When you purchase a property, it is mandatory to deduct the applicable TDS as per section 194IA of the Income Tax Act. It is the responsibility of the buyer to deduct the TDS on property sale and file the TDS return to the government within the given time frame. This article covers complete insights on- what is TDS on the sale of property in India, the Online TDS filling process, and the most important FAQs.

Page Contents

- TDS On The Sale Of The Property

- TDS Rate on The Sale of The Property In India

- TDS Rate For NRIs on The Sale of The Property In India

- Conditions for TDS on The Sale of The Property

- TDS on Sale Of Property By NRI

- Details Required To File The TDS on Property

- Important Things Buyer Should Consider regarding the TDS

- The Important Things Property Sellers Should Consider On the TDS

- How To Pay The TDS On The Property Sale Online

- What If You Don’t Pay the TDS On Sale of Property

- FAQs

TDS On The Sale Of The Property

While buying a property, a buyer has to deduct 1% TDS (tax deduction at source) from the payment he makes to the seller.

It is the responsibility of the property buyer to deduct the applicable amount of TDS from the payment he is supposed to make to the seller and then file the TDS amount to the government.

For example, if you buy a property from the seller at 1 crore, you have to deduct 1% of the total amount that is Rs 1Lakh, and make the payment to the property seller. Then you will be responsible to file the 1 Lakh TDS to the government.

This TDS amount should be filed to the government within a specific period.

You can file the TDS by generating the 26QB form online.

However, there are different sets of conditions for the Indian Resident and Non-Indian residents to file the TDS returns on property. Read on to know What is TDS rate is, how to file TDS online, and what are the important conditions related to TDS that you should know while buying a property.

TDS Rate on The Sale of The Property In India

Following are the TDS rates on the sale of the property in India.

| For Properties More Than 50 Lakh | 1% |

| For Properties Less Than 50 Lakh | No TDS |

| For Agricultural Lands | No TDS |

| For No PAN (Permanent Account Number) | 20% |

TDS Rate For NRIs on The Sale of The Property In India

Following are the TDS rates for NRIs on the sale of property-

| Long Term Capital Gains | 20% |

| Short Term Capital Gains | As Per The Income Tax Slab |

The total percentage of the taxes applicable can slightly increase with the additional cess and the surcharges.

Section 194IA introduced in the finance Act 2013 provides the detailed guidelines for the TDS on the sale of the property. Following are the conditions for the TDS based on the property according to section 194IA.

Conditions for TDS on The Sale of The Property

- There is no TDS deduction if the transfer of the property is less than 50 Lakh

- The TDS is only applicable if the total property amount is more than 50 Lakh

- The TDS is calculated by considering a complete property amount but excluding the stamp duty and the GST charges.

- It is the responsibility of the property buyer to deduct the applicable TDS and pay the remaining amount to the seller.

- The property buyer needs to file the TDS to the government. In case of defaults, the buyer is liable for the penalties as per Section 194IA of the Income Tax Act.

- If the payment has been done in installments, the TDS of 1% should be deducted for each installment.

- The PAN number of the property seller is compulsory for the TDS. If the PAN is not available, then 20% of the TDS will be deducted.

TDS on Sale Of Property By NRI

If the property seller is NRI, then the TDS is charged regardless of the purchase price.

The TDS on the sale of property for NRI sellers depends entirely on the Capital Gain of the property.

The capital gains on the property are categorized as the-

- Short Term Capital Gains (Holding period less than 2 years)

- Long Term Capital Gains (Holding period more than 2 years)

For Short Term Capitals Gains, the TDS is as per the income tax slabs. Whereas, for the long-term capital gains, the TDS on the property is 20.6% of the purchase price of the property.

For TDS on Sale Of Property By NRI, form 27Q is to be filed.

Details Required To File The TDS on Property

Even though it is the responsibility of the buyer to deduct the TDs and file them to the government, the details are required from the buyer and the seller as well.

Here are the details or information required to file the TDS on the property.

- Address of the Buyer

- PAN Details of the Buyer

- Address of the Seller

- PAN Details of the Seller

- Transaction Value

- Property Related Value

- Applicable TDS Amount

- Transaction/ Payment Date

Important Things Buyer Should Consider regarding the TDS

- The Buyer should deduct the TDS at the time of making payment to the seller.

- After making the TDS return, the buyer should provide a form 16B to the seller as proof of the TDS return filling

- The buyer should not delay the TDS payment otherwise the interest is applicable on the TDS amount throughout the default period.

- The buyer is liable to pay the Rs 200 fine per day for not filing the TDS return. The fine can go upto Rs 1 Lakh.

- When the payment is done through the Home Loan, the TDS is deducted when the payment is made to the seller, and not at the time of EMI payment to the bank.

The Important Things Property Sellers Should Consider On the TDS

- Ensure that the TDS has been deducted as per the section 194IA, i.e 1% of the agreement value of the property

- The property seller should collect form 16B of the property from the buyer as an acknowledgment of the TDS filling by the property buyer.

- If the property seller is NRI, then form 16A should be collected from the property buyer.

How To Pay The TDS On The Property Sale Online

According to section 194 IA, the property buyer need to pay the TDS deducted amount to the central government within 30 days from the last day of the month when the transaction happened.

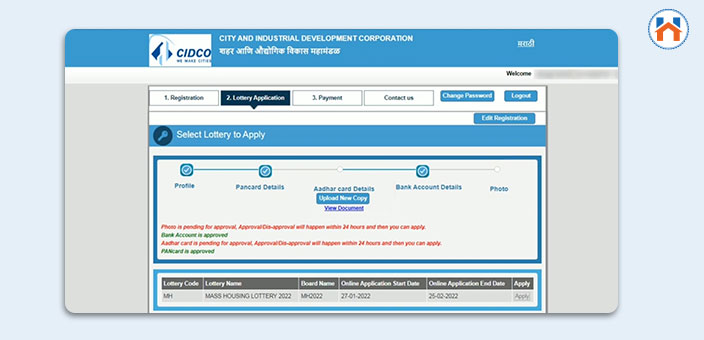

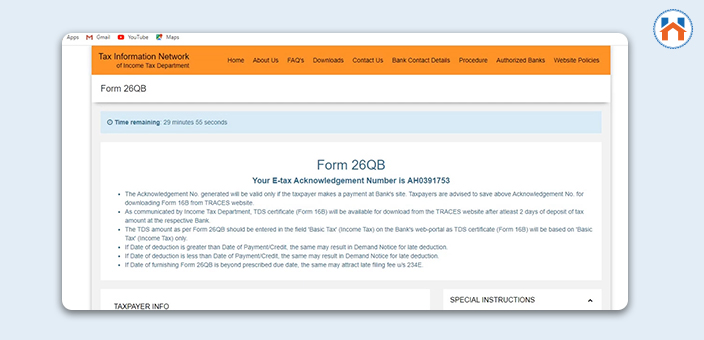

You can pay the TDS on property online by generating the 26QB Challan Online. If the property seller is NRI, then form 27Q needs to be filled.

Here is a stepwise process to pay the TDS on the sale of the property.

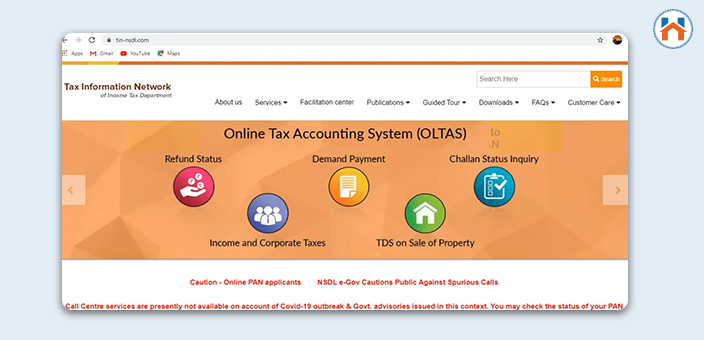

Step 1: Visit the Tax Information Network of Income Tax Department at tin-nsdl.com

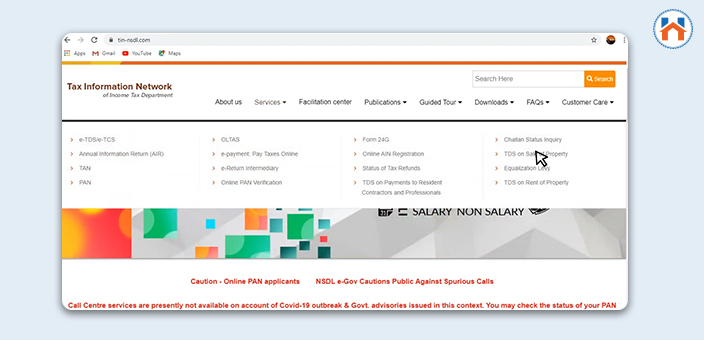

Step 2: Go to the Services section and click on TDS on sale of the property.

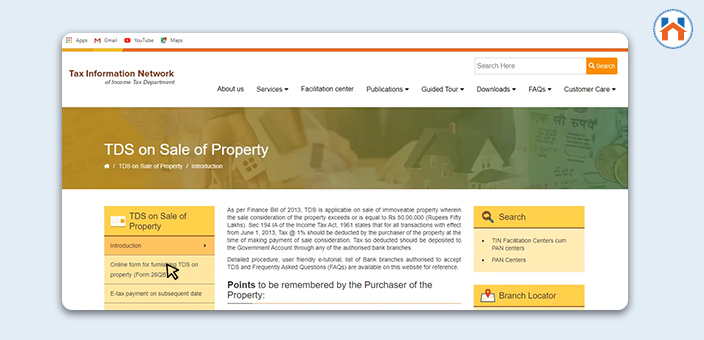

Step 3: Then Scroll Down and Click on the 26QB application form.

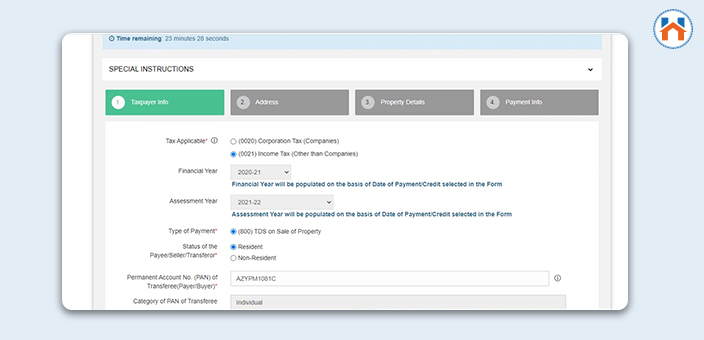

Step4: Fill In the Tax Payer Info such as Applicable Tax, Financial Year, Assessment Year, Type of Payment, PAN Details, etc

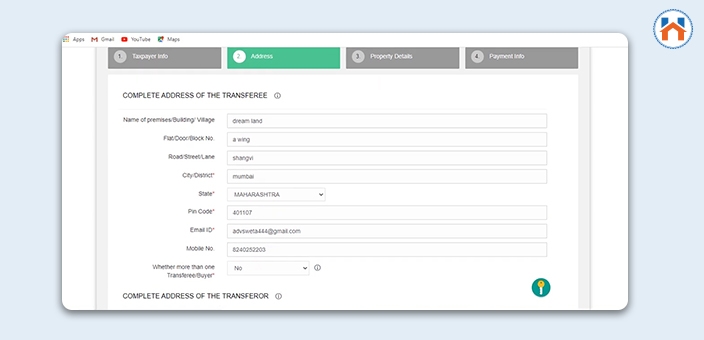

Step5: Fill In The Address Details of the Buyer and the Seller

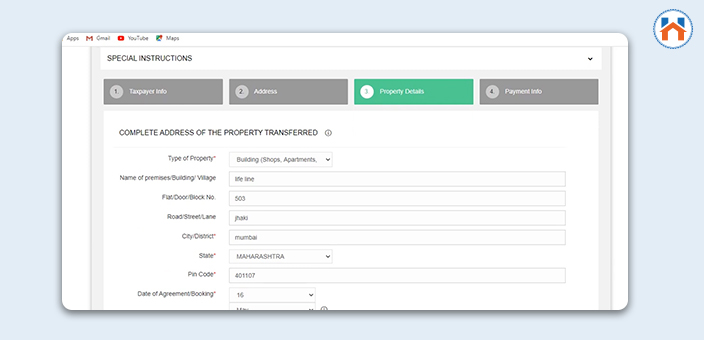

Step6: Fill In the Property Details such as Property Type, Address Details, etc

Step7: Fill In the Payment Info such as Date of Payment, Date of Tax Deduction, etc

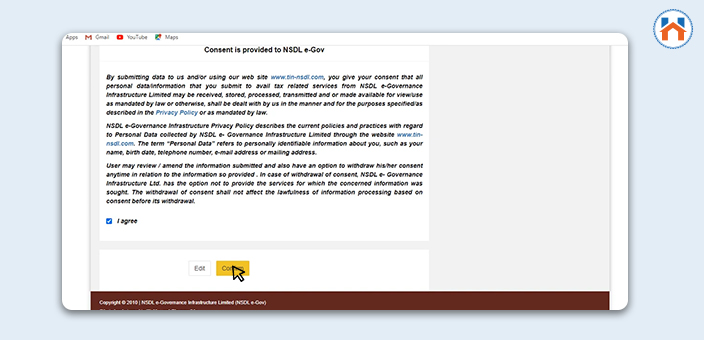

Step8: Then Click on I agree and Confirm the Form

Step9: After the payment, a challan will be generated. You can also download the challan or the TDS receipt.

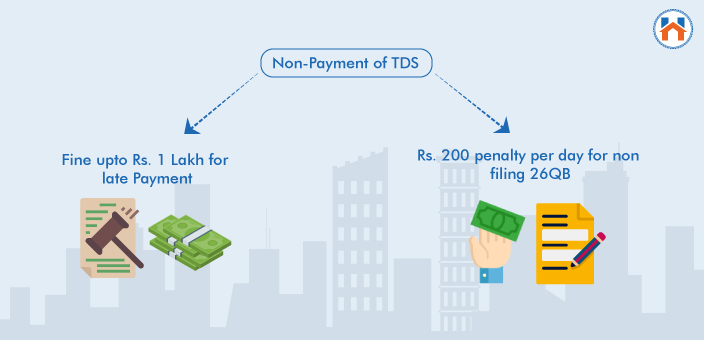

What If You Don’t Pay the TDS On Sale of Property

The income tax department regularly tracks and evaluates the property registrations from the sub registrar’s office. If the TDS is not paid, the property buyer receives the notice for defaulting the TDS.

Following are the penalties of the nonpayment of the TDS

- The defaulter is liable to pay the whole TDS amount plus the interest on the TDS deductions for the default period.

- For the late payment of the TDS, you can be liable to pay the penalty of upto Rs 1 Lakh.

- Rs 200 penalty per day for non-filling the 26QB under section 234E of the Income Tax Act.

- The property seller is not liable for the payment of TDS to the government. And therefore, no penalties are charged against the property seller.

FAQs

| What is TDS?

Tax Deducted at Source (TDS) is some part of payment deducted directly by the buyer while making certain payments. The buyer then pays this amount to the government. |

| What is TDS on property on sale In India?

While buying a new property, the buyer has to deduct the TDS and make payment to the seller. It is the responsibility of the property buyer to deduct the TDS and make the payment to the government. |

| What is the rate of TDS on the sale of property in India?

The TDS on the sale of the property in India is 1% of the agreement value of the property. |

| What is the rate of TDS for NRIs on the sale of property in India?

The rate of TDS on the sale of the property for the NRIs In India is 20% of the Capital Gain on the property. |

| What is the time limit for the payment of the TDS?

After making the payment to the seller, you need to pay the TDS within 30 days from the last day of the month when the transaction happened. |

| What is form 26QB?

Form 26QB is a challan for filing the TDS. It is the responsibility of the buyer to generate the 26QB challan online and make the TDS payment. |

| What is form 27Q?

If the property seller is NRI, then the form 27Q needs to be filled to file the TDS. |

| What is form number 16B?

Form 16B indicates that the TDS has been filed successfully by the property buyer. The buyer can show form 16B as proof of the TDS deduction and the necessary payment to the income tax department. |

| How To file the TDS Online?

You can file the TDS online by visiting the official website of the Tax Information Network of the Income Tax Department. |

| How to pay the TDS when the property when the payment to the seller is done with the Home Loan?

In the case of the Home Loan, the TDS is deducted on the payment made to the seller and not on the EMI paid to the banks. |