Page Contents [hide]

- What is GST On Property In India

- GST Rates on Flat Purchase In India 2025

- Conditions: GST on Residential Property

- Highlights: Latest GST Rates 2025 On Flats

- GST Calculation on The Flat Purchase In India?

- Highlights

- GST On Commercial Properties in India

- GST Calculation On The Commercial Property In India

- Latest GST Rates 2025 Vs Previous GST Rates In India

- Effect of GST on the Real Estate Sector

- GST On TDR, FSI, And Long Term Lease Of Land

- GST On Real Estate Raw Materials

- Summing Up: GST on Purchase of Property 2025

- FAQs

What is GST On Property In India

The Goods and Service Tax was launched in 2017 to standardize with global taxation systems.

Before the GST, the developer and the property buyers needed to pay the value-added tax, service tax, central excise, etc.

It was, directly and indirectly, adding more burden on the property buyers.

And because of the complex taxation system, there was less transparency in the taxation of the properties.

Initially, the GST on purchase of property was 8% for affordable housing and 12% for non-affordable housing or premium residential projects.

However, the property buyers could get the benefit of the ITC on the previously applicable GST rates.

The GST rates were then revised in the 33rd GST Council meeting. The new GST rates are applicable from the 1st of April 2019.

As per the new GST rates, the GST on the flat purchase is 1% for the affordable housing segments, whereas 5% for the non-affordable or premium housing units without ITC.

Note:

Homebazaar serves homebuyers searching for flats in India with end-to-end services like site visits, and lower-interest home loans to property registration guidance. We provide the best price options & offers for 1 to 4 BHK RERA-registered flats, villas & penthouse properties in India. To begin a smooth homebuying journey with us, fill out the form mentioned below or on the right side.

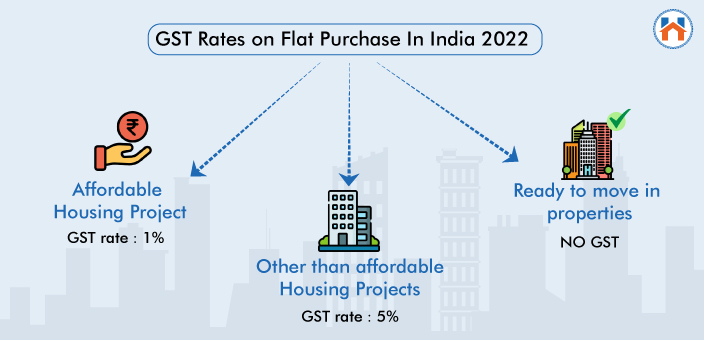

GST Rates on Flat Purchase In India 2025

| Type of Residential Property | GST Rates |

| GST On The Under-Construction Affordable Housing Projects | 1% |

| GST On The Other than Under-Construction Affordable Housing Projects | 5% |

| For Ready-to-move-in properties | No GST |

Conditions: GST on Residential Property

To Get The 1% of the GST on Residential Property Following Are The Important Conditions

- The property qualifies as an affordable housing project If–

| For Metros

The Property Comes Under Affordable Housing If- |

Area of the Under construction House = 60 sqm

The Price Upto 45 Lakh |

| In Non-Metros

The Property Comes Under Affordable Housing If- |

Area of the Under construction House = 90 sqm

The Price Upto 45 Lakh |

With the above conditions, the property is qualified as an affordable housing project.

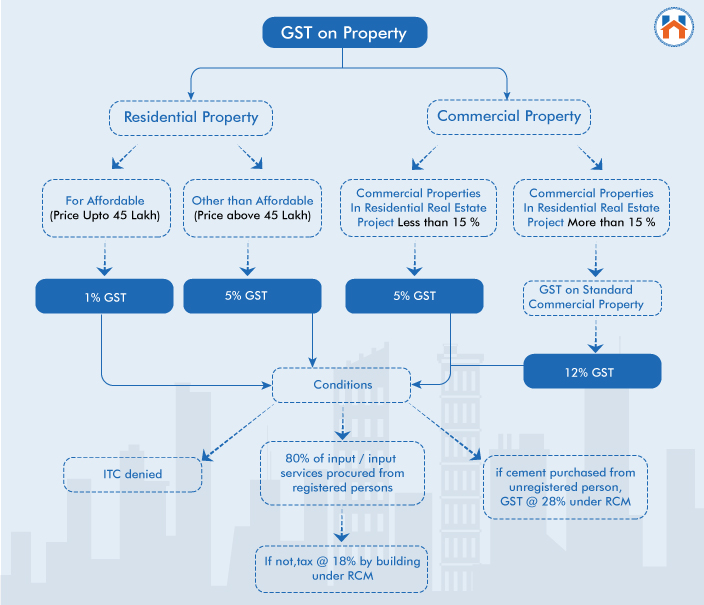

Other Conditions to Get 1% GST on Flat Purchase

- Also, to get the 1 % GST Rate on Flats, at least 80% of the raw material has to be procured from the registered dealer. Otherwise, the developer is liable to pay the GST of 18% under RCM.

- The 1% GST applicable on the affordable under-construction properties, is without the input tax credit. Meaning the GST you pay while purchasing the property can’t be claimed as a deduction from the income. Therefore, you will not get the benefit of reduced annual income tax applicable on your income.

Highlights: Latest GST Rates 2025 On Flats

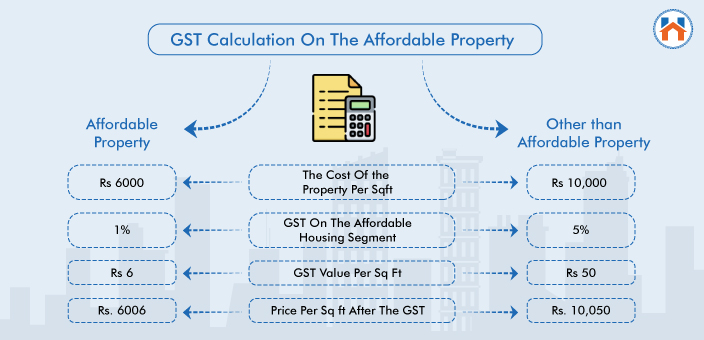

GST Calculation on The Flat Purchase In India?

To calculate the GST on property In India, it is necessary to know the conditions for affordable or other than affordable properties.

The GST for affordable housing is lesser than the GST on non-affordable housing units.

Let’s see examples for the GST calculation on a flat purchase in India.

GST Calculation On The Affordable Property

| The Cost Of the Property Per Sqft | Rs 6000 |

| GST On The Affordable Housing Segment | 1% |

| GST Value Per Sq Ft | Rs 6 |

| Price Per Sq ft After The GST | Rs. 6006 |

GST Calculation On The Non- Affordable Property

| The Cost Of the Property Per Sqft | Rs 10,000 |

| GST On The Affordable Housing Segment | 5% |

| GST Value Per Sq Ft | Rs 50 |

| Price Per Sq ft After The GST | Rs. 10,050 |

Highlights

GST On Commercial Properties in India

The GST for commercial properties is higher than that of residential properties.

Here are the latest GST rates on commercial properties in 2025.

| Type of Commercial Property | Applicable GST |

| GST On Commercial Properties In Residential Real Estate Projects with Area Less Than 15% of the carpet area. | 5% |

| GST On Standalone Commercial Properties

In Residential Real Estate Projects with areas of More Than 15% |

12% |

GST Calculation On The Commercial Property In India

Here is how GST on commercial property in India can be calculated.

| The Cost Of the Property Per Sqft | Rs 10,000 |

| GST On The Affordable Housing Segment | 5% |

| GST Value Per Sq Ft | Rs 50 |

| Price Per Sq ft After The GST | Rs. 10,050 |

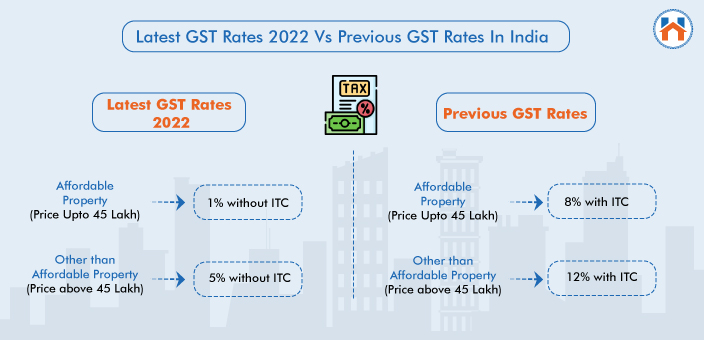

Latest GST Rates 2025 Vs Previous GST Rates In India

Here is the comparison between the latest and the earlier GST rates.

| Property type | Earlier GST Rates 2017-2019

(Before April 2019) |

Latest GST Rates 2024

(From April 2019) |

| Affordable Housing | 8% with ITC | 1% without ITC |

| Other Than Affordable Housing | 12% with ITC | 5% without ITC |

Effect of GST on the Real Estate Sector

The GST has been one of the major changes in the real estate industry.

In the previous tax regime, the tax was paid by the developer in various segments such as VAT, Customs Duty, Excise Duty, service taxes, legal fees, approval fees, etc. This complicated the Taxation process for the developers and added an additional burden on the homebuyers.

Therefore, under the newly introduced GST regime, the tax on property was streamlined. However, as per the new GST regime, the tax rate was higher at a 12% slab for the real estate sector.

Under the GST the burden on the property buyers was definitely reduced. However, the taxation affects greatly the developers and to some extent the property buyers.

In the 34th council meeting held n 2019, the new GST rates were introduced. According to this, the tax rates were significantly reduced.

For the affordable housing projects, the new GST was 1% for the affordable housing projects, whereas for the other premium residential projects the GST rate is 5%.

GST On TDR, FSI, And Long Term Lease Of Land

To develop real estate projects, the developer needs the Transfer of Development Rights (TDR), FSI, or the Long term Leasing of the land. And these may be subject to taxes depending on the various conditions.

The developer is liable to pay the taxes on TDR, FSI, and the Long Term lease of the Land.

So, here are the conditions for the GST on the TDR, FSI, and Long Term Lease of Land

- If the developer uses the TDR, FSI, and the Long Term Lease of Land for building the residential spaces and sold the flat before the completion certificate, then the developer is exempted from paying the tax on such properties.

- There is no tax exemption for the developer if the tax if flats are sold after the completion certificate. In such cases, the 1% GST is applicable for the affordable housing units, whereas 5% GST is applicable for other than the affordable housing units.

- If the developer uses the TDR, FSI, and the Long Term Lease of the Land for building the commercial project then 18% of the GST is applicable.

GST On Real Estate Raw Materials

The construction cost of the buildings or the properties depends directly on the raw material and the labor cost.

The GST on the raw material significantly impacts the total cost of the construction.

Here are some of the important materials and the GST applicable to them.

| Raw Material | Applicable GST |

| GST on Sand | 5% For Natural Sand

18% For Bituminous Sand |

| GST on Cement | 28% |

| GST on Brick | 5% For Building Bricks

18% Refractory Bricks 28% Cemented Bricks, Building Blocks |

| GST on Marble Granite | 12% |

| GST on Building Stone | 5% |

| GST on Steel | 18% |

| GST on Tiles | 5% Earthen or Roofing Tiles

18% Bamboo Flooring Tiles 28 % Cement Tiles |

| GST on Mica | 12% |

| GST on Electric Machinery | 28% |

| GST On Paint And Varnish | 18% & 28% |

| GST on Bathroom Fittings | 18% & 28% |

Summing Up: GST on Purchase of Property 2025

FAQs

| What are the GST Rates on Flat Purchase In India 2025?

GST Rates on Flat Purchases in India is 1% for affordable flats and 5% for properties other than affordable housing or premium flats. |

| What is GST for the ready-to-move-in properties in India?

No GST is applicable for the ready-to-move-in properties in India. |

| What are the GST concessions?

To get the 1% or the 5% GST rates, the conditions at least 80% of the raw material has to be procured from the registered dealer. |

| What is the GST on the land properties?

There is no GST is applicable on land properties in India. |