Disclaimer: With 11+ years of experience & expertise in the real estate industry, Homebazaar provides end-to-end property-buying solutions. Hundreds of 100% verified RERA-registered residential & commercial properties are listed on our website. We provide facilities like Zero brokerage, 360° virtual street view, effortless site visit services, end-to-end property buying agreements & documentation guidance, and low-interest home loan assistance. This helped us gain the trust of 1,25,000+ clients across India & sold 9,500+ homes of top reputed developers while saving Rs. 210+ Crores of brokerage.

Being a symbol of status and financial security, homebuying is one of the vital aspects in everyone’s life. Homebuying is a tenacious process for first time homebuyers that requires thorough research, budget planning, financial analysis, documentation work, loan processing, property visits, inspections, and more.

Read further to get a better understanding of the entire homebuying process. It presents several steps and important tips to facilitate your property ownership.

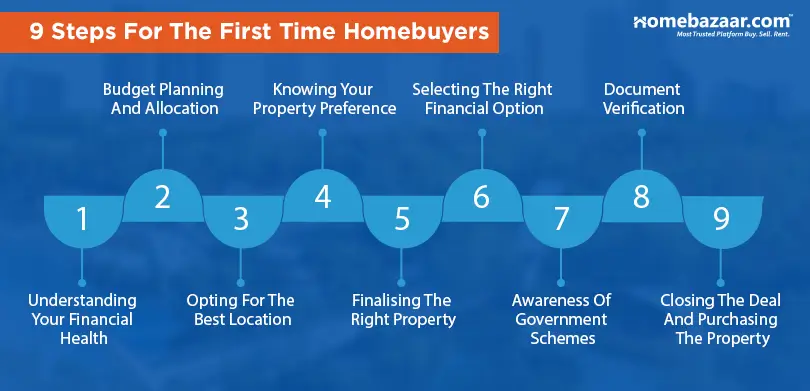

Starting from the financial planning and arranging the finance to finally purchasing the property, the homebuying process involves various steps. Each step should be properly met. Fulfilling the necessary requirements ensures faster home ownership without any financial burden or non-compliance.

Starting from the financial planning and arranging the finance to finally purchasing the property, the homebuying process involves various steps. Each step should be properly met. Fulfilling the necessary requirements ensures faster home ownership without any financial burden or non-compliance.

Page Contents [hide]

Understand Your Financial Health

While planning for a home, you must analyse your current financial status and whether it is feasible to purchase the property at the moment. This is the foremost step, as your homebuying journey should be backed by financial stability. Without sufficient financial backup, you cannot purchase or even rent any property.

How to do your financial analysis?

Financial analysis is a complete understanding of your financial status, ongoing market conditions, and future predictions. It also involves assessing potential risk factors.

What aspects are included in financial analysis?

Financial analysis includes current savings, income level, additional income, debts, investments, ongoing loans, emergency funds, and credit score. You must also consider the potential return on investment value of a certain property.

How analysing your financial health help in homebuying?

Setting clear financial goals is necessary to meet the financial requirements in homebuying. It also helps in mitigating the potential risk and uncertainty in the economic dynamics.

Tips In Financial Assessment:

- Ensure you have sufficient backup and income stability to fund EMIs and other related costs.

- Consider all relevant costs other than EMIs, such as tax deduction, processing fees, stamp duty and registration fees, etc.

- Avoid or postpone homebuying if you have higher debts at the moment.

- Make sure to have a strong backup or emergency corpus in the case of market unpredictability or delay in possession.

- Focus on enhancing your savings and controlling your expenses.

Note:

Homebazaar serves homebuyers searching for flats in India with end-to-end services like site visits, and lower-interest home loans to property registration guidance. We provide the best price options & offers for 1 to 4 BHK RERA-registered flats, villas & penthouse properties in India. To begin a smooth homebuying journey with us, fill out the form mentioned below or on the right side.

Budget Planning and Allocation

Homebuying is a huge financial commitment, and thus, you must have a well-planned budget for it. It is necessary to plan and allocate your budget according to your requirements. Plan and decide how much of your funds can be dedicated to a down payment, EMIs on loan, and other related costs involved in homebuying.

Homebuying is a huge financial commitment, and thus, you must have a well-planned budget for it. It is necessary to plan and allocate your budget according to your requirements. Plan and decide how much of your funds can be dedicated to a down payment, EMIs on loan, and other related costs involved in homebuying.

What is budget planning in homebuying?

Budget planning in homebuying includes assessment of ongoing expenses and monthly income and setting clear targets for monthly savings. Allocation of funds across expenses should be well-defined and fixed.

Can a credit score impact the budget for homebuying?

Yes, credit score is the vital factor that determines the fund allocation. You must duly pay your debts to maintain your credit score. A healthy score helps in the approval of the maximum loan amount to fund your property investment.

What should be considered when allocating funds for homebuying?

Apart from the downpayment and monthly installments, homebuying also incurs various costs such as maintenance, amenities, stamp duty and registration fees, processing fees, agent brokerage if present, and more.

How to plan for a loan while homebuying?

You must be prepared with an estimated loan amount before purchasing a property. First, set your down payment amount. The more amount you pay for down payment, the less you have to borrow. Be sure to repay debts or keep them at a minimum while opting for a home loan.

Tips For Proper Budget Planning

- For a proper fund allocation, control impulsive expenditures.

- Keep track of income, expenses, and savings.

- Get your loan preapproved before purchasing the property.

- Take into account all costs associated with the loan, such as EMIs, interest rates, processing fees, taxes, late charges, etc.

- Interest rate keeps fluctuating. So, keep a share of sufficient funds in case of a rise in interest rates.

- Be prepared for any upfront costs to prevent financial strain.

Read more: Financial Planning For Buying A House

Opting For The Best Location

Prime location offers better infrastructure, excellent connectivity options, projects by renowned developers, proximity to commercial hubs, vibrant social lifestyle, and a safer neighbourhood. Thus, choose the location of your property wisely. A well-developed location has great potential for price appreciation and convenience.

Prime location offers better infrastructure, excellent connectivity options, projects by renowned developers, proximity to commercial hubs, vibrant social lifestyle, and a safer neighbourhood. Thus, choose the location of your property wisely. A well-developed location has great potential for price appreciation and convenience.

Why is an underdeveloped location not profitable for purchasing a home?

An underdeveloped location costs you more on daily transportation and basic necessities. Though these locations offer comparatively affordable properties, they lack the comfort and convenience of the prime city centres.

How to choose the perfect location for your home?

Know whether the location you are looking for has a railway or metro station nearby. The location must also have an advanced social infrastructure, such as educational institutions, hospitals, malls, business landmarks, restaurants, etc.

What is the best location for your home?

The location that has a safe neighbourhood, cleaner environment, proximity to schools and workplaces, emergency services, nearby connectivity options, and ambitious infrastructure is ideal for your home.

Is it important to select the right location for your home?

Yes, it is important to choose the location for your home wisely as it determines the future value of your property. A location with excellent infrastructure and ongoing developments will result in remarkable price appreciation. Moreover, such location is mostly near workplaces that lays an opportunity for rental income.

Tips For Selecting The Best Location

- From basic needs of groceries to having proximity to prominent business landmarks, an ideal location meets these requirements.

- Check the location’s accessibility to your workplaces, which should not be lengthy.

- Select a location with ambitious ongoing developments like major flyovers, metro stations, railway extensions, etc. This will increase the resale value of your home.

- Check the crime and pollution rates of the location for a safer and healthier lifestyle.

- Select a location that has a stable demand for assured returns on investment.

Knowing Your Preferences

Before looking out for properties, analyse and finalise your preferences regarding the same. If you are only looking for a comfortable living space at an affordable price, then a flat in a standalone building is ideal for you. However, if you prefer a premium and exclusive lifestyle with in-house amenities, then opt for a gated community. Setting clear preferences helps you to find out the best-suited property.

Type of Home

Villas, Bungalows, Penthouses, Apartment Buildings are the common type of residential properties to buy in India. Selecting the right type of property first allows you to decide the budget and all the other things that you need to consider in the home buying process.

Size and Configuration

The size and configuration of the home depend on the needs of the family. Meaning, if you have a joint family, it is ideal to go for a spacious 2-3 BHK configuration. Whereas if you are a single or a married couple then 1-2 BHK unit might suffice the need.

Amenities

Amenities are additional facilities provided for extra living comfort. The modern-day amenities include a swimming pool, gymnasium, kids’ play area, sports club, etc. There might be fees associated with certain lifestyle amenities. The best approach is to list out the necessary amenities and less important amenities for you.

Nearby Social Infrastructure

Proximity to the Social infrastructure is important for buying a home. The proximity to quality healthcare services, educational institutions, and retail outlets decides the ease of living in a particular area.

But you can further prioritize which essential facility is the most important for you. And take the home-buying decisions accordingly.

Possession Time

If you want to avoid rental spending, you can go for the ready-to-move properties. On the other hand, if you want time to get ready for the financial demands of buying a new home, you can go for the under-construction properties.

How can you know the right property type?

Knowing your need for space determines the property type. If you have a smaller family and are looking for a reasonable apartment, then a 1 BHK flat is the best option. Those with larger families and a flexible budget can choose 3 BHK or 4 BHK flats. If you wish to customise and design your home, you can opt for bareshell units or even a plot.

What are the factors that can influence your property preferences?

Numerous factors like the size of the property, reputation of the builder, availability of the amenities, proximity to the roadways or railway stations, economic status, and family size influence your property preferences.

Which property should I prefer if I have urgency?

In the case of urgency, you must opt for a ready to move property rather than under-construction ones. These properties cost more than the under-construction properties. If your budget is insufficient at the moment, then you can look for rental options.

Do personal factors impact property preferences?

Personal factors such as the age group of your family member, functionality, cultural background, lifestyle status, and future prospect of career can drive your property preferences.

Tips For Choosing The Right Property As Per Your Preferences

- Select the preferred configuration as per your family size and needs.

- While choosing the property, check whether the size, layout and direction are as per your preferences.

Finalising The Right Property

Choose the right medium for searching the property. Look for reputable websites or consult a real estate expert. Explore various property options and choose the one that suits your requirements, such as location, transportation, and public utilities. Ensure the project is RERA-registered and developed by a trusted developer for high quality, commitment, and timely deliveries.

What is the vital factor while selecting your home?

The most vital factor while selecting a home is its location. The quality of life and the return value of your property are defined by the location.

What are the things you should check when selecting a property?

While finalising the property, you should check the builder’s reputation, encumbrance certificate, inspect the property, and the surrounding to avoid any discrepancies in the future.

Tips For Finalising The Right Property

- Research and study the builder and its track record of project deliveries.

- Use online credible sources for property listings. Homebazaar.com is a dedicated platform with an array of property listings from mid-range to ultra-luxury segments.

- Always select a RERA-registered project to purchase your home.

- Getting the right real estate consultants will be beneficial. Also, be aware of their charges.

- You should never fail to inspect the property thoroughly and from time to time.

Also read: Top 7 Tips For Buying A House At A Young Age In 2025

Selecting The Right Financial Option

Choosing the right financial source for your property will ease your homebuying process. Before site visits, get prepared for your loan approval. Make sure to arrange all necessary documents and get your mortgage pre-approved. Your EMIs will vary based on the loan type, interest rate, loan amount, tenure, applicable taxes, and processing fees. Thus, select your financier consciously.

Choosing the right financial source for your property will ease your homebuying process. Before site visits, get prepared for your loan approval. Make sure to arrange all necessary documents and get your mortgage pre-approved. Your EMIs will vary based on the loan type, interest rate, loan amount, tenure, applicable taxes, and processing fees. Thus, select your financier consciously.

Why should you get your loan pre-approved while homebuying?

Getting your loan pre-approved gives you a clear understanding of your budget. This will filter out the most suitable housing options for you and also act as solid proof for your property purchase to negotiate on better terms.

What costs are included in the monthly mortgage payment or EMIs?

EMIs include several other costs such as the interest on the amount, processing fee, applicable government taxes, etc. The rate of interest and tax slabs keep fluctuating hence, you must be well-prepared for such upfront costs.

Tips For Selecting The Right Financial Option:

- Study various lenders and choose the one with a suitable loan tenure and interest rate.

- Make sure to check the credibility of the financial institutions.

- Keep your downpayment higher to keep your EMIs lower.

- Keep your real estate consultant as a mediator for better negotiations.

- Get your necessary documents ready for quick processing.

- Always keep your credit score high to get the maximum loan amount.

- Always read all the rules, terms, and conditions for the loan repayment.

Awareness of Government Schemes

Having awareness and understanding of government schemes will assist you in your homebuying process. The state government has introduced several schemes and tax concessions to support homebuyers. The PMAY scheme offers tax benefits and concessions on interest rates for first time homebuyers. Government organisations such as MHADA, CIDCO, and DDA offer affordable housing options through a lottery system.

What is the government scheme for home loan subsidy?

Pradhan Mantri Awas Yojana (PMAY) provides subsidies on a home loan for first time homebuyers in India. This scheme is only applicable for those who do not own any property in any part of India.

Who is eligible for the benefits of the PMAY scheme?

The PMAY scheme is applicable to only first time homebuyers coming under the Lower Income Group (LIG), Economically Weaker Section (EWS), and Middle Income Group (MIG).

What are the benefits of the PMAY scheme?

First time homebuyers can get subsidies on the rate of interest and tax benefits for up to 20 years or up to the loan tenure, whichever is earlier.

Is a female owner necessary for the PMAY scheme?

Yes, female ownership is necessary for the application of the PMAY scheme and it also provides a subsidy up to ₹2.67 Lakhs on the home loan.

What is the income limit for availing the subsidy under the PMAY scheme?

The income limit should be up to ₹ 18 Lakhs to avail the benefits of the PMAY scheme.

Tips To Get The Benefits Of Government Schemes:

- Get your loan pre-approved before applying for the PMAY scheme.

- Make sure you have not availed any government scheme for housing before.

- Research the scheme and ensure that your lender is registered under the specific scheme that you want to avail.

Documentation and Verification

Before finalising the deal and making payment for the property, make sure to read all the legal documents carefully. Check the sales agreement including the laid down terms and conditions by the developer. Check the encumbrance certificate to avoid any pertaining issues related to land ownership. Property inspection is another vital step to do before signing the purchase agreement.

| Documents To Check | |

|---|---|

| RERA Approvals | RERA registration of the developer ensures accountability and ethical practices |

| Occupancy Certificate | This certificate is given by the government body to the builder after checking the suitability of the real estate project for occupancy |

| Commencement Certificate | A completion certificate is an important document issued by the local authorities to start the construction work. |

| Encumbrance Certificate | An encumbrance certificate ensures that property is free from legal or monetary issues. |

| No Objection Certificate | No Objection Certificate is required from the various departments such as the Environment Board, Forest Department, Pollution Control Board, Sewage Department, etc. |

Closing The Deal And Purchasing The Property

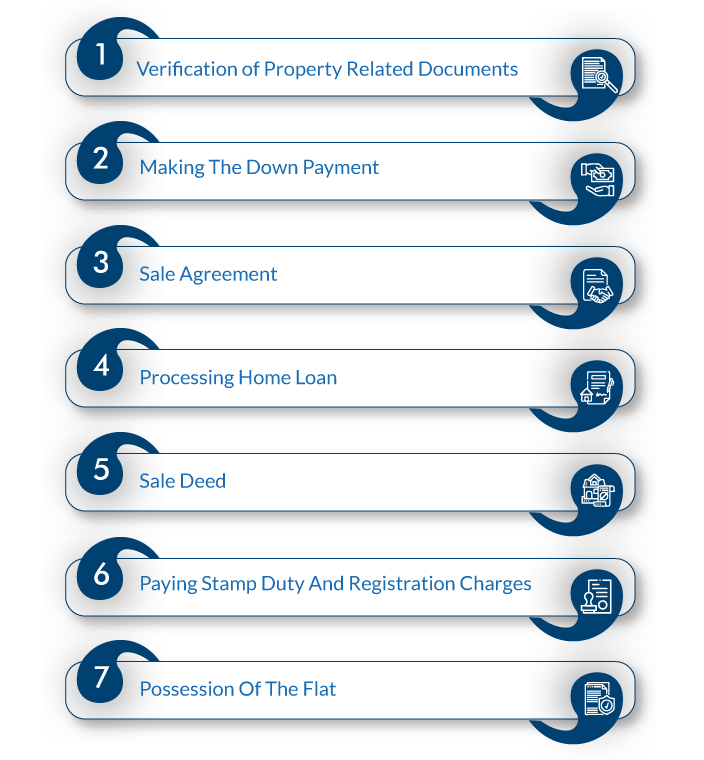

Before finally purchasing the property and signing the agreement, you should know the buying process thoroughly. Be prepared for the stamp duty and registration of your property with the necessary documents. After property registration and signing the sales deed, the property title gets transferred to your home.

Before finally purchasing the property and signing the agreement, you should know the buying process thoroughly. Be prepared for the stamp duty and registration of your property with the necessary documents. After property registration and signing the sales deed, the property title gets transferred to your home.

Tips For Closing Your Property Deal Seamlessly

- Get all the necessary documents ready before the registration process and sales deed.

- Review the sales deed thoroughly and confirm the possession timeline.

- Know the payment plan of the property for smooth payments.

- Check the maintenance costs and other relevant costs with the developer.

- Have a final walkthrough of the property to inspect any damages or poor-quality work.

- Keep all the original documents in a secured place for future reference.

The Home Buying Process

As a first-time home buyer in India, you need to know the complete process involved in buying a property. This helps you to streamline the buying process and make the right decisions at the right stage.

The process for buying under construction and ready to move in property is slightly different. Here is the complete process for buying an under-construction property.

Buying Process for Under Construction Property

Buying Process for Ready to Move in Property

Buying Process for Ready to Move in Property Myths vs Facts For First Time Homebuyers

Myths vs Facts For First Time Homebuyers

1.

Myth: First-time homebuying is a complicated and stressful task.

Fact: With in-depth research and understanding, homebuying is a simplified process with long-term financial stability.

2.

Myth: As a first-time homebuyer, a Resale property is a better option than buying a new or under-construction property.

Fact: It is always better to buy a new property. You can inspect your home while it is being constructed.

3.

Myth: Buying a new home is more expensive than buying a resale property.

Fact: Not necessary. Many affordable and flexible financing options assist in buying a new home.

4.

Myth: A Higher down payment is mandatory in homebuying.

Fact: You can take a home loan with a minimum down payment of 10%. Several financial institutions offer loans with a lower down payment.

5.

Myth: Renting is better than buying a new home. It saves money.

Fact: Renting might be better to save upfront costs; however, buying your own home results in financial security and fruitful investment.

6.

Myth: A big home is more beneficial than a small apartment.

Fact: The size of the house depends on your family size and needs. A small and well-designed home can be equally better and advantageous as the larger one.

7.

Myth: Home loans are burdensome and should be avoided.

Fact: A home loan is very helpful for investing in a property as it provides you with flexibility and allows you to smoothly manage your monthly expenses.