Stamp Duty and Registration Charges in Maharashtra are payable under Maharashtra Stamp Act 1958. While buying a new property, buyers have to pay the applicable Stamp duty and registration charges to register the property at the sub-registrar office. This article gives you the latest Stamp Duty and Registration charges in Maharashtra, how to pay Stamp Duty registration charges online in Maharashtra, and all-important FAQs.

Page Contents

- Latest Stamp Duty & Registration Charges In Maharashtra 2024

- Latest News On Stamp Duty & In Maharashtra 2024

- When To Pay Stamp Duty In Maharashtra

- How To Pay Stamp Duty And Registration Charges in Maharashtra

- How To Pay Stamp Duty & Registration Chagres In Maharashtra

- Why Pay Stamp Duty And Registration Charges in Maharashtra.

- Stamp Duty and Registration Charges in Maharashtra 2024 for Females

- Factors That Decide Stamp Duty and Registration Charges In Maharashtra.

- FAQs

Latest Stamp Duty & Registration Charges In Maharashtra 2024

Here is a complete list of Stamp Duty and Registration Charges for the main cities in Maharashtra 2024.

| City | Stamp Duty | Registration Charges |

| Stamp Duty In Mumbai | 7% | 1% |

| Stamp Duty In Navi Mumbai | 7% | 1% |

| Stamp Duty In Thane | 7% | 1% |

| Stamp Duty In Pune | 7% | 1% |

| Stamp Duty In Lonavala | 6% | 1% |

| Stamp Duty In Nagpur | 7% | 1% |

| Stamp Duty in Nashik | 4% | 1% |

The Stamp Duty is stated as some percent of the total value of the property.

Stamp Duty In Maharashtra keeps changing depending on the government policies.

Also, the Stamp Duty and Registration charges depend on various factors such as the location of the property, jurisdiction, ready reckoner rates, type, and area of the property, etc.

Latest News On Stamp Duty & In Maharashtra 2024

- In March 2020, the Government of Maharashtra announced two years concession. This waiver has been ended on Mar 31, 2022 This can increase the existing stamp duty and registration charges in Maharashtra by 1%

- The Stamp Duty on Gift Property on Maharashtra is currently Rs. 200 if the residential property or agricultural land is transferred within the blood relations. However, from the new financial year 2022-23, the stamp duty of the gift deed will be 1% of the property value.

- In the financial year 2021-22, Maharashtra recorded the highest collection of Stamp Duty- Rs 17,097 crore. Mumbai and Pune mark the maximum stamp duty collection in Maharashtra in the financial year 2021-22.

When To Pay Stamp Duty In Maharashtra

During the property transaction, the sales deed needs to be registered at the sub-registrar office by paying the applicable stamp duty charges.

Once the sales deed is ready the stamp duty registration charges can be paid-

- Before Execution of the Sales Deed.

- At The Time of Executions of Sales Deed.

- Immediate Next Day After Executions of the Sales Deed

How To Pay Stamp Duty And Registration Charges in Maharashtra

The Stamp Duty and Registration Chagres in Maharashtra Can be paid through the following options-

- e-payment

You can pay the stamp duty and registration charges online in Maharashtra. Paying the stamp Duty online in Maharastra is a simple and quick process.

You can fill in the personal and property-related details and makes the Stamp Duty and Registration payment online.

You can also download a copy of the stamp duty and registration charges payment receipts for the record or proof.

- Traditional Stamp Papers and Adhesive Stamps.

You can pay the Stamp Duty and Registration charges in Maharashtra with the physical stamp papers.

To pay the stamp duty through Stamp Papers, you need to purchase the stamp paper for an amount equal to the applicable stamp duty on the property.

The e-payment method is more convenient and cost-effective than the traditional stamp paper for making the stamp duty payment.

- Franking of Stamp Impression.

In Franking all the important property-related information is provided on the document. You need to contact the bank and take the adhesive stamp on the document. Banks gives the stamp impression with the Franking machine.

How To Pay Stamp Duty & Registration Chagres In Maharashtra

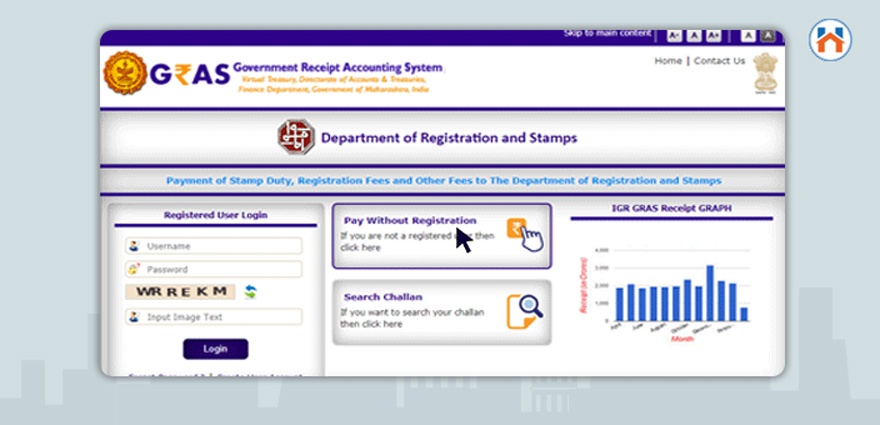

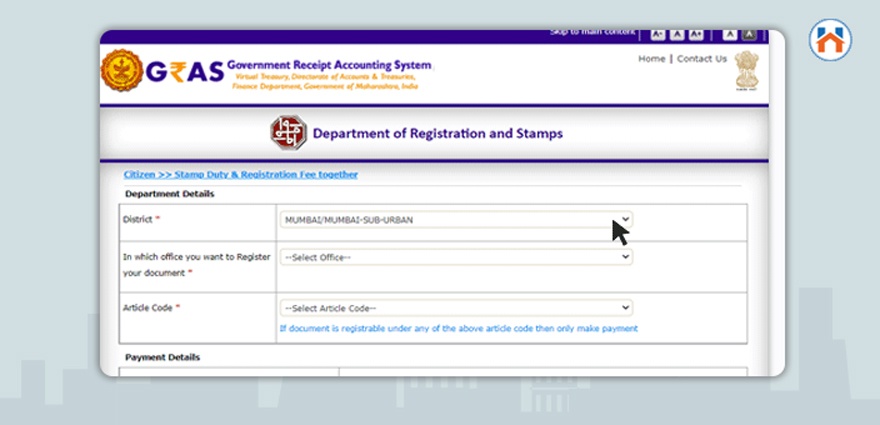

Step 1: Visit the GRAS (Government Receipt Accounting System) at gras.mahakosh.gov.in.

Step 2: Then Select “Inspector General Of Registration”

Step 2: Then Select “Inspector General Of Registration”

Step 3: Then click on the pay without Registration.

Step 3: Then click on the pay without Registration.

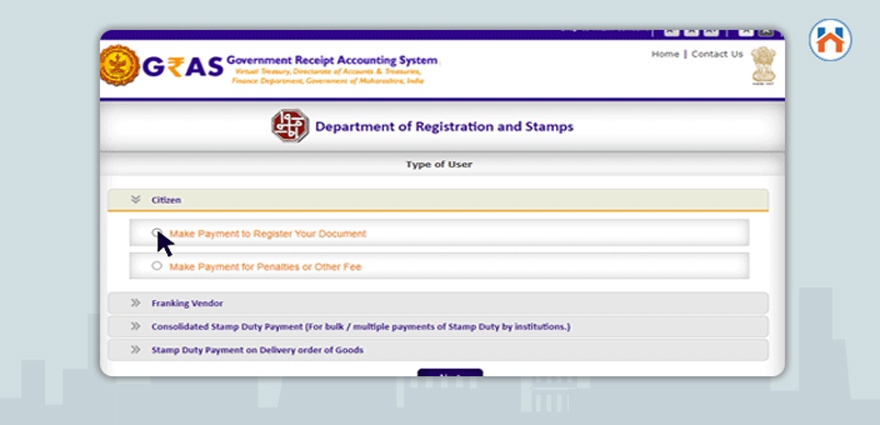

Step 4: Then, Click on Citizen Option and Click on Make Payment to Register Your Document

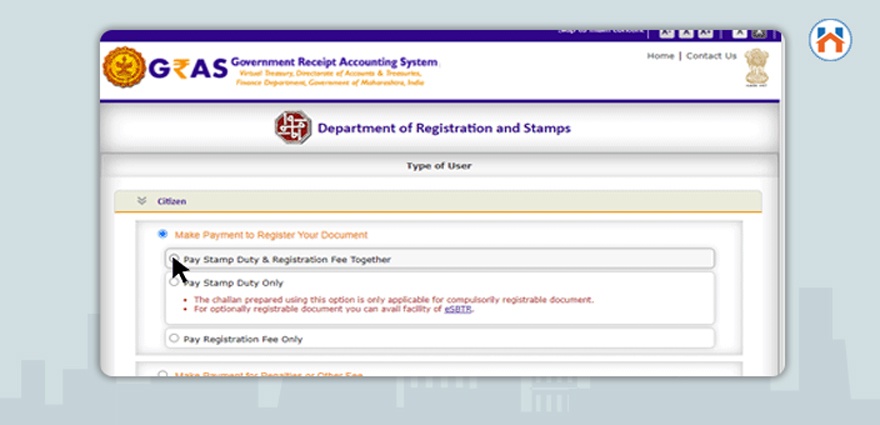

Step 5: And select from the three options: Pay Stamp Duty, Registration Charges.

Step6: Fill in the important details such as District, Registrar Office, the Stamp Duty Amount, etc.

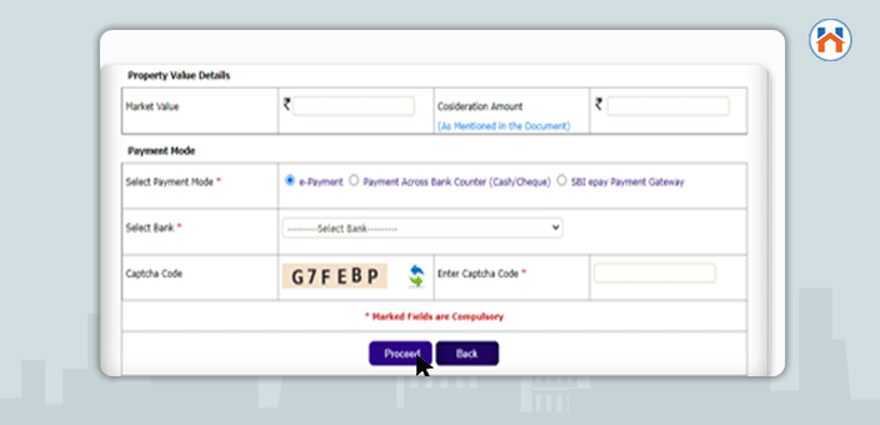

Step 7: Select The Payment Option and Proceed.

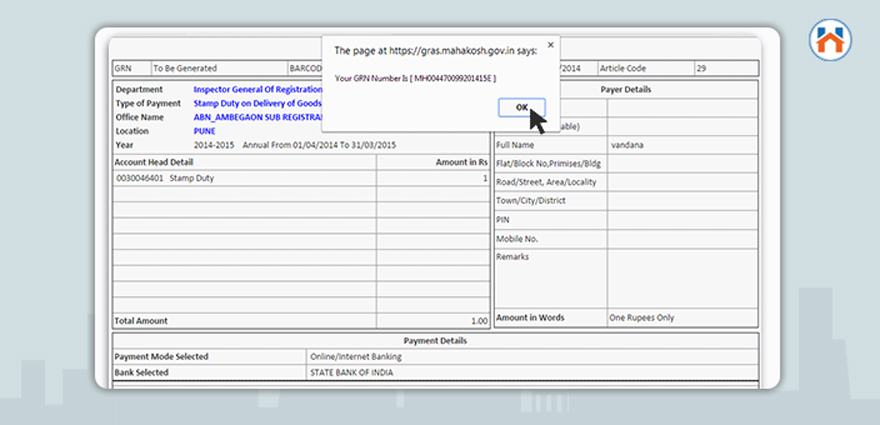

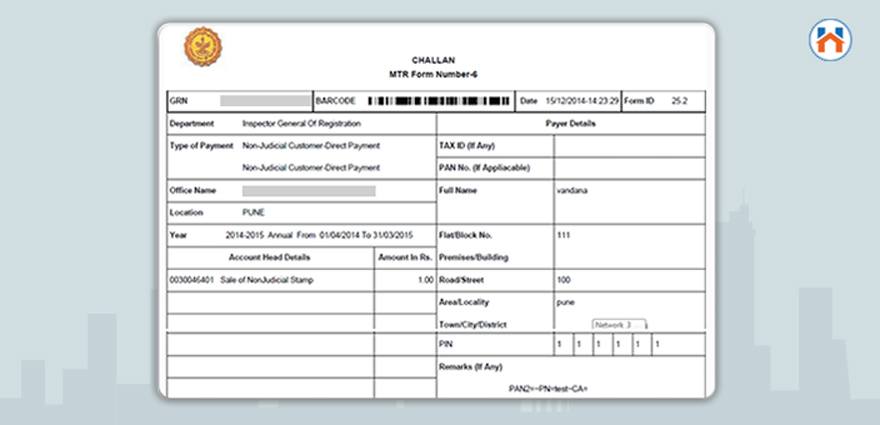

Step 8: Check the Generated Draft Challan, if the details are correct then click Proceed.

Note Down the GRN number for future references.

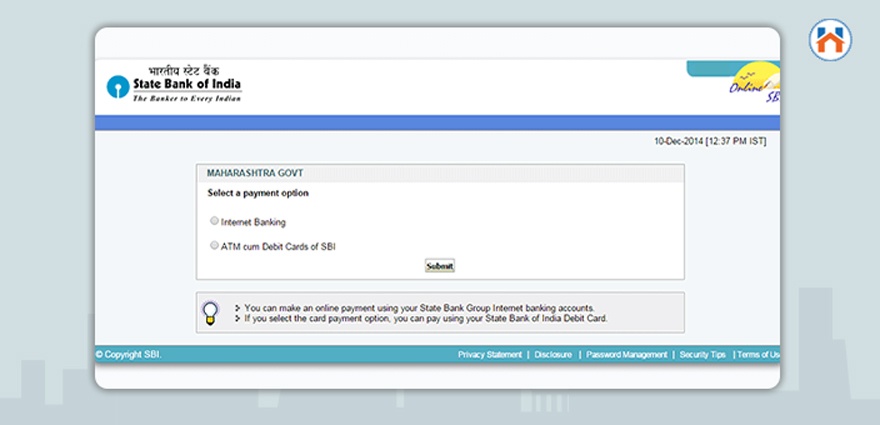

Step 9: Select the payment Method either Internet Banking or ATM Debit Cards

Step 10: After the payment, You will be redirected to the Copy of the Challan.

Why Pay Stamp Duty And Registration Charges in Maharashtra.

The property buyers must pay the stamp duty and applicable registration charges in Maharashtra to register the property.

If the Stamp Duty and Registration Charges are not paid, the property transaction is not considered legal.

Moreover, In Maharashtra, a penalty of 2% is charged on the unpaid stamp duty charges.

This amount can go as high as 200% of the unpaid applicable stamp duty amount.

Stamp Duty and Registration Charges in Maharashtra 2024 for Females

In Maharashtra, there is a 1% concession on stamp duty and registration charges for female property buyers.

The stamp duty and registration charges in Maharastra 2024 for females are less than the stamp duty applicable for men.

The government keeps lower stamp duty for females to promote female ownership of the property.

| City | Stamp Duty For Females |

| Stamp Duty In Mumbai | 5% |

| Stamp Duty In Navi – Mumbai | 5% |

| Stamp Duty In Thane | 6% |

| Stamp Duty In Pune | 6% |

| Stamp Duty In Lonavala | 5% |

| Stamp Duty In Nagpur | 6% |

| Stamp Duty in Nashik | 4% |

Factors That Decide Stamp Duty and Registration Charges In Maharashtra.

The Stamp Duty and Registration charges are calculated on the basis of the Ready-Reckoner Rates.

The Ready Reckoner rates are published by the government by considering the various factors such as the location of the property, the type of the property, and the jurisdiction in which the property locates.

Following Are The Factors that decide the Stamp Duty and registration charges in Maharastra.

The Market Value/ Agreement Value Of The Property

The Stamp Duty of the property is calculated on the market value or the agreement value of the property.

The agreement value or the market value whichever is higher is considered for the Stamp Duty and Registration Calculation.

Location Of The Property

The Stamp Duty and Registration charges may vary depending on the jurisdiction of the location. For gram panchayat limits or the municipal limits, there are different stamp duty and registration chagres.

Gender Of The Buyer

The Stamp Duty and registration charges also depend on the gender of the property buyer.

In Maharashtra, the female property buyers have a concession on the stamp duty and registration charges.

FAQs

| Can you pay Stamp Duty and Registration Charges Online In Maharashtra?

Yes, you can pay the Stamp Duty and Registration Charges Online in Maharashtra at gras.mahakosh.gov.in. |

| What are the Stamp Duty and Registration charges for Females in 2024 in Maharashtra?

There is a 1% concession for the Stamp Duty and Registration Charges for Females in 2024. |

| What if you don’t pay the Stamp Duty and Registration Charges In Maharashtra?

Not paying the stamp duty & registration charges makes the property transaction unauthorized and legally unverified. |

| What are the penalties for not paying the Stamp Duty and Registration Charges in Maharashtra?

The penalty of 2% is applicable on the unpaid stamp duty and registration charges which can go high up to 200% of the property stamp duty charges. |

| Can You Claim a Refund of Stamp Duty Charges?

You can claim a stamp duty charge refund online in the circumstances defined by the Maharashtra Government. |