The Maharashtra CM Uddhav Thackeray has announced the complete property tax waiver on residential properties upto 500 sq ft within the Mumbai municipal limits. Applicable from the 1st of April 2022, The property tax waiver will offer great relaxation to the Rs 16 Lakh property owners in Mumbai. Read on to know how it will impact the property owners in Mumbai and important FAQs.

Page Contents

What is Recently Announced Property Tax Waiver In Mumbai?

The property owners in Mumbai have to pay the MCGM property Tax annually. The applicable property Tax amount depends on the total value of the property. The general components involved in the property tax are general tax, sewage tax, education cess, tree cess, and water benefit taxes, etc.

As per the recent announcement by Maharashtra CM Uddhav Thackeray, there will be no property tax applicable on the residential properties measuring 500 sq ft within the Mumbai Municipal limits.

The complete MCGM property tax waiver is applicable from the 1st of April 2022. For this, the necessary amendments into the Mumbai Municipal Corporation Act, 1888, the Maharashtra (Urban Areas) Preservation of Trees Act, 1975, and the Employment Guarantee (Cess) Act, 1962 will be done.

Impact Of Property Tax Wavier on the Property Owners in Mumbai

The exemption on the MCGM property will be a significant relaxation to the property owners in Mumbai. The complete MCGM property tax waiver will benefit the Rs 16 Lakh properties with an area less than 500 sq ft.

According to the recent announcement by the Maharashtra Government, the property owners will get an exemption on all tax components. It includes the general tax and other tax components such as tree cess, water benefit tax, sewage taxes, etc.

Previously, the government had announced the tax concession only on the General component of the MCGM property tax. The general component of the property tax is 10-30% of the total applicable tax. However, the property owners had to pay the taxes such as tress cess, education cess, employment cess, and sewage tax. Now the government has completely removed the property tax for the properties within the 500 sq ft.

Also, there is 60% of tax concessions if the property is between 500 – 700 sq ft and lies within the municipal limits of Mumbai.

MCGM Property Tax Exemption Timeline

- The proposal for the Tax Wavier was announced first in 2017 during the civic body polls.

- The state government in 2019 had cleared a bill for the exemptions of the property tax for residential properties within the 500 sq ft.

- In 2019, however, there was no clarity on which property tax component would be reduced.

- In 2020, BMC only exempted the General Tax component. The decision on the tax waiver was unclear. Therefore, BMC did not issue the property tax bills to the properties below 500 sq ft in 2020.

- Later in Jan 2021, BMC issued the Tax bills with the Tax exemption only on the General Tax component that was 10-30% of the total tax values.

- In Jan 2022, the Maharashtra government announced the complete waiver on the property tax for the residential properties measuring upto 500 sq ft and located within the Mumbai Municipal limits.

Property Tax Wavier in Mumbai Overview

The Property Tax is one of the main sources of revenue for the Brihanmumbai Municipal Corporation. The share of the MCGM property tax is 24% of the total revenue generated. And therefore, the total revenue loss for the MCGM is estimated to be Rs 300-500 Crore.

For 2021-2022, the BMC has set the target of Rs 5000 Crore which will easily be achieved according to the top BMC officials.

For tax collection of 2020-2021, the BMC had set the target of Rs 6788 Crores. Also, the previous MCGM property tax targets were Rs 5,206 Crore for 2018-19 and Rs 5600 Crore for 2019-2020.

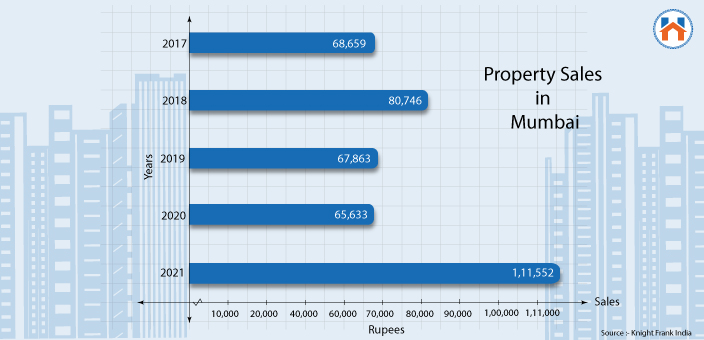

Property Registrations in Mumbai set up a New Record in 2021

Mumbai’s real estate market has witnessed an unprecedented rise in property registrations in 2021. The property registrations are increased by 46 % as against December 2019.

Following are some of the key factors that scaled up the Property registration in Mumbai in 2021.

Lower Interest Rates– The banks offer an interest rate of 7% and less that is the lowest in the last 15 years. The home loan processing fees were too at the minimum bar.

Subdued Housing Prices- The pandemic has triggered the higher supply and lower demand at the beginning of 2021. It resulted in reduced costs and more offers and discounts from the developers.

Offers and Discount- The developers offered attractive discounts and offers considering the unsold inventory resulting from the covid19 impact. The developers also offered flexible payment plans, No EMI till possession, 10% booking charges, and so on.

Tax Reliefs- First-time homebuyers got the benefit of Rs 1.5 Lakh on the principal component of home loan under section 80C. Also, the relief of Rs 2 Lakh was applicable on the interest component of the home loans as per section 26C.

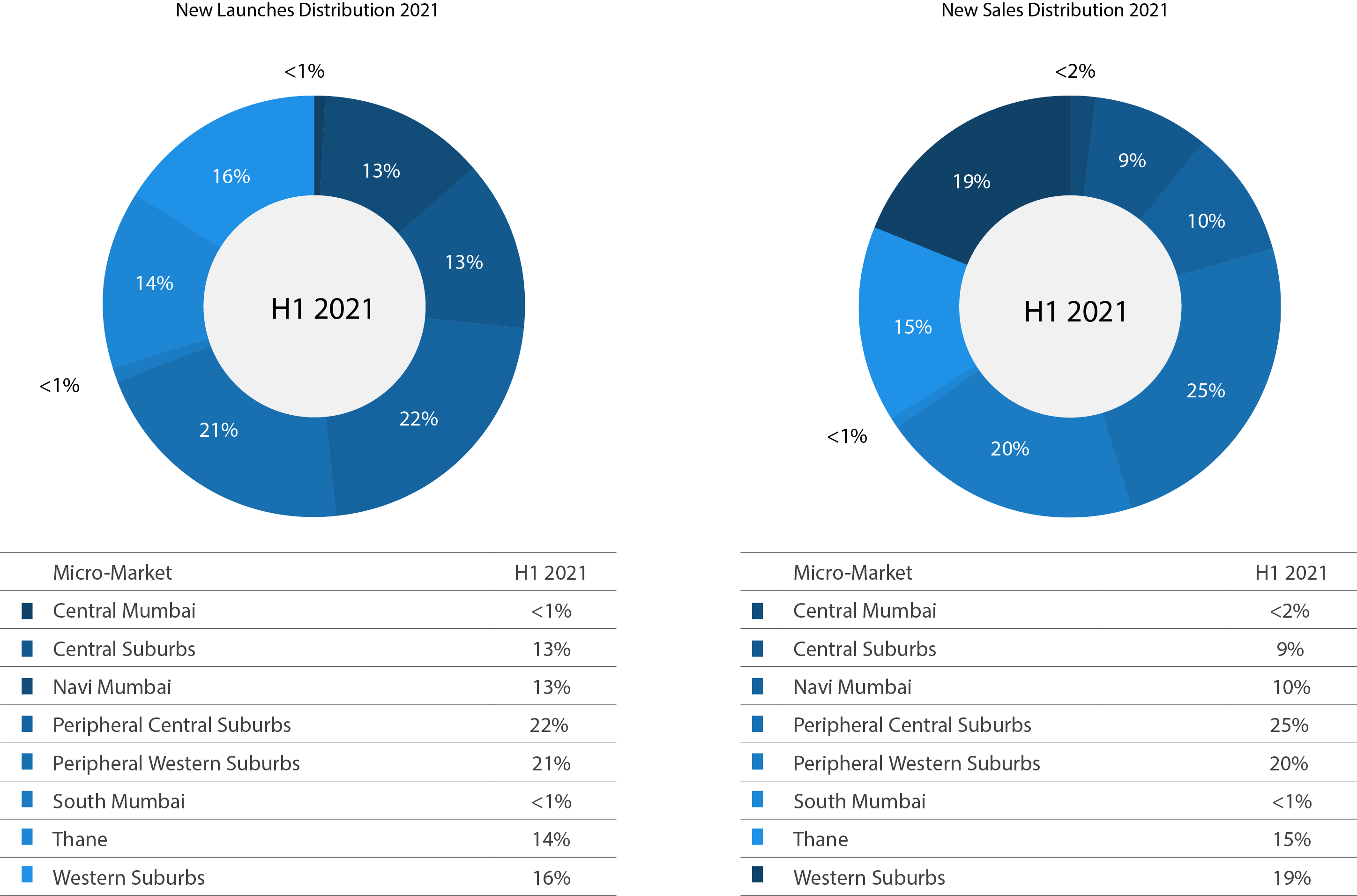

Mumbai Real Estate Overview 2021

This trend will continue in the year 2022 considering the unchanged affordability factors. The banks are still offering low-interest rates and the developers have been positive towards extending the offers and discounts to the homebuyers.

FAQs

| What Is the Recent MCGM property tax waiver announced by Maharashtra Government?

The Maharashtra government has announced no property tax for the properties measuring less than 500 sq ft and are within the Mumbai municipal limits. |

| Who will get the benefit of the Property Tax Wavier in Mumbai?

The property owners with residential properties less than 500 sq ft and located within the municipal limits of Mumbai will get the benefit of a property tax waiver. |

| When will the complete waiver on the MCGM property tax be applicable?

The complete waiver on the MCGM property tax will be appliable from the 1st of April, 2022. |