Under Maharashtra Stamp Act 1958, it is mandatory to pay the stamp duty and registration charges in Thane. According to this act, the property buyer registers the sales deed document at the sub-registrar office by paying the applicable stamp duty and registration charges. Read on to know: What are the stamp duty and registration charges In Thane, online registration process, and important FAQs.

Page Contents [hide]

- What are The Stamp Duty and Registration Charges in Thane?

- Why Stamp Duty and Registration Is Important

- Factors That Decide Stamp Duty and Registration Charges in Thane

- How To Calculate The Stamp Duty and Registration Charges in Thane

- How to Pay Stamp Duty and Registration Charges In Thane

- How To Pay Stamp Duty and Registration Charges Online In Thane

- How To Check the Generated Challan for Stamp Duty and Registration Online in Thane

- FAQs

What are The Stamp Duty and Registration Charges in Thane?

| Stamp Duty | Registration Charges | |

|---|---|---|

| Male | 7 % (Includes the Local Body Tax) | For properties under Rs 30 lakh - 1% of the Agreement Value For properties above Rs 30 lakh - Rs 30,000. |

| Female | 6 % (Includes the Local Body Tax) | For properties below Rs 30 lakh - 1% of the Agreement Value For properties above Rs 30 lakh - Rs 30,000. |

| Joint Male- Female | 7 % (Includes the Local Body Tax) | For properties below Rs 30 lakh - 1% of the Agreement Value For properties above Rs 30 lakh - Rs 30,000. |

Why Stamp Duty and Registration Is Important

When you buy a property in Thane, you need to pay the stamp duty and registration charges after or while executing the sales deed document.

You become a legal owner of the property only after registering the document at the registrar’s office by paying the applicable stamp duty and registration charges in Thane.

- Only after the payment of Stamp Duty and registration charge, you become a legal owner of the property.

- The stamp duty and registration charge receipts are valid as proof of ownership.

- The property registration gets reflected in the official government records

- It protects the buyer’s interest by an official registration of the property.

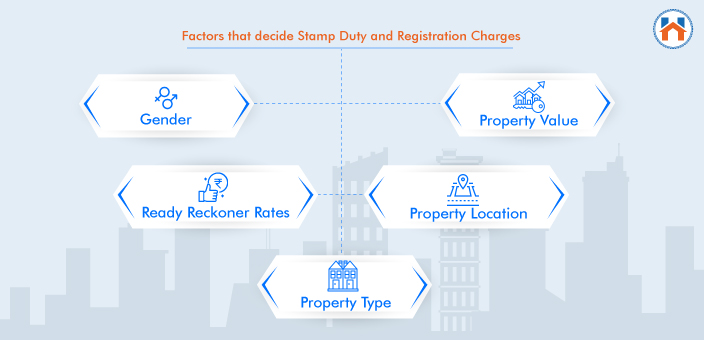

Factors That Decide Stamp Duty and Registration Charges in Thane

- Gender-

The stamp duty and registration charges are low for women. In Thane, the stamp duty and registration charges are 6% for women and 7% for men.

- Property Value-

Stamp Duty and registration charges are calculated based on the agreement value of the property. Stamp Duty in Thane is 7% of the property value. Whereas, the registration charges in Thane are Rs 30,000 (for properties below 30 lakh) or 1% ( for properties above Rs 30,000)

- Ready Reckoner Rates-

Ready reckoner rates are the standard property rates for a particular location published by the government. The market value of the property is calculated based on ready reckoner rates.

- Property Location

The stamp duty and registration charges vary from one location to the other. Different stamp duty rates are applicable as per the area of jurisdiction. The properties under the municipal limit have comparatively higher stamp duty than those in the Panchyat Limits.

- Property Type

Stamp duty and registration charges also depend on the type of property. The Stamp duty and the registration charges for the residential properties than the commercial properties and plots.

How To Calculate The Stamp Duty and Registration Charges in Thane

Consider the following example to calculate the stamp duty and registration charges in Thane.

| Location | Thane |

|---|---|

| Configuration | 2 BHK |

| Area | 900 Sq ft |

| Rate | Rs, 15,000/ sq ft |

The Value of the Property = 900 X 15,000

= Rs 1,35,00,000

So, Stamp Duty Thane is 7 % for Male.

Therefore, 7 % of Rs 1,35,00,000 is Rs 945,000.

How to Pay Stamp Duty and Registration Charges In Thane

There are two ways to pay Stamp Duty ad Registration charges in Thane.

First, you can pay the stamp duty and registration charges offline by Physical Stamp paper or Franking.

However, paying the stamp duty and registration charges offline is a time-consuming process.

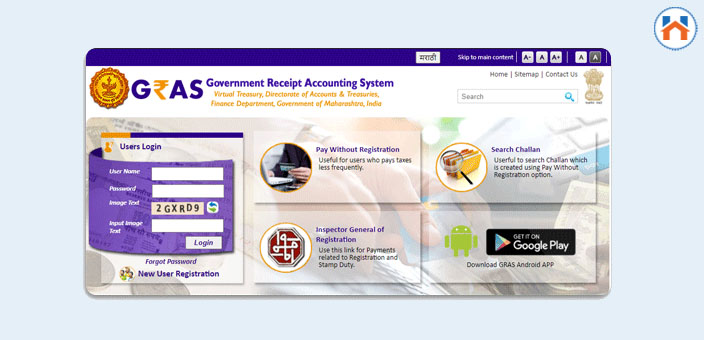

The second option is to pay the Stamp Duty and registration charges online through Government Receipt Accounting System (GRAS).

How To Pay Stamp Duty and Registration Charges Online In Thane

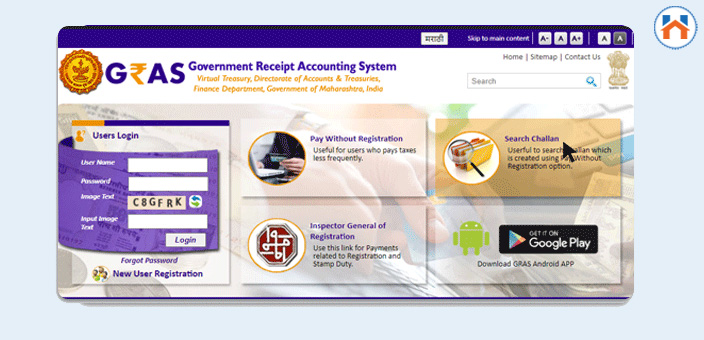

To pay the stamp duty and registration charges in Thane, you need to visit the Government Receipt Accounting System (GRAS) portal. By using this portal, you can register your document and pay the stamp duty ad registration charges online.

Here is a statewide process for Stamp Duty and Registration Payment online in Thane.

Step 1: Visit the website of the Government Receipt Accounting System (GRAS)

Step 2: Then Select the ‘Inspector General of Registration’ tab from the Home Page.

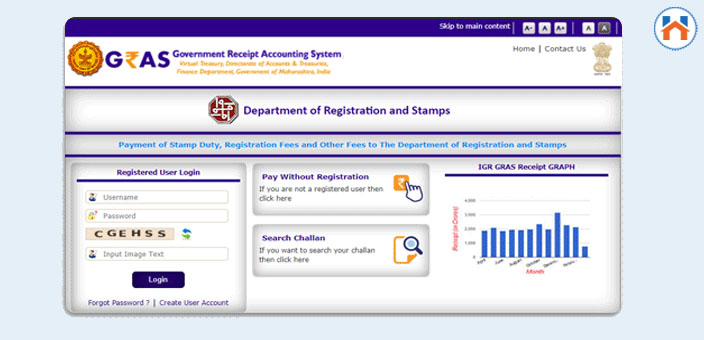

Step 3: Then From the displayed ‘Department of Registration Stamps’ Page select ‘Pay Without Registration’

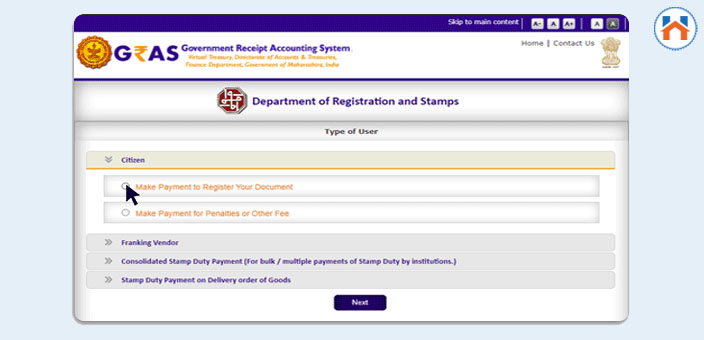

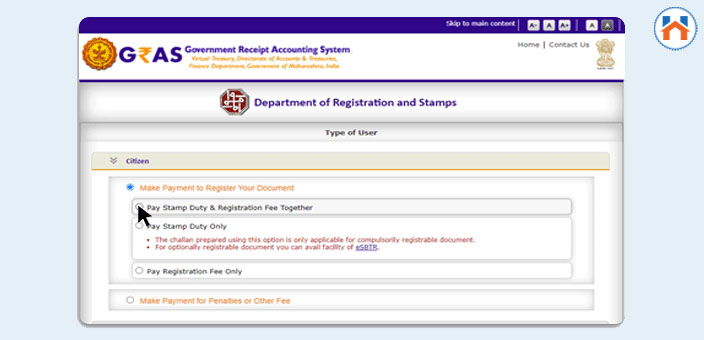

Step 4: Now, Select the ‘Make Payment to Register Your Document’ from Citizen Tab

Step 5: Select ‘Pay Stamp Duty and Registration Fee Option Together’

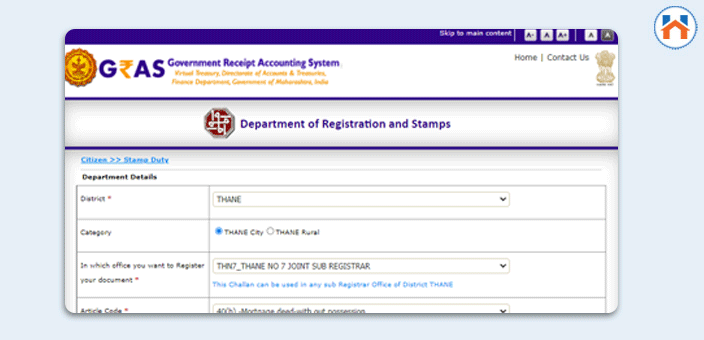

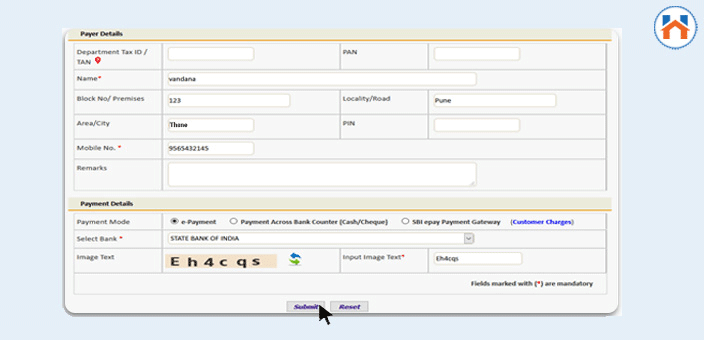

Step 6: Add the important details such as District, Stamp Duty Amount etc.

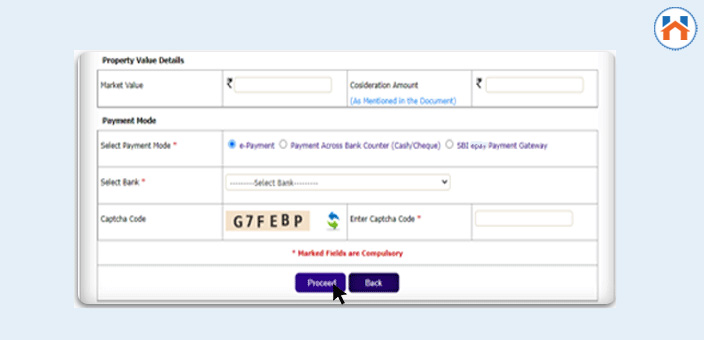

Step 7: Select the Payment option from the following three options-

- E-Payment

- Payment Across bank Counter (Cash/Cheque)

- SBI Payment Gateway

Then Click Proceed

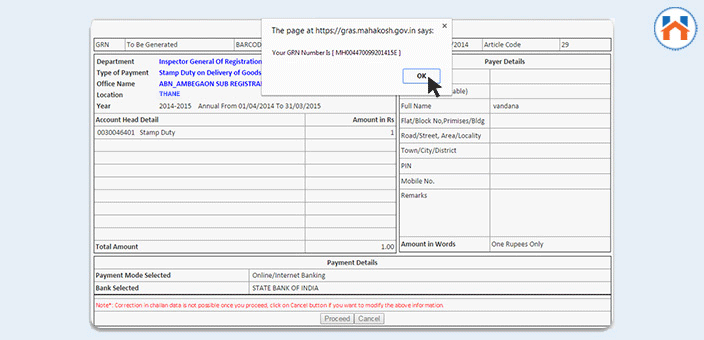

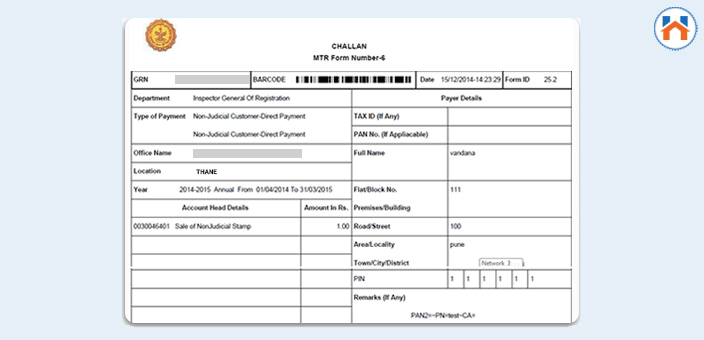

Step 8: Then the Draft Challan will be generated. Record the GRN number and Click On proceed.

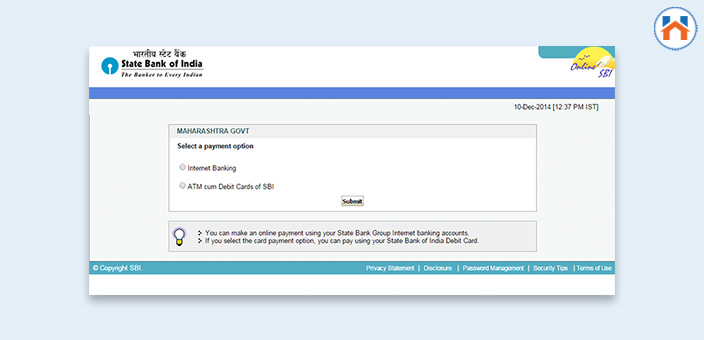

Step 9: Select the Suitable Payment Option.

Step 10: After the successful payment, a copy of the challan will be generated.

How To Check the Generated Challan for Stamp Duty and Registration Online in Thane

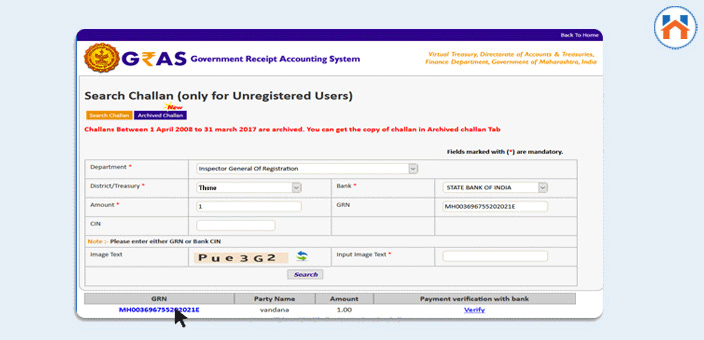

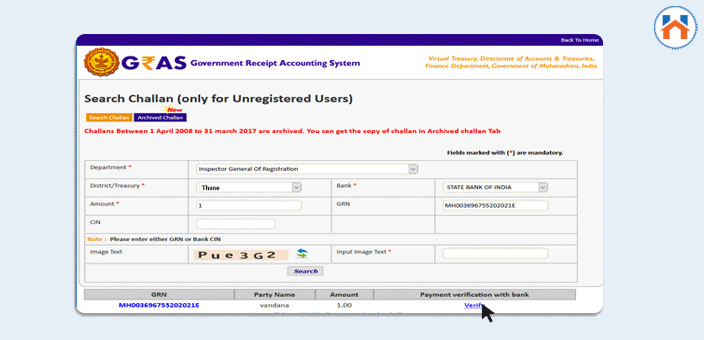

Once you make the stamp duty and the registration charge payment you can check the generated challan online.

Here is the stepwise process to check the Challan for Stamp Duty and registration online.

Step 1: Visit the website Government Receipt Accounting System (GRAS).

Step 2: Then Click on the ‘Inspector General of Registration Tab’.

Step 3: Click on the Search Challan Option.

Step 4: Then fill in the required information- Name, Address, Mobile Number, and GRN and Click on The Search Button.

Step 5: Then Click on The GRN to get the copy of Challan.

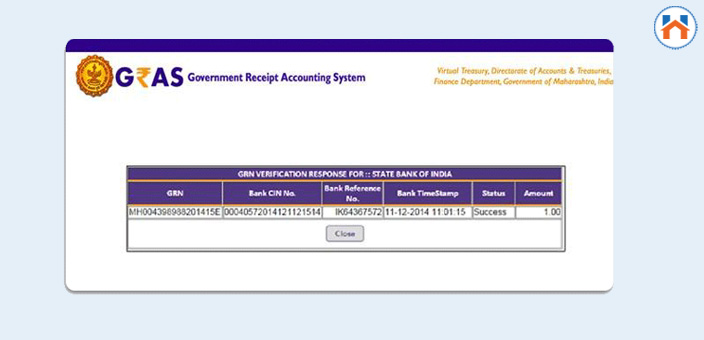

Step 6: Click on the Verify to know the status of the Registration.

FAQs

| When do you need to pay the stamp duty and Registration Charges?

You need to pay the Stamp Duty and Registration charged while executing the Sales Deed document, you can pay the stamp duty before or while executing the Sales Deed. |

| What if you do not pay the stamp duty and registration Charges?

If you do not pay the stamp duty and registration charges you are liable to pay the penalty of 2% of the applicable stamp duty and registration. This penalty can go upto 200% of the main stamp duty as registration charges. |

| How To Pay Stamp Duty and Registration Charges in Thane?

You can pay Stamp duty and registration charges online or offline. For online registration of stamp duty and registration charges in Thane, you need to visit the https://gras.mahakosh.gov.in/echallan/ |