First up, what exactly falls under the commercial property segment?

Basically, it is the area dedicated specifically to earning profits. Commercial property investment means buying small shops, office spaces, retail stores, or more dedicated categories such as warehouses, industrial spaces, etc., and getting consistent returns through rents or reselling the property when the market is up.

The investment in the commercial properties is best known for its-

- Attractive Rental Rates

- High Rental Yields

- Capital Appreciation

- A Positive & Less Specific Demand

- Low Vacancy Rate And Impact

- Longer Lease Periods & Continuous Cash Flow

- Good ROIs

Investments in commercial properties, however, involve some challenges and risks.

For example, in the case of commercial real estate investment in malls, different shops are owned by individual investors. Improper property management, maintenance, and an overall ineffective real estate ecosystem may not give the expected returns. Other challenges could be high capital investments and long-term horizons.

But still, the commercial properties outrank the residential properties by giving comparatively double returns.

Provided that a broader outlook on the entire commercial real estate ecosystem is considered. This involves the important factors that decide positive returns from commercial property investments such as

- Property Valuation

- Market Dynamics

- Who is Managing The property

- No of Units

- Future Growth of the region

- Location

The location is at the center of the entire commercial real estate ecosystem. The right location ensures continuous cashflows, reduced risks, and better ROIs.

So what makes a location better for commercial real estate investments?

- Good Commercial Space Demand

- Growing Economic Activities

- Infrastructure initiatives

- Industrial Hubs

- Proximity To Markets

- Favoring Policies

- Centrality

These are some of the important points that define the suitability of the location for commercial property investment.

Mumbai is one of the cities considered ideal for investments in commercial properties. Being the economic capital of India, Mumbai leads on all the commercial real estate fronts. So, here are the top reasons to invest in commercial property in Mumbai.

Page Contents

Growing Commercial Hubs:

Along with the existing established commercial centers in Mumbai, there are some emerging commercial centers in the surrounding regions with rapidly growing infrastructure. Navi Mumbai, Powai, and Thane and commercial centers in the eastern suburbs are emerging hubs in Mumbai.

All the commercial hubs have benefits such as

- Sound Connectivity

- Advanced Infrastructure Projects

- Good Demand For Commercial Spaces

- Growing Economic activities

- Many Potential Locations For Future Growth

| Locations | Industries | |

|---|---|---|

| Central Business District | Nariman Point, Fort, Churchgate, Colaba, Cuffe Parade. | Financial Institutions, Bank Sector, MNCs |

| Central Mumbai | Lower Parel, Prabhadevi, Worli | MNCs, IT, Textile, |

| Western Suburbs | Bandra Kural Complex (BKC) Andheri (East) Goregaon | Banking Sector, MNCs, Finance, Chemical, IT, Media Finance. |

| Eastern Suburbs | Vikhroli, Bhandup, Kanjurmarg | IT, ITES, Manufacturing |

| Emerging Business Hubs In Mumbai MMR | Navi Mumbai, Thane, Powai | IT, Manufacturing, MNCs, Chemical, Finance |

Notable Trends

BKC has emerged as a great alternative to the Business District Centre (BDC). commercial properties in BKC have given higher returns since its inception. There also has been the rise of residential properties in BKC making it an even more attractive destination for commercial investment.

BKC’s centrality has played a key role in its development. Moreover, it is very well connected by railway network (Bandra & Kurla nearby stations), western and eastern express highway and has proximity to the domestic and international airport.

Andheri East has also gained significance because of established hubs such as MIDC and Seepz. The region has been emerging as a commercial hub with the presence of the IT sector, Pharmaceutical Industry, Manufacturing, logistics, entertainment, and finance.

Navi Mumbai, Powai, and Thane are the newly rising commercial hubs of Mumbai. This is because-

Advanced infrastructure projects such as Navi Mumbai International Airport.

The economic activities in these regions have been scaled over the last few years and are expected to continue this trend.

There will be a high demand for office spaces, and retail shops in Powai for its thriving IT sector. And industrial spaces, offices, warehouses, and retail spaces for Navi Mumbai and Thane with rising MNCs, IT, Manufacturing, chemical, and finance sectors in the region.

There is an increase in the affordable residential housing development in these regions and hence pushing the commercial real estate sector.

With the greater demand for commercial space in the region along with the advanced infrastructure projects, these locations are perfect for investment in commercial property in Mumbai.

Growth For Every Commercial Property Segment.

The three main commercial property segments are Office, Retail, and Warehousing. For Mumbai, there is considerable demand for all three commercial segments with promising growth avenues.

Let’s have a look at each of them with some important statistics proving Mumbai as one of the best places for real estate investment.

Office Spaces:

Over the last decade, the average returns from the office space in Mumbai have been 8-12% along with significant rental yields.

In Mumbai, there have been increasing office space investment trends. Currently, private equity investment in office spaces in Mumbai has been all-time high since 2011.

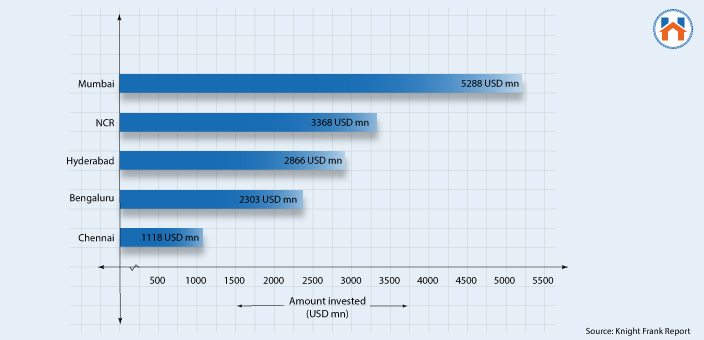

For the first quarter of 2021, Mumbai is the top destination as per private equity investment.

City Wise Graph of Private Equity Investment In Office Spaces: (For Q1 2021)

BKC & Navi Mumbai and the Thane region have been the popular locations for real estate investment in office spaces. These locations have been set for good returns in upcoming years considering the favorable real estate ecosystem.

Investment in Warehouses:

The demand for warehouse spaces has been sharply increasing in Mumbai for three primary reasons- Manufacturing, Imports/Exports, and the high consumption pushed by eCommerce.

Bhivandi, Panvel, and JNPT are the three warehousing clusters in Mumbai.

Warehousing cluster Major warehousing locations in Mumbai:

Bhiwandi: Mankoli, Kalher, Kasheli, Dapode, Padgha, Vashere, Vadpe, Saape, Lonad, Bhavale, Sawad Naka, Dohole, Sonale, Anjurphatta

Panvel: Palaspe, Uran Road, Taloja, Patalganga

From 2017-2020 there was around 69% growth in the Warehouse transaction in Mumbai. This is the highest number among all the Indian cities.

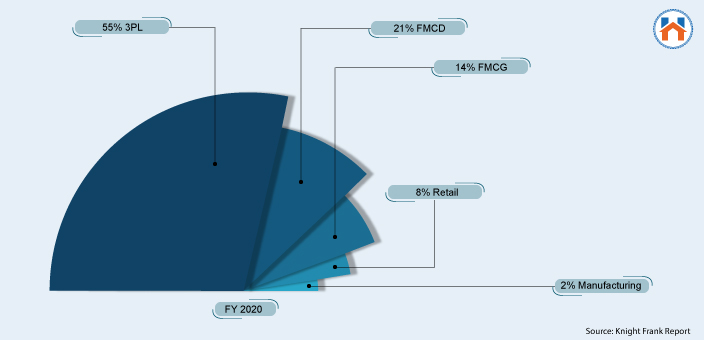

Industry-wise Distribution of Warehousing in Mumbai.

Investment in Retail Spaces:

The key location for the investment in the real estate is Lower Parel, Andheri,

Colaba and Bandra.

The Retail landscape in Mumbai is mainly driven by the emerging eCommerce industry and the new innovative ways of customer experience. The flexible leasing terms and design conversions have been the key to the successful investment in the Retail spaces in Mumbai.

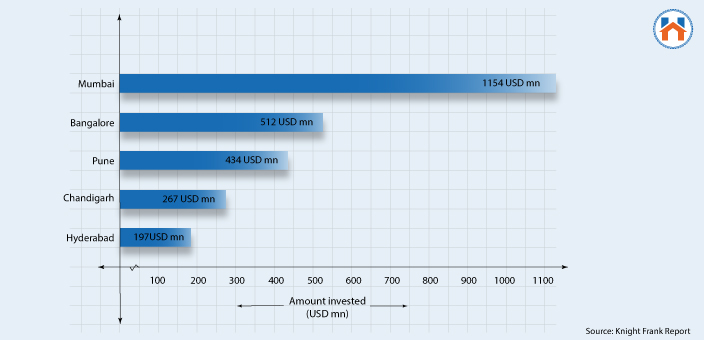

According to current market trends, Mumbai has the most retail investment as compared to the other cities.

City Wise Graph of Private Equity Investment In Retail Spaces (For Q1 2021)

Promising Infrastructure Growth:

The advanced infrastructure projects in Mumbai will have a positive impact on the commercial real estate market because-

- The infrastructure projects will scale up the economic growth in the entire Mumbai MMR region.

- New connectivity networks will open up new markets with cost-effective investments and positive growth in the future.

- Infrastructure corridors will create a good economic impact on the regional belts

- Establishment of new industries with increased commercial property investment avenues.

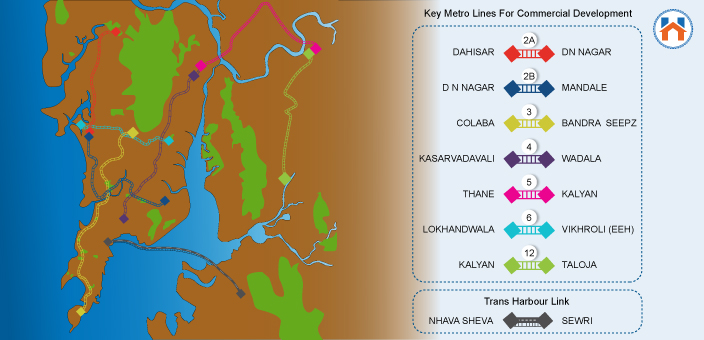

Mumbai has already established connectivity that plays a key role in driving the economic activities in the region. Moreover, the upcoming projects that are likely to be completed between 2023-2030 will redefine the economic landscape of the Mumbai region.

Infrastructure Projects In Mumbai MMR (To be Completed Between 2023-2030)

| Project | Connecting | Key Impact |

|---|---|---|

| METRO LINE – 2A | DAHISAR- DN NAGAR | Boost to Retail Spaces Mald, Charkop, Ekta Nagar |

| METRO LINE – 2B | D N NAGAR MANDALE | Connect BKC to Residential Areas. Boost for Office Spaces Commercial investment. |

| METRO LINE – 3 | COLABA-BANDRA SEEPZ | Covers Marol-MIDC belt. Redevelopment of mill land parcels in Lower Parel BKC Connectivity |

| METRO LINE – 4 | THANE (KASARVADAVALI) WADALA | Development Wadala truck terminus as BKC-2 New Opportunities for Commercial Real Estate investors. Office Spaces, Industrial Spaces. |

| METRO LINE – 5 | THANE BHIWANDI KALYAN | Availability of warehouses for redevelopment at Kalher-Anjurphata-Bhiwandi belt Affordable Housing at Bhiwandi. |

| METRO LINE – 6 | LOKHANDWALA VIKHROLI (EEH) | Availability of warehouses for Industrial units in SEEPZ-Powai belt to get the traction. |

| METRO LINE – 12 | KALYAN TALOJA | Affordable housing along with the scope for the commercial office space. |

Positive Future Outlook:

The DCPR, 2032 is an aspiring plan to transform Mumbai city on the economic landscape.

The plan has proposed several approaches to scale up the commercial development in the key area of Mumbai.

Boost to Mumbai Commercial Real Estate Sector through-

- Increasing the permissible Floor Space Index (FSI)

- Additional FSI for IT, ITES, Smart Fintech Centres, Biotechnology Centres

- Through the re-development of cotton textile mill lands

- Conversion of industrial plot

Let’s compare the existing commercial landscape of Mumbai and the estimated commercial development by 2032 according to the DCPR.

| Parameter | Existing Commercial Market As of 2019 | Future Commercial Development 2032 |

|---|---|---|

| Sectoral share of Primary-Secondary-Tertiary Economic activity | Primary Sector 1% Secondary Sector 31% Tertiary Sector 68% | Primary Sector 0.5% Secondary Sector 19.5% Tertiary Sector 80% |

| Workforce participation | 5.2 Mn | 8 Mn |

| Per Capita Commercial office space consumption – market standard | 7.5 – 8.5 Sqm | 12.5 Sqm |

| Commercial Office space inventory | 1304 Ha. | 10,000 Ha. |

Along with this, the development of the Special Development Zones in the various emerging parts of the city makes it a good prospect for commercial real estate investment in the future.

Key Takeaways:

Commercial properties in Mumbai give better returns with some manageable risks. Mumbai as the economic cluster shows great potential for investment in commercial real estate because of-

- Growing Commercial Hubs: Along with the established commercial hubs, there are some emerging locations in Mumbai that are ideal for investing in commercial property.

- Growth For Every Commercial Property Segment: Office Spaces, Retail Shops, and Warehousing have considerable demand in Mumbai.

- Promising Infrastructure Growth: The upcoming advanced infrastructure in Mumbai to strengthen the commercial space real estate ecosystem.

- Positive Future Outlook: The future of the commercial real estate landscape is encouraging with the scaling economic plans.