Disclaimer:

With 11+ years of experience & expertise in the real estate industry, Homebazaar provides end-to-end property-buying solutions. Hundreds of 100% verified RERA-registered residential & commercial properties are listed on our website. We provide facilities like Zero brokerage, 360° virtual street view, quick site visit services, end-to-end property buying agreements & documentation guidance and low-interest home loan assistance. This helped us gain the trust of 55,000+ clients across India & sold 6,500+ homes of top reputed developers.

Page Contents

- How to Calculate TMC Property Tax?

- TMC Property Tax Online Payment Process

- TMC Property Tax Offline Payment Process

- TMC Property Tax Bill Receipt: How to Download?

- TMC Property Tax Exemptions

- Are There Any Transaction Charges For Paying Thane Property Tax Online?

- Is There Any Penalty on Delay in Thane Property Tax

- TMC Property Tax Latest Updates 2025

- FAQs

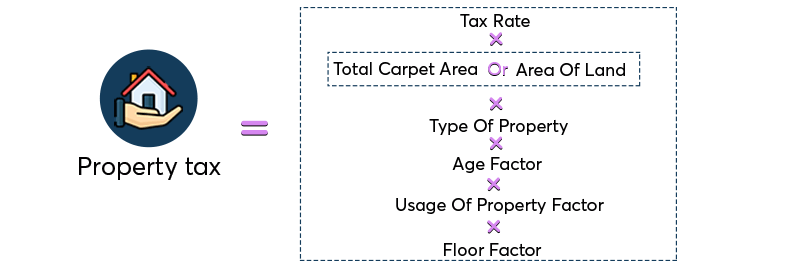

How to Calculate TMC Property Tax?

Thane is no exception to the property tax imposed by like every other city. The current property tax rate for TMC is 38.67%. There are a few factors that have to be taken into account while calculating TMC property tax.

- Location of Property

- Carpet area in total property

- Lifetime of property

- Types of property ( Number of floors in property also matters)

The property tax is calculated by the following formula,

The property tax rate is calculated separately for each specific zone of Thane and other charges are added to it for the final tax rate.

To check the TMC property tax bill amount online you can visit the official website, for the online calculation, you must register yourself first on TMC. By entering the name or code of your property, you can search for it.

TMC Property Tax Online Payment Process

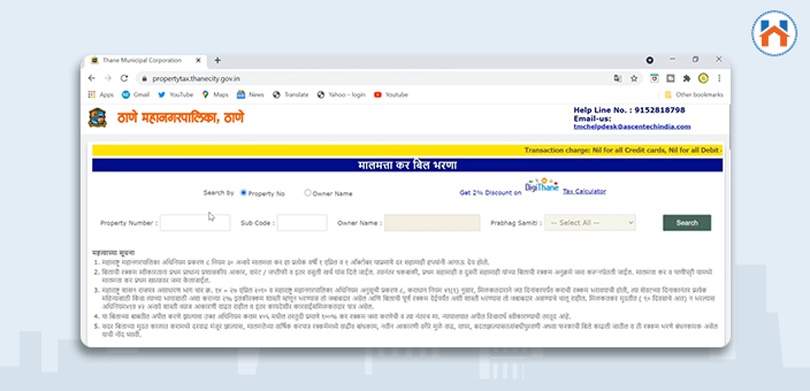

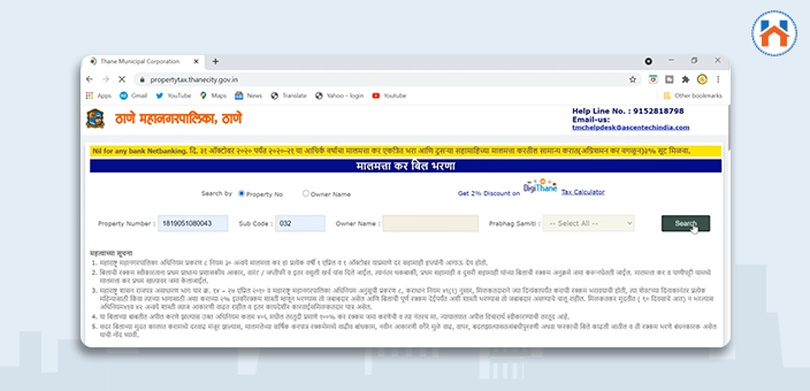

You can use the official portal of Thane Municipal Corporation to pay property tax online. Follow the process to pay TMC property tax online.

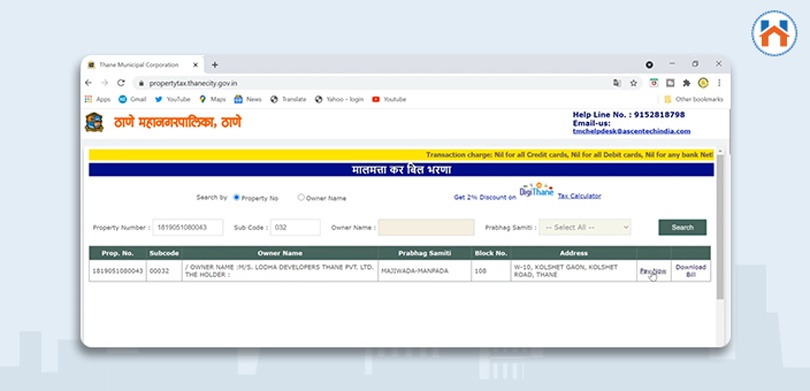

Step 1: Go to the official website https://propertytax.thanecity.gov.in/

Step 2: You can choose from Marathi or English language.

Step 3: Now enter all the required details like owner name, property number, subcode, etc.

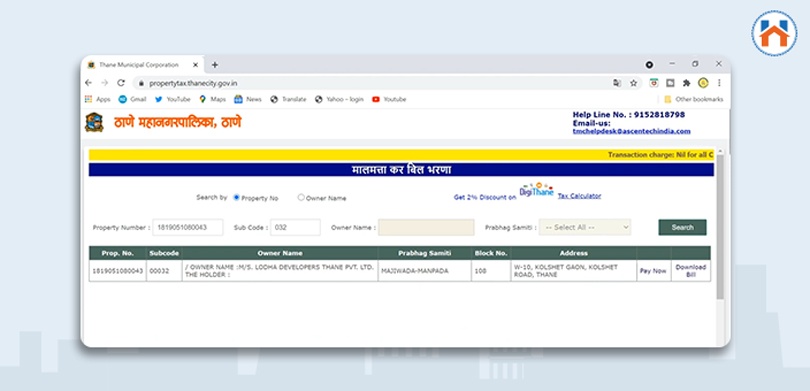

Step 4: Select Search and the property tax dues will be shown.

Step 5: You can choose from various payment modes. Once the payment is done your receipt will be generated.

Step 6: You can download the receipt for further reference.

TMC Property Tax Offline Payment Process

You can use the good old traditional method to pay TMC property tax.

Visit the Municipal Corporation of Thane (TMC) branch office and go to the tax payment counter. You will need to give all the required information to the concerned person such as property ID, and name. You can use cash or cheque or debit/ credit card mode for payment. Ask for the receipt after successful payment.

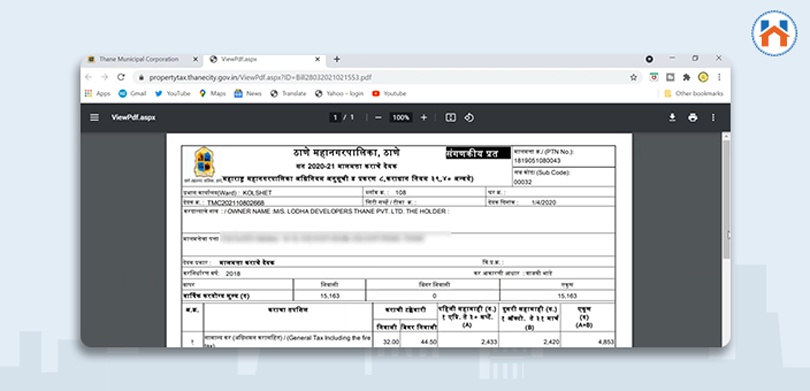

TMC Property Tax Bill Receipt: How to Download?

Property tax payment bill receipt is important for record keeping. After the completion of payment, you can see the generated receipt. To download the receipt, select the option download on the page. You will get your TMC property tax bill receipt.

TMC Property Tax Exemptions

The people who pay property tax before the due date can avail 2-3% refund by TMC.

Furthermore, TMC recently passed a resolution waiving off property taxes for houses with an area of up to 500 square feet. In response to this resolution, the State Government has approved the waiver of 31% on property taxes for such flats within Thane Municipal Corporation boundaries. From April 2022 the waiver has come into action. It would cost the TMC Rs. 45 crores in revenue.

There are also Property tax deductions for certain categories such as a person with disabilities as a property owner, Senior citizens or females as a property owner, Educational institutes, and Army or Navy personnel as a property owner.

Are There Any Transaction Charges For Paying Thane Property Tax Online?

When paying TMC property taxes online with credit/debit cards or net banking, there are no transaction fees applied.

Is There Any Penalty on Delay in Thane Property Tax

Yes. After the due date, the property owner is bound to pay 2% of tax as a penalty according to the government of Maharashtra Gazette Extraordinary Part Four No. 14-27 April 2010. Until the full payment is completed, the property owner is liable to pay this penalty.

A property owner will get 90 days to pay the property tax after the penalty interest will increase and will be responsible for other legal action.

TMC will seize the property if the property owner fails to pay tax after a delayed time.

TMC Property Tax Latest Updates 2025

Within the initial 66 days of the first quarter of 2024-2025, the municipal corporation has accomplished a remarkable achievement by collecting INR 200 crores in property taxes. This surpasses the previous fiscal year’s first-time record of INR 720 crores in property tax for Thane in 2023-2024. For the ongoing fiscal year, the TMC has set an ambitious target of INR 900 crores in property tax collections.

FAQs

| What is the property tax rate in Thane?

Thane currently has a 38.67% property tax rate. |

| How do I change my name on property tax in Thane?

To change your name you must go to the office of the Commissioner of the Revenue and submit an application form along with supporting documentation, such as a NOC from the housing society, a copy of the sale deed, a receipt for the most recent payment of property taxes, etc. |

| How can I get a property tax discount in Thane?

By paying tax before the due date you can get a TMC property tax discount i.e 2-3% refund. |

| How do I check my Mumbai property tax online?

You can check property tax on portal.mcgm.gov.in. |

| What is the last date for property tax in Thane?

You can pay your property tax until July 31. |