Stamp Duty is a one-time property tax that needs to be paid while buying a property. It is levied by the state government when a property is transferred from the seller to the buyer.

In more technical terms, Stamp duty is a state levy imposed on the agreement document executed between the seller and the buyer which is registered at the registrar.

The stamp duty is payable under the Indian Stamp Act 1899, but the responsibility for setting up the stamp duty is shared between the Central and State Governments. Therefore, the stamp duty charges in Mumbai are payable under the Maharashtra Stamp Act 1958 and are governed by the state government.

Since stamp duty is one of the important legal aspects of the property buying process it is beneficial to have detailed information.

Page Contents [hide]

Why Stamp Duty Is Important?

The stamp duty is applicable in all types of property transactions whether it be residential, commercial, or land.

The Stamp duty is important in the real estate translation because-

- Only after paying the stamp duty would you become a legal property owner.

- The receipt of acknowledgment of the stamp duty is considered proof of ownership.

- The stamp duty rates influence your overall buying budget.

Factors Affecting Stamp Duty Charges

Stamp duty is a one-time charge paid during real estate transactions. Stamp duty depends on various factors such as

- The Market Value Of The Property

- Location

- Gender Of The Buyer

The Market Value Of The Property

The stamp duty is always charged as a percentage of the market value of the property. In Mumbai, the stamp duty charges are 5% of the market value of the property.

For instance, If the Market Value Of the property is 1 crore, then the stamp duty charged in the case will be Rs. 5 Lakh.

However, if the agreement value is more than that of the market value, in such cases the stamp duty will be charged on the agreement value. We will have an example covering how exactly the stamp duty charges are applied.

Remember, the Market Value is the price at which the home can be sold in the open market under normal conditions. It is the standard price at which the buyer is willing to accept considering all the important factors. To calculate the market Value a Ready Reckoner Rate (RRR) is used which is published by the state government. It varies from one location to the other, and no transaction takes place below this mark.

Location

Location is one of the important factors that decide the exact percent of the market value charged as stamp duty. Depending on the jurisdiction of the location the stamp duty varies. In Mumbai, there are different stamp duty charges for the localities within the municipal limits, areas within MMRDA, and within gram panchayat limits.

The registration charges in all the localities are 1% of the market value of the property.

Gender Of the Buyer

Most of them charge less percentage of Stamp Duty if the property is owned by a female. The intention is to promote the security of independent women. For example, in Mumbai, the stamp duty charges for women are 1% less than that for male property buyers.

Some states even have more than a 1% discount on stamp duty charges for women.

Registration Charges In Mumbai:

Stamp Duty and Registration charges are different. But both can be paid online at one time.

Registration charges depend on the market value of the property. And calculated as a percentage of the market value of the property.

How Stamp Duty Charges are Calculated?

Market value is the base for calculating the Stamp Duty Charges.

And to calculate the market value we need to consider the official Ready Reckoner Rate (RRR)

So, consider this example:

| Location | Andheri |

| Unit | 1 BHK |

| Area | 600 sq ft |

| Rate | 2300 per sq ft |

So the market value will be:

Market Value: 550 X 23000 = Rs. 1,26,50000

This is the minimum selling price. If the deal is closed for let’s say Rs. 1,50,00000.

Then, The the agreement value = Rs. 1,50,0000

Now the Stamp Duty is charged on the basis of Market Value or Agreement Value whichever is higher.

In this case, the agreement value is more. Therefore:

Stamp Duty: 5 % of Agreement Value = 5 % Of 1,50,0000 = Rs. 750000

Registration Charges: Rs. 30000 (As the market value is more than 30 Lakh)

When To Pay The Stamp Duty?

After the sales deed is processed, the stamp duty must be paid by the buyer.

Thus, the stamp duty can be paid-

- Before the execution of the document

- At the time of executing the document

- And can’t be paid after the execution of the document. However, there is a provision in the Maharashtra Stamp Act that permits the stamp duty payable on the next working day after the execution.

Execution means the signature of both parties on the document.

What If You Don’t Pay Stamp Duty?

If you fail to pay the stamp duty during the document execution period, you are penalized with 2% of the stamp duty monthly. This can go up to 200% of the original stamp duty.

Moreover, you are not the legal owner of the property unless you have the receipt of acknowledgment of the stamp duty payment.

Therefore, it is recommended to pay the stamp duty during the execution of the agreements.

Ways for Paying The Stamp Duty

There are three different ways to pay the stamp duty.

Physical Stamp Paper:

This is the most common offline method of paying the stamp duty. For this, you need to buy the stamp paper of an equal amount of applicable stamp duty from an authorized stamp vendor. All the agreement-related information is mentioned on the stamp paper.

Franking:

Various banks provide franking services to buyers. The important details of the property are mentioned on the document along with the applicable stamp duty. After the submission of this document to the bank, it gives an adhesive stamp on the document with a franking machine.

Online Payment Of Stamp Duty:

The most reliable and transparent way of paying the stamp duty is through e-stamping portals. In this, the buyer and seller can digitally sign the documents. Moreover, they can get it stamped on the same day.

But, how to pay stamp duty online in Mumbai?

You can pay the stamp duty charges in Mumbai online through the Government Receipt Accounting System (GRAS) portal. Online payment allows you to do the payment quickly and with ease.

How to Pay Stamp Duty Online In Mumbai

To Pay Stamp Duty & Registration Charges In Mumbai following are the important prerequisites:

- PAN Card Details of Both Parties

- Flat/Survey Number

- Market Value- You can have this calculated from the Sub-Registrar Office.

- Applicable Stamp Duty & Registration Charges Amount

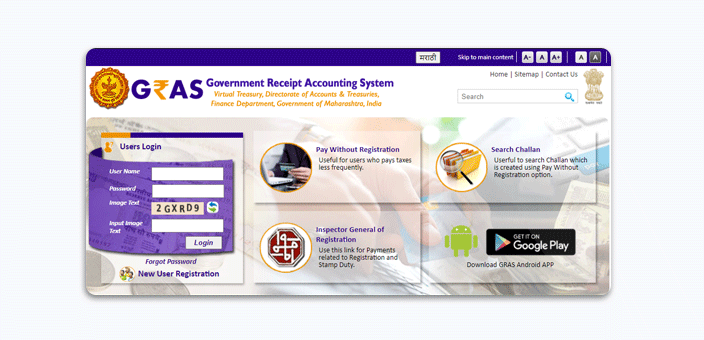

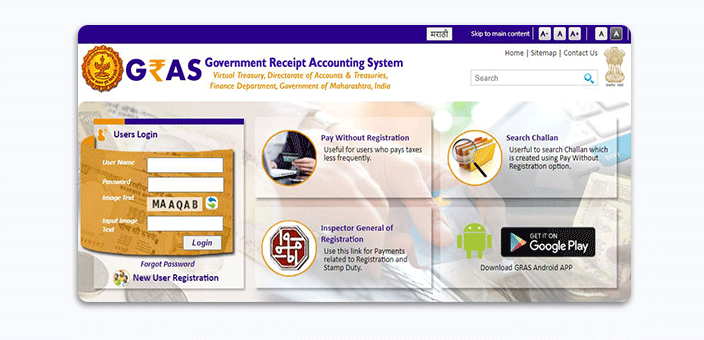

Step 1: Visit gras.mahakosh.gov.in.

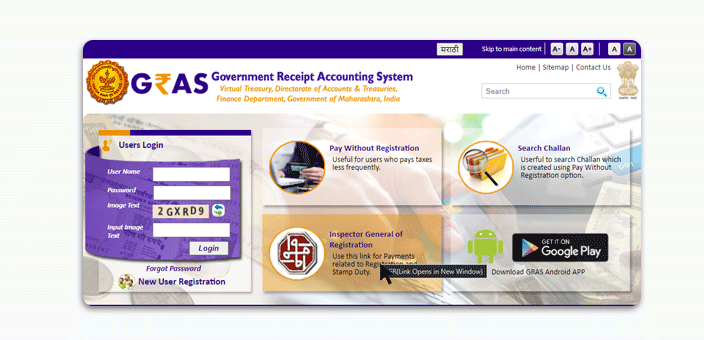

Step 2: Then Click On The “Inspector General Of Registration”

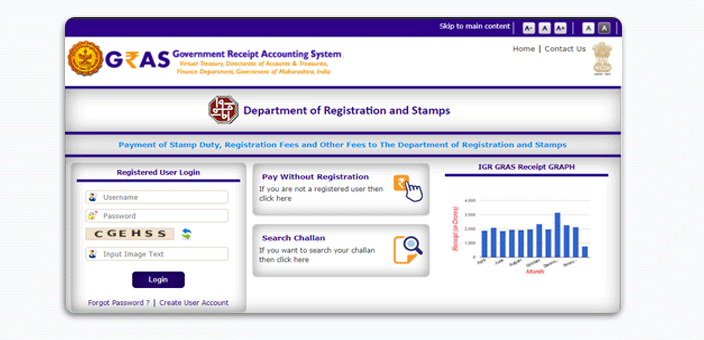

Step 3: It will take you to the Department of Registration and Stamps. Then click on the pay without Registration.

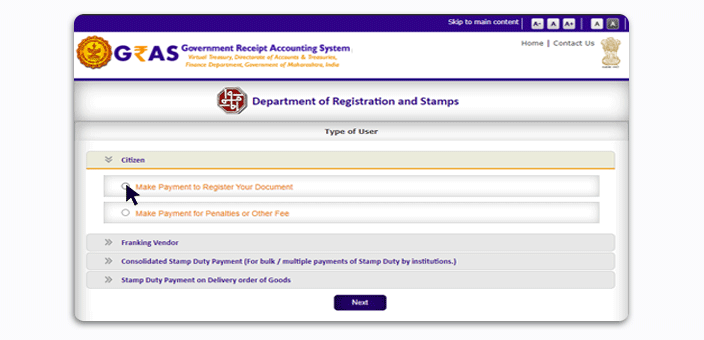

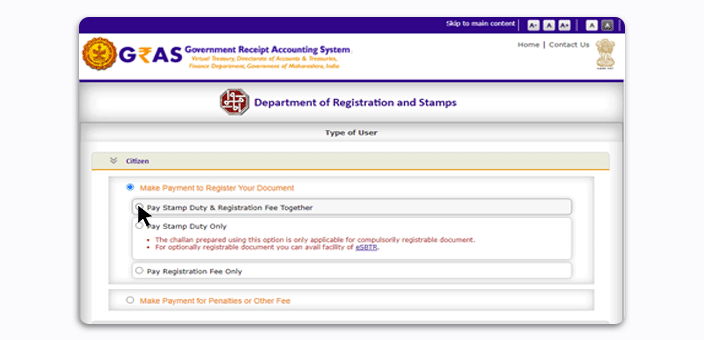

Step 4: Now, Click on Citizen Option and Click on Make Payment to Register Your Document

Step 5: And select from the three options: Pay Stamp Duty, Registration Charges.

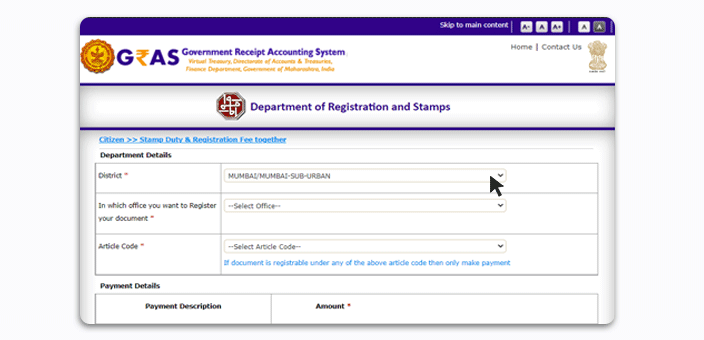

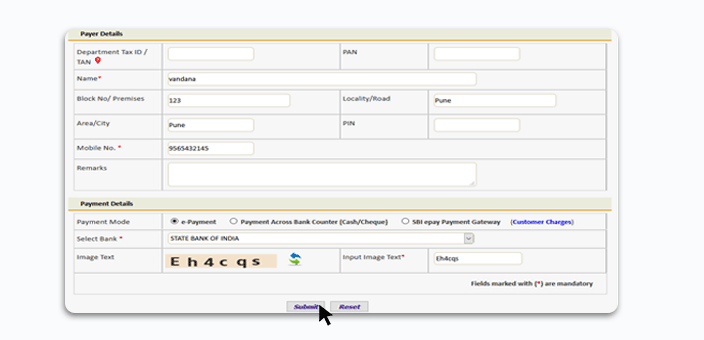

Step6: Then fill in the important details such as the District, Registrar Office, And the Stamp Duty Amount, etc.

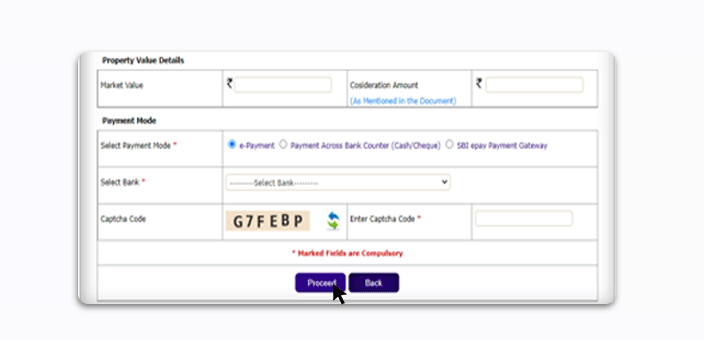

Step 7: Select The Payment Option and Proceed.

Note: For Payment across the bank you have to visit the bank among the options provided and pay the amount in the Check or DD.

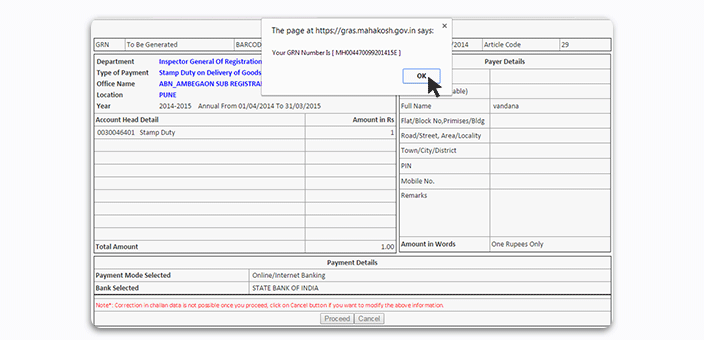

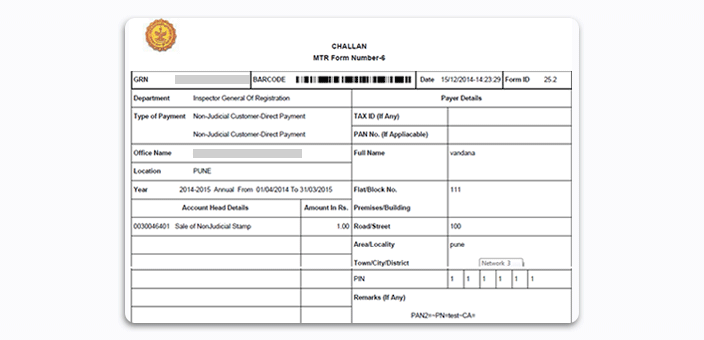

Step 8: Check the Generated Draft Challan, if the details are correct then click Proceed.

Note Down the GRN number for future references.

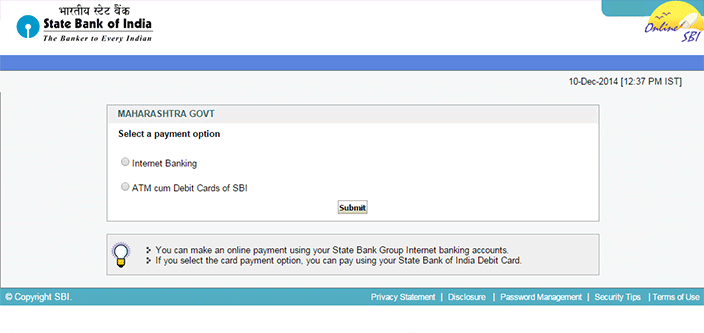

Step 9: Select the payment Method either as Internet Banking or ATM Debit Cards

Step 10: After the payment, You will be redirected to the Copy of the Challan.

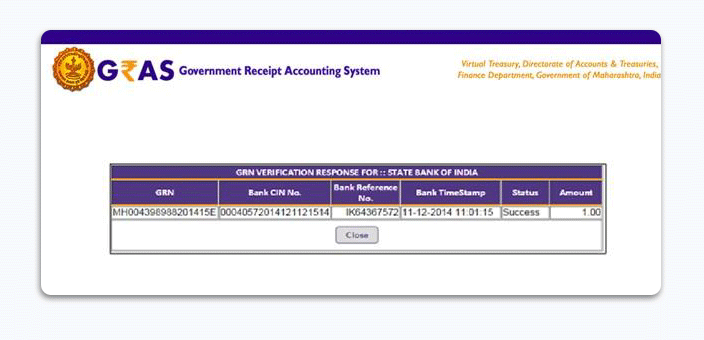

In the case of Payment Across the Bank, You will receive the Challan in the end along with the Government Reference Number (GRN). The user gets bank CIN No. and Branch code and PRN No of that respective bank after the successful completion of the transaction.

How To Search The Copy Of Generated Challan:

Once you make the payment, you can check the copy of Generated Challan and take a printout.

Here is the step-by-step process to search for a copy of Challan.

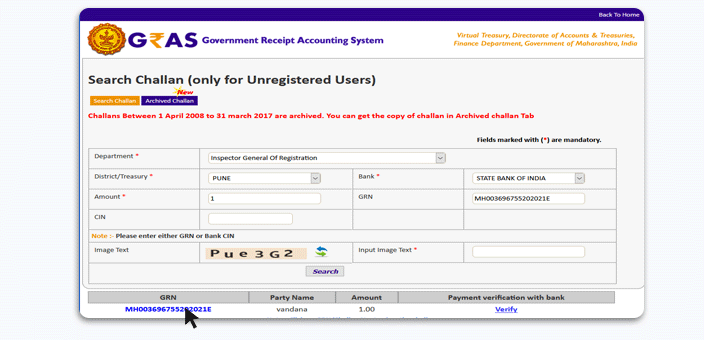

Step 1: Visit gras.mahakosh.gov.in

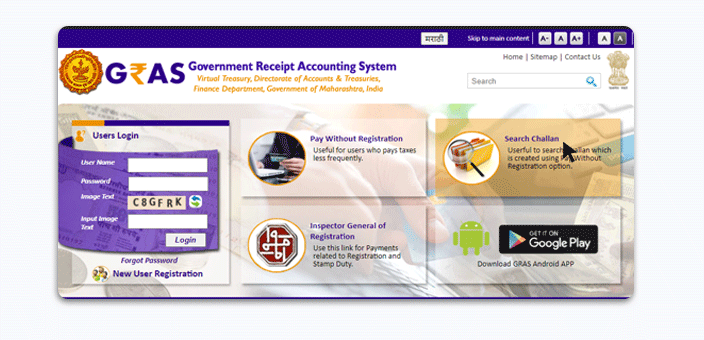

Step2: Then From The Home Page Section Click On The ‘Search Challan’ Tab

Step 3: Fill in The Details such as Department, Amount, Bank, GRN/CIN, etc., and click on ‘Search’.

Step 4: Click on the Challan Number to view the copy of the challan

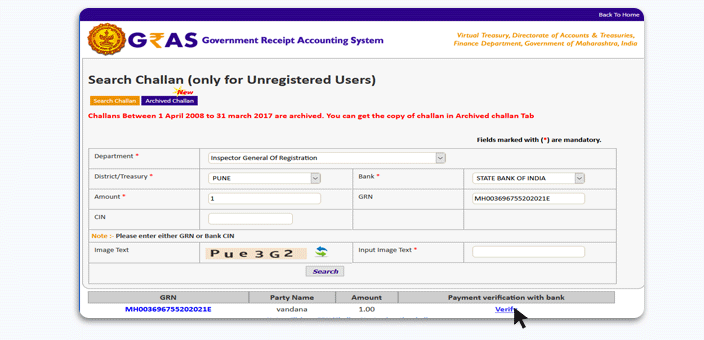

Step 5: You can further verify the payment from the bank by clicking on the verify

Step 6: Then it will show the Payment Verification Status

Summing Up:

- You need to pay the stamp duty charges while buying a new property.

- Stamp Duty depends on various factors such as The Market Value Of The Property, Location, Gender Of The Buyer.

- The Stamp duty is always calculated as a percentage of the market value/agreement value (whichever is higher).

- In Mumbai, the stamp Duty charges are 5% for males and 4% for female property buyers. whereas the registration charges in Mumbai: For Properties above 30Lakh it is 30000 And for properties below 30Lakh it is 1% of the market value.

- Paying the stamp duty charges online is more reliable than the other forms of stamp duty payments such as Physical Stamp Paper and Franking.

Quick Links To Pay The Stamp Duty:

GRAS website portal for stamp duty online payment: Click Here

To search the challan after the stamp duty online payment: Click Here