Page Contents

- What Is Tax On Rental Income?

- Calculate Rental Income

- Calculate Tax On Rental Income

- Types Of Rental Properties

- Rental Income Tax For NRIs

- Tax Rate On Rental Income India 2021-22

- How Much Rent Is Considered Tax-Free?

- Deductions From House Property Income Section 24

- How Can You Save Tax On Rental Income?

- FAQs

What Is Tax On Rental Income?

The income you get from renting out the property is taxable under section 24. It will be calculated as per the Income Tax Act under the title of Income From House Property.

Municipal taxes, standard deduction & interest on home loans will be deducted to determine the rental income on which the tax will be levied. The security deposit taken from the tenants during the rental agreement will also be included while considering the rental income tax.

Calculate Rental Income

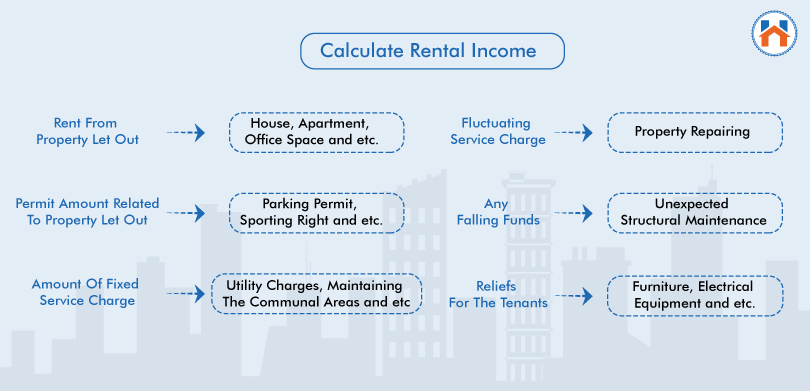

Before understanding the rental income tax of a property, it is important to know which factors will be considered to calculate the rental income of a property.

The following points can be included in the rental income when received any extra amount apart from rent as per the tenancy act:

- Rent from property let out (for example house, apartment, office space and etc.)

- Any permit amount related to your property let out (for example parking permit, sporting right, and etc.)

- Amount of fixed service charge (for example utility charges, maintaining the communal areas, and etc.)

- Fluctuating Service charges (for example property repair)

- Any falling funds (for example unexpected structural maintenance)

- Reliefs for the tenants so that they can use your property as per the utilization (furniture, electrical equipment, and etc)

- Any amount received for utilizing the furniture or others

However, it should be noted that any other service provided by the landlord or owner of the property should be treated as Trading Income. These services must be apart from the regular or stated responsibilities of the owner and this income should not be treated as Rental Income.

Calculate Tax On Rental Income

It is easier to calculate the tax on rental income when you know which terms are required to be deducted and which of them are required to be added. It can be understood including an example.

Income From House Property or taxable income can be calculated by deducting Municipal Taxes or Property Taxes, Standard taxes, and home loan interest.

For example: Suppose you are earning Rs 40,000 per month from renting out your property. Your Property tax is supposed to be Rs 25,000. To buy this property, you have taken a home loan from a bank and the interest is Rs 90,000. Then the taxable income will be calculated according to the below table.

| Income From Rented Property | Amount (in Rs) |

| Gross Annual Income From Rental Property | 4,80,000 (40,000 per month) |

| Deduction: Property Tax | 25,000 |

| Net Annual Value | 4,55,000 |

| Deduction: 30% Standard Deduction | 1,36,500 |

| Deduction: Interest From Home Loan | 90,000 |

| Income From House Property | 2,28,500 |

Types Of Rental Properties

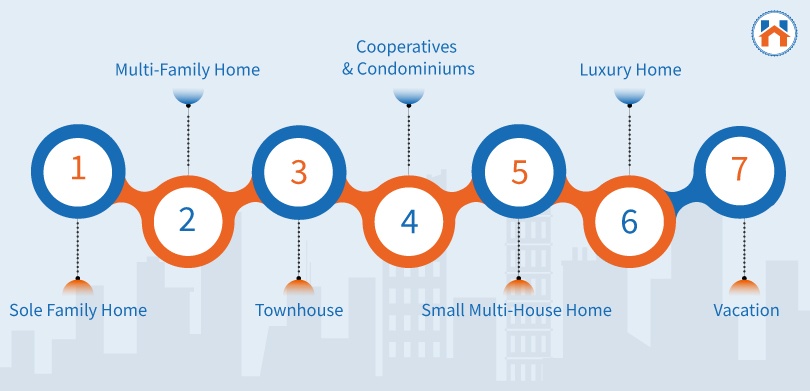

There are commonly 7 types of rental properties that generate rental income and they are explained in the following points:

- Sole Family Home: This is one of the common types of rental property that has enough space to reside a single family by not sharing walls with any other unit.

- Multi-Family Home: This type of rental property consists of more than one unit.

- Townhouse: This is a property that shares a connecting wall, and the front yard.

- Cooperatives & condominiums: These properties include the privately owned units in the multi-tenant building.

- Small multi-house home: Generally, two to four units are there in a small multi-family home, and more than four units are large multi-family homes.

- Luxury home: Some high-end renters demand a luxurious property to stay in.

- Vacation: These homes are useful for short-term stays like Airbnb, and VRBO.

Rental Income Tax For NRIs

As per the Income Tax Act, citizens who have property in India but currently not staying in India, then they will have to pay taxes to the Government.

The rental income tax for NRIs is calculated in the same manner as for the residents of India. 30% under section 24 is allowed from the total Net asset value. The home loan interest ( if taken any) will be deducted similarly.

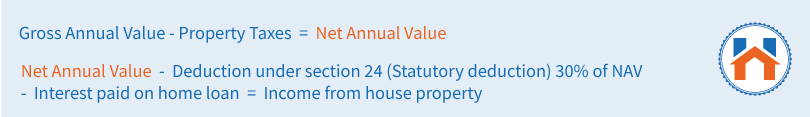

Calculation Of Rental Income Tax For NRIs

Gross annual value-property taxes = Net Annual Value

Net Annual Value-Deduction under section 24 (Statutory deduction) 30% of NAV-Interest paid on home loan=Income from house property

The result will state income or loss on rental property. If the property is self-owned then there will be no rental income tax.

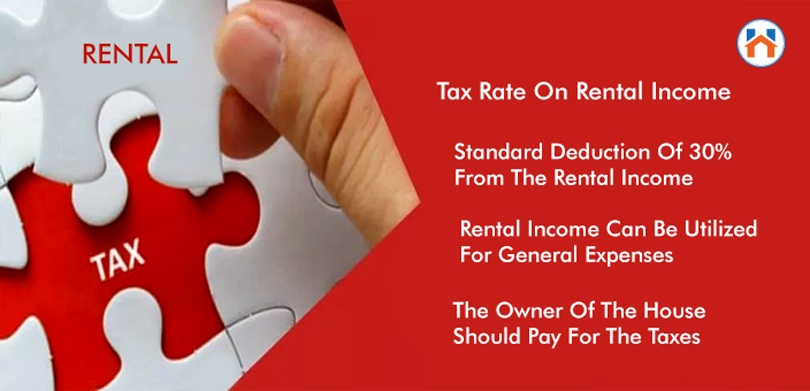

Tax Rate On Rental Income India 2021-22

According to Section 24A of the Income Tax Act, every taxpayer is eligible for a standard deduction of 30% from the rental income.

This portion of the rental income can be utilized for meeting general expenses like house repair and renovation work.

However, to avail of the deduction, the owner of the house should be legally proven to pay the taxes. the owner of the house should pay for the taxes

How Much Rent Is Considered Tax-Free?

The individual will not pay any taxes if the GAV (Gross Annual Value) of the house is less than Rs 2,50,000. If the house is less than Rs 2,50,000

However, if the rental income from the house is the only source of income then the individual or the owner of the house will have to pay taxes.

Moreover, the rental income is utilized for rental expenses like mortgage interest, operating expenses, repairing costs, and property tax. rental income utilized for rental expense

The interest on capital borrowed for buying or constructing the house is also deductible.

Deductions From House Property Income Section 24

The house property owners can avail few deductions on their rental income under section 24. These deductions are explained in the following:

- Municipal Tax: The municipal tax is the tax amount payable to the municipal corporation of that area. The municipal tax is levied only when it is bourn by the land owner.

- The standard deduction: The standard deduction amount fixed under the Income Tax Act is 30% of the Net Annual Value. This deduction will be included regardless of the actual expenditure on the rental property.

- Interest on home loan: If you are residing in the property then you can receive a home loan deduction up to Rs 2 lakhs. However, if you have rented out the property then the entire interest amount will be deductible from the total rental income.

There are a few conditions over which the deduction of 2 lakhs on home loan interest will be considered:

- The home loan must be used only for the purpose of purchasing or constructing a property

- The home loan must be applied and taken after 1st April 1999

- The purchase process or the construction work of the property must be completed within 5 years of taking the home loan.

How Can You Save Tax On Rental Income?

There are different options that can be utilized to save tax on rental income legally and these are explained below:

- Cost of maintenance: You can save tax on a rental property by excluding the cost of maintenance charge from the rental income. Some rent owners include the cost of maintenance in the rent which ultimately increases the rental amount. However, the tax on increased rental value can be saved if maintenance costs can be deducted.

- Joint Property: If you are buying or constructing a house in partnership with your spouse or parents. The rental tax will be divided between two, hence the pressure on you will now reduce.

- Municipal or Property tax: This kind of payment like sewage tax, and property tax can be used for reducing rental income tax amount. However, it is to be ensured that the tax incurred should be payable by the owner of the house.

- Furnished: If you are providing a property in a semi-furnished or furnished house, then it will help the tenant to lower the extra cost of paying any extra amount separately. As this will be included in the rent payment, the rental tax will also be lower for the landowner.

FAQs

| Q1: How much rent is taxable under section 24?

Ans: The amount received as rent will be deducted from the municipal tax, standard deduction, and interest on the home loan, and the remaining amount “Income from house property” will be taxable under section 24. |

| Q2: What if I do not pay rental income tax?

Ans: If you do not pay your rental income tax deliberately then the Income Tax department will impose a fine over the total value of unpaid tax along with the underpaid taxes. |

| Q3: Is rental income considered earned income?

Ans: No, rental income is not considered earned income, rather it is considered passive income. |

| Q4: How to calculate the income from house property?

Ans: The formula for calculating the income from house property is Gross annual value-property taxes = Net Annual Value Net Annual Value-Deduction under section 24 (Statutory deduction) 30% of NAV-Interest paid on home loan=Income from house property |