Know The Requirements

Knowing all the requirements before buying a home is the right approach. It helps you to have a clear idea of what will be a perfect home for you.

Buying a home without the proper definition of the requirements often leads to incorrect decisions and significant loss of time and money.

So, the following are points that you need to consider while defining your requirements.

Type of Home

Villas, Bungalows, Penthouses, Apartment Buildings are the common type of residential properties to buy in India. Selecting the right type of property first allows you to decide the budget and all the other things that you need to consider in the home buying process.

In India, the highest demand is for apartments or flats of varied sizes and configurations. And more importantly, the apartments and flats in India come in the range of affordable to premium and luxurious housing units.

While selecting the type of home, you need to be realistic about your financial capacities and choose the option accordingly.

Note:

Homebazaar serves homebuyers searching for flats in India with end-to-end services like site visits, and lower-interest home loans to property registration guidance. We provide the best price options & offers for 1 to 4 BHK RERA-registered flats, villas & penthouse properties in India. To begin a smooth homebuying journey with us, fill out the form mentioned below or on the right side.

Size and Configuration

The size and configurations of the home depending on the needs of the family. More spacious apartments mean more privacy and the freedom to use the space.

The better configuration of the apartment ensures comfort. Meaning, if you have a joint family, it is ideal to go for a spacious 2-3 BHK configuration. Whereas if you are a single or a married couple then 1-2 BHK unit might suffice the need. However, it comes down to personal preference.

Generally, the size of the home is indicated in terms of the carpet area or built-up area. RERA has made it mandatory for builders to indicate the property size in the carpet area for more transparency. So, you should know the meaning of terms such as carpet area, built-up area, and super built area to get more clarity on the required size and configuration.

Check out the blog post on the detailed meanings and comparison on Carpet Area, Built-up Area, and Super built-up area.

Amenities

Amenities are additional facilities provided for extra living comfort. The modern-day amenities include a swimming pool, gymnasium, kids play area, sports club, etc. Amenities play an important role in influencing you as a buyer. Therefore, careful considerations are required while choosing real estate projects with amenities.

There might be fees associated with certain lifestyle amenities. And it is important to know these beforehand. The best approach is to list out the necessary amenities and less important amenities for you.

It is advised to-

- Select the amenities on the basis of the two parameters- Affordability and Personal Preferences.

- Avoid unnecessary amenities if they are contributing to the cost.

- Compare the real estate projects only on the basis of amenities that are necessary.

- Avoid paying for the amenities that you never use.

Nearby Social Infrastructure

Proximity to the Social infrastructure is important for buying a home. The proximity to quality healthcare services, educational institutions, retail outlets decides the ease of living in a particular area.

But you can further prioritize which essential facility is the most important for you. And take the home-buying decisions accordingly.

If you are a working-class couple you will give an emphasis on the locations near to the employment hubs. If you are living with the family you might want schools, healthcare services nearby. So, evaluate your need and choose properties in that manner.

Possession Time

While buying a new home you get the two options. You can either choose a ready-to-move-in property or under-construction property.

If you want to avoid rental spending, you can go for the ready-to-move properties. On the other hand, if you want time to get ready for the financial demand of buying a new home, you can go for the under-construction properties.

Compare the ready-to-move-in properties and under-construction properties, know the pros and cons and then decide what is best for you.

Possession time plays an important role in home-buying decision-making. Therefore, prefer what suits you best considering the ready-to-move and under-construction property options.

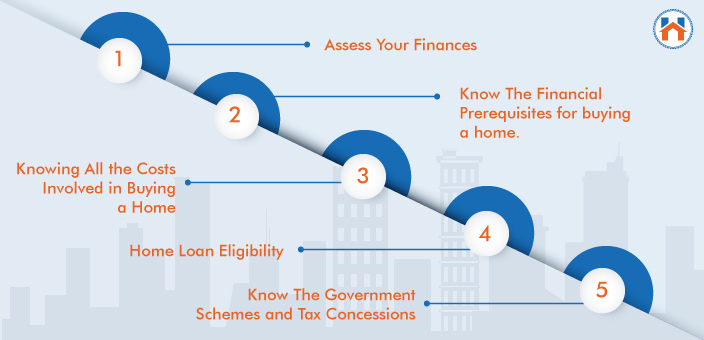

Financial Planning

When it comes to financing your home, two important things you need to consider. First, you have to assess your finances thoroughly. And second, you must know all the financial prerequisites for buying a home. This approach gives you a clear idea of what you have in hand and what will be required while buying a home.

Let’s first begin how to assess the finances from the home buying perspective.

Assess Your Finances

Following are the points that can help you to assess your existing financial state from the home buying objective.

- Know the continuity of your monthly income

- Income Projections in the near future

- Your Expenses

- Other Financial Liabilities-Loans and Debts

- Your savings

- Investments

- Emergency/ Backup Funds

These points will give you a fair idea of what can be an affordable deal for you. By assessing the finances, you will be able to set a realistic budget for buying a home.

Financial Prerequisites for Buying a Home

Let’s understand what are the general financial prerequisites for buying a home in India-

- Home Loan Eligibility.

- Knowing The Applicable EMIs.

- Emergency fund equivalent to 3-5 EMIs.

- Additional funds to manage the repair, maintenance, and interior costs.

- Fund to manage the rents if the possession is delayed in case of under-construction properties.

- Maintaining a good CIBIL credit score.

- A minimum 10% down payment as booking charges.

- Knowing the total costs involved in buying a home.

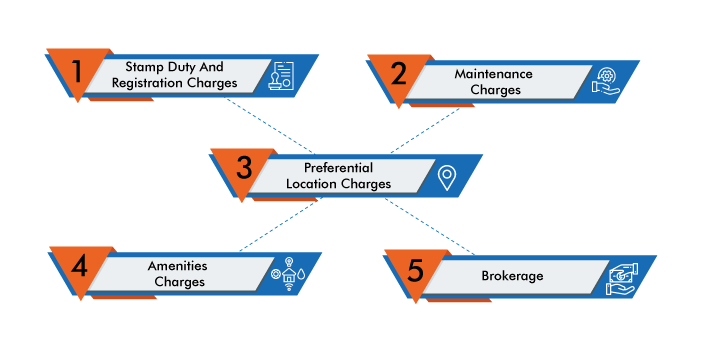

Know All the Costs Involved in Home Buying Process

While doing the finances, it is necessary to understand the possible costs involved in buying a home. Knowing all the costs beforehand helps you to set the right budget.

Following are the various costs involved in buying a house.

| Cost | |

|---|---|

| Stamp Duty and Registration Charges | The Stamp Duty charges are 5-6% of total property value. Whereas the registration charges are 1% of the property value. |

| Preferential Location Charges | To get the particular location in the building you need to pay the preferential locations charges. The PLC charges can be 2-5% of the property value. |

| Amenities Charges | You need to pay for the extra amenities such as Gym, Swimming Pool, Club Membership, etc. |

| Brokerage | If you choose a real estate agent or a broker to find the property, then you need to pay 1-2% of the property value as the brokerage. |

| GST | 5% GST is applicable for the under-construction properties. No GST is applicable for ready-to-move properties. |

Home Loan Eligibility

Knowing the Home Loan eligibility is the most crucial point in the financial planning for buying a new home.

The general home loan eligibility criteria for the banks Include-

| Parameter | Eligibility Criteria |

|---|---|

| Age of the Applicant | Between 21-71 |

| Monthly Income | Min Monthly Income Between Rs 10,000- 25,000 |

| CIBIL Credit Score | CIBIL Score Above 700 is required by Most of the lenders |

| Employment Status | Salaried or Self Employed |

| Work Experience | 2-5 Years |

| Loan Tenure | Upto 30 years |

Following are the important points for Home Loan Eligibility-

- The banks set up the eligibility criteria to ensure whether you can repay the home loan amount.

- Generally, the banks lend you the home loan amount 40-50 times of monthly income. The best way to find the exact applicable home loan amount is to use the Home Loan eligibility criteria.

- The EMI depends on the two parameters- The Home Loan Amount and Loan Tenure. Higher the home loan tenure, the lower is the EMI.

- The maximum home loan tenure is 30 years. You can calculate the applicable EMIs by using the Home Loan EMI calculator.

- It is advised that the EMI should not be more than 40% of your monthly income.

Also Read- Complete Home Loan Guide For Buying A Home In India 2025

Know The Government Schemes and Tax Concessions

As a first-time homebuyer, you become eligible for the government schemes and tax concessions that help you to save a significant amount. While doing the financial planning it is necessary to know these schemes and set the budget accordingly.

The Pradhan Mantri Awas Yojana PMAY offers concession upto Rs 2.67Lakh on the home loan amount through a PMAY Credit Linked Subsidy Scheme. Read the complete article on Pradhan Mantri Awas Yojana (PMAY) to know the eligibility criteria and the application process.

Also, the government has provided significant relief to first-time property buyers. Under section 80C property first-time home buyers in India can get the concession upto Rs 1.5 Lakh on the principal portions of the EMI. Also, you can save upto Rs 2 Lakh on the interest component of the EMI applicable under section 26.

The government has taken initiatives to increase the affordability factor in buying a new home. Therefore, the home buyers are getting benefits such as low-interest rates, tax concessions, reduced stamp duty charges among others. This makes 2024-25 more suitable for home buyers.

Also Read: Why is 2025 a Perfect Time to Buy a New Home In India?

Property Search

The property search involves a lot of considerations. You can mark it as the most crucial step while buying a new home. Following are the general steps involved in searching for the right property.

Choose The Right Medium For Information

You need to refer the accurate and updated information to make the right decisions. The best source is an online real estate portal that updates the content in real-time and gives a realistic outlook of the properties.

Also, give preference for those mediums that offer features that simplify the process of viewing, comparing, and buying properties online.

The other sources could be the real estate agents or brokers that provide the required information. It is important to note that the agents or brokers charge a fee. The best approach is to choose a platform that provides accurate information and guidance with a no brokerage policy.

Choose the Best Location

Deciding on the right location is the most important decision that you need to take in the home buying process. This is because the location decides the ease of living and the return on the investment on the property.

Therefore, while deciding the locality, you need to consider two important sets of factors.

- Factors That Decide Ease of Life

- Real Estate Factors

Factors That Decide Ease of Life

The factors that decide the quality of life in a particular location are-

- Quality Healthcare

- Quality Education

- Proximity to workplace

- Less polluted area

- Accessibility to large green areas

People living in the top metro cities in India such as Mumbai, Chennai, Pune, Bangalore have given preference to the locations which have accessibility to the large open area, good quality of air, and proximity to the employment hubs.

Real Estate Factors

Real estate factors define how property prices will increase over time. These factors are often related to the development of the locality which in turn results in property price appreciations.

Following are the important real estate factors you need to consider while selecting the locality-

- Property price trends in the locality

- Future Scope For Development

- Upcoming Infrastructure Projects

- Government Policies

- Commercial Development

The best locations for real estate in India have a complete balance between the quality of life and real estate factors.

Shortlist and Compare the Real Estate Projects

Finalizing the location first narrows down your property search significantly. And the next step is to find, compare, and shortlist the real estate projects in the finalized location.

Choosing the right builder is crucial while buying a home. Here are the points that can help you out to choose the right builder.

- The Quality of the Real Estate Projects Delivered

- Past Track Record

- Experience of The Builder

- Approvals and License

- Number of projects Delivered

- Number of Ongoing Projects

- Structural Quality

- Affordability Factor

- Delivery Timelines

- Post Sales Services

While buying a new home you should compare the real estate projects on the basis of the right parameters. While doing the comparative analysis of the projects all the possible parameters should be considered.

Here are the key points that will help you to shortlist and compare real estate projects.

| Parameter | |

|---|---|

| Location of the project | Check Proximity to the Social Infrastructure while comparing. |

| Carpet Area & Built-up Area | More Carpet Area and Super Built-up Area gives More features. |

| Amenities | While comparing the projects consider the amenities such as Gym, Swimming Pool, Kid Play Area. |

| Facilities | Give preference to the project that provides Facilities such as Parking, Power Backup, Safety, Security. |

| Prices | While comparing on the basis of prices, consider all-important points- Location, Areas, Amenities, Facilities, etc |

| Construction Quality | Get the construction details from the developer and compare the shortlisted projects. |

| Builder Reputation | Consider the builder’s reputation and track record before finalizing the real estate project. |

Property Related Document Verification

After the comparative analysis of the real estate project, you can have a detailed outlook on the shortlisted property. In this stage, you need to do important verifications, quality inspections, and legal documentation checks.

Following are documents to check before buying a new flat-

| Documents To Check | |

|---|---|

| RERA Approvals | RERA registration of the developer ensures the accountability and ethical practices |

| Occupancy Certificate | This certificate is given by the government body to the builder by checking the suitability of the real estate project for the occupancy |

| Commencement Certificate | A completion certificate is an important document given issued by the local authorities to start the construction work. |

| Encumbrance Certificate | An encumbrance certificate ensures that property is free from legal or monetary issues. |

| No Objection Certificate | No Objection Certificate is required from the various departments such as Environment Board, Forest Department, Pollutions Control Board, Sewage Department, etc. |

“The Real Estate Regulation is the governing body that safeguards the interest of the home buyers. RERA has maned it mandatory for the developers to provide all the documents and details to the property buyers for checking and verification. “

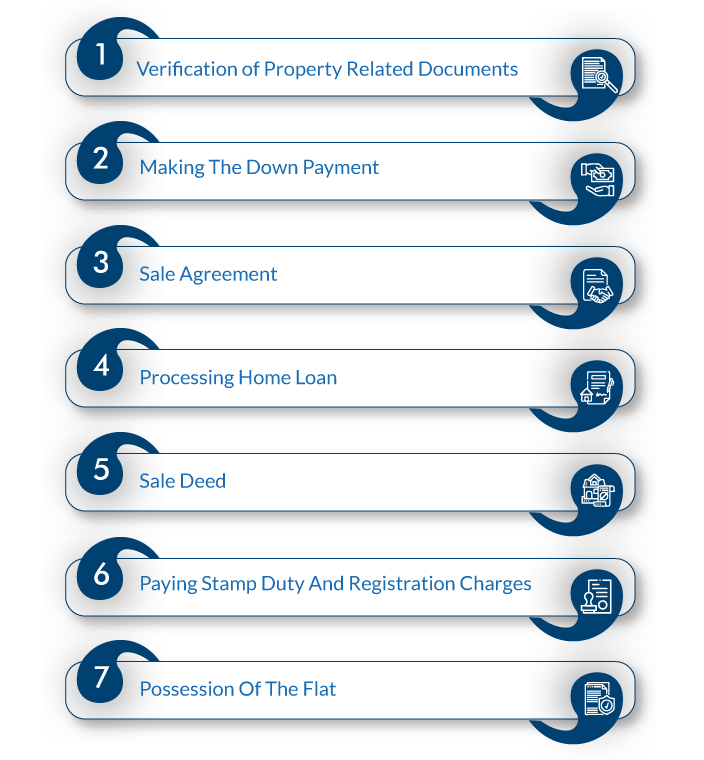

The Home Buying Process

As a first-time home buyer in India, you need to know the complete process involved in buying a property. This helps you to streamline the buying process and make the right decisions at the right stage.

The process for buying under construction and ready to move in property is slightly different. Here is the complete process for buying an under-construction property.

Buying Process for Under Construction Property