Page Contents [hide]

- What Is Pradhan Mantri Awas Yojana PMAY

- Key Objectives Of The Pradhan Mantri Awas Yojana (PMAY)

- Four Major Verticals of Pradhan Mantri Awas Yojana (PMAY)

- Eligibility Criteria For The Pradhan Mantri Awas Yojana PMAY

- PMAY Urban

- PMAY Gramin

- How To Apply For The Pradhan Mantri Awas Yojana (PMAY)

- Documents Required for The PMAY CLSS Subsidy

- How To Calculate The PMAY Subsidy

- How to Check the PMAY Subsidy Status Online

- FAQs

What Is Pradhan Mantri Awas Yojana PMAY

The Government Of India launched Pradhan Mantri Awas Yojana in 2015, with an ambition of building 2 crore homes for various income categories by the year 2022. The PMAY scheme provides a subsidy on the Home Loans by bringing the Credit Linked Subsidy Scheme (CLSS). This allows the homebuyers from the Low, Medium, and Economically Weaker sections to get the interest subsidy from 3%- 6.5% on the home loans depending on their income category.

So, let’s first understand some of the key objectives of the Pradhan Mantri Awas Yojana and its four major verticals of implementation.

Key Objectives Of The Pradhan Mantri Awas Yojana (PMAY)

- The promotion of affordable housing in India by providing financial relaxation to the Low, Medium, and EWS income groups.

- Introducing Credit Linked Subsidy Scheme (CLSS) to promote affordable housing.

- Partnership with the Public and Private sectors to boost the affordable housing.

- Subsidizing the individual housing construction in urban and rural areas.

The PMAY scheme was planned to be implemented in a total of three phases since 2015.

Phase I (April 2015 – March 2017): covering 100 Cities selected from States/UTs

Phase II (April 2017 – March 2019): covering additional 200 Cities

Phase III (April 2019 – March 2022): covering all other remaining Cities

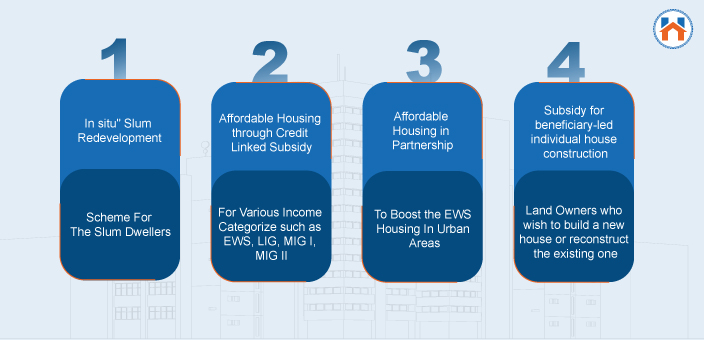

Four Major Verticals of Pradhan Mantri Awas Yojana (PMAY)

The PMAY will be implemented through the four major verticals.

‘In situ’ Slum Redevelopment

Under this scheme, the land under slums will be used to provide housing to the slum dwellers. For this, private participation will be encouraged to promote the urban settlement of the existing slum dwellers. For this, The respective state government will make the decisions on the eligibility, ownership rights, and restrictions, etc.

Affordable Housing through Credit Linked Subsidy

Under the Credit Linked subsidy scheme, the homebuyers get an interest subsidy of up to 6.5% of the total home loan depending on their income category. The subsidy is only applicable for Home Loans up to Rs 6 Lakh. Additional home loan amount after Rs 6 Lakh is non-Subsidized. Meaning, the maximum subsidy that can get under the PMAY is 6.5% of the maximum 6 Lakh home loan amount that is Rs 2.67 Lakhs.

Affordable Housing in Partnership

This vertical of the PMAY aims to provide houses to the EWS category at many affordable rates. To ensure that there is enough supply of the EWS housing units government encourages the private players to develop the EWS housing projects by providing financial assistance of Rs 1.5 Lakh per EWS housing unit. Moreover, PMAY will provide financial assistance to the Affordable Housing Projects with at least 35% of the houses are EWS units.

Subsidy for beneficiary-led individual house construction

This PMAY vertical gives a subsidy of Rs 1.5 Lakh for the construction of the New Houses or re-construction of the existing house. The beneficiaries who do not get the benefit of the above three PMAY verticals will be eligible. For this, the state government releases the financial assistance in 3-4 installments. Whereas the last installment of Rs 30000 is released after the construction of the house.

Eligibility Criteria For The Pradhan Mantri Awas Yojana PMAY

following is the set of eligibility criteria to get the benefits under the PMAY scheme.

- The annual income of the household should be between 3Lakh- 18Lakh.

- The applicant should not own a pucca house in any other part of the country.

- The Applicant should not be the beneficiary of other housing schemes of the state or the central government.

- No subsidy for the already built houses.

- The subsidy is applicable only on the Home Loan Amount up to Rs 6.7 Lakh.

- The Home Loan tenure is 20 Years.

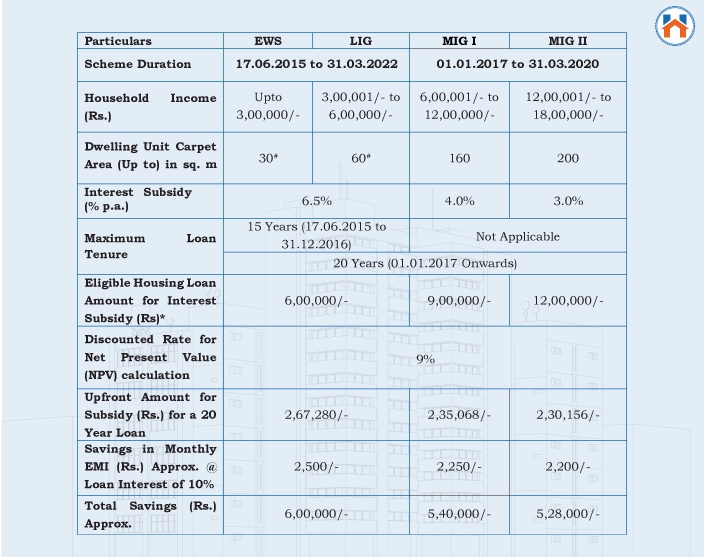

These were the general eligibility criteria for the PMAY. However, under the PMAY CLSS, the following is the eligibility criteria and the applicable subsidies for different types of incomes group.

Important Note: As per the recent development, the credit-linked subsidy for MIG I and MIG II is not applicable from April 2021. Only the applicants from the Lower Income and Economically Backward Class EWS can avail the benefit of the PMAY Credit Linked Subsidy.

Pradhan Mantri Gramin and Pradhan Mantri Urban are the two categories of the PMAY scheme. The. PMAY Gramin aims at providing affordable housing in rural areas. Whereas PMAY Urban promises the development of affordable housing in the urban area. Through PMAY Gramin and Urban have the same aligned purpose it is different in the application process, funding structures, and eligibility. Here are more details on the PMAY Urban and PMAY Gramin and the PMAY Urban.

PMAY Urban

The PMAY urban includes the areas that come under the jurisdiction of Urban Development, Industrial Development Authority, Planning and development authority, and other state government authorities.

For PMAY urban the government has been working along with the private sectors to provide affordable housing in the urban areas. PMAY urban is implemented through four major verticals namely-

- In Setu Redevelopment

- Affordable Housing Through Credit Linked Subsidy

- Affordable Housing In Partnership

- Subsidy for beneficiary-led individual house construction

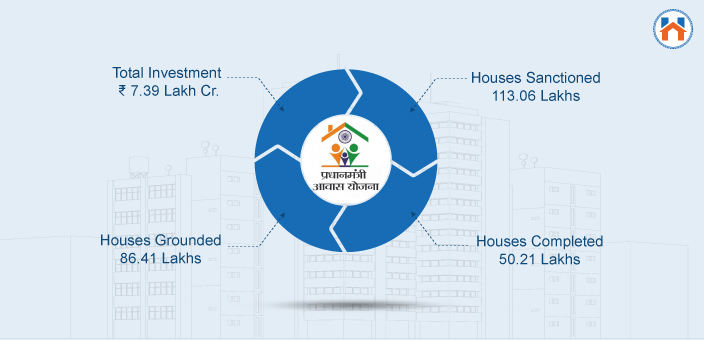

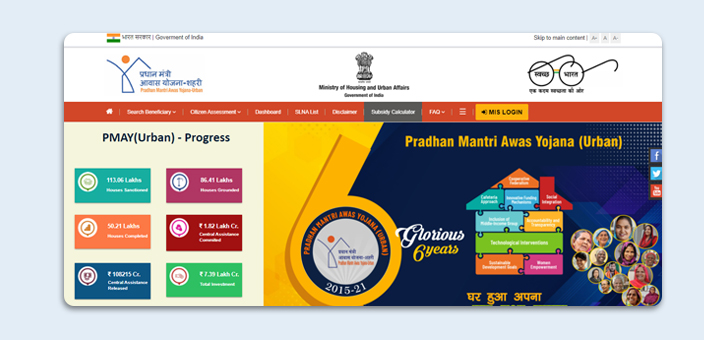

The current status of the PMAY Urban Scheme

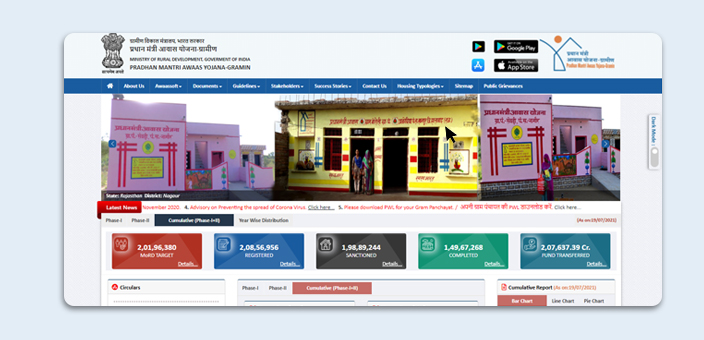

PMAY Gramin

Pradhan Mantri Awas Yojana Gramin aims to provide pucca houses in rural areas. People who live in the rural areas and do not own a house or live in a kutcha house get financial assistance. Under the PMAY Gramin, the maximum principal amount for the subsidy is Rs 2 Lakh.

The Target Number of houses to be constructed by the year 2021-2022 is 2.95 Crores. The immediate objective of the PMAY Gramin was to provide 1 crore households in rural areas between 2016-2019. However, till the year 2019, the completed households were 57,20,303 Whereas the total number of registrations remained at 98,08,104.

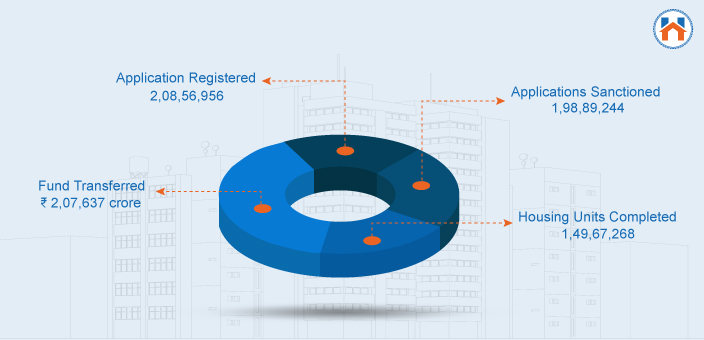

The current status of the PMAY Gramin is as-

Under PMAY Gramin, the subsidy of 1.2 lakh for the units in the plain areas. Whereas the 1.3 lakhs subsidy is given for the homes in the hill areas. Recently, in PMAY Gramin the minimum area for the construction is increased to 25 sqm from earlier 20 sqm. Under PMAY Gramin, interest rate subsidy up to 3% on the maximum 2 Lakh Home Loan amount can be availed.

How To Apply For The Pradhan Mantri Awas Yojana (PMAY)

To get the subsidy you first need to apply for the Home Loan. Check Out: Complete Home Loan Guide For Buying a Home Then at the time of the Home Loan application, you need to select the PMAY Credit Linked Subsidy (CLSS). While making the application in the Bank, you need to fill the PMAY application form with self-declaration. The applicant needs to submit the important documents which are verified in the next stages.

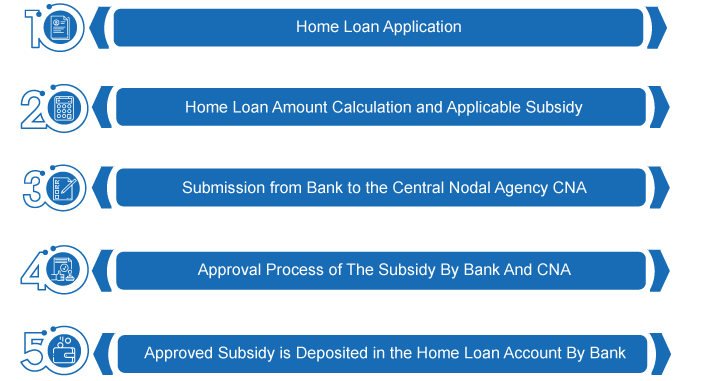

Complete Process Of PMAY Application

Documents Required for The PMAY CLSS Subsidy

Following are the important documents required for the PMAY CLSS subsidy.

- PAN Card

- Proof Of Identity- Aadhar Card, Passport, Voter Card, Driving License

- Proof Of Address- Electricity Bills, Residence Address Certificate, etc

- Salary Slips, Bank Statements, Income Certificate

- Existing Loan Details

- Declaration of Not owning a pucca house or benefited from any other State/Central government housing scheme.

- Income Tax Returns and Form 16

- Property Related Documents- Sale Agreement, Payment Receipt, Allotment Letter, etc

- NOC from the competent authority you need to submit all the documents at the Bank while making the Home Loan application.

Upon the successful verification of the documents, the centralized Nodal Authority will approve the application and disburse the subsidy amount in the Home Loan account of the applicant.

How To Calculate The PMAY Subsidy

You can calculate the PMAY subsidy directly by using the PMAY Subsidy calculator.

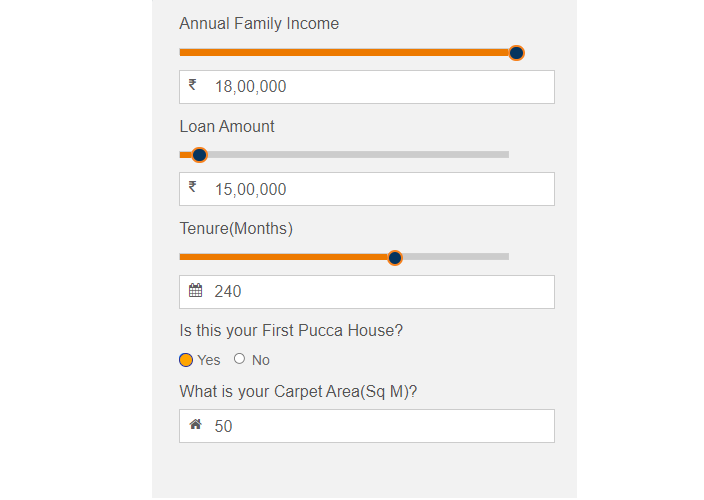

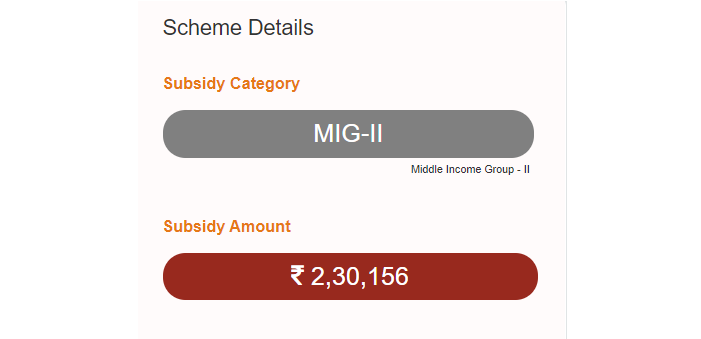

Following are the important stages to calculate the PMAY subsidy.

Step1: Visit the PMAY Urban official website

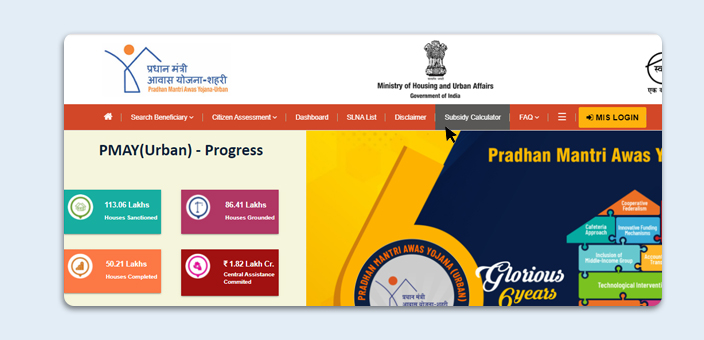

Step 2: Then from the Home Page Select the Subsidy Calculator Option.

Step 3: Now, from the new Window, Set the Annual Family Income, Loan Amount, Loans Tenure, and the Carpet Area.

Step 4: Then it will show the Subsidy Category and the Subsidy Amount.

This calculator can be a great tool to understand the exact amount of subsidy you will get under the PMAY Scheme.

How to Check the PMAY Subsidy Status Online

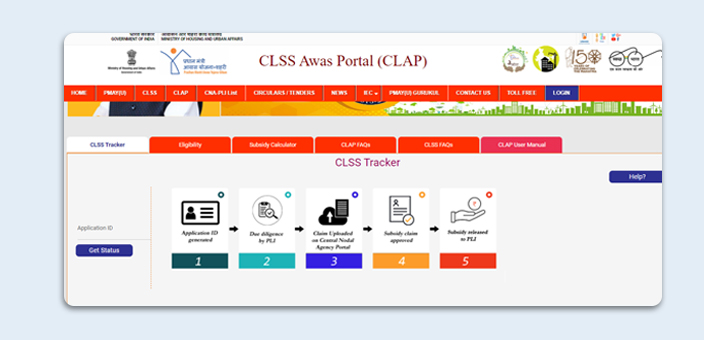

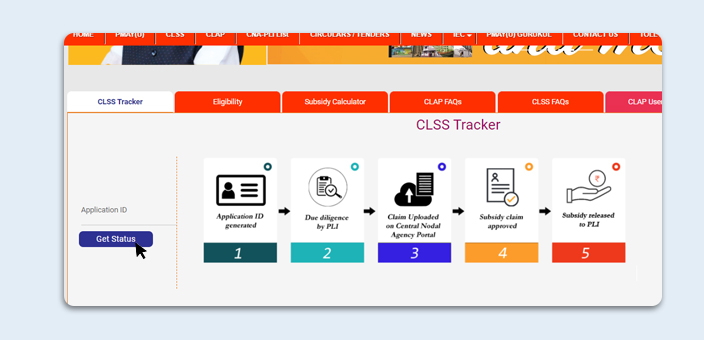

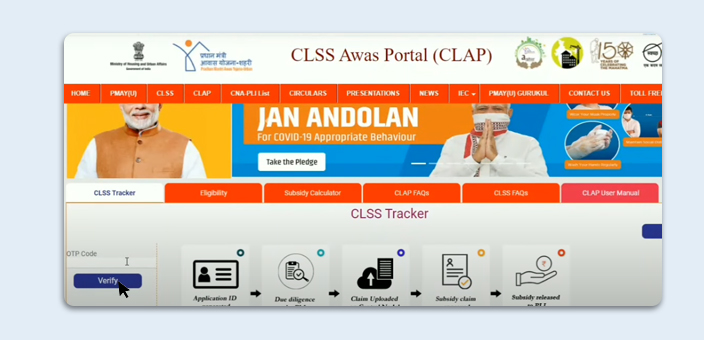

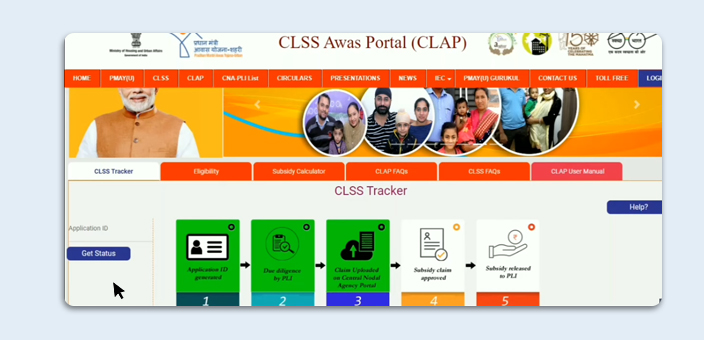

The individual will not have to go to banks to check the status of their application for CLSS subsidy. The status of the Credit Liked Subsidy Scheme can be checked by using the official CLSS Awas Portal CLAP.

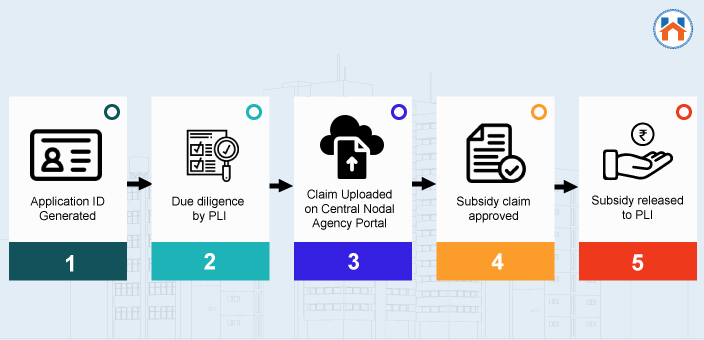

The process of the Credit Linked Subsidy Scheme takes place in total 5 stages-

When the Bank submits the claim to the Central Nodal Agency then the applicant gets the Application ID on the registered mobile phone. This application ID is important for checking the status of the Credit Linked Subsidy Scheme.

Here is the Step-wise process to check the status of the Credit Linked Subsidy Scheme Online.

Step1: Visit the CLSS Awas Portal (CLAP)

Step 2: From the Left Side Tab, Click On The Application ID Tab and Enter the application ID.

Step 3 After filling in the Application ID, The OTP will be sent to your registered Mobile Number, add the received OTP, and Click On The Verify.

Step4: After this, The Status of the CLSS subsidy will be displayed.

How To Apply For The Pradhan Mantri Awas Yojana PMAY Gramin

To apply for the PMAY Gramin you need to visit the respective Gram Panchayat. The application can be submitted at the Gram Panchayat with all the required documents.

The Eligibility Criteria for the Pradhan Mantri Awas Yojana PMAY Gramin is-

- The applicants should have no house or a kutcha house.

- Families without an adult male member over 25 years of age

- Families without a male member between 16-59 age

- Families which do not own land and rely on causal labor works

- Families belonging to the Scheduled Caste, Scheduled Tribes, and other Minorities.

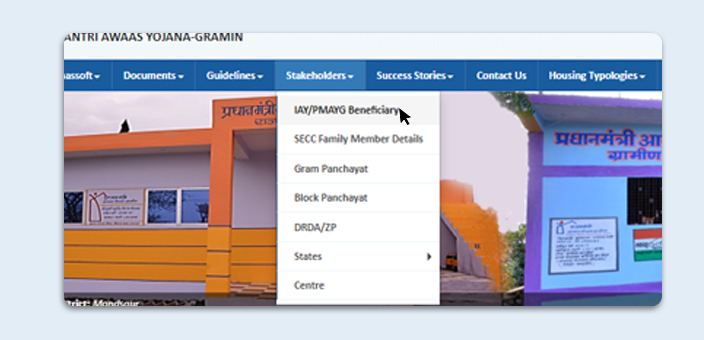

The official website of the PMAY Gramin displays the list of eligible candidates for the PMAY Gramin. You can check the complete list of beneficiaries online.

Following are the important steps to check the status of the PMAY Grami Application-

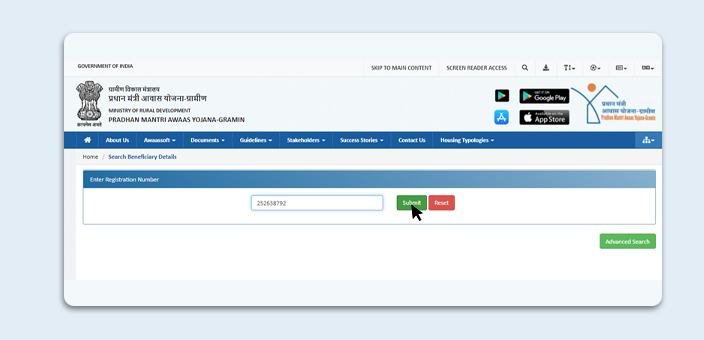

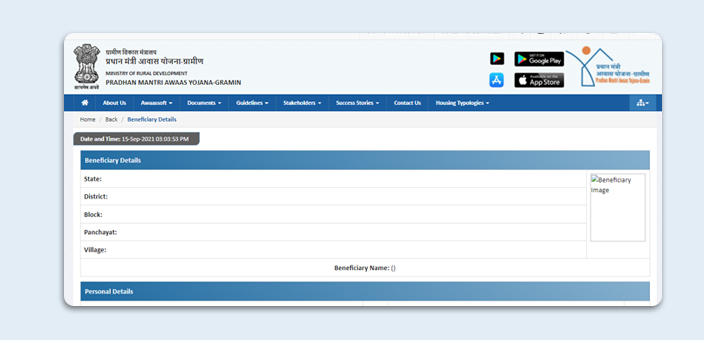

Step 1: Visit The Official Website of The PMAY Gramin

Step 2: From The Top, Menu Select the Stakeholder Option. Then From the Drop-Down menu, Select IAY/PMAYG Beneficiary.

Step 3: Now, from the newly opened tab, fill in the Registration Number. And Click On Advanced Search.

Step 4: Then the newly opened window will ask the important details such as State, District, Block, Panchayat, Scheme Name, Financial Year, Search By Name, Search By BPL Number, Account Number, Search By Sanction Order, Search By Father Husband Name.

Step 5: After filling In the Details, Click on the Submit button to get the list of access to the list of beneficiaries.

FAQs

| Who Are Eligible For The PMAY Scheme? According to the general eligibility criteria of the PMAY scheme, the applicant who comes under the EWS or LIG incomes category with an annual income less than Rs 6 Lakh is eligible for the PMAY scheme. However, the applicant should not own a house in any part of the country or should not have benefited from the other shouting schemes by the state/central government. |

What is the Credit Linked Subsidy Scheme (CLSS)? Credit Linked Subsidy Scheme is one of the most important verticals of the PMAY. Under the CLSS scheme, the homebuyers get a subsidy between 3-6.5% on the Home Loan amount. The subsidy depends on the income categories such as EWS and LIG. The maximum subsidy you can get under the PMAY CLSS is Rs 2.65 Lakhs. |

| How To Apply For The PMAY CLSS? You can apply for the PMAY CLSS at the bank while making an application for the Home Loan. You need to submit a self-declaration along with the important documents for the PMAY. You get the unique Application ID which can be used to track the status of the application later. |

| ARE MIG I and MIG II Not Eligible For The PMAY CLSS Scheme? Yes. 31st March 2021 was The deadline for the Middle Income Group (MIG I) and (MIG II) to apply for the PMAY CLSS. Now, the MIG I and MIG II with annual income from Rs 6-12 Lakhs are not eligible to avail of the PMAY CLSS scheme |

| Which Income Categories are eligible for PMAY CLSS? According to the latest updates, only EWS (Annual Income Less Than Rs 3 Lakh) and LIG (Annual Income between Rs 3-6 Lakh are eligible for the PMAY CLSS scheme. |

| Why is the Maximum subsidy one can get under the PMAY CLSS? The Maximum subsidy one can get under the PMAY is Rs. 2.65Lakhs depending on the income category. |

| What Are The Important Documents Required For The PMAY Scheme? The important documents required for the PMAy scheme are- a PAN Card, Identity Proof- Adhar Card, Voter ID, Passport Etc, Light Bills; Income ProofsBank Statement, Property Related Documents- Sales Agreement, Allotment Letter, ReceiptsForm 16, etc |

| What Is The Process OF Receiving the Subsidy under the Pradhan Mantri Awas Yojana? You need to apply for the PMAY scheme while making a home loan application in the bank. The Bank acts as a mediatory scheme application process. You need to submit the important documents to the bank. Banks then submit the application and Upon the verification, the CNA (Central Nodal Agency) will disburse the subsidized amount in the Home Loan bank account. |

| What is Interest Subsidy Applicable For The various Categories Under PMAY? For Economically Backward Class (EWS) and the Lower-income Group (LIG), the applicable subsidy is 6.5% of the Home Loan, The Maximum home loan amount on which the Subsidy is applicable is Rs 6 lakh. If the home loan amount is greater than Rs 6 lakhs the subsidy will only be applicable on the 6 Lakh amount not for the exceeding amount. |

What is the Processing Fee for availing of the PMAY Scheme? There is no processing fee for availing of the PMAY Scheme. |