Page Contents

NMMC Property Tax

The NMMC property Tax depends on various factors. Mainly, the type of the property, size, and location decide the NMMC property tax.

The percentage of the NMMC property tax rates is fixed by the Navi Mumbai Municipal Corporation on or before the 20th of February every year.

The NMMC Property Tax includes the General Tax, Water Benefit Tax, Sewerage Tax, Sewerage Benefit Tax, Education Cess, Street Tax, Tree Cess, and the state government taxes as per the Maharashtra State Education & Employment Guarantee Cess, etc

Latest NMMC Property Tax Rates

| Particulars | Residential Property | Non-Residential Property | Industrial |

| General Tax (with Fire Tax 0.50%) | 23.50% | 32.50 % | 34.50 % |

| Water Benefit Tax | 1 % | 4% | 3% |

| Sewerage Tax | 3% | 7% | 0% |

| Sewerage Benefit Tax | 1% | 2% | 3% |

| Mun. Education Cess | 1% | 4% | 4% |

| Street Tax | 2.67% | 3.33% | 8.33% |

| Tree Cess | 0.50% | 0.50% | 0.50% |

| State Govt. Taxes as per The Maharashtra State Education & Employment Guarantee | 6.00% | 15.00% | 15.00% |

| Total Tax | 38.67% | 68.33% | 68.33% |

Also, the NMMC tax value is calculated based on the rateable value of the property. This rateable value is decided by the Municipal corporation and published every year.

The ratable tax depends on various factors including the area of the property, type of property and type of construction, and so on.

Ratable Value Calculation: NMMC Property Tax For Residential Properties

| Wards & Type of Construction | Rate Rs. Per sq. meter

per month |

| I. (A) BELAPUR, NERUL, VASHI, TURBHE WARDS CIDCO DEVELOPED NODE | |

| Upto 20 sq. mtrs. for economically weaker section 22 | 22 |

| CIDCO built tenements above 20 sq. mtrs. | 28 |

| Bungalow/ Rowhouse (RH) type tenement | 33 |

| Co-op Hsg. Societies on CIDCO allotted plot (up to 7 floors) | 33 |

| Co-op Hsg. Societies on CIDCO allotted plot (Towers above 7 floor) | 39 |

| Charitable institution buildings like schools, Colleges, public hospitals, Sanatorium | 61 |

| Private/Non-Charitable Medical/ Engineering/ Management Institutes/Educational Institutes/ School, etc. | 66 |

| [B] BELAPUR, NERUL, VASHI, TURBHE WARDS VILLAGE AREA, AND OLD GAOTHAN. | |

| Bungalows/ Row Houses – RCC | 28 |

| RCC houses | 22 |

| Load Bearing houses | 17 |

| Tiled Houses (manglorie tiles/AC Cement) | 11 |

| Slums | Rack rent Rs.200 per month/Hut |

| C) BELAPUR, NERUL, VASHI, TURBHE WARDS G.E.S. | |

| Bungalows/ Row Houses – RCC | 28 |

| Co-op Societies. (up to 7 floor) | 24 |

| Co-op Societies. (above 7 floor) | 28 |

| Load Bearing houses | 22 |

| II. (A) KOPAR KHAIRANE , GHANSOLI, AIROLI DIGHA WARDS CIDCO DEVELOPED NODE | |

| Upto 20 sq. mtrs. for economically weaker section | 17 |

| CIDCO built tenements above 20 sq. meter. | 22 |

| Bungalow/ Rowhouse (RH) type tenements | 28 |

| Co-op Hsg. Societies on CIDCO allotted plot (up to 7 floors) | 24 |

| Co-op Hsg. Societies on CIDCO allotted plot (Towers above 7 floor) | 28 |

| Charitable institution buildings like schools, Colleges, public hospitals, Sanatorium | 61 |

| Private/Non-Charitable Medical/ Engineering/ Management Institutes/Educational Institutes/ School, etc. | 66 |

| [B] KOPARKHAIRANE , GHANSOLI, AIROLI & DIGHA WARDS VILLAGE AREA AND OLD GAOTHAN. | |

| Bungalows/ Row Houses – RCC | 28 |

| RCC houses | 22 |

| Load Bearing houses | 17 |

| Tiled Houses (manglorie tiles/AC Cement) | 11 |

| Slums | Rack rent Rs.200 per month/Hut |

| (C) KOPARKHAIRANE , GHANSOLI, AIROLI & DIGHA WARDS G.E.S | |

| Bungalows/ Row Houses – RCC | 28 |

| Co-op Societies. (up to 7 floor) | 24 |

| Co-op Societies. (above 7 floor) | 28 |

| Load Bearing houses | 21 |

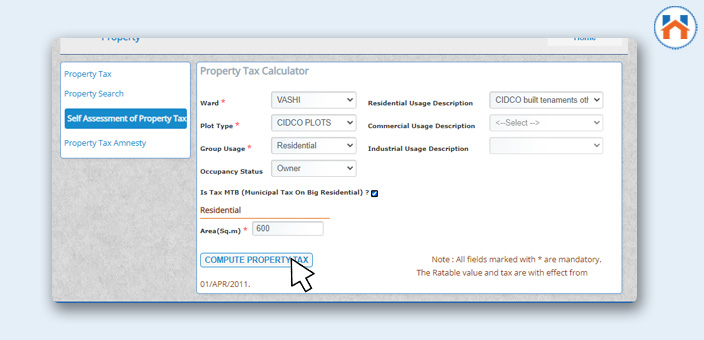

NMMC Property Tax Calculation

You can calculate the NMMC Property Tax online by filling in basic property-related details.

By calculating the NMMC Property Tax details online, you can easily calculate the exact amount of the applicable NMMC Property Tax amount.

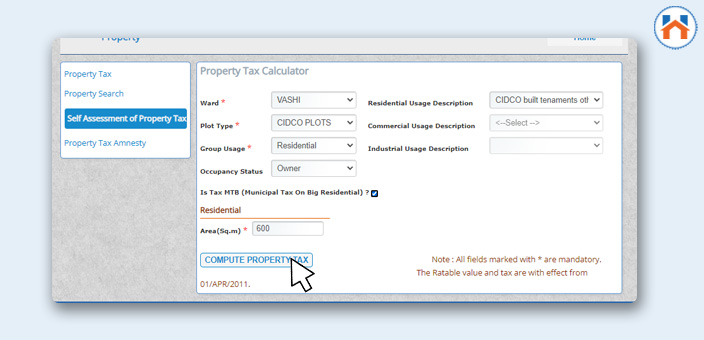

You need the following information to calculate the NMMC Property Tax Online

- Ward

- Plot Type

- Group Usage

- Occupancy Status

- Residential Usage Description

- Commercial Usage Description

- Industrial Usage Description

Here is the stepwise process to calculate the NMMC Property Tax Online.

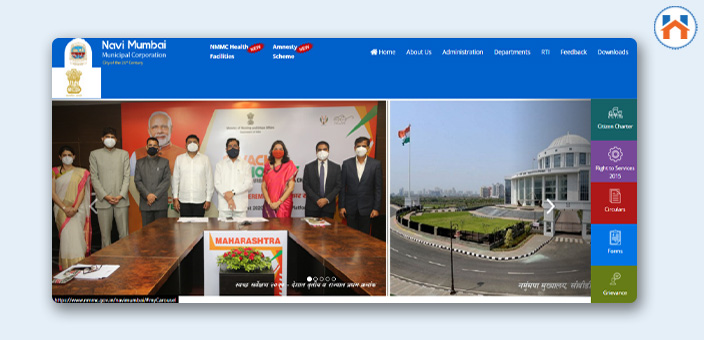

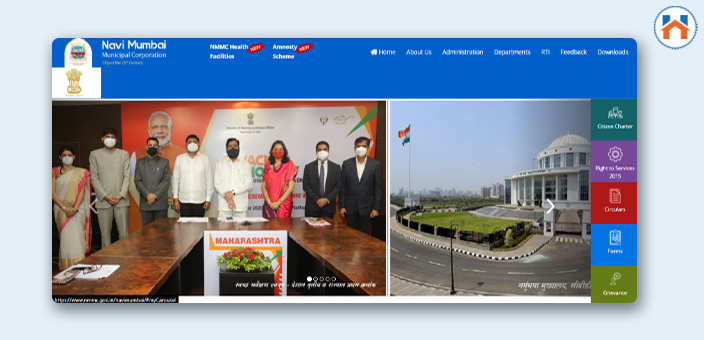

Step 1: Visit The nmmc.gov.in

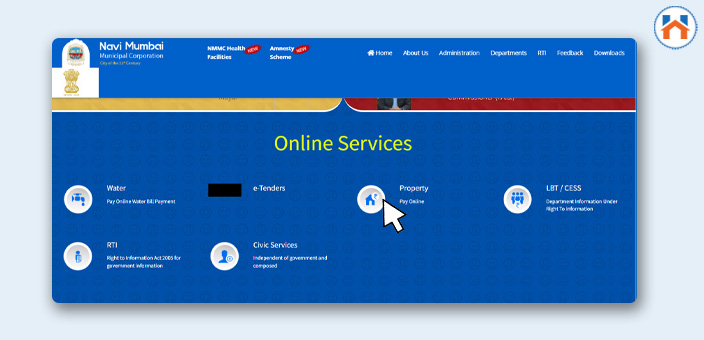

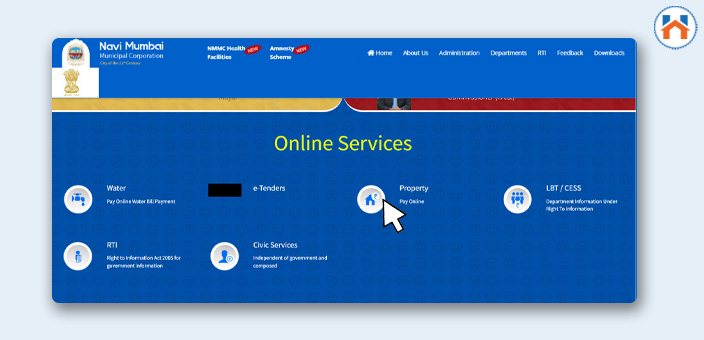

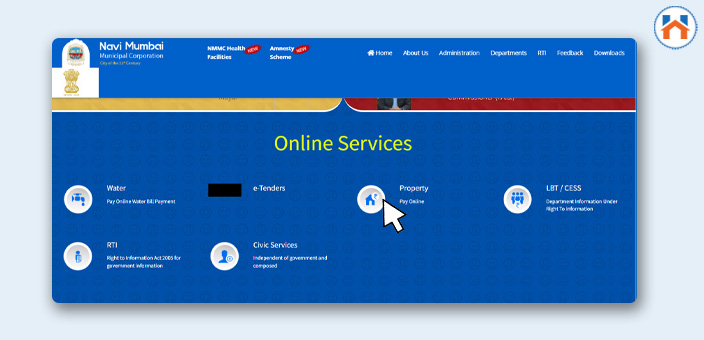

Step 2: Then From The Online Service Section, Click on The Pay Online Option

Step3: Then From The newly Opened Page Select The Self Assessment of the Property Tax

Step 4: Then choose the Ward, Plot Type, Group Usage, And Occupancy Status

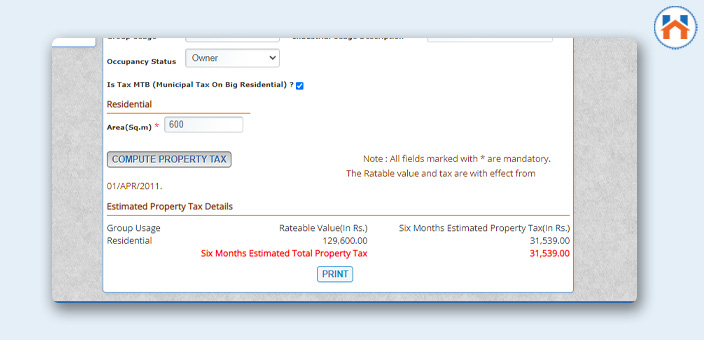

Step 5: Then Click On the Compute Property Tax Button

Step 6: The Six Months Estimated Total Property Tax will be displayed.

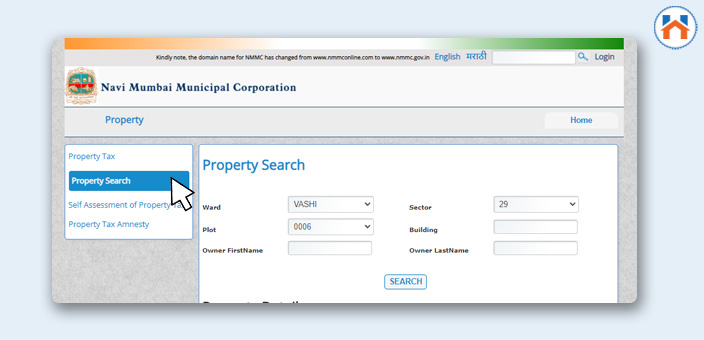

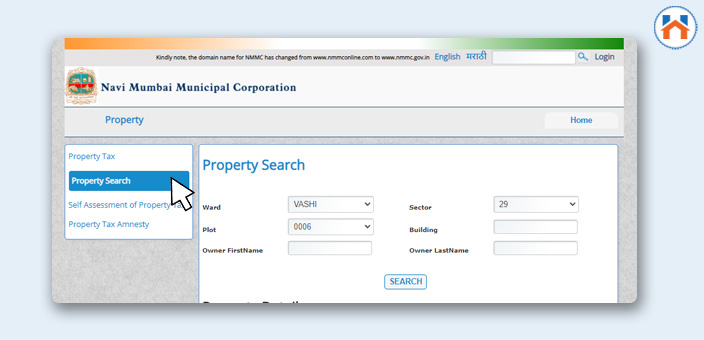

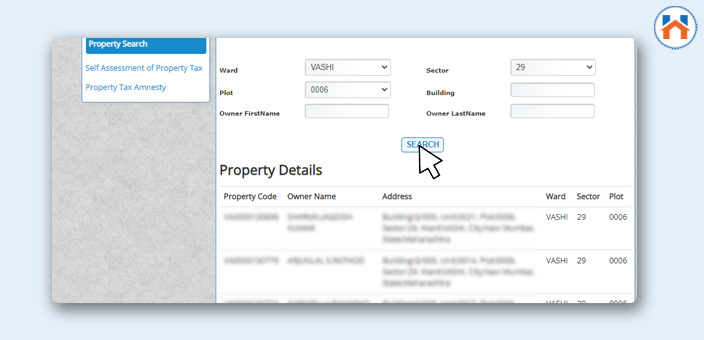

NMMC Property Search Online

You can also make the NMMC Property Search Online.

Here is the stepwise process for the NMMC Property Search Online.

Step 1: Visit The nmmc.gov.in

Step 2: Click on The Pay Online Option From The Online Service Section

Step 3: Then Select the various options such as Ward, Plot, Owner First Name, Sector Building, and The Owner Last Name

Step 4: Then Click On The Search Button to get the required property details.

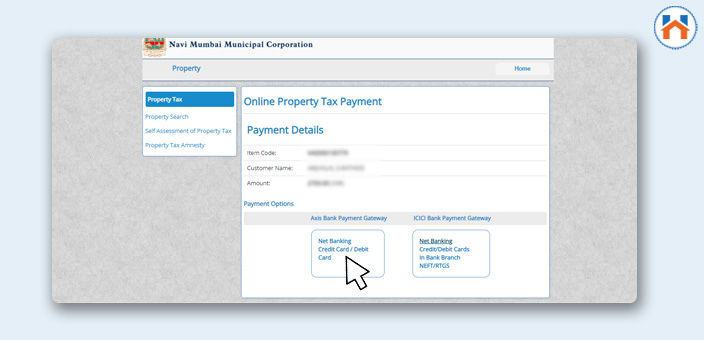

NMMC Property Tax Online Payment

The Navi Mumbai Municipal Corporation allows the NMMC Property Tax can online payment.

You can calculate and Pay the NMMC Property Tax Online by following the simple steps.

Here is the process to pay the NMMC Property Tax Online in Navi Mumbai

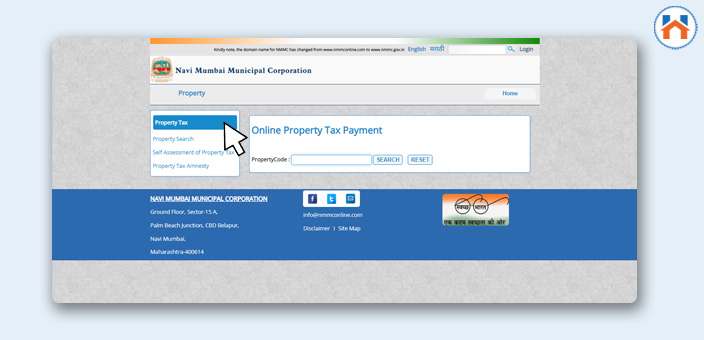

Step 1: Visit the nmmc.gov.in

Step 2: Click on The Pay Online Option From The Online Service Section

Step 3: From the Newly opened window, select the Property Tax Option

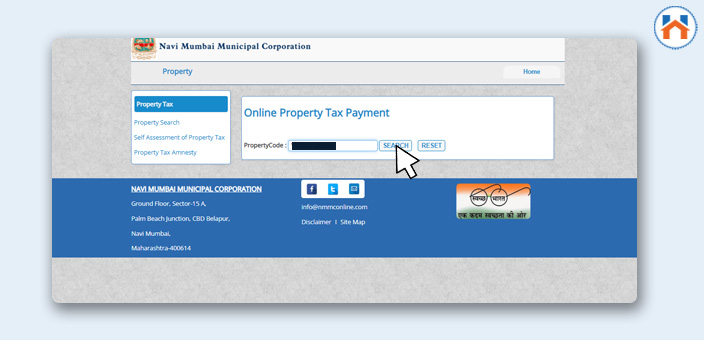

Step 4: Then Add the Property Code and Click On The Search

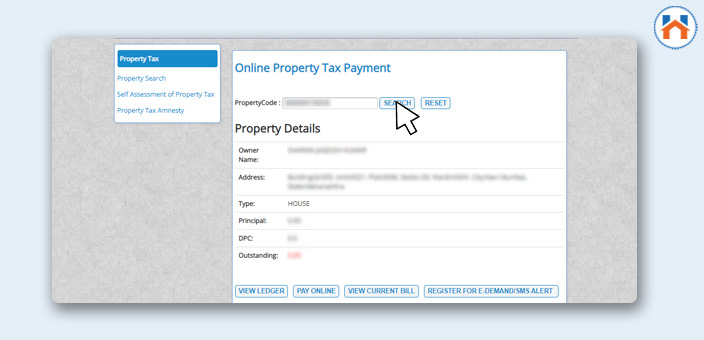

Step 5: Then the property-related details will be displayed

Step 6: Check the displayed NMMC Property Tax Rate and Click on The Pay Online options

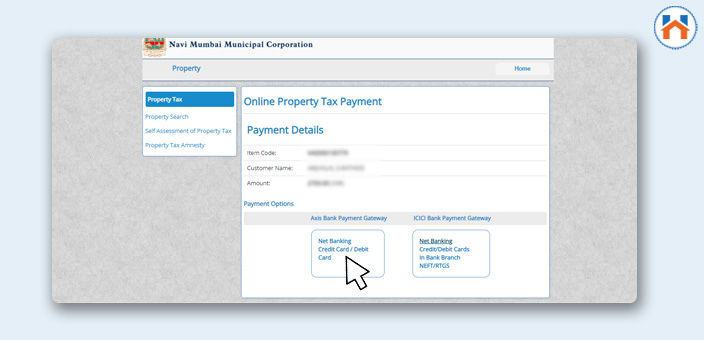

Step 7: Select The Suitable Payment Gateway and Make the Online Payment

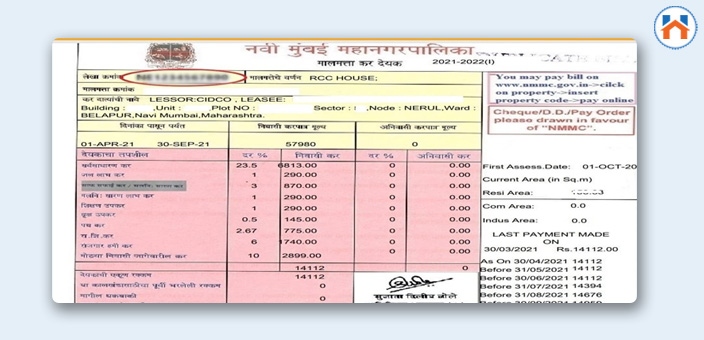

Step 8: Then View and Download The NMMC Property Tax Receipt

FAQs

| What is NMMC Property Tax?

The Navi Mumbai Municipal Corporation levies the NMMC Property tax In Navi Mumbai. The NMMC Property Tax rates are released every year. |

| What are the NMMC Property Tax rates?

The current NMMC Property Tax rates in Navi Mumbai are 38.67% for the residential property and for the commercial 68.33%. The NMMC Property Tax is calculated against the rateable value published by the corporation yearly in the month of February. |

| How To Pay the NMM Property Tax Online?

You can pay the NMMC Property Tax Online by visiting nmmc.gov.in. From the home page select the Property Tax option, Add the correct property code to view, and pay the NMMC Property Tax Bill Online. |

| How to Download NMMC Property Tax Online Payment Receipt?

You can view and download the NMMC Property Tax online by visiting nmmc.gov.in. you need to enter the property code, make payment and download the NMMC Property Tax Online Payment Receipt. |

| How To Calculate The NMMC Property Tax Online?

You can calculate the NMMC property Tax online by using the Self Assessment of the Property Tax option. |