Page Contents [hide]

Latest Stamp Duty and Registration Charges in Noida 2025

| Type Of Property Owner | Stamp Duty | Registration Charges |

| Male | 7 % | 1% |

| Female | 7 % ( Rs 10,000 Concession) | 1% |

| Joint Male- Female | 7 % ( Rs 10,000 Concession) | 1% |

How To Pay Stamp Duty and Registration Charges In Noida

You need to pay the stamp duty and registration charges while executing the sales deed of the property.

Without paying the stamp duty and registration charges, the property is not officially registered.

Also, it does not get ownership rights transferred from the buyer to the seller.

Here is a simple stepwise process to pay the stamp duty in Noida.

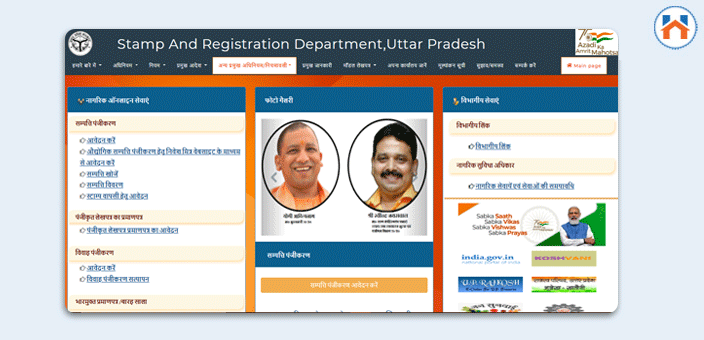

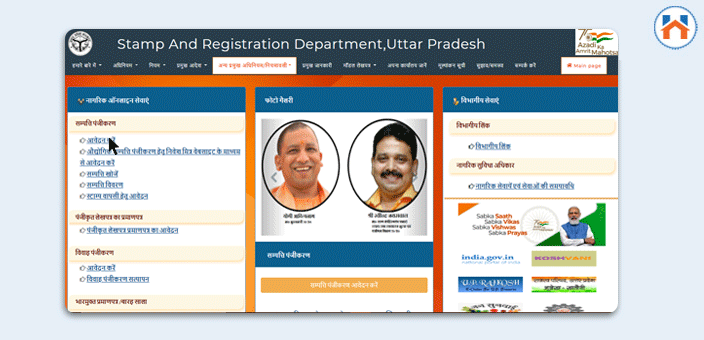

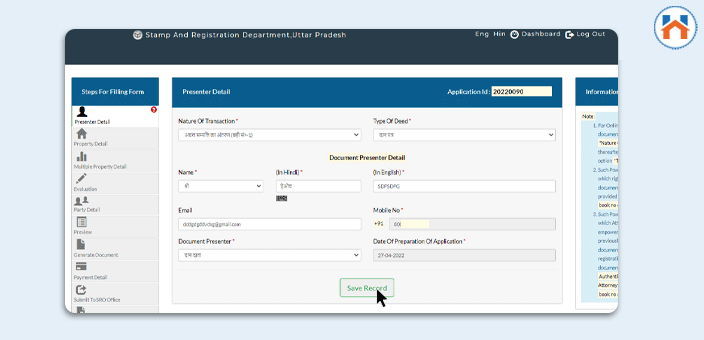

Step 1: Visit the official site of the Stamp & Registration Department, Uttar Pradesh at igrsup.gov.in

Step 2: Then Select The Application Tab

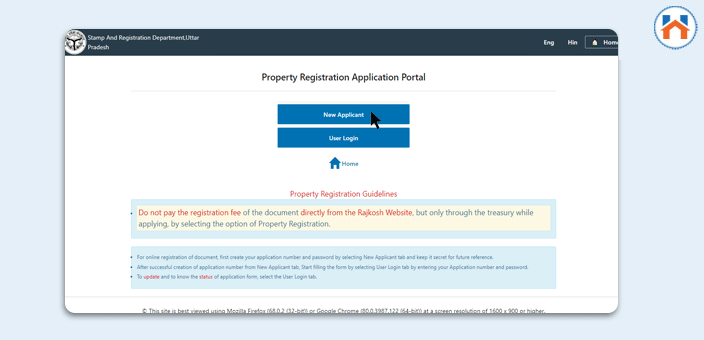

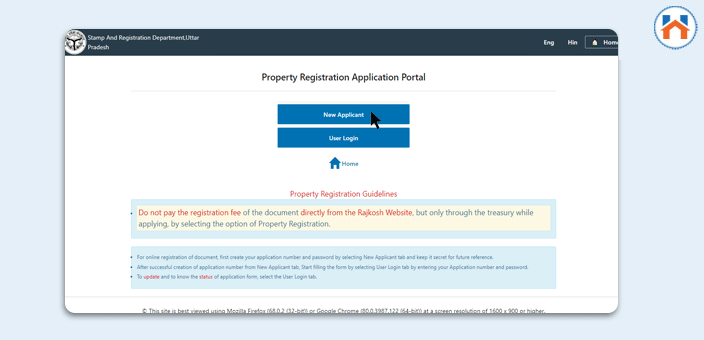

Step 3: From The newly opened window, select The New Application

Step 4: Then fill in the Property Registration – New Applicant Form

Choose the District, Tehsil, Sub Registrar, Mobile Number, Password, Re-Password, Captcha.

Step 5: Then fill in the Presenter Details, Property Details, and the Party Details

Step 6: After the Online Application, the document has to be produced in the Sub Registrar’s office within 120 days of execution.

Stamp Duty and Registration Charges in Noida Calculation

The stamp duty and registration charges in Noida are calculated on the basis of the agreement value of the property.

The stamp duty is given as some percentage of the agreement value of the property.

Here is an example of how the stamp duty and registration charges are calculated-

| Location | Noida |

| Configuration | 1 BHK |

| Area | 400 sq ft |

| Rate | Rs 6000/sq ft |

Total Value of The Property = 400 X 6000

= Rs 24,000,00

So, considering the male property owner, the Stamp Duty in Noida is 7%

Then Stamp Duty in Thane is 7% of 24,000,00 which is Rs 1,68,000.

The Registration charges In Noida are 1% of the property value.

So, Registration charges= 1 % of Rs 24,000,00

= Rs 2400

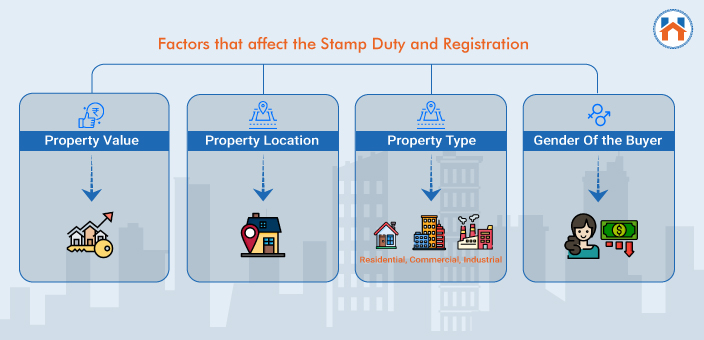

Factors That Decide the Stamp Duty and Registration

Value of The Property

The stamp duty and registration charges depend directly on the value of the property. The agreement value of the property is considered for calculating the applicable stamp duty and registration charges.

For example, the stamp duty and the registration charges in Noida are 7% of the total property value.

For example, if the total property value is Rs 60,000,00 then the applicable Stamp Duty and Registration chagres will be 7 % of Rs 60,000,00 i.e Rs 42000

Property Location

The location of the property plays an important role in deciding the stamp duty. The stamp duty and the registration are different for the urban and the rural areas.

If the property lies within the municipal limits, the stamp duty and registration charges are comparatively higher than those falling within the Panchayat Limits.

Property Type

The stamp duty and registration charges in Noida also depend on the type of property. There are different Stamp Duty charges for residential, commercial, or industrial properties.

Comparatively, the stamp duty for the residential property is lesser than that of the commercial and industrial properties.

Gender

The Gender of the property buyers plays an important role in the Stamp Duty and Registration charge. For Stamp Duty in Noida, there is a concession of Rs. 10,000 for the female property owners. Also if the property owners are Joint Male & Female, then the same concession of Rs. 10,000 is applicable.

FAQs

The stamp duty and the registration charges in Noida are 7% for male property buyers. Whereas, for the female property owners, the Stamp Duty in Noida for the female property buyers is 7% with the concession of Rs. 10,000. |

Value of the property, property location, property type, and gender are some of the main factors that affect the Stamp Duty and Registration Charges. |

You can pay the stamp duty and registration charges online at igrsup.gov.in |