You need to pay the property taxes when you buy, sell and own the property in India. The taxes you pay on the property may be a significant amount and therefore it is important to know the methods of calculation and various ways to save the property taxes. This article covers all types of property taxes in India, property tax calculations, and gives you effective ways to save the property taxes along with the most crucial FAQs.

Page Contents

- What are the Property Taxes in India

- Property Tax on Buying a Property

- GST On Property in India

- Stamp Duty and Registration Charges

- Property Taxes During The Property Ownership

- Property Tax Calculation

- Property Tax on Selling The Property

- How to Save the Property Tax In India

- How To Pay The Property Tax Online

- FAQs

What are the Property Taxes in India

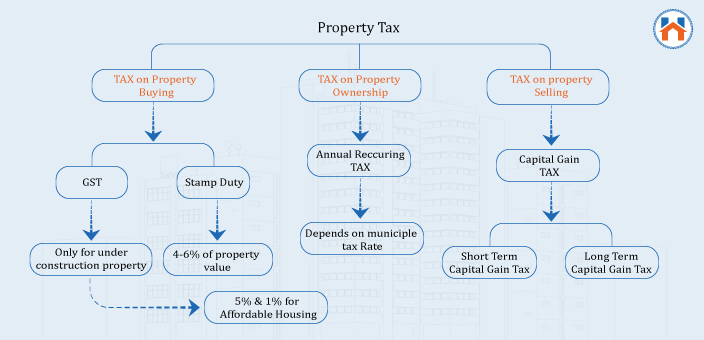

In India, the property tax is applicable as per the Income Tax Act 1961. The tax is applicable while buying the property, during the ownership of the property, and selling the property.

Here is the general distribution of the applicable property taxes in Idia in buying, selling, and owning the property.

Property Tax on Buying a Property

When you purchase a new property, you need to pay the property taxes in India. These taxes are GST and Stamp Duty Registration Charges.

GST On Property in India

The property buyers in India need to pay 5% GST while buying a new under-construction property. The properties under the affordable housing segment have the 1% GST applicable.

The property qualifies as affordable housing when the total value of the property does not exceed Rs 45 Lakh and the carpet areas are up to 60 sq ft (for metropolitan regions) and 90 sq ft (other than metropolitan cities).

No GST tax is applicable for the properties Ready-to-Move properties. Also, the GST is not for inherited properties.

However, as per the new tax regimes effective from 2019, the income tax credit ITC is not applicable on the GST paid for the under-construction properties. Meaning, you can’t take the credit to pay the other tax income tax dues.

Highlights-GST On Property in India

| For Under Construction Properties | 5% |

| For Under Construction Affordable Housing Properties | 1% |

| For Ready-To-Move Properties | No GST Applicable |

Stamp Duty and Registration Charges

You need to pay the Stamp Duty tax for buying a new property. The state government levies the stamp duty tax on the property transactions.

The Stamp Duty generally depends on the following important factors-

- Total Value of the Property

- Age of the Property Buyer

- Gender of the Property Buyer

- The Location of the Property

The Stamp Duty and Registration Charges in India are governed by the State Government. And therefore, the Stamp Duty percentages vary from one state to the other.

Generally, the Stamp Duty charges are between 4-6% in India depending on the state policies. The registration charges are 1% of the total value of the property.

From time to time, the government provides relaxation to the property buyers by cutting off the stamp duty tax charges.

It is mandatory to pay the Stamp Duty as you become an owner of the property only after paying the Stamp Duty and Registration Charges.

If you do not pay the stamp duty taxes, the penalty of 2% monthly is charged. This amount can go up to 200% of the original applicable Stamp Duty Tax

Here are the Stamp Duty and Registration Charges in some of the major cities in India.

| Stamp Duty in % of Market Value of the Property. | For Male | For Female |

| Stamp Duty and Registration Charges In Mumbai | 5% | 4% |

| Stamp Duty and Registration Charges In Navi Mumbai | 6% | 5% |

| Stamp Duty and Registration Charges in Thane | 6% | 5% |

| Stamp Duty and Registration Charges in Pune | 6% | 5% |

| Stamp Duty and Registration Charges in Bangalore | 5% | 5% |

| Stamp Duty and Registration Charges in Chennai | 7% | 7% |

Property Taxes During The Property Ownership

A property owner has to pay the tax applicable on the property annually. The land, house, offices and other commercial properties are subject to annual property taxes calculated by the local municipal authorities or corporations.

Recurring Amount of Taxes Calculated by the Local Municipal Authority.

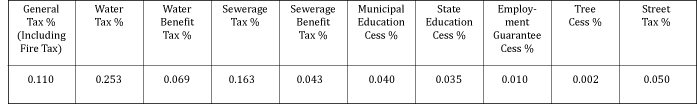

The property taxes consist of the various components such as-

General Tax, Sewage, and Drainage Cess, Education Cess, Employment Cess, Environmental Cess, etc. The percentage of these components differs from one municipal authority to the other.

For example, here are the tax distributions set by the Mumbai Municipal Corporation.

The annual property taxes can be between 5-20% depending on the various factors. Following are the factors that decide the annual property taxes in India.

The municipal authority and its tax rates Total Value of the Property.

The Vacant properties are generally exempted from paying the annual property taxes.

Property Tax Calculation

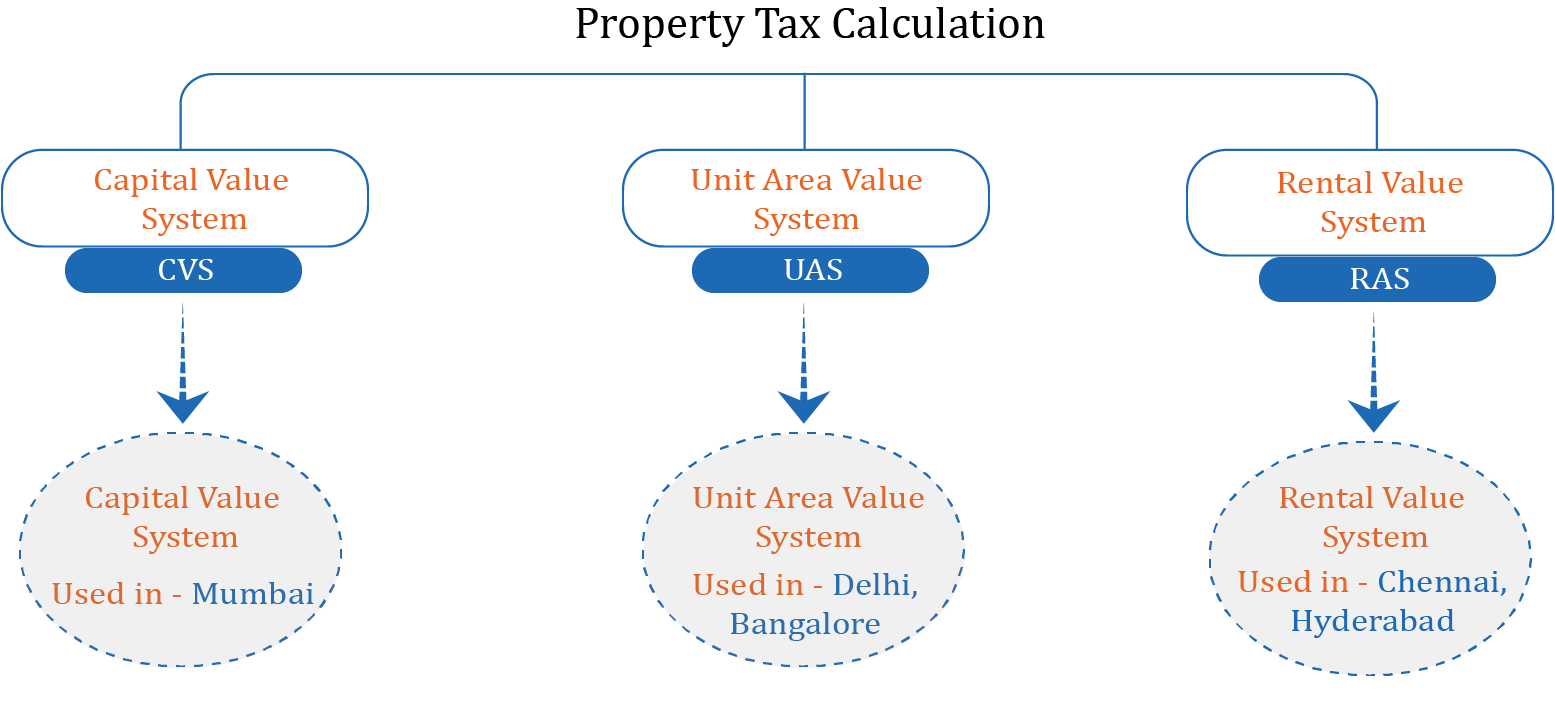

The property tax is calculated by the municipal authorities of the specific region. Different municipal authorities have used different property tax calculation methods.

Generally, the property tax in India is calculated based on the following three methods.

Capital Value System (CVS)

The Capital Value System is used in Mumbai. In this method the Capital Value System (CVS) the annual property tax is computed based on the Market value of the property. In Mumbai, the Ready Recokber rates are considered as the market value of the property. The Municipal corporation releases the ready reckoner rates every year.

The Property Tax formula can be given as-

Property Tax = Capital Value X Property Tax Rate

The formula to calculate the capital value-

Capital Value For Land

Capital Value (CV) = BV x UC x FSI x AL

Where,

BV = Base Value As per Ready Reckoner Rate

UC = User Category

FSI = Floor Space Index

AL = Area of Land

Capital Value for the Flats can be calculated as

Capital Value (CV) = BV x UC x NTB x AF x FF x CA

Where:

BV = Base Value As per Ready Reckoner Rate

UC = User Category

NTD= Nature and Type of Building

AF= Age of the Building

FF= Floor Factor

CA= Carpet Area

Example For Calculating the Property Tax on Flat

Consider the following property details to calculate the applicable property tax with the Capital Value System (CVS)

Ready Reckoner Rate = Rs 50,000/ Sq mt

User Category = Residential Property (0.5)

NTB = 1 For RCC building

AF = 0.95 Age Factor 9-10 years Old Building

FF = 1.0 (1-4 Floors)

Carpet Area = 100 Sq mt

TAx Rate for Residetial Properties in Mumbai = 0.755%

so the capital value will be-

Capital Value (CV) = BV x UC x NTB x AF x FF x CA

= 50,000 X 0.5 X 1 x 0.95 X 1 X 100

= Rs 23,75,000

Total Property Tax = 0.755% of 23,75,000

= Rs 17,931

Unit Area Value System (UAVS)

Unit Area Value system is the modern method for calculating property tax. It does not depend on the market value or the rental value of the property and, therefore, gives an accurate calculation of the property taxes.

This method for calculating the property considers the age of the property, location of the property, and the type of the property.

In the unit area value system, the localities are categorized based on livability ratings.

Property Tax Calculation Formula by Unit Area Value System

Property Tax = Annual Value X Tax Rate

The Annual Value can be calculated as

Annual Value = Area Covered X UAV X Use Factor X Age Factor X Structure Factor X Occupancy Factor X Flat Factor

Where,

UAV = Unit Area Value per Square Meter; depends on the property category. (Between 100- 630) (Categories AH)

Use Factor = It is the factor assigned based on the property use. Between 1-10, For residential property, it is 1

Age Factor = Depends on the age of the property. New properties have a higher age factor. Usually in between 0.5-1

Occupancy Factor = Depends on whether the property is for self-use or has been rented out. Occupancy Factor 0.6-2

Flat Factor = It is the total area covered by the flat.

Area Covered = Indicates the total area covered by the property.

The Tax rate depends on the total categories made by the multiple authorities, In Delhi, the Tax rate is between 7-20% of the annual value of the property.

Consider an example- You own a flat in Delhi with a UAV of Rs 400, Category C and the total area of the property is 90 sq meters. You have purchased the property in 2002. And you are using the property for self-use.

In this case-

UAV = Rs 400 per sq ft

Use Factor= 1.0 since it is resdieital property

Age Factor= 1.0 since the property is brought after 2000

Structure Factor= 1.0 for RCC Building

Occupancy Factor= 1.0 for self-occupied

The property tax can be calculated as-

Property Tax = Annnual Value X Tax Value

Annual Value = Area Covered X UAV X Use Factor X Age Factor X Structure Factor X Occupancy Factor

= 90 X 400 X 1 X 1 X 1 X 1

= Rs 36000

The Property Tax rate for residential properties is 11% in Delhi for Category D localities.

Therefore,

Property Tax = Rs 36000 X 0.11

Property Tax = Rs. 4356

Annual Rental Value System (ARV)

This method calculates the property tax by considering the annual rental value of the property. The municipal authority does the calculation of the rental value of the properties depending on the location, age of the property, and the total area of the property.

This method is used in major cities such as Chennai and Hyderabad.

Property tax = NARV X Tax Rate

Where NARV is the rental value of the property that depends on the multiple factors defined by the municipal corporation of the region.

Property Tax on Selling The Property

The Tax is also applicable to the profit you get after selling the property. This property tax is also called the capital gain tax.

The capital gain tax on the property is classified into two categories- Short Term Capital Gains and Longer-Term Capital.

Short Term Capital Gain Property Taxes

If the holding period for the property is less than 2 years, then the tax applicable is termed as the short-term capital gain tax.

If you buy the property and sell it within 2 years of purchase, then the profit you get from this deal is subjected to short-term capital gain property tax.

In this case, the tax is calculated as per the income tax slabs prefixed by the Income Tax Department.

Long Term Capital Gain Property Tax

If the holding period for the property is less than 2 years, then the tax applicable is termed as the short-term capital gain tax.

If you sell the property after 2 years, then the profit you get is subject to the long-term capital gain taxes.

In this case, 20% property taxes apply to the profit you get from selling the property.

How to Save the Property Tax In India

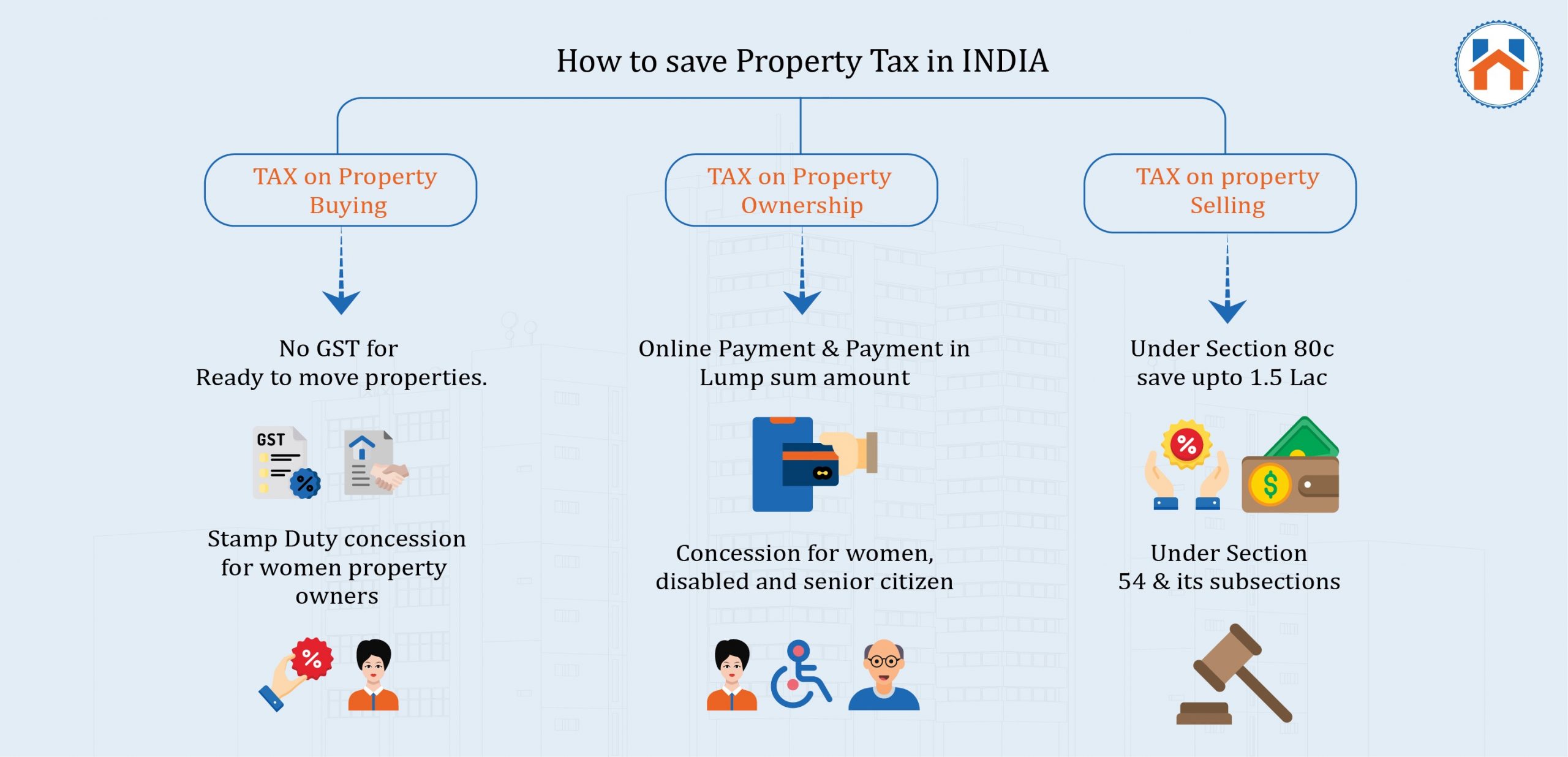

There are legal provisions that can help you save a considerable amount of property taxes.

As we have categorized the property tax into three segments, let’s check what are the tax-saving provisions available for all three types.

How To Save Tax on Property Buying

GST and Stamp Duty are the two taxes you pay while buying property.

However, GST is only applicable to under-construction properties. Meaning if you are buying a ready-to-move property, you will be exempted from the GST on property.

Also, you can save the GST on the property if the property comes under the affordable housing segment (within the 45 Lakh). In this case, you need to pay 1% GST instead of 5%.

There is no direct provision to save the Stamp Duty taxes. However, the state government has given concessions to female property buyers. In many states, females have to pay 1-2% stamp duty lesser than male property owners.

Another way to stave the stamp duty tax is by the concession and rebates offered by the state governments.

How to save the property Tax on Ownership

The annual taxes you pay the local municipal authority has some tax reliefs if you pay the taxes in the lump sum amount. In Pune for example, the PCMC gives the concession if you make the payment in one lump sum amount.

Also, some municipal authorities give them some concessions on the property taxes for the online payment of the property taxes.

How to Save the Property taxes on Selling the property

There are many legal provisions for saving the tax after selling the property. The taxes after selling the property can be categorized as the Short Term Capital Gain Tax and the Long Term Capital gain Tax.

Both of these have different provisions for saving property taxes.

| Short Term Capital Gain Taxes | Long Term Capital Gain Taxes |

| Under Section 80C you can save 1.5 Lakh on the Short Term Capital Gain Taxes.

For this, You need to make the investment and payment into the following options. Investments-

Payment-

|

Under section 54 gives you can save the property taxes by investing the profit into the other residential property.

|

How To Pay The Property Tax Online

You can pay the property tax online by visiting the official website of the respective municipal corporation.

Paying the property tax payment online makes the process hassle-free. Moreover, some municipal corporation offers a discount on paying the property tax online.

To pay the property tax online, you need the basic personal and property details. The online payment of the tax online also gives you an option to calculate the property tax online.

By using the online tools provided on the municipal corporation by providing the basic property details- such as property location, property area, and other important property details.

Following are the link to pay the proper tax online in the major cities in India

- Greater Hyderabad Municipal Corporation

- Pune Municipal Corporation

- PCMC

- Navi Mumbai Municipal Corporation (NMMC)

- Municipal Corporation of Greater Mumbai (MCGM)

- Municipal Corporation of Delhi (MCD)

- NOIDA Authority

- Municipal Corporation of Gurgaon

- Kolkata Municipal Corporation (KMC)

- Bruhat Bengaluru Mahanagara Palike (BBMP)

- Greater Chennai Corporation

FAQs

The GST for the under-construction residential properties in India is 5%. Whereas there is 1% GST for the residential properties in the affordable segments. No GST is applicable for the ready-to-move residential properties. |

Stamp Duty charges are different for different states. These charges are generally 4-6% of the market value or the agreement value of the property. |

The annual recurring taxes are calculated by the regional municipal corporation. The property tax has many components such as general tax, sewage tax, education cess, environmental cess, employment cess, etc |

The property taxes can be calculated by using Capital Value System (CVS), Unit Area Value System (UVS), and the Rental Value System (RVS). The Unit Area Value System (UAVS) is considered as the modern and fair tax calculator method. |

To save the property tax on the profit gained after selling the property, you need to reinvest the profits as per the provisions made under sections 80C or 54 and its sub-sections. |

You can calculate the property taxes online by visiting the official website of the municipal body of the region. To calculate the property tax online you need the basic property details. |