Paying Land tax online gives you the benefits of simple and quick payment of tax, and receiving a discount on your total tax amount. You can pay your property tax online by following the simple steps explained in this article.

Page Contents

What is Property Tax?

When a person is liable to pay some amount to the local or state government for their property, it is termed property tax or land tax. However, not every asset will be considered for the property tax.

Those assets which are classified as real property like land and building will be calculated under the property tax calculation.

On different kinds of real estate possession like land, the landowner has to pay on an annual or half half-yearly basis.

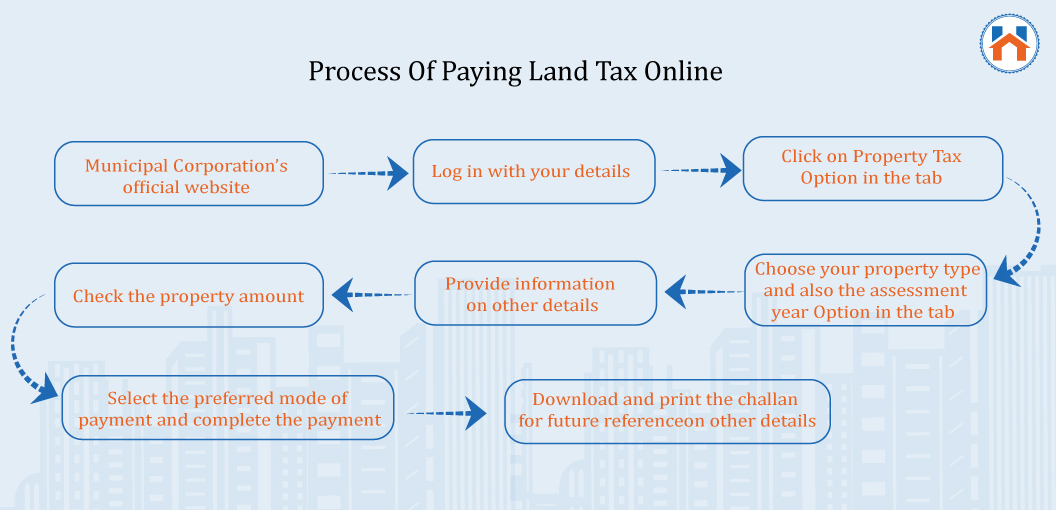

Process Of Paying Land Tax Online

Generally, the Municipal Corporations of different states have a specific method for the payment procedure online.

However, some of the Municipal bodies do not have an online payment facility or property tax available.

Gather relevant information required for the Land Tax payment online. Follow the below steps:

- Visit Municipal Corporation’s official website

- Log in with your details. If you are a new user then you need to register first and then visit the log-in page.

- Click on Property Tax Option in the tab

- Then you need to choose your property type and also the assessment year

- Then you have to provide information on other details like the name of the property owner, identification number of the property, and other related information.

- Before selecting the mode of payment, you should check the property amount first.

- Then select the preferred mode of payment and complete the payment

- You can download and print the challan for future reference

Please note that the above steps may vary depending on the requirement of Municipal corporations in different states. However, steps for the payment of property tax online will be similar for every state.

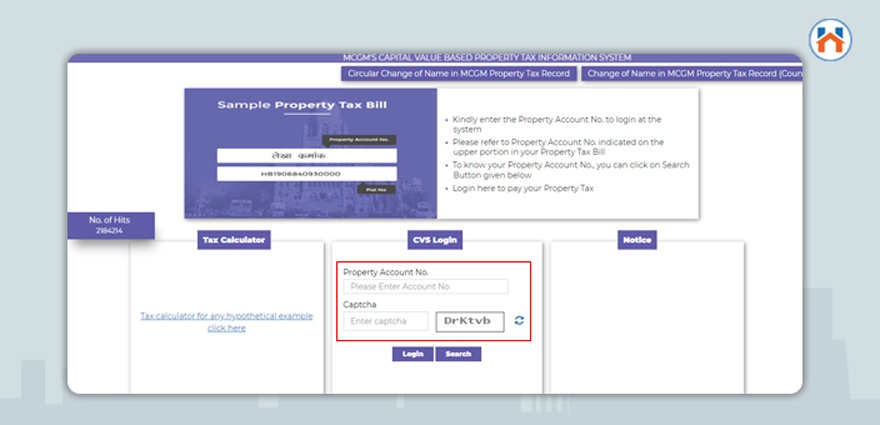

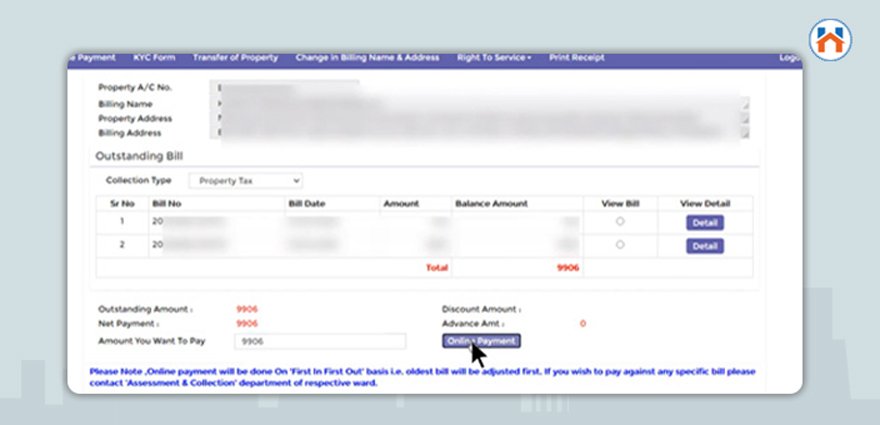

For eg: In MCMG Property Tax portal of Greater Mumbai includes the following steps for payment of property tax.

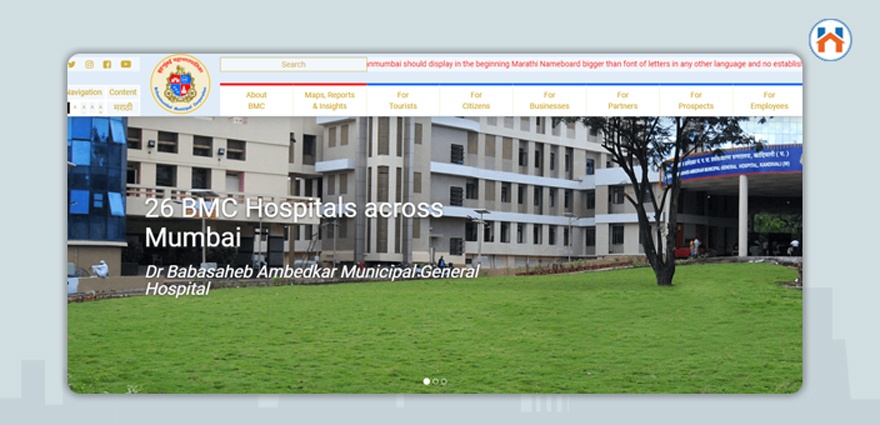

Step 1: Visit MCMG official portal @portal.mcgm.gov.in

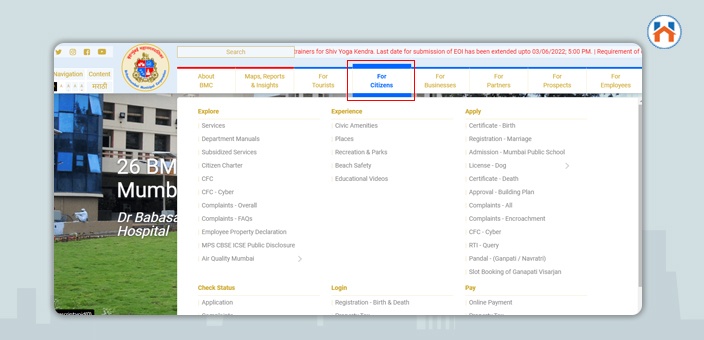

Step 2: Click on ‘For Citizens’ from the home page

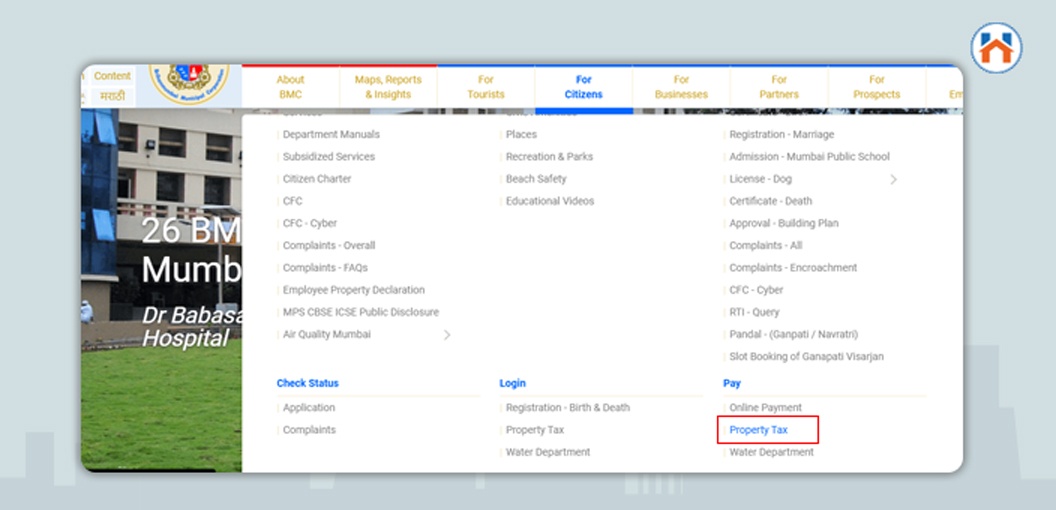

Step 3: Click on Property tax under the Pay section from the drop-down

Step 4: Provide the property account number and captcha

Step 5: Then you will be able to pay the property taxes

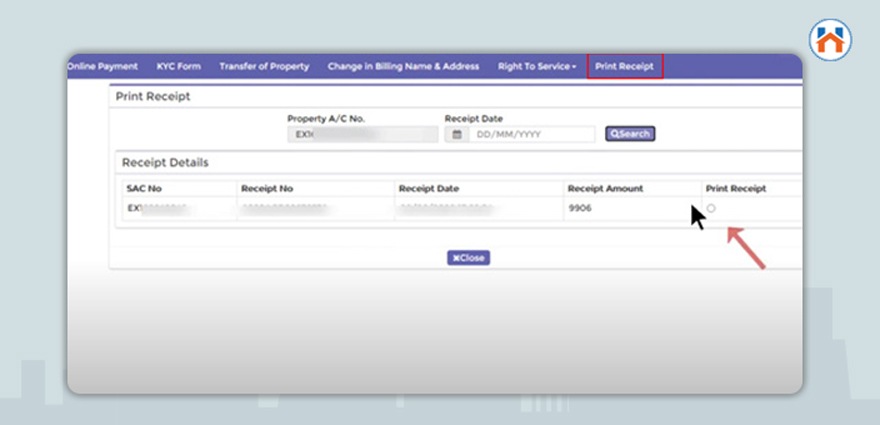

Step 6: After the payment is successful, a receipt will be generated. Take a printout for future reference.

Calculation Of Land Tax

The property tax depends on the valuation and the appraisal of the locality. Th amount of property tax may vary from one locality to another depending on the amenities available in that area and other factors.

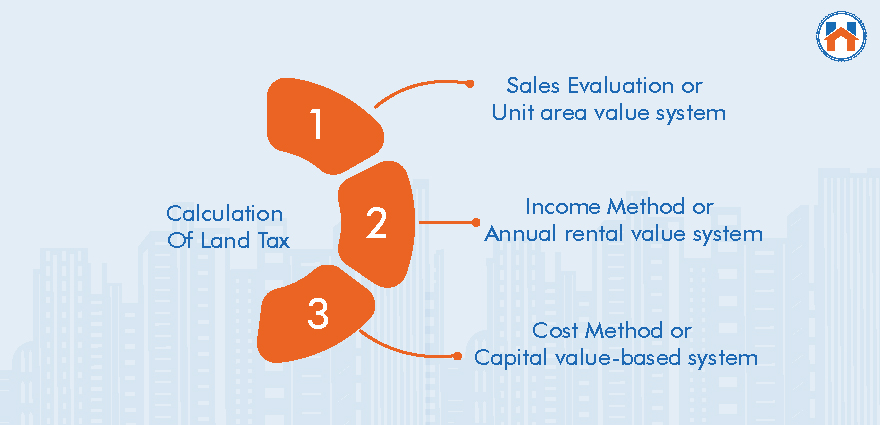

The methodologies of calculating the land tax are different for different areas. However, there are three different ways provided in the following which can be used for deciding the property tax:

- Sales Evaluation or Unit area value system: Here the assessor will value the property by comparing the sales value in that area. The evaluation criteria will include the location, state of the property, improvements done, and the overall market condition. Per-unit price is calculated base on the carpet area. This approach is used in Bengaluru, Ahmedabad, Patna, Hyderabad, and Kolkata.

- Income Method or Annual rental value system: Here it is assessed how much money could be incurred if the property was rented. Under this approach the maintenance cost, property management cost, insurance & tax cost, and the returned income can be anticipated from the property. This approach is used by municipal bodies of Chennai and Hyderabad.

- Cost Method or Capital value-based system: Here the property value is assessed based on the amount to replace it. When the property is old, the assessment will be done on the amount of depreciation and vacant property value. When the property is new then the cost of building materials and labor is focused on deducing any realistic depreciation for the final value. The BMC (Brihanmumbai Municipal Corporation) uses this approach.

The general formula used for municipal tax calculation is

Tax on property = Base value of the property x Type of building x Age of the building x built-up area x category x floor factor

In whichever way the property tax is paid i.e, through offline mode or online mode, you should collect the tax receipt after the payment for future reference.

Almost every tax portal website the government provides an option for tax calculation so that you get an idea of how much you should pay and save.

For eg: in Citizen Portal Services Property Tax of Greater Mumbai, the tax calculator would require information like your ward, zone, occupancy type, year of construction, FSI factor, etc to calculate the capital value.

Information Required For Land Tax

Before visiting the official website of the Municipal corporation to pay property tax, you must keep the following information and documents ready.

- Name

- Address

- Property ID number

- Email ID

- Phone number

While doing the payment you have to provide any of the following details:

- Debit card details

- Credit card details

- Net-banking details

- E-Wallet or UPI details

Concession On Land Tax

The property taxpayers can enjoy different concessions provided when they are paying the land tax. However, these depend on different factors like

- Age of the landowner: Senior citizens are eligible for concession. They will pay discounted property tax.

- Nature of the locality: Properties in the flood-prone area will get a concession on their tax amount.

- Utilization of the property: Any property which is meant for public use or charity purposes is eligible for the concession amount.

- Age of the property: If the property is ancient, then it will be eligible for the concession amount.

- Occupancy of the property: If you are staying in the property for a longer time then it is eligible for a concession amount.

- Income of the property owner: For economically weaker sections or low-income groups, there is a concession on the land tax rate.

Why Should We Pay Property Tax?

The main reason behind paying property tax is that it helps the state government to utilize the amount for the development of roads, schools, parks, etc.

However, you can choose to pay the property tax on a half-yearly or annual basis according to your convenience. There are various reasons why you should pay the property tax on time:

- Early comer benefits: Many state governments provide a special discount to the early comers which influence other taxpayers to pay on or before the due date. There is no specific discount amount for every state. The tax concession may vary from state to state between 2-10%.

- Penalty on late payment: If you are paying the property tax after its due date then you will be penalized with 5-20% more on the due amount. This amount will be higher if your property or land area is large.

- Fulfilling the tax obligations: Apart from getting benefits of concession on property tax, it should also be a moral obligation. The tax amount is used for the betterment of the state.

- Easy process of payment: The online payment process for property tax is easier because here you do not have to visit the municipality office physically. You will also get an online receipt which will be used for future reference.

FAQs

| Q1: How much property tax is paid in Mumbai?

Ans: The property tax rate in Mumbai varies from 0.316% to 2.296% |

| Q2: How can I pay property tax for a property in Pune while staying in a different state?

Ans: You can follow the below steps for any state to pay property tax online

|

| Q3: Who is liable to the property tax?

Ans: A person owning a property will be liable to pay the property tax |

| Q4: Is it important to pay the property tax every year?

Ans: Yes, the landowners are liable to pay the property tax every year to the municipal corporation |