If you are selling your old house then it will create capital gain which will generate capital gains tax. However, different ways can be used to reduce the tax against any long-term capital term.

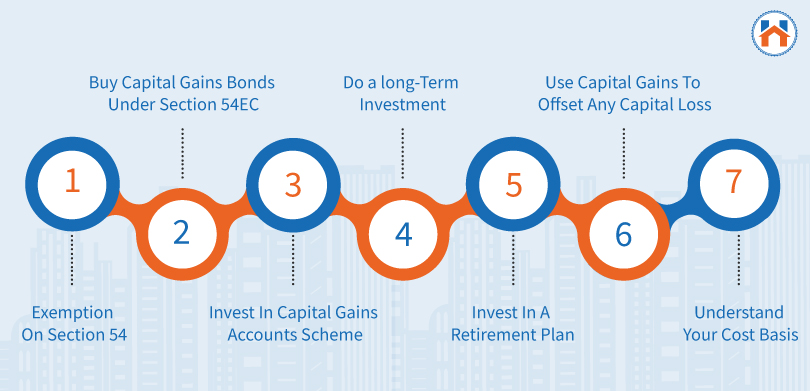

Different tax-saving methods for property sales are explained in the below points:

- Exemption on Section 54: If you are selling your old house and utilizing the money to buy a new house, then you are eligible for the exemption under Section 54. However, certain conditions need to be fulfilled like:

- You bought the new property one year before or two years after you sell your old property.

- You can invest the capital gained from selling the old house to buy a new house

- Ensure that the construction work of the new house should be completed within 3 years of selling the old property.

- If you are willing to buy or invest in a new house then there should be only one property.

- After you get possession of the property, you should not sell the property within 3 years.

- If the new property costs less compared to the gains from the sale of the old property, then there will be exemption proportionately. The remaining amount can be reinvested according to section 54EC. However, it should be done within 6 months.

- Buy Capital Gains Bonds under Section 54EC: If you are selling a house and do not want to buy a new house with the amount, then you can invest the amount into capital gains bonds under section 54EC to save taxes. When you are selling an asset that was held by you for more than 2 years and gain a specific amount, then it is called capital gain. If you are investing the entire amount into a capital gains bond, then you will receive around a 5-6% return every year. You should do the investment within 6 months of selling your property. The lock-in period of these bonds is for 5 years and it is a highly secured investment with an AAA rating. The limit set for minimum investment is Rs 10,000 and for maximum investment is Rs 50,000.

- Invest in Capital Gains Accounts Scheme: If you are willing to invest the capital gains amount into a new property, then you might have to go through several paperwork which can be time-consuming. If you want to invest in the capital gains account scheme of 1988, then you can avail of this service from banks that offer this investment.

- Do a long-term investment: If you have invested in a company’s stocks for a longer period, then you can receive a deduction on the capital gain from the return.

- Invest in a retirement plan: If you are investing your money into an investment plan like 401(k), 403(b), or IRA, then you will receive tax exemption on the plan. However, if you have a traditional retirement account, then your capital gain will not be tax-free.

- Use capital gains to offset any capital loss: If have any capital loss from any investment, then you can use your capital gain to offset the amount. The capital gain will be tax-free in this case.

- Understand your cost basis: If you have invested in shares of a company or a different mutual fund, then you will have to find the cost basis of the investment. Cost basis is considered as the original value of an investment like dividends, return on capital, and adjusted stock splits for calculating the investment. When you deduct the current market value of the investment from its purchase price, you will get capital gain.

FAQs

| Q1: How to avoid tax on property sales?

Ans: To avoid tax on property sales or long-term gains then you can apply different methods like Exemption on Section 54, Buy Capital Gains Bonds under Section 54EC, Invest in Capital Gains Accounts Scheme, Do a long-term investment, Invest in a retirement plan, Use capital gains to offset any capital loss, and Understand your cost basis. |

| Q2: How can I save capital gain tax on the sale of the property?

Ans: You can save capital gain tax on the sale of property with different methods like Invest in Capital Gains Accounts Scheme, Invest in a retirement plan, and the Use capital gains to offset any capital loss. |

| Q3: How to calculate capital gains tax?

Ans: Capital gains tax can be calculated as the difference between the capital asset and the rate at which it is sold. |

| Q4: When to invest in government bonds under section 54EC for availing exemption?

Ans: You should invest in the government bonds under section 54E of the National Highways Authority of India and Rural Electrification Corporation after 6 months of the capital gains. |