Page Contents

How Much Of Your Salary Should You Spend On Rent?

28% of the urban population lives in rented accommodation. Hence, it is a common issue to calculate how much of the salary can ideally be spent on rent.

With so many expenses, you have to manage the cost of your rent every month. There are many options for your available at different rates, hence, it becomes difficult for a tenant to understand how much should be spent on rent.

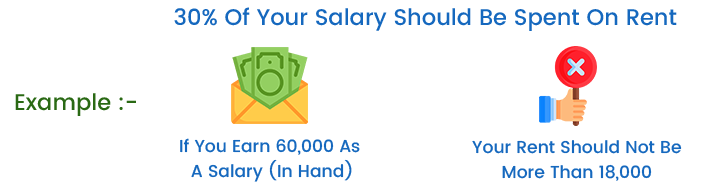

Ideally, you should not pay more than 30% of your salary for rent which consists of 1/3rd of your monthly income. Hence, if you earn 60,000 as a salary (in hand), your rent should not be more than 18,000.

However, there are a few factors which you need to consider before selecting a rented house like your budget, locality, and convenience to your workplace.

If you have an affordable house with a good locality, but it takes longer to reach your workplace, then it would be better to increase your budget for rent and stay a little closer to your workplace.

The daily expense and exhaustion to your workplace will be more compared to the amount you will save in that affordable rented house.

Percentage Of Income For Rent

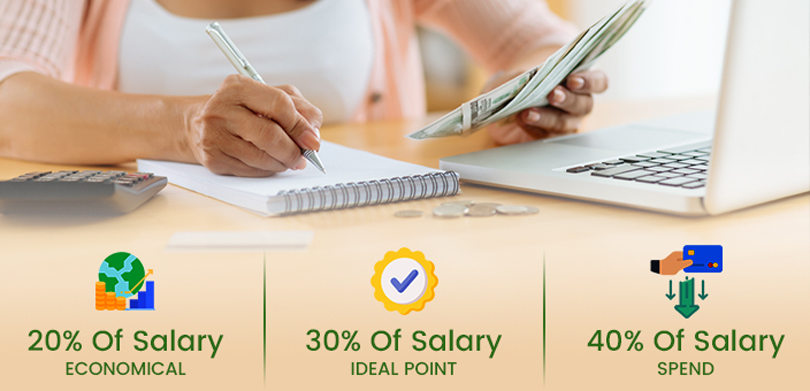

Experts state that ideally, you should be spending only 30% of your salary on rent payments. However, it is not the only option.

Let’s check which are the other options which you can also opt for paying your rental expense monthly.

20% of salary: If you are spending 20% of your salary on rent every month, then you can spend more on non-essential items. However, if you are earning a regular income, then you should stay away from sleek apartments as that would be out of your budget if you are in a metro city. 20% of your salary on rent can help you save money.

30% of salary: Spending 30% of your salary on rent is the golden rule. If you are spending 30% of your salary on rent, then you will get a healthy balance between comfort and affordability. If you have a regular income, then 30% of your salary will be ideal to spend on space you can call your home. This percentage can help you save a lot of money and invest somewhere else.

40% of salary: If you want a better location with a huge and beautiful house, then you might have to spend 40% of your salary on rent. If you are earning more than average, then spending 40% on your rent can help you get your desired house. However, if you are spending 10% on your rent, then you should keep a regular check on your expenses.

Impact Of HRA On Rent

As per section 10 (13A) of the Income Tax Act, you can ask for a deduction which is permissible and you can also claim for exemption on your HRA. Hence, if you are staying in a rented apartment, then you will receive HRA from your employer.

However, the HRA amount will be based on whichever is lower among these three options:

- The actual HRA was received.

- Rent paid in excess of 10% of the salary (defined as Basic + DA + Commission as a percentage of T/O).

- For metro cities, an amount = 50% of the salary and for non-metro cities, an amount = 40% of the salary.

How To Manage The Rent Payment With A Low Salary

Managing monthly expenses along with rental expenses can be difficult. Hence, it is important to balance your income and expenses in a calculated manner.

At this point, you should imply that 30% rule and try to find an apartment that is under this 30% salary amount. If possible, go for an even lesser rental apartment.

This will help you to manage your monthly expenses better and also save the maximum of your salary.

You should also regularly keep track of your monthly outflows so that you can manage your expenses properly and save enough money.

FAQs

| Q1: What is the HRA exemption limit?

Ans: The HRA exemption amount will be based on whichever is lower among these three options which are the actual HRA received; rent paid in excess of 10% of the salary (defined as Basic + DA + Commission as a percentage of T/O); for metro cities, an amount = 50% of the salary and for non-metro cities, an amount = 40% of the salary. |

| Q2: Is HRA a part of section 80C?

Ans: No, HRA exemption cannot be claimed under section 80C. Hence, it can only be claimed under section 10(13A), and section 80GG. |

| Q3: How can I manage my rent payment with a low monthly income?

Ans: You need to find accommodation where you have to pay only 30% of your salary. Track your expenses regularly for better results. |

| Q4: What is the impact of HRA on home rent?

Ans: As per section 10 (13A) of the Income Tax Act, you can ask for a deduction which is permissible and you can also claim for exemption on your HRA. |