Page Contents

What Is The Tax For NRIs on Property Selling

During the real estate boom, you invested in the property like any other NRIs in India and now you have received a good offer on that property for sale. The important thing to consider in this process is your property tax liability.

During the real estate boom, you invested in the property like any other NRIs in India and now you have received a good offer on that property for sale. The important thing to consider in this process is your property tax liability.

NRIs who decide to sell real estate property in India have to pay taxes on the profit i.e. on Capital gain.

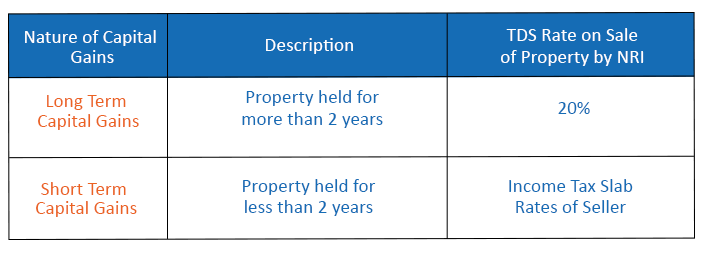

The capital gain is divided into two that is short-term capital gain and long-term capital gain.

Selling your property within two years of buying it is seen as a short-term gain. And it is regarded as a long-term gain if you sell your property after more than two years or 36 months.

Because both are subject to differing tax treatments, it is crucial to distinguish between short-term and long-term capital gains. These two kinds of gains can be reinvested with a variety of rates of taxation and tax benefits.

How Much Tax For NRIs Are Payable on The Property Sale

Profits on the property sale decide how much tax is payable. Whether a gain is a short-term or long-term capital gain determines the amount of tax that is due.

Profits on the property sale decide how much tax is payable. Whether a gain is a short-term or long-term capital gain determines the amount of tax that is due.

Short-term profits are taxable at the relevant tax slab ratios for the NRI depending on the entire income that is payable in India for the NRI.

Capital Gain Tax for NRIs After Selling Property in India

NRIs are accountable for paying taxes after selling property in India.

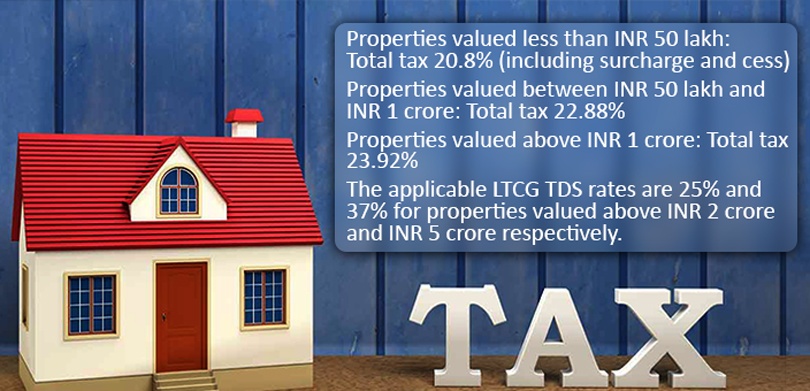

If you are NRI and consider selling a real estate property in India, the buyer will deduct 20% as Long Term Capital Gains Tax (TDS) for the property that is sold after two years.

The TDS value is 30% and is subtracted as short-term gains tax for real estate for two years.

In case of the real estate property is transferred or inherited. The date of the first purchase by the original owner is important for calculating whether the property is for short-term capital gains or long-term.

TDS plus surcharge, education cess, health and other taxes must be included in the deduction.

How to Calculate Tax for NRIs on Property Sale

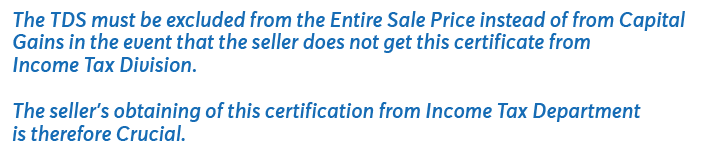

As required by Section 195, TDS on real estate sold by an NRI should preferably be subtracted from capital gains.

Instead of the seller, who isn’t allowed to calculate capital gains, a Tax Officer at the Income Tax Department conducts it.

The is seller required to submit Form 13 which is the application to the Tax Department to have their capital gain calculated.

The application process is cumbersome a little, so the seller can avail of a chartered accountant for submission of an application to the Tax Department of India.

According to the capital appreciation that results from the property sale, the Tax Department of India will calculate the seller’s capital gain and provide certification for Nil/Lower TDS reduction.

The seller must provide this certificate to the buyer, who will deduct TDS at the rates defined in the taxation certificate.

It is customary to include the information about TDS levied in the realty sale agreement.

Regardless of whether the TDS will not be reduced or will be deducted incorrectly, the Registry will still register the Deed Of Sale.

The Income Tax Office of India won’t take steps against the NRI seller if the TDS is incorrectly subtracted or not withdrawn; rather, they go after the real estate property buyer to pay the TDS.

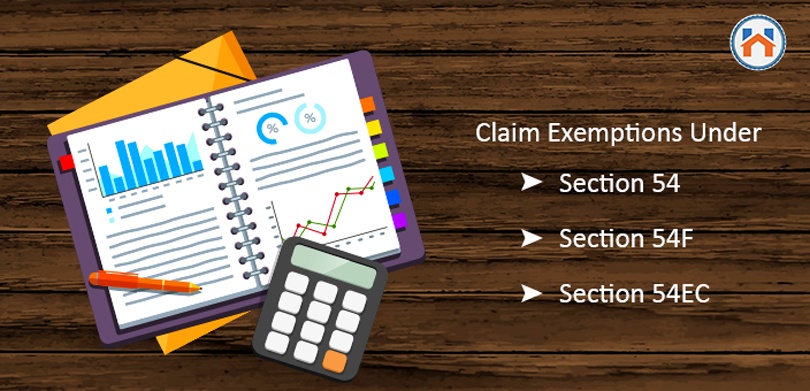

Exemptions on Tax for NRIs

In India, long-term capital gains from the sale of real estate are excluded from taxation for NRIs under sections 54, 54F and 54EC.

- The NRI must buy one residential property within one year of the capital asset’s transfer date, within two years of the transfer date, or within three years of the capital asset’s transfer date to qualify for the exemption under Section 54F.

- This brand-new home must be located in India and cannot be sold for three years after being bought or built.

- Additionally, NRI should not possess over one residential property (apart from the new house), nor should they purchase another residential house within a 2-year window or build another one within a 3-year window.

- To lower tax obligations, capital gains from the sale of real estate may be reinvested in India. The profit from the sale is tax-free if you use the capital gains to buy a different property within two years.

- Similar to this, per section 54EC, investors have six months to invest the profits from the sale of the estate in Capital Bonds to qualify for an exemption. These bonds feature a five-year lock-in period and a rate of interest of about 5.75% p.a.*

Also, you can Check out properties online in India at Homebazaar.com.

FAQ

| How is NRI income tax calculated?

NRIs are subject to a 20% income tax when they invest in specific Indian assets. |

| Can NRI claim a basic exemption for capital gains?

You continue to benefit from the basic exemption ceiling of Rs. 2,50,000 as a non-resident of India. However, the advantage of the basic exclusion ceiling is not applicable in respect of these gains if your whole earnings in India consist only of short- or long-term capital gains. |

| Can NRI sell their property in India?

An NRI may sell either commercial or residential property to an Indian national, another NRI, or another NRI (PIO). |

| How can I pay TDS on the sale of the property to NRI?

The NRI must submit a Form 13 application to the Department of Income Tax for the issuing of a Certificate for Nil/Lower Deduction of TDS to lower the TDS on the sale of the property. |