Disclaimer:

With 11+ years of experience & expertise in the real estate industry, Homebazaar provides end-to-end property-buying solutions. Hundreds of 100% verified RERA-registered residential & commercial properties are listed on our website. We provide facilities like Zero brokerage, 360° virtual street view, quick site visit services, end-to-end property buying agreements & documentation guidance and low-interest home loan assistance. This helped us gain the trust of 55,000+ clients across India & sold 6,500+ homes of top reputed developers.

Page Contents [hide]

- What is the Ready Reckoner rate?

- Ready Reckoner Rate Importance for Home Buyers

- How to Calculate Ready Reckoner Rate

- Find Ready Reckoner Rates Online

- Factors Affecting Ready Reckoner Rate

- How Does the Ready Reckoner Rate Affect Real Estate Transactions?

- Difference Between Ready Reckoner Rate and Market Rate

- What is the Ready Reckoner Rate in Pune

- What is the Ready Reckoner Rate in Mumbai

- Latest update on Ready Reckoner Rate 2025

- FAQs

What is the Ready Reckoner rate?

Ready Reckoner Rate is also known as a Circle rate. It is the lowest rate of property in a specific region defined by the government authority.

Ready Reckoner Rate is also known as a Circle rate. It is the lowest rate of property in a specific region defined by the government authority.

The ready reckoner rate is decided on the property’s location, size, and specifications.

These factors are used to define a benchmark below which no real estate transaction is allowed in that particular area.

Every state, every city, and various neighbourhoods within those cities have a varied ready reckoner rate. This rate is determined by real estate regulatory authorities of a state to ensure that no property can be dealt with fraudulently and sold at a minimum rate.

The government only imposes stamp duty and registration costs on this minimum price.

Ready Reckoner Rate Importance for Home Buyers

The Ready reckoner rate is an important factor if you are in the market to sell your property as it provides a rough idea about the value of your property.

Homebazaar.com VP Nikhil Naikhare commented, ” The current financial year has seen the ready reckoner rates for properties remain unchanged, providing stability to the real estate market. However, there is an anticipation of potential changes in the elections, as the government is likely to review and adjust these rates in the coming period.”

Ready reckoner rate helps in the calculation of government tax which helps you understand the true market value of a property.

If the difference between the ready reckoner rate and market rates is relatively less then it is favorable for buyers to purchase property in that region.

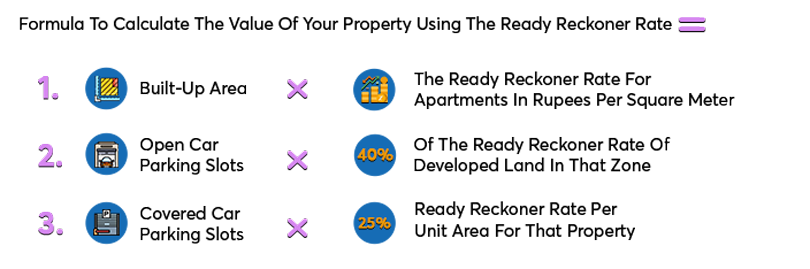

How to Calculate Ready Reckoner Rate

The ready reckoner rate is the most commonly used method for calculating the rough value of the property in a particular area.

You can start by Calculating the property’s built-up area, taking into account elements like floors, amenities, construction age, area, and more (depending on the property’s kind, such as a flat or commercial unit).

If two built-up area numbers are supplied, the original value and the one with 1.2 times the carpet area, consider the higher value. After choosing the property’s location, use the formula below to get the property’s value at the ready reckoner rate.

The government bodies calculate the Ready reckoner rate based on all the factors like build-up area parking slots.

Use this formula to calculate the value of your property using the ready reckoner rate.

Let’s say you want to purchase a piece of real estate, like a residential apartment in a Maharashtra city, but the area has a 5% stamp duty.

The property is valued at Rs. 80 lac according to the Maharashtra government’s RRR. The stamp duty is estimated to be Rs. 4 lac at 5%.

However, you will have to pay 5 lac in stamp duty if the actual purchase price of the apartment is Rs. 1 crore (following the actual value of the transaction)

Note that you would have had to pay the minimum amount of 2.5 lacs in stamp duty if you had purchased the property for Rs. 40 lakh (according to the minimum value of a property set by the Maharashtra government or ready reckoner rate).

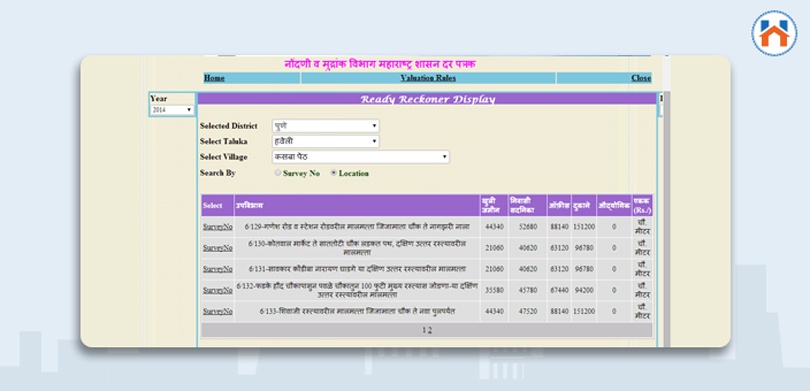

Find Ready Reckoner Rates Online

The ready reckoner table is a table where ready reckoner rates are added to assist people in determining the minimal worth of their property.

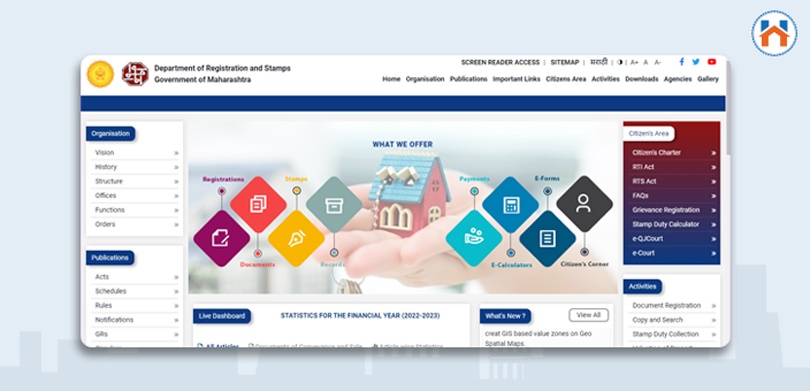

You can go to the official website of the Department of Registration and Stamps Maharashtra to find the ready reckoner rate online.

Step 1: Go to the above-mentioned website which navigates you to the online service section.

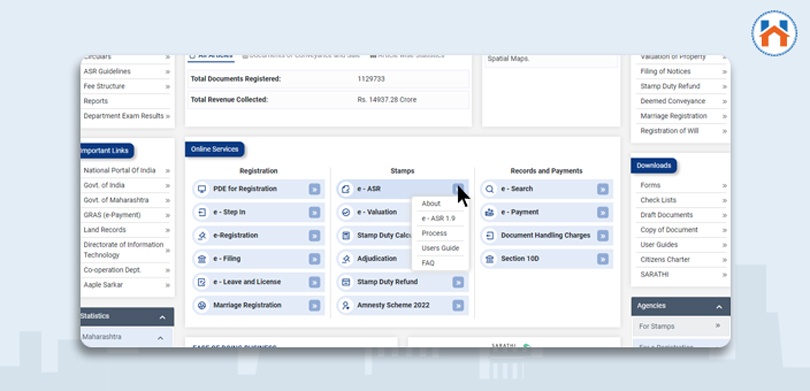

Step 2: Select the ‘e-ASR’ option. Once you click on the drop menu you can see About, Process, e-ASR, User Guide, and FAQs. Choose according to your requirements. The user guide option will take you to the detailed process of finding a ready reckoner rate.

Step 3: Click on the process which will open the map of Maharashtra, in this map you need to select your region or city for which you want to find a ready reckoner rate.

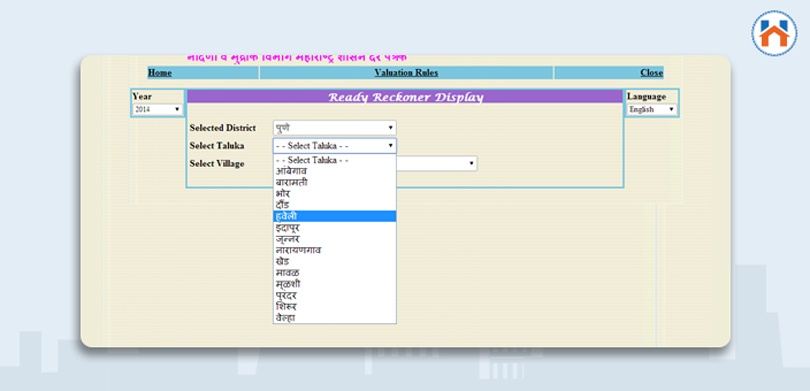

Step 4: From the drop-down menu select Taluka and village.

Step 5: You will see the ready reckoner rate of the selected locality.

Factors Affecting Ready Reckoner Rate

Factors Affecting Ready Reckoner Rate

Many factors affect the ready reckoner rate

- The location of the supplier and the client (the closer they are to each other, the lower their ready reckoner rates), the location of the property

- Amenities available in that location

- Lifetime of property

- Property type ( Residential, commercial, or plot)

- The length of time needed for delivery (longer lead times require higher costs)

How Does the Ready Reckoner Rate Affect Real Estate Transactions?

The majority of real estate transactions in India are based on the neighbourhood average price.

The stamp duty and registration fees that the home buyer must pay are calculated based on this market rate. As a result, the government loses money when the ready reckoner rate differs significantly from the market rate.

The stamp duty and registration costs will be computed using the ready reckoner rate in uncommon circumstances where the ready reckoner rate is higher. Higher reckoner rates, on the other hand, deter home buyers from registering their properties.

The state government can promote transparency in real estate transactions and ensure that they do not miss out on money by periodically modifying ready reckoner rates and bringing them closer to market rates in every locality.

Difference Between Ready Reckoner Rate and Market Rate

Ready reckoner rate and market rate are two different things.

Ready reckoner rate and market rate are two different things.

The government establishes ready reckoner rates depending on the lowest amount of property rate recorded during the event of transfer for real estate registration transactions. On the other side, the actual property prices that buyers and sellers negotiate when purchasing and selling real estate, are referred to as market pricing.

Market rates can be higher or lower than ready reckoner rates depending on many different factors, such as whether or not a borrower has collateral or assets available to cover loan payments if they become unable to make them.

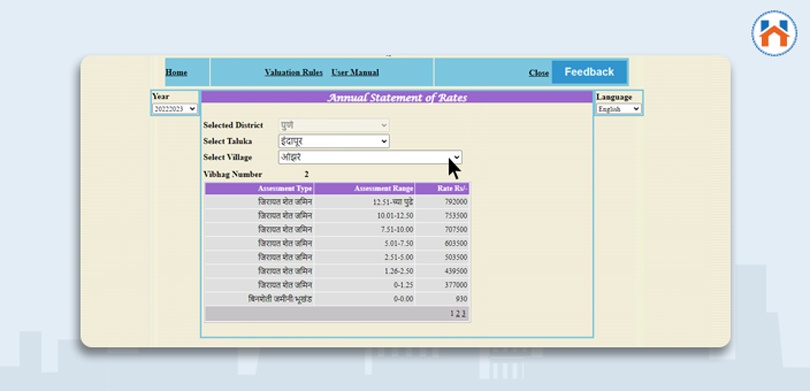

What is the Ready Reckoner Rate in Pune

The ready reckoner rates in Pune are governed by the government of Maharashtra.

On March 31 of each year, this fee schedule is released. The state government recently announced a hike in Pune ready reckoner rates of 6%

You can check the Ready Reckoner Rate in Pune by visiting the website

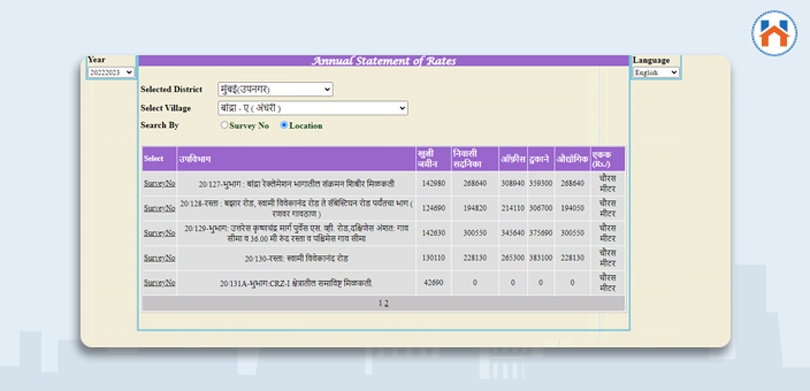

What is the Ready Reckoner Rate in Mumbai

Originally the ready reckoner rate is considered for determining the right market value of a property while buying or selling.

Ready reckoner rates In Mumbai remained unchanged for the year 2023- 2024, they were last hiked on September 12, 2020, by the government of Maharashtra, the revised rate for Mumbai is -0.6%.

In Mumbai, Nashik, Navi Mumbai, and Pune, the premium is solely applied to high-floor structures. From the 5th floor onwards the rates are increasing at 5%.

You can check the Ready Reckoner Rate in Mumbai by visiting the IGR Maharashtra website–

Floor Charges

| Up to 4th | Nill |

| 5th -10th | 5% |

| 11th -20th | 10% |

| 21st- 30th | 15% |

| 31st and above | 20% |

Latest update on Ready Reckoner Rate 2025

There are indications that the state government may increase the ready reckoner (RR) rates for properties in the upcoming financial year, marking the end of a three-year hiatus induced by the pandemic. The Department of Registration and Stamps is anticipated to propose a hike ranging from five to ten per cent, with the ultimate decision resting with the government in the elections.

FAQs

| What is the ready reckoner rate in Pune?

The ready reckoner rate in Pune is minimal, it is 6% according to the recent hike by the state government. |

| What is the ready reckoner rate in Mumbai?

For Residential land, it is Rs. 16,500-Rs. Rs.4,75,500 per sq. mt. For apartments and flats, it is Rs.42,000 – Rs.8,61,000 per sq. mt. |

| How property value is calculated in Mumbai?

Property value is calculated by multiplying the base value by the market value of the property (as determined by the Ready Reckoner), by the built-up area, the age factor, the type of building, the category of use, and the floor factor. Various characteristics, such as the type of construction, the age of the structure, and the user category, are given varying weights. |

| How can I determine my property’s market value in Maharashtra?

Market value is determined by Ready Reckoner’s annual statement rate value fixed and published every financial year under the Maharashtra stamp act and Maharashtra Stamp Rule 1995. |