Page Contents

- Points To Keep In Mind Before Investing In Real Estate in India

- How To Invest In Real Estate In India For Beginners

- How To Invest In Real Estate In India Online

- How To Invest In Real Estate Investment Trust India (REIT)

- Types Of REIT

- What is the Difference Between REIT and Mutual Funds

- How to Invest In Commercial Real Estate in India

- How To Get a Loan to Invest in Real Estate in India From a Bank

- Other Ways to Invest in Real Estate Without Buying Property

- FAQs

Points To Keep In Mind Before Investing In Real Estate in India

A wise investment has the power to transform your life and give you the resources that need to realise your ambitions.

Today, the majority of people own a variety of investments in their investment portfolios, including stocks, various bonds, gold, government programmes, and so on.

However, one of the overlooked or undervalued investments in recent years continues to be real estate.

People often get carried away just by hearing certain things and profits about the real estate sector and ignore the risks behind it.

There are certain risks which beginners should keep in mind before you invest in real estate your hard-earned money.

Research about the Property: It is not harmful to do little homework on a property before making any decision. Choosing the right real estate can be challenging with so many projects in the works, especially because sellers are frequently known for charming potential purchasers.

The facilities provided, the reputation of the building business, the materials utilised, and the location of a home can all affect the returns on your capital. If you don’t do your research before making a purchase, you can regret it later and lose your money.

Verify Market Rates: Most local governments offer a guideline value to assist investors in determining an asset’s rate. By keeping track of neighbourhood trends with the help of the market rate, you may avoid being misled into paying more for a house than it is worth.

Verify the paper: A property’s paperwork is the most essential consideration, as anyone unfamiliar with the market for real estate may be fooled into booking a house with phoney papers. This can create legal battles or motions that effectively make the property investment worthless.

You can take the help of legal personnel to check the authenticity of any property papers.

A few times, people sell homes with less than market value properties, which may be bad for you because such homes may be the subject of lawsuits or have other problems with the seller.

Analyze Your Finances: To make sure that you achieve specific objectives, it is critical to calculate your financial situation. Bank loans are simple, but it’s important to factor in the interest rate and other costs.

How To Invest In Real Estate In India For Beginners

The real estate market is growing day by day and people are looking for different options for investments. The residential sector has grown dramatically in the last few years. You can start to invest in real estate in India with little money in this market.

Although the cost of manpower and primary materials has been steadily growing, demand-driven increases in property values have also been significant.

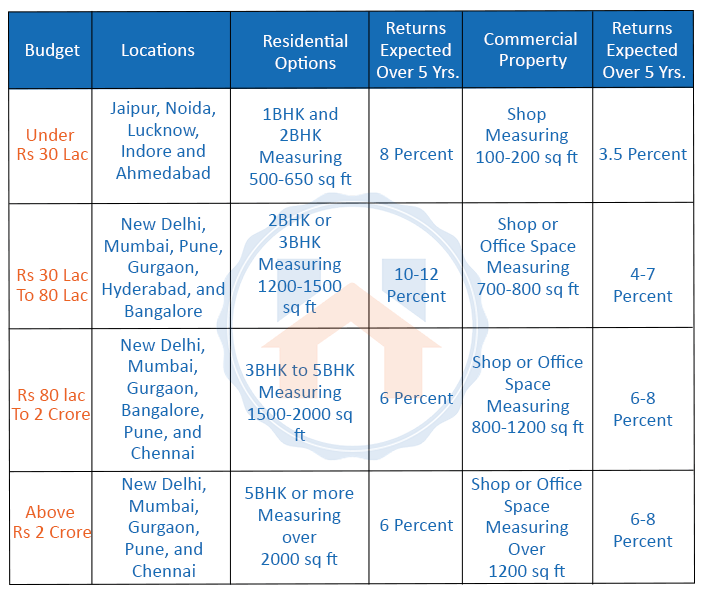

The most Frequent question is how much money you should put into the real estate sector to get the best returns on investments and what other possibilities are accessible for different price brackets.

The investment factor depends on the individual’s income selected location or market and the expected return on investment.

While discussing the real estate growth and market condition in India Homebazaar.com AVP Dharmesh Thakkar Said,” 2024 marks an unprecedented opportunity in the real estate market – a golden era for investment. I confidently affirm that this year presents the perfect confluence of factors, making it the ideal time to invest in real estate. Property prices in the top 7 cities in India are predicted to rise at a high level.”

For consistent profits on real estate investments, the least range of Rs 25–30 lakh is expected. Within this cost range, some residential, as well as commercial spaces, are available in places like Banglore, Jaipur, Pune, Noida, and Indore.

This area is because the infrastructure development is at a great pace and many significant projects are being under construction, which will be the main factor boosting real estate prices.

How To Invest In Real Estate In India Online

Many Platforms are available To invest in real estate in India online. These Online platforms for real estate investing combine the money of many investors and make investments in their accounts in possibilities that would otherwise be expensive to investigate.

These areas vary greatly in areas of investment opportunities, property kinds, and investment thresholds.

Internet platforms allow investors to invest in a single asset or a diverse portfolio of real estate, with a concentration on both commercial and residential property.

The medium, however, is most appropriate for people who have the financial means to leave their holdings unattended for a considerable time.

How To Invest In Real Estate Investment Trust India (REIT)

Real estate investment trusts are the same as mutual funds. They gather funds from various investors and use those funds to purchase real estate assets that produce income.

- REITs manage these assets so they can profit from capital growth and rental income.

- REITs are introduced via an IPO (Initial Public Offering) as well as a subsequent public offering, like equity equities (FPOs). Therefore, owning a Deposit Account is a must.

- REIT exchange on the security interchange when the real offer is gathered and the assigning is complete. These investments required the lowest investment of INR 50,000.

- The threshold amount for investment is now from INR 10,000 and INR 15,000 following SEBI’s notice in 2021.

- Within the same SEBI regulation, the smaller batch size for REITs was also decreased from 100 units to 1 unit.

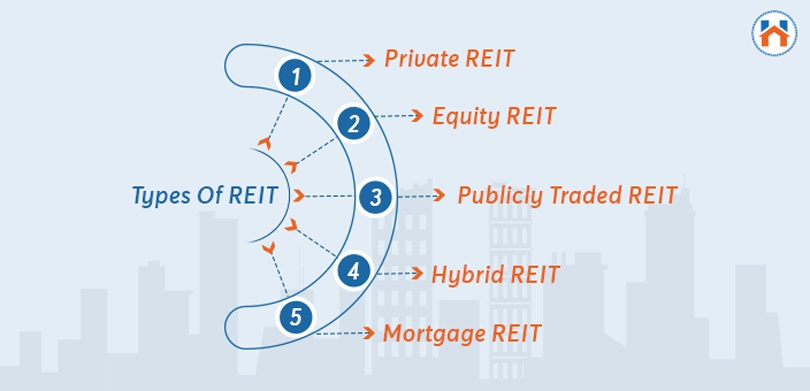

Types Of REIT

The following are the types of Real Estate Investment Trust,

Private REIT: These are private placements with a small investor base. They are neither registered on any stock exchange nor are they registered with SEBI.

Equity REIT: They’re the ones who own all the assets that generate income. Rents are how it makes money. The most common kind of REIT is this one. All investors will receive a share of the income earned.

Hybrid REIT: These generate consistent income from rent and interest on both owned and mortgage-based assets. Investors can diversify and gain from both sources owing to it.

Publicly Traded REIT: This is registered with SEBI and registered on the stock exchanges (NSE). Holdings of it are available for purchase and sale on stock exchanges. Although they are less volatile, they are more liquid.

Mortgage REIT: Also known as MREITs, which provide financing to companies involved in the market of real estate. Instead of receiving income from rent, they receive it from EMI and mortgage rates.

These companies also buy mortgage-backed properties and generate interest-based revenue that is distributed to all shareholders.

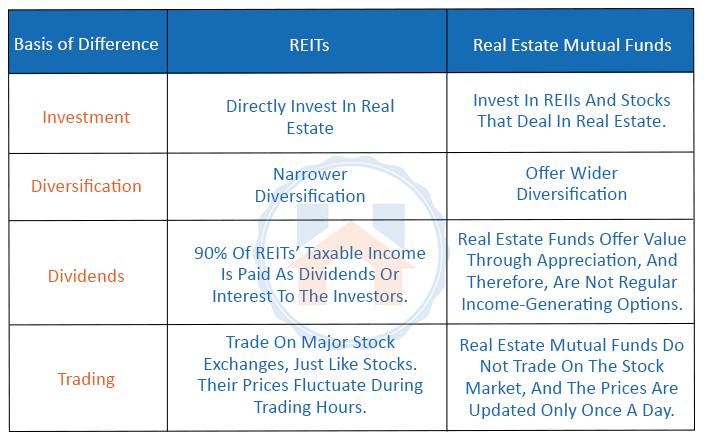

What is the Difference Between REIT and Mutual Funds

Real estate exposure is provided at low investment costs by REITs and mutual funds, which are related but there are some differences between the two as follows,

How to Invest In Commercial Real Estate in India

The commercial real estate sector in India is expanding quickly, making now a prime moment to acquire in this investment market. Due to its strong profits over time, Indian businesses receive the biggest allocation from the top funds in the world.

Commercial real estate is a good investment now because returns are higher than they would be in a mature market.

Now would be a good moment to invest if you want to benefit from India’s growth and share in it. Because of the ideal ratio of stability to returns.

- There are two methods to invest in commercial properties buying the property outright or through fractional platforms. Mumbai, Delhi, Pune, Hyderabad, and Bangalore are the greatest locations to purchase commercial property in India.

- Since commercial projects are often less risky and costly than residential ones and there is a growing market from company owners who need a warehouse or office space, lenders are more likely to fund them.

- Real estate with a commercial usage potential is known as commercial property. When investing in commercial real estate, there are numerous things to take into account.

- The property’s location and its accessibility to major thoroughfares, roads, airports, and some other landmarks come first. Until making any purchase, consider the building’s and the neighbourhood’s conditions as well.

How To Get a Loan to Invest in Real Estate in India From a Bank

Getting a secured loan from banks, housing organisations, and non-banking financing institutions (NBFIs) over real estate, whether it be commercial or residential property, is known as a loan against property (LAP).

These loans are swiftly disbursed and have lower rates of interest than personal or company loans. Anyone who owns prior the property and is employed or in a professional endeavour is eligible to qualify for a loan against the property.

Before approaching a lender, be sure to comprehend the conditions of each type of loan and carefully research how the various options operate.

Traditional bank mortgages, hard money financing, and property equity financing are the three most common forms of loans for an investment portfolio.

Other Ways to Invest in Real Estate Without Buying Property

With the above real estate investment options there are other ways to invest in real estate without buying property they are as follows.

Wholesaling in real estate

Without making a sizable initial investment, real estate distribution is an excellent option for people to enter the real estate market. It is a type of property flipping where the investor, also known as the wholesaler, signs a contract to purchase a house they think is being overpriced.

A newcomer might learn crucial bargaining skills and gain an understanding of the real property sector via the process.

The charge associated with the transaction, which is often a fixed percentage of the total cost of the property, is how the wholesaler makes money.

Cash advance loans/ liquidity loans,

In essence, a liquidity loan is a personal loan given to an investor in real estate. Hard money loans, sometimes known as bridge loans, entail short-term funding to fund an investment project.

The loan is granted based on the worth of the secured property.

The lender often extends credits up to 65 to 75 % of the value of the property and receives payment in the form of income, which is typically greater than that of traditional real estate loans.

Realty Mutual Funds

An excellent strategy to broaden your real estate holdings is by investing in estate mutual funds.

The idea is comparable to that of a mutual fund, in which the corporation owns the investments it makes while the investor holds a share of the mutual fund.

Real estate mutual funds mostly make direct acquisitions of housing, commercial, and industrial properties as well as REITs and real estate shares.

The gains from mutual property funds depend on several variables, including supply and demand demographics, which is an important element to keep in mind.

Also Read, Top places for investment in Navi Mumbai

FAQs

| What is the minimum amount to invest in real estate in India?

In India, you can invest in real estate for under 30 Lakh amount. |

| Is real estate in India still a profitable investment?

Due to its high return on investments (ROI) value, the Indian real estate sector is booming and has integrated itself into numerous successful investment portfolios. According to a survey, real estate makes up 77% of the average Indian household’s total assets. |

| How much profit does real estate make in India?

Averaging 13.717%, quarterly updates to the Profit Margin data From India. |

| Will property prices fall in 2023 in India?

According to a survey, the price of real estate in India will rise to a maximum of 7.5% in 2022 and so around 6% in 2023. |

| Which city is best for real estate investment in India?

Pune, Noida, Navi Mumbai, Bangalore, Hyderabad and Chennai are considered as best cities to invest in India. |