Disclaimer:

With 11+ years of experience & expertise in the real estate industry, Homebazaar provides end-to-end property-buying solutions. Hundreds of 100% verified RERA-registered residential & commercial properties are listed on our website. We provide facilities like Zero brokerage, 360° virtual street view, quick site visit services, end-to-end property buying agreements & documentation guidance and low-interest home loan assistance. This helped us gain the trust of 55,000+ clients across India & sold 6,500+ homes of top reputed developers.

Page Contents [hide]

What Is Property Valuation?

The process of measuring the value of a property through various methods is called property valuation. The value of a property helps both the buyer and the seller to get a proper insight of the property.

The value of a property keeps changing, hence, it is important to calculate the value of a property periodically.

By Property valuation, you can calculate the selling price, property rental valuation, and market value of the property.

The property evaluators and investors conduct the property valuation according to its features, floor plan, amenities, and location.

Property valuation is done to evaluate the income tax, capital tax, wealth tax, auction process, division of property, home loans, etc.

To calculate the exact value of the property, it is necessary to analyze the location as well as receive proper guidance.

Rental Property Valuation

It should be noted that the rental valuation of a property is however different from the valuation of a primary residence as there is a good potential for monthly rental income.

The property owners will find the value of their property before renting it out so that they get the best price in the market.

Knowing the actual market value of the property can help with negotiation for the best rental deal.

Why Rental Property Valuation Is Important?

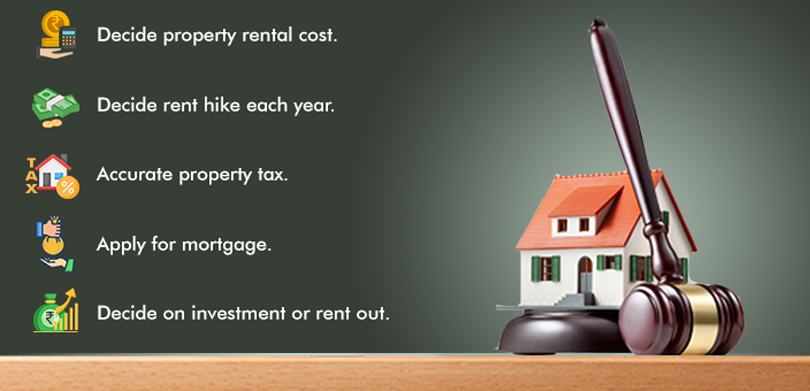

Real estate investors believe that every property has a different value, hence, it is important to calculate the exact value of a property for a better investment decision.

- The valuation of the property will help in deciding the rental cost of that property. Identifying the exact rental value of that property can help to calculate the total property value. The rental value comprises around 6-10% of the total value.

- The landowners can understand how they can increase the rent every year. With time, the value of a property increases. Getting an online property valuation can help both the owners and tenants to accept the increased value of a property.

- When the exact property value is calculated, it will help to pay the correct property tax. The property value may fluctuate, hence, you can pay lesser property tax in those cases.

- When you are owning a property, you can apply for a mortgage in an emergency. Hence, if you know the value of your property, you can claim a loan amount. Moreover, the financial institution may ask for a valid property valuation report for determining the loan amount.

- A lot of investors buy different properties only to rent them out. Hence, knowing the exact value of the property in the market can help to invest and rent out with the best value.

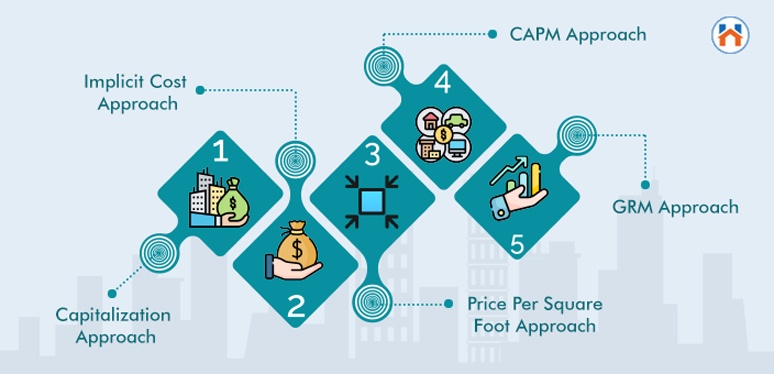

Rental Property Value Methods

There are various ways in which the rental property value can be calculated. The most commonly used 5 methods of valuation are explained in the following

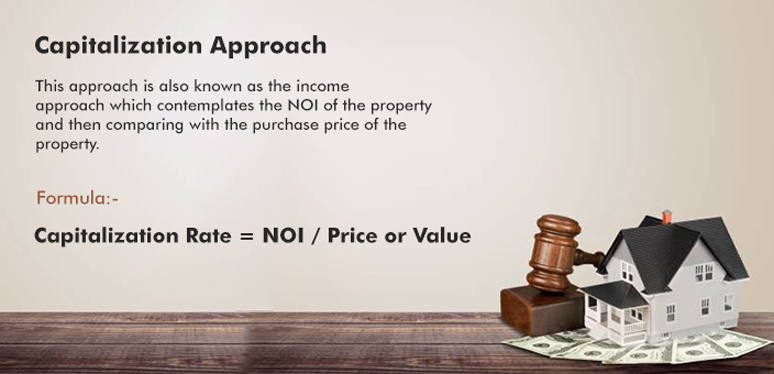

Capitalization Approach

Capitalization approach is also known as the income approach.

In this approach, the capitalization rate of the property is calculated on the basis of NOI (Net Operating Income) & Purchase Price of The Property.

Where the NOI is the net income you are getting from the rental property excluding the operating expenses.

The NOI of the property only includes the operating expenses of the property and does not include the mortgage, capital repair cost, interest payment, and depreciation.

Formula:

Capitalization Rate = NOI / Market Value of the property

NOI (Net Operating Income) includes the income generated from the rent and how much the property will be valued under a specific (current) condition.

Net Operating Income is the amount left after fixed costs and variable costs is subtracted from the gross operating income of the property.

The higher capitalization rate defines a better potentiality of return on investment. The approach provides an idea for real estate investors. The construction of a real estate investor.

The value of a rental property is higher compared to similar rentals which are not profitable as it seems.

For example: Suppose the market value of a property is Rs 1,00,000 and it is creating Rs 10,000 NOI. the capitalization rate will be 10000/100000 = 0.10 = 10%.

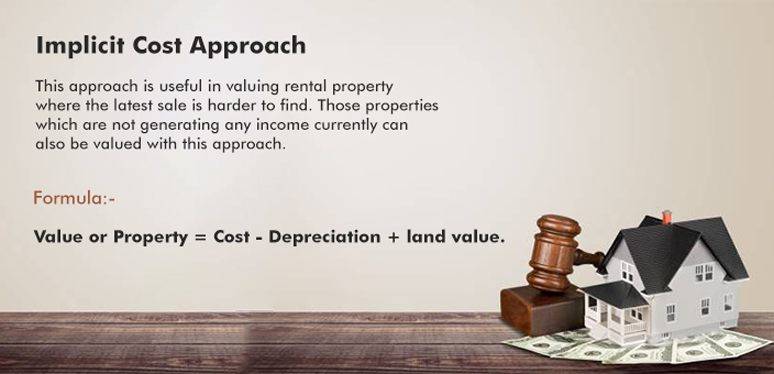

Implicit Cost Approach

This approach is useful in valuing rental property where the latest sale is harder to find. Those properties which are not generating any income currently can also be valued with this approach.

The main idea of this approach is that the real investors will not pay for the resale of the property which will be higher than the cost of construction.

Formula:

Value or Property = Cost – Depreciation + land value.

The value of the property will include the cost of building construction subtracting the depreciation of the existing property and adding the cost of the land.

This approach helps the buyers to find the exact price of the property and pay less compared to any new property in the same area.

Price Per Square Foot Approach

Real estate investors prefer this approach where they determine the value of the property by considering the sale value of similar projects in the market.

It is also called the sales comparison approach. It is used for valuing recently sold properties within a specific period.

It is noticed that the properties which are nearer to the properties that were compared are sold easily.

When the size of the property, age, number of rooms, and other factors are similar to the compared property, then it gets easier to figure out the comparison.

Formula:

Price per square foot = Total Cost/ Area of the Property

For Example: Suppose the neighbour of your property has a home price worth Rs 3,50,000 with a size of 2,000 square feet. The price of each square foot will be Rs 175 (350000/2000). Hence, if you have an 1800 square feet size property, the price will be Rs 3,15,000 (1800*175).

CAPM Approach

The CAPM (Capital Asset Pricing Model) approach considers the relation between the expected return and investment risk of an asset.

The expected return is similar to the risk-free return, including the risk premium. According to the CAPM, real estate investors can earn more if they are accepting a higher level of return in exchange for more rewards.

Formula:

Expected Return = Risk-Free Rate + (Beta x Market Risk Premium)

Beta calculates the risk that the investment is going to add to the property.

However, in some cases, investors had argued that there are rental properties that can offer a balance of risk and reward.

For example: Suppose a share worth Rs 100 is paying an annual dividend of 3%. According to the market, the stock has a beta of 1.3, which states that the investment might be riskier compared to the portfolio in the market. If the risk free rate of return is 3% then the investor can expect a market rise of 8% each year.

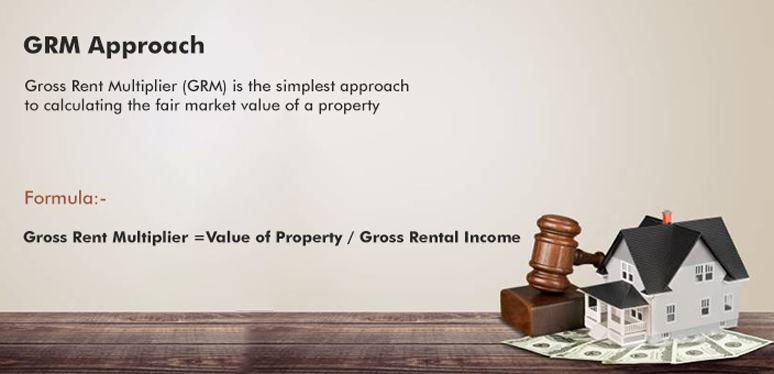

GRM Approach

Gross Rent Multiplier (GRM) is considered to be one of the simplest approaches to calculating the fair market value of a property.

In some cases, even if the GRM is lower showcasing a higher value to the investor, it may require some extra repairing costs.

Formula:

Gross Rent Multiplier = Value of Property / Gross Rental Income

For example: If a property is selling for worth Rs 20,00,000 and gross rental income is Rs 3,20,000. Then the GRM will be 20,00,000/3,20,000=6.25.

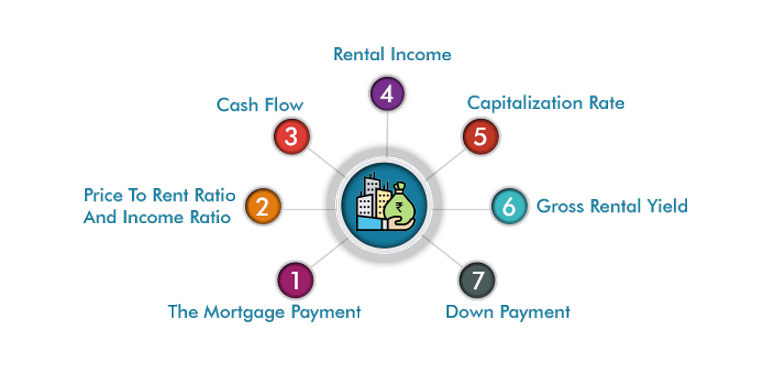

Important Data For Property Valuation

Before starting with the calculation of rental property valuation, the investors are required to collect relevant financial data which are:

- The Mortgage Payment: Whether there is a mortgage payment or not and how much of the amount is to be given for the property loan. It should be noted whether the mortgage payment includes property taxes and insurance of the property or not.

- Price to rent ratio and income ratio: Dividing the median home price with the median annual rent will give the price to rent. This ratio will compare the affordability of renting with buying a house. In the income ratio, the median household price and median household income is compared. If the ratio is less then buying a house will be more affordable.

- Cash flow: This depicts the money which is left after all possible expenses. This is measured monthly or annually. If the calculation shows a positive cash flow then there have been more income compared to expenses and debt.

- Rental income: The amount including allowance for vacancy and the amount left after paying the mortgage and operating expenses is the rental income.

- Capitalization rate: This rate shows the potential rate of return while considering the gross rental yield. It becomes easier to understand the comparison between two properties with similar features.

- Gross rental yield: The total purchase price of the house is divided by the annual gross rent. When the percentage of rental yield is higher, it will depict a better investment opportunity in the property.

- Down Payment: Initially paid amount for a loan is the down payment. This will vary according to the mortgage loan taken or the investment strategy of the property owner.

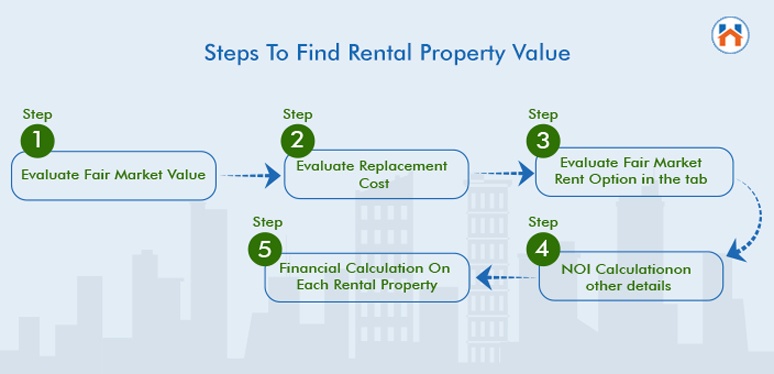

Steps To Find Rental Property Value

After collecting relevant key financial data for property investment, it’s time to understand the steps which are required to evaluate the rental property. Let’s check the steps for quality analysis of the property value.

Step 1: Evaluate Fair Market Value: Fair market value is the rate that a buyer is willing to pay for the property. You can get the information for determining the fair market value of the rental property from different reliable sources on the internet.

Step 2: Evaluate Replacement Cost: The replacement cost is the money that can be used to construct an exact similar property. The cost will include similar land value, labour cost, and material cost.

Step 3: Evaluate Fair Market Rent: This step includes evaluating the rental value of a property in the market. If the rental value at the market is high then the tenants may not renew the lease. However, lower rental value at the market can provide benefits like lease renewal.

Step 4: NOI Calculation: Net Operating Income is determined after subtracting normal operating expenses is deducted from the gross income. NOI includes the cost of utilities, property taxes, insurance, maintenance, routine repairs, and property management fees. However, this excludes the mortgage payment.

Step 5: Financial Calculation On Each Rental Property: The most commonly used financial calculations are Capital rate, cash-on-cash return, and ROI.

Factors Impacting The Value Of Property

Apart from the commonly used term “Location” as the only factor for a property value, there are many other factors that influence the value of a property.

Let’s discuss each of the factors individually:

- Location: The main and commonly used factor is the location of the property as it influences the rental tax rate, job growth, rent control, and population. If the locality is prone to natural disasters then there will be less property value.

- Modifications on the property: When any rental property is modified with new specifications, its value automatically increases as it becomes a great deal for the tenants. Even a small modification can help to increase the value of the property.

- Age of the property: The value of old properties is lesser compared to the newer ones because the older property requires frequent routine repairs and maintenance.

- Property neighbourhood: The value of a property also depends on the neighbourhood. If the property is located near any criminal activity or graffiti, then tenants will decline the property. The rental income along with NOI decreases resulting in less cash flow.

- Market condition: If there are more tenants than homeowners, then the rental value of a property will automatically increase.

- Property size & floor plan: In the market, the commonly used metric is the price per square foot. The size of the bedroom, bathroom, and floor plan of the property will determine the value of the property. Hence, it declines the rule that if the house is bigger, then the value will be better.

- Property condition: If the property requires any update cost for the modification. Then the value of the property will reduce.

FAQs

| Q1: What is a rental property valuation?

Ans: The Rental method of valuation is the type of valuation that is commonly used for fixing up all the taxes of the property. |

| Q2: Which are the 5 methods of calculating rental property value?

Ans: The 5 methods of calculation that are used for the rental property value are Capitalization Approach, Implicit Cost Approach, Price Per Square Foot Approach, CAPM Approach, and GRM Approach. |

| Q3: Which factors are important to decide the value of a property?

Ans: The factors which are important for the property valuation are the following location, modifications, age of the property, property neighbourhood, market condition property size & floor plan, and property condition. |

| Q4: Which are the steps which are needed to be followed for property valuation?

Ans: The steps which are required to be followed for property valuation are:

|