Stamp Duty and Charges in Bangalore are payable under the Karnataka Stamp Act 1957 and registration Act 1908. You need to pay the stamp duty and registration charges in Bangalore while buying a new property. This article gives you the Latest Stamp Duty and Registration charges in Bangalore along with the step-wise process for stamp duty and registration charges calculation online.

Page Contents

- What Are Stamp Duty and Registration Charges In Bangalore?

- Factors that Affect the Stamp Duty and Registration Charges In Bangalore

- How To Calculate Stamp Duty and Registration Charges in Bangalore

- How to Calculate The Stamp Duty and Registration Charges online In Bangalore?

- When To Pay The Stamp Duty and Registration Charges in Bangalore?

- How to Pay The Stamp Duty and Registration Charges In Bangalore?

- FAQs

What Are Stamp Duty and Registration Charges In Bangalore?

Following are the latest Stamp Duty and Registration Charges in Bangalore.

| Stamp Duty Charges in Bangalore | Registration Charges In Bangalore | |

|---|---|---|

| Male | 2% For Properties Less Thane 20 Lakh 3% For Properties Between 21-45 Lakh 5% For Properties Above 45 Lakh | 1% of the agreement value of the property |

| Female | 2% For Properties Less Thane 20 Lakh 3% For Properties Between 21-45 Lakh 5% For Properties Above 45 Lakh | 1% of the agreement value of the property |

| Joint Male Female | 2% For Properties Less Thane 20 Lakh 3% For Properties Between 21-45 Lakh 5% For Properties Above 45 Lakh | 1% of the agreement value of the property |

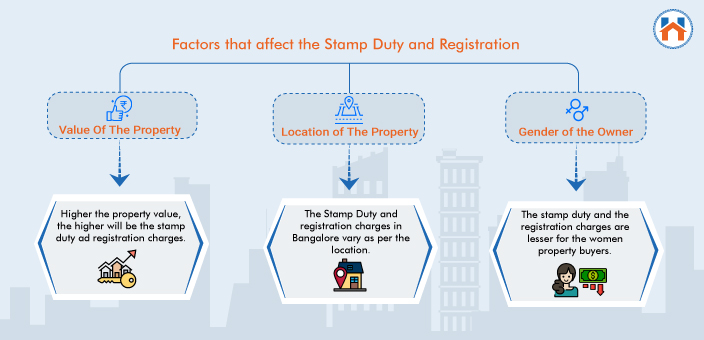

Factors that Affect the Stamp Duty and Registration Charges In Bangalore

Several factors decide the Stamp Duty and Registration Charges In Bangalore.

Factors that affect the Stamp Duty and registration charges in Bangalore are-

- Value Of The Property

- Location of The Property

- Gender of the Owner

Value of the Property

The stamp duty and registration charges in Bangalore are calculated as the percentage of the total value of the property.

To put it simply, the higher the property value, the higher will be the stamp duty and registration charges.

While calculating the stamp duty and registration charges in Banglore, the market value or the agreement value, whichever is higher is considered.

The stamp duty in Bangalore is 2, 3, and 5% of the total value of the property. The percentage of the stamp duty charges in Bangalore are applicable as per the total value of the property.

The registration charges in Bangalore are 1% of the total property value.

Location of the Property

The location of the property is crucial for the stamp duty and registration rates.

The Stamp Duty and registration charges in Bangalore vary as per the location.

For rural areas, the stamp duty is lower as compared to the stamp duty for urban areas.

BBMP, City Corporation, Municipal Corporation, Town Panchyat, Gram Panchayat, City Municipal Council, Town Municipal Council have different stamp duty and registration charges in Bangalore.

Gender of the Owner

The stamp duty also depends on the gender of the property buyer.

The stamp duty and the registration charges are lesser for the women property buyers. The state government announces the stamp duty concessions for the women property buyers.

How To Calculate Stamp Duty and Registration Charges in Bangalore

Here is an example of how Stamp Duty and Registration Charges in Bangalore are calculated.

| Configuration of the Property | 3BHK |

|---|---|

| Property Area | 800 Sq ft |

| Rate | Rs 20,000 Sq ft |

The Value Of The Property = 800 X 20,000

= Rs 1,60,00,000

Here since the value of the property is more than 45 Lakh, 5% of the stamp duty and registration charges are applicable.

So, The Stamp Duty will be 5% of 1,60,00,000 = Rs 800000

How to Calculate The Stamp Duty and Registration Charges online In Bangalore?

You can also pay the stamp duty and registration online In Bangalore.

Calculating the stamp duty stamp registration charges in Banglaore is a crucial step before making the payment.

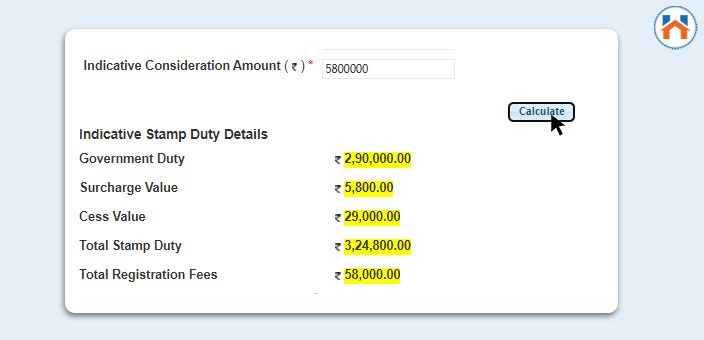

Here is a stepwise process for the Stamp Duty and Registration Charges in Bangalore.

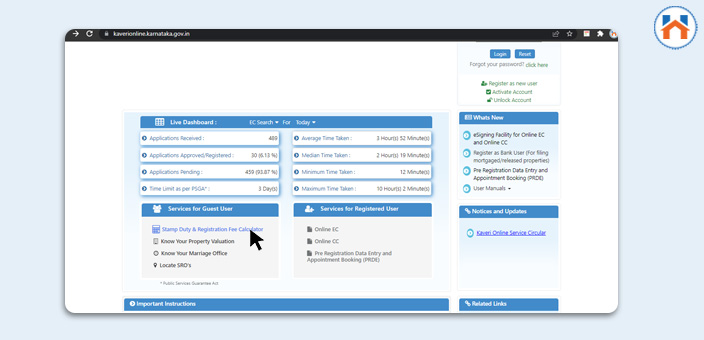

Step 1: Visit the online Kaveri Portal

Step 2: Select the Stamp Duty and Registration Fee Calculation option from the Service from Guest Users

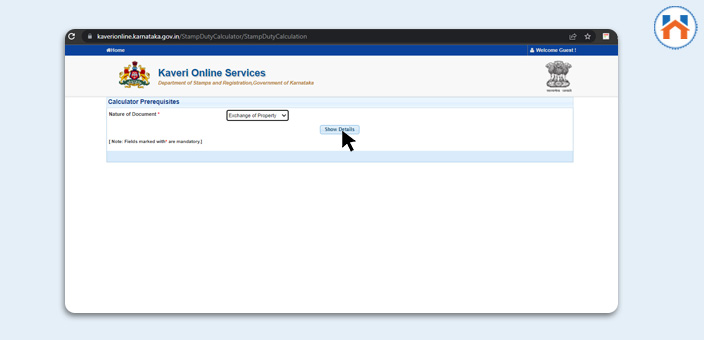

Step 3: Select the Exchange of the property option from the Nature of Document Drop Down

Step 4: Then fill in the important details such as-

Region Type-

- Indicative Market Value

- Indicative Consideration Amount

- Indicative Market Value

- Indicative Consideration Amount

Step 5: Click on the Calculate button. The stamp Duty details will be shown.

When To Pay The Stamp Duty and Registration Charges in Bangalore?

You can pay the Stamp Duty and Registration Charges in Bangalore before or after executing the sales deed document.

You can pay the Stamp Duty and Registration Charges in Bangalore-

- Before Executing the sales deed document

- While executing the sales deed document

How to Pay The Stamp Duty and Registration Charges In Bangalore?

It is mandatory to pay the stamp duty and the registration charges in Bangalore while transferring the property rights.

You can pay the stamp duty and the registration charges in Bangalore by the following methods.

- By purchasing the impressed stamps from the licensed stamp vendors.

- By purchasing the adhesive stamps called Franking.

- By making the payment to the state government through DD or Check.

- By making an online payment of the stamp duty and registration.

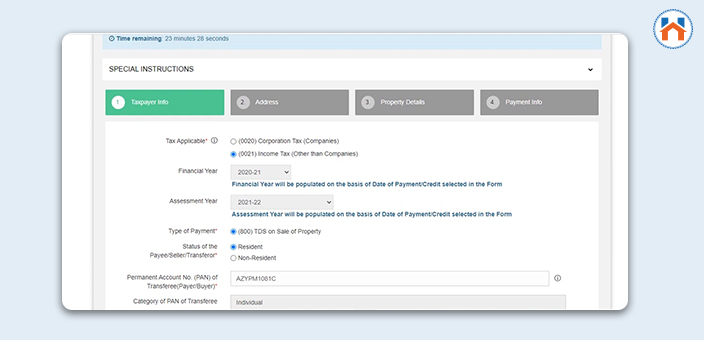

You can make the stamp duty and registration payment in Bangalore by creating a challan on the official K2 Payment Gateway.

FAQs

| When to pay the stamp duty and registration charges in Bangalore?

You can pay the stamp duty and the registration charges in Bangalore before or after the execution of the property sales deed. |

| How to pay the stamp duty and registration charges in Bangalore?

You can pay the stamp duty and registration charges in Bangalore by purchasing the stamp papers from a registered stamp vendor, franking, or online payment. |

| What if stamp Duty and registration charges are not paid?

If you do not pay the Stamp Duty and registration charges then the property transaction is not considered valid. Moreover, the penalty of 2% of the total stamp duty and registration charges are applicable that may go upto 200% of the total property value. |

| What if you don’t pay the Stamp Duty and Registration Charges?

The property transaction is not considered valid if you do not pay the stamp duty and the registration charges. There is a penalty of 2% of the total amount applicable every month from the date of execution of the sales deed document |