remaining principal amount to the other bank. However, to transfer the loan to other banks you need to pay switch overcharges or Balance Transfer Fees.

You still get the tax benefits on the Balance Transfer loans. And the maximum tenure of the balance transfer loan also remains 30 years.

Remember, some banks impose a lock-in period on the home loan. Meaning you can’t transfer your loan for a specified period. Therefore, check out the Lock-in period before you apply for the home loan in a specific bank.

What If you fail to Pay The Bank Loan EMIs:

If you fail to pay the EMIs on the Bank Loan, then it can be categorised into two types of defaults- Major Defaults and Minor Defaults

If you do not make the EMI payment in more than 90 days, it will be marked as a Major Default. The pending loan beyond 90 days is counted as a Non-Performing Assets.

Whereas, if you miss the actual payment date, but are able to make the EMIS payment in less than 90 days then it is categorized as the Minor Default.

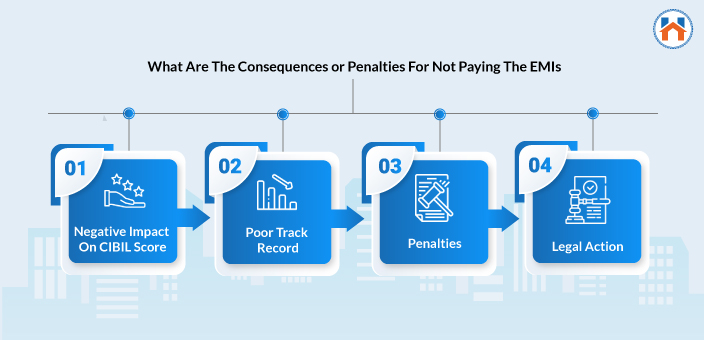

What Are The Consequences or Penalties For Not Paying The EMIs On The Bank Loan?

Negative Impact On CIBIL score:

Both the Major and Minor defaults impact negatively on the CIBIL score. Missing the EMI dates can reduce the CIBIL score considerably. Usually, missing EMI single time can reduce the CIBIL score by 40-70 points. This impacts your eligibility for availing of the loans n the future.

Poor Track Record:

The CIBIL has a complete record or history of the repayment. If you repeatedly fail to pay the EMIs on time, it can affect your creditworthiness. This leads to the rejection of the loans in the future.

Penalties:

If you miss the EMI, the other banks can penalize you. Generally, the banks penalize 2-3% of the EMI after missing the deadline. However, the penalty charges depend on the respective bank.

Legal Action:

Banks are entitled to take legal action against the borrowers if they do not repay the home loans.

If you miss the EMI deadlines for three months consecutively, the bank sends you reminders and tries to communicate with you. However, still, if you do not respond or repay the home loan amount Bank has a right to proceed with the auction of the property as per the 2002, SARFAESI Act.

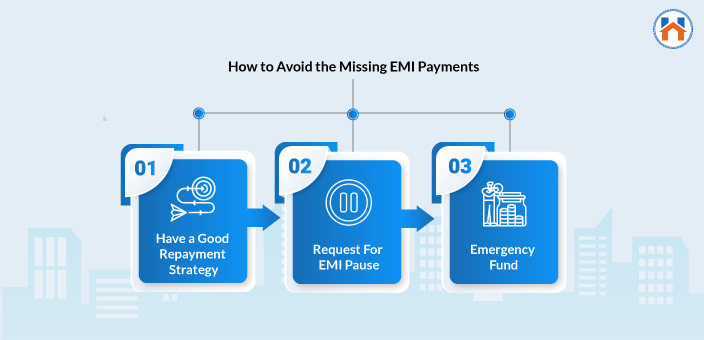

How To ensure Timely Payment Of EMI

Here are some of the methods that can help you to avoid missing the EMI payments.

Have a Good Repayment Strategy:

It is necessary to have a clear and effective Home Loan repayment strategy. So, before applying for the home loan you should calculate the applicable EMIs and accordingly make the financial arrangements.

As a thumper rule, you should not keep your EMI more than 40% of your monthly income. Ansd this when you do not have other financial liabilities or loans.

Request For EMI Pause:

In case of any financial emergency, you can request banks to pause the EMIs temporarily. Banks have the obligation to provide this relaxation to the borrowers. Usually, Banks can pause the EMIs for up to three months, if you have valid financial reasons.

Have an Emergency Fund:

The right approach to avoid missing the EMI deadlines is to have an emergency fund. This fund will help you to meet the demand for consistent EMI payments. By keeping an emergency fund you pay the EMIs on time and keep your CIBIL score intact.

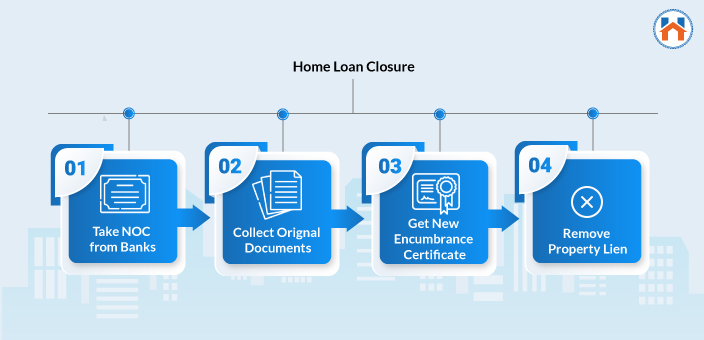

Home Loan Closure

Home Loan Closure is one of the most important parts of the Home Loan Process.

Once you pay the complete principle Home Loan amount along with the interests, you need to take NOCs and other confirmations from the Bank.

Here is the list of things you need to close the Home Loan.

Take NOC from the Bank:

After repaying the Home Loan, the bank issues a No Objection Certificate to you. The NOC indicates that you have successfully repaid the home loan and there are no dues from your side. This NOC is also considered as the certificate of Home Loan Closure

Collect Original Documents:

Once you clear the home loan it is necessary to collect the original documents. The important original documents such as the sales deed, allotment letter should be cross-checked and collected. Also, some banks ask for security checks while applying for a Home Loan. so, Collect the security checks as well.

Get New Encumbrance Certificate:

The Encumbrance certificate is an important document that shows property-related transactions. Once you repay the loan completely, it is necessary to get the new Encumbrance certificate that indicates no financial liability on the property.

Remove Property Lien:

In some cases, the banks put a lien on the property to prevent you from the resale the property. But once you clear the home loan you have the complete right to take any further decisions with the property. Therefore it is important to clear the lien on the property once you repay your home loan.

What To Do In Case Of Grievance

If you have any complaint or grievance against the Bank regarding the Home Loan, you can first reach out to the central office of the respective Bank. If the central branch office fails to respond to resolve your complaint you can further appeal to the Banking Ombudsman.

You can lodge the complaint with the Banking Ombudsman online by visiting bankingombudsman.rbi.org.in

There are no fees applicable to launch a complaint with the Banking Ombudsman. The complaints can be launched with the justification of the bank branch location. Once you launch the complaint you get the complaint identification number to track the complaints.

Further, If you are not satisfied with the decision gives by Bank Ombudsman, then you can appeal to RBI Appellate Authority.

Quick Links:

Home Loan EMI Calculator: Use This Home Loan EMI Calculator

Frequently Asked Questions- RBI: Click Here

Home Loan Grievance Registration: Click Here