Buying a house can be quite a tiring process. However, if you want to know how to change the name in property tax record, then you can do it with a simple process.

Property Tax Record is the documentation that is maintained in every country by the relevant department which includes the information related to the property.

The process of changing the name in the property tax record is quite easy, provided that all the required documents are ready with the owner of the property.

It is important that whenever the ownership of the property is being changed, the name of the previous owner is removed and the name of the new owner is recorded.

Otherwise, the previous owner will still be liable to pay the taxes.

It has become quite an easy process to change the name in Property Tax Record online as well as offline.

How To Change The Name In Property Tax Record

The Commissioner of Revenue will verify the submitted documents and application form of name change in the Property Tax Record.

However, before starting with the process of change in name, it is advised to recheck whether you have all the required documents or not.

While following the offline process, you will have to write an application for the name change to the Commission of Revenue of your specific area.

Then submit the below documents along with the application to the Commission.

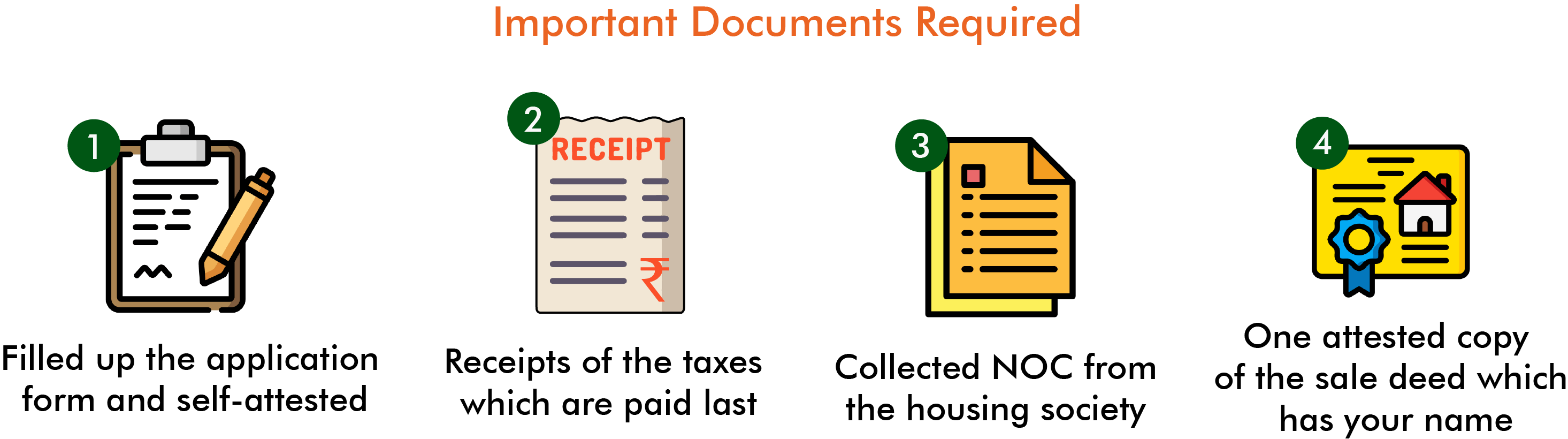

The important documents are the following:

- Filled up the application form and self-attested

- Receipts of the taxes which are paid last

- Collected NOC from the housing society

- One attested copy of the sale deed which has your name

Through the online process, you will have to visit the official website and fill up an application form for the same.

The important documents are required to be submitted along with the application form.

After the submission of the application form, it will be verified and the approval will be done

The name change might take 15 to 30 working days to reflect in the records.

Change Ownership Through Property Mutation

Mutation of Property is a process through which the owner of the property can change the ownership of the property.

You do not need to provide any outstanding certificate for the property before applying for property mutation.

However, if the property is inherited, then an original Death Certificate and affidavit are required. The revenue officer checks all the detail for the mutation of property.

You can apply for the property mutation online. Visit the official website of the state’s revenue body and apply for the same.

In case you want to apply for it offline then you will have to submit the required documents to the revenue office.

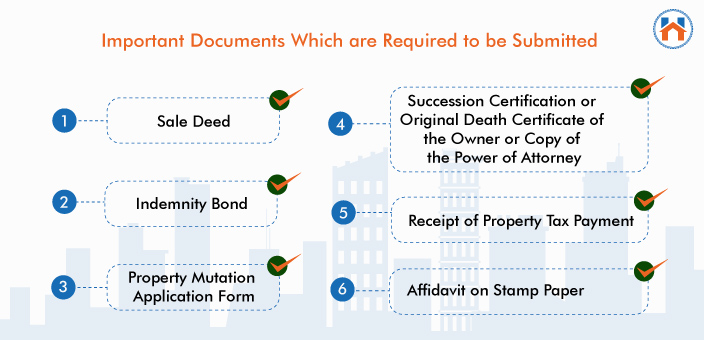

The important documents which are required to be submitted are the following:

- Sale deed

- Indemnity bond

- Property Mutation application form

- Succession certification or original death certificate of the owner or copy of the power of attorney

- Receipt of property tax payment

- Affidavit on stamp paper

FAQs

| Q: What is Property Tax Record?

Ans: Property Tax Record is the documentation that is maintained in every country by the relevant department which includes the information related to the property. |

| Q: What documents are required to be submitted for change of name in property tax records?

Ans: The important documents are the following:

|

| Q: What documents are required to be submitted for property mutation?

Ans: The important documents which are required to be submitted are the following:

|

| Q: Whom to submit the application for a change of name in property tax records?

Ans: The Commissioner of Revenue will verify the submitted documents and application form of name change in the Property Tax Record. |