Page Contents

What is TDS On Rent?

A TDS on rent is when a person who is liable to pay rent which is not Independent or HUF is required to reduce 10% of the yearly rent as a tax exempted at the source each year. This means a person who is paying rent will deduct a specific amount at the source and pay that same to the Central government.

The deduction has a limit set in the Income Tax Act, section 194I by the Indian government.

Section 194-I specifies how tax at source, or TDS on rent, should be withheld.

The following section is mainly for people who make money by renting out or subleasing their property. Since rent is an extra source of income for business owners, employees, and others, it is subject to TDS.

This is intended for those who pay rent for real estate, constructions, equipment, furnishings, and other items.

Is TDS Deducted on Rent?

Tenants are required to deduct TDS on rent from their rent payments and report these to the tax authorities of the Income tax department. This is liable if the rent exceeds the annual threshold limit set in the Income Tax Act.

What is TDS on the Rent Threshold limit for FY 2023-24?

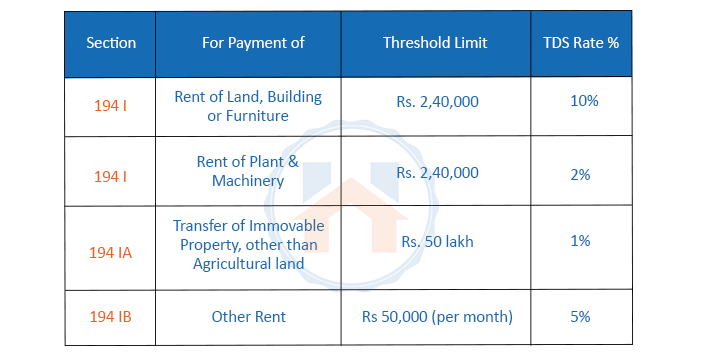

For the financial year 2023–2024, the TDS threshold limit is Rs. 2,40,000. (this was Rs. 1,80,000 till FY 2018-19).

If the total amount of rent paid or anticipated to be paid during the year reaches a certain threshold, Section 194I of the Income Tax Act’s current requirements require the payer of rent to withhold tax at a rate of 10% of the rental on any property building or land.

Who is liable to pay TDS on rent?

All tax-paying citizens, including businesses, firms, trusts, associations of people, etc., are liable to the current provisions to pay TDS on rent.

Furthermore, the regulations will apply if the rent payer is a single or HUF, is involved in a profession or business and the accounts had to be audited the previous year because the turnover exceeded the allowed threshold.

Visit the official Income tax portal, if you want to pay a TDS on your rent. On the link, you will find Form26QC to fill out. Fill in all the required information and details.

How Is TDS Calculated On Rent?

TDS must be subtracted when paying the rent money to the payee account via a cheque, cash, or another payment mode.

TDS on rent is calculated as follows,

How Much Rent is TDS Free?

The person who pays rent to an Indian citizen must deduct TDS tax if the rent amount exceeds the limit. For the current financial year 2023-24, the maximum TDS-free Rent is 2.4 lakhs.

If the annual rent crosses this threshold limit then the person is liable to pay TDS to the central government.

Is TDS applicable on the Rent Deposit?

For the rent deposit, there is no TDS applied if it is refundable by the owner or landlord. But if the paid deposit is adjusted as rent then a TDS deduction is applied for the same.

TDS on Rent Section 194Ib

When paying rent to the Lesser, Landlord, or Payee, the Tenant or Payer is required to deduct taxation at a rate of 5% by Section 194-IB if the landlord is an Indian resident, if not then the TDS rate is 20% applicable. Any approved bank branch must deposit the tax that has been subtracted to the government electronically.

The TDS under Section 194IB must also be withheld by individuals covered by Sections 44AD and 44ADA whose annual revenue does not exceed Rs. 1 Cr or Rs. 50 Lakhs, as such cases as well.

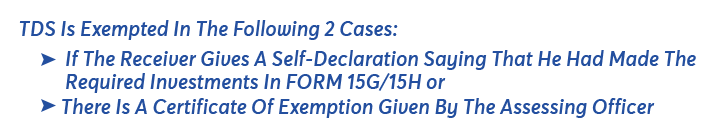

How Can I Avoid TDS on Rent?

You cannot avoid TDS on rent if your annual rent amount exceeds the threshold limit set by the Income tax act. If you are late to deduct the TDS on rent then a penalty is applied.

Until the day when TDS is eventually withheld and remitted to the government, a penalty of 1% simple interest is imposed per month.

If you are paying rent to your landlord then it is better for you to understand the Income Tax laws. It will help you to give a clear understanding of the timely tax payments, the TDS on the sale of property and other important details.

FAQs

| What is TDS On Rent Above Rs 50,000?

The tenant should pay 5% of TDS to the central government on rent above Rs. 50,000 |

| Is TDS compulsory on rent?

If your annual rent amount exceeds the 2.4 lakh limit then you are liable to pay TDS on rent. |

| What is the current TDS rate?

The TDS amount on income is depending on an individual’s salary and can range from 10% to 30%. |

| What is the minimum TDS deduction?

Only when the final payment is made TDS will be deducted from a salary. Additionally, it will be subtracted when the employee’s salary is taxed. TDS on salary won’t be deducted, however, if the remuneration is equivalent to or lower than Rs. 2,50,000. |

| Can we get TDS back?

Yes, you will receive a refund if you paid an excessive amount of tax. You must file an ITR before your return can be completed to receive your additional tax refund. |