Page Contents

What Is A Rent Receipt With A Revenue Stamp?

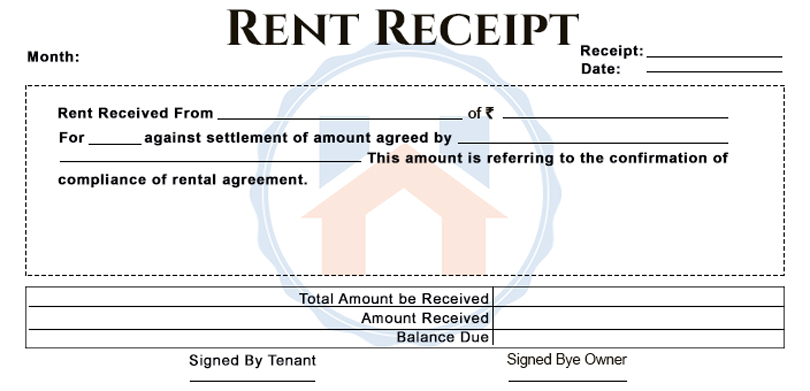

A rent receipt is a document that is submitted as proof of rent expense and receiving tax deductions under the House Rent Allowance which is a part of your salary package. The rent receipt contains many important elements like:

- The month

- Amount of rent provided

- Tenant’s name

- Rent address

- The period

- The date on which the rent was provided

- Name and PAN number of the landlord

- Revenue stamp

Revenue stamps are used to acknowledge the revenue receipts and the main purpose of it is to collect fees for the maintenance of court.

Importance Of Rent Receipts In Claiming Income Tax Benefits

The important factors as to why rent receipt is important in claiming income tax benefits are explained in the points below:

- Saving Tax: One of the most important benefits of rent receipt is that it helps in saving taxes. The tax under the HRA slab of your income will be deducted from your gross income.

- Maintaining record: When you have taken a property on rent, the rent receipt helps to keep a record of whether you have paid the rent on time. You can use this to settle any future dispute with the landlord.

- Stability & consistency: A proper rent receipt can help in serving as proof of timely payment or rent and also claim tax benefits on time.

HRA Tax Exemption With Revenue Stamp

Under section 10 (13A) of the Income Tax Act, a part of HRA is exempted from the tax. Unlike the salary, the HRA is not fully taxable.

The HRA tax exemption can be availed by the person who satisfies the following conditions:

- If you are a salaried person

- If you receive HRA as a part of your CTC/ salary package

- If you are living in rented accommodation

To avail of the benefit of HRA tax exemption, you need to submit a rent receipt and rent agreement with the landlord. If the rent is more than Rs 1,00,000, then the PAN of the house is also required. These documents should be submitted to the employer.

Rent Receipt For Tax Declaration

If you know how to calculate the HRA exemption then you can able to save money on taxes. Let’s take a look at the below example:

Suppose you are getting a basic salary of Rs 6,00,000, DA of Rs 1,00,000 and an HRA of Rs 2,50,000.

If you provide proof of your rent receipt with your employer and HRA is a part of your salary, then you should follow the below calculation technique.

| Basic | 6,00,000 |

| DA | 1,00,000 |

| HRA | 2,50,000 |

| Other taxable allowances | 1,20,000 |

| Gross salary | 10,70,000 |

| Investments (80C) | 1,50,000 |

| Total taxable salary | 9,20,000 |

| TDS amount | 1,12,270 |

| Impact of submission of rent receipts | |

| Calculation of HRA exemption (notes) | 1,10,000 |

| Net amount of TDS is deducted | 8,10,000 |

| TDS amount | 89610 |

| Tax saved (1,12,270-89610) | 22660 |

Notes:

Suppose the rent paid is Rs 1,80,000

Then,

The lower of the following will be HRA exemption

- Actual HRA received= 250000

- Rent paid-10% of basic salary+DA= 180000-70000= 110000

- 50% of basic salary+DA= 350000

How You Can Claim Tax Benefits On Rent Receipts

There are a few steps provided below that you can follow to claim tax benefits on rent receipts:

Step 1: You need to calculate the HRA deduction amount from the salary

Step 2: Deduct the calculated tax amount from the gross salary

Step 3: The amount will then be provided under the head Income from Salary/ Pension. For eg: If your salary is 8,00,000 and your HRA exemption calculated is 1,20,000. Then you should declare 6,80,000 for the ITR file.

Rent Receipt With Revenue Stamp PDF

Check this below link to download the PDF of revenue stamp

Online Rent Receipt With Revenue Stamp

You can generate a rent receipt with a revenue stamp with the following steps:

Step 1: Visit the website @tax2win.in

Step 2: Click on the Tax option from the home page

Step 3: Select ‘Rent Receipt Generator’ from the scroll down

Step 4: You will be redirected to a new page

Step 5: Provide the relevant information and click on Generate options

Also, read What is Rental Yields And Why It Is Important In Real Estate

FAQs

| Q1: Which proof do I have to provide to claim for HRA?

Ans: You need to provide the rent receipt and rent agreement to your employer to claim for HRA. |

| Q2: When do I have to give my employer rent receipts?

Ans: You can provide rent receipts to your employer on a quarterly, half-yearly, or annual basis. |

| Q3: What is the purpose of the rent receipt?

Ans: The main purpose of the rent receipt is to have proof of the timely rent payment as it includes the rent amount, date, and the name of the landowner. |

| Q4: How many months of rent receipts should be provided for tax exemption?

Ans: You need to provide 3 months’ rent receipts to avail the tax exemption. |

| Q5: How to save maximum tax on HRA?

Ans: You can save maximum tax on HRA only if your HRA is considered as a part of your salary and also provide the rent receipt to your employer. |

| Q6: Can I receive an exemption on HRA while living with my parents?

Ans: Yes, you can receive an exemption on HRA provided that you are paying rent to your parents and the property is owned by your parents. |