Buying a plot offers impressive returns as compared to residential or commercial properties. Provided that there is careful consideration of the important factors that govern the property appreciation of the land. The average returns on the strategic plot investment can be between 15-20%. It can go as high as 30-35% or even more with exponential growth factors such as Commercial and industrial corridors and infrastructure development in the region.

However, there are certain challenges in plot investment. Longer investment horizons, liquidity risks, title clearances, and encroachment disputes are Some of them. But these challenges are manageable with a constructive investment strategy. The best approach is to know everything beforehand and be prepared to counter these challenges effectively in the later stages.

So, here are the top 10 things to consider before buying a plot in India in 2023.

Page Contents

- 1. Setting Up An Investment Strategy

- 2. Selecting the Type Of Land

- 3. Benefits Of Investments in Plots

- 4. Locality Analysis

- 5. Land Evaluation

- 6. Consider The Risk Involved in Buying A Plot

- 7. Important Documents To Check Before Buying A Plot In India

- 8. Loans For Buying A Plot In India

- 9. Computation Of The Capital Gain on Land Properties

- 10. Step Wise Process For Buying a Plot in 2025

- FAQs

1. Setting Up An Investment Strategy

Before buying the plot you must have a strategic aim for the investment. Owning land allows you to have multiple options for monetization. You must first explore all the possibilities and choose what works best within the given factors.

Note:

Homebazaar serves homebuyers searching for plots in India with end-to-end services like site visits, and lower-interest home loans to property registration guidance. We provide the best price options & offers for 1 to 4 BHK RERA-registered flats, plots, villas & penthouse properties in India. To begin a smooth homebuying journey with us, fill out the form mentioned below or on the right side.

Various Options After Buying a Land:

| Buying Land And Re-Selling | Here you Can buy land at a price lower than the market price and sell at a competitive price to get within a short period of time. |

| Buying a Land, Holding For Appreciation, And Selling | In this case, you buy land, hold for property price appreciation and then sell at higher rates. For this, the holding period could be more than 10-20 years. |

| Buying a Land, Developing, Selling | In this case, you can buy land and develop residential or commercial property. After the construction, you sell the entire property and get the profit. |

| Buying a Land, Developing, and Renting | In this case, you buy land, develop a commercial or residential property and rent it out. This ensures continuous cash flows and keeps the ownership with you. |

| Buying a Land, And Cultivating And Holding | This is purely for agricultural use. You buy the land, and cultivated the crop or use it for the other allied farming means. |

Now, every type of land investment mentioned above has different profit capabilities. To know what’s best for you should consider three main factors while choosing the best option.

- Total Capital Investment Required

- The Investment Horizon

- Your End Investment Goal

For example, let’s compare the two plot investment options. The first is buying land and reselling it without any construction. Second, you buy land, construct a residential or commercial property and then sell it. The first option is much simpler and involves less effort and comparatively lower investment horizons but gives you lower returns. On the other hand, buying, constructing, and reselling have high to moderate risks, longer-term horizons but give impressive returns.

Therefore an ideal approach is to align your land investment goals as per the investment capacities and the involved risks.

2. Selecting the Type Of Land

The land can be categorized as Agricultural or Non-Agricultural Land. To use the land for the Non-Agricultural purpose such as for building Residential, Commercial, or Industrial there should be a Change Of Land Use Clearance (CLU).

Let’s compare the Agricultural and Non-Agricultural Land:

| Agricultural Lands | Non-Agricultural Lands |

| The Agricultural Land investment is done for two main reasons- Holding, Cultivating and getting Profits By reselling. |

The Non-Agricultural Lands includes the construction for Residential, Commercial, and Industrial purposes. |

| Agricultural lands in remote areas have a very steady rate of price appreciation. | The residential, commercial, and industrial lands have higher chances of higher property price appreciation. |

| There are no tax concessions applicable on the loans applied for buying Agricultural Lands. | There are tax concessions applicable on the loans applied for buying the land and constructing the Non-agricultural lands. |

| The Floor Space index criteria are not applicable | The Floor space index needs to be considered before buying and constructing the properties under the Non-Agricultural Lands. |

You can buy agricultural land and later convert it into Non- Agricultural land by taking the permissions through CLU. However, The process of obtaining the CLU can take a long time and may involve legalities. Therefore it is always beneficial to have the CLU ready while buying the plot.

Floor Space Index:

The Floor Space Index (FSI) has great significance in residential as well as commercial plots. The Floor Space Index indicates the amount of construction that can be done on a particular land. The FSI index is set by the Municipal Corporation or the regional development authority. Therefore, FSI is different for different regions.

Here is an example that shows the significance of the FSI.

If the FSI for a certain region is 2 then for 1000 sq ft of the residential plot, you can construct a house/ building with the total usable area of 2X 1000 sq ft i.e 2000 sq ft. Knowing the FSI will decide the total applicability of the land and therefore has great investment significance. So, check the FSI of the particular region and evaluate the total applicability of the land.

3. Benefits Of Investments in Plots

Higher returns, flexibility, and low taxes are some of the benefits of buying plots.

- Investment in the Plots Give Higher Returns for Long Term Horizons.

- Buying land gives you flexibility in utilizing the space as per the specific investment goals.

- Commercial, Residential or Industrial properties can be built and sold, or rented out.

- The economic and commercial corridors can give higher returns.

- Lower Applicable Property Taxes.

- Almost No Maintenance Cost.

However, to realise these benefits fully all the real estate investment factors should be considered. This includes doing a complete analysis of the locations, upcoming infrastructure projects, connectivity, and market price trends, etc.

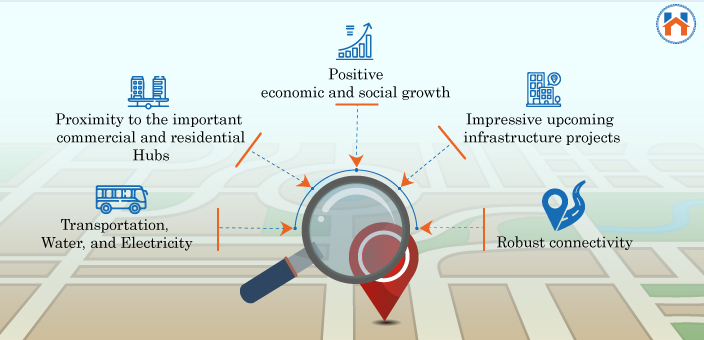

4. Locality Analysis

The locality plays an important role in the property price appreciation of the land. Buying Plots in the region where there is complete scope for future development always proves to be a good investment. Therefore it is essential to give utmost importance to the Locality while buying a plot in India.

So, here are some of the main characteristics of the ideal locality for buying plot In India-

- Easy access to the essential facilities- Transportation, Water, and Electricity.

- Proximity to the important commercial and residential locations.

- Positive economic and social growth of the region.

- Impressive upcoming infrastructure projects that boost the overall development of the locality.

- Robust connectivity options to access the developed markets.

Location viability is important for better Returns on the real estate investment. Moreover, the right location from the investment standpoint is the one where there is huge scope for development.

Investments in the already developed or established localities either pick out or remain constant. Therefore, while investing in Plots always consider the locations which are developing or at the earliest phase of the development. This will allow you to buy the plots at a comparatively lower price and with upcoming developments, the prices will appreciate.

In the case of investing the agricultural land, the consideration for the locality might be slightly different. Since the agricultural land is in Tier I and Tier II cities, the consideration of the basic facilities such as water, electricity, and transportation might be sufficient. Therefore the extent to which you consider the various points completely depends on the type of land you are buying and the end goal of your investment.

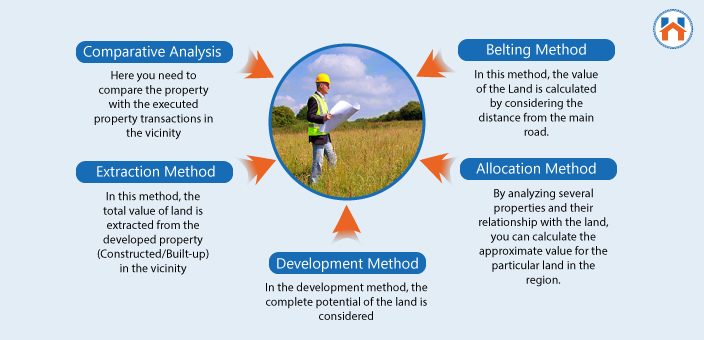

5. Land Evaluation

Land evaluation is necessary for two reasons. First, it gives clarity on the actual area and the total value of the property. Second, it gives a reference to project the returns on the real estate investment.

The property can be evaluated by methods such as-

Comparative Analysis

In a comparative method, the evaluation of the property is done by comparison. For this, the recent plot deals in the surrounding regions are considered. On the basis of this data, you can get the precise value of the particular property. Here you need to compare the property with the executed property transactions in the vicinity. There might be minor variations in the land size, features, and other qualities. Comparative analysis is considered one of the simplest and precise methods for Land Evaluation.

However, the challenge in this method of analysis is the availability of sufficient information. In cases where there are very limited deals, this method is less effective. In such a case, you must take assistance from a real estate expert.

Extraction Method

In this method, the total value of land is extracted from the developed property (Constructed/Built-up) in the vicinity. However, in this method, the value of the depreciation of built-up property needs to be considered, and therefore, this method is usually used for newly built properties.

Development Method

In the development method, the complete potential of the land is considered. For this, important factors such as Location, Use, FSI, and Features of the land are taken into account. Moreover, the upcoming commercial and industrial developments are considered and the value is projected accordingly.

The Development method is beneficial as it gives you the actual value of the property. Therefore, from the investment standpoint, it is always better to have the plot value on the basis of the Development Method.

Allocation Method

This method is suitable where the built-up property sales are high enough to provide sufficient data for the land evaluation. There is a relation between the total property built on the land and the value of the land. By analyzing several properties and their relationship with the land, you can calculate the approximate value for the particular land in the region.

Belting Method

In this method, the value of the Land is calculated by considering the distance from the main road. For this, the plot is divided into a series of belts, and accordingly to the distance from the main road the total value is calculated.

6. Consider The Risk Involved in Buying A Plot

The investments in plots need more fiance and a longer investment horizon. Therefore, it is important to consider all the risks involved in buying a plot. These risks factors can greatly impact the investment prospects.

Following are the important risk factors involves in Buying Plot-

Risks Related To Title Clearance

It is important that the seller of the land have complete ownership of the land. In many cases, the complexities of the title clearance cause dispute in the property transactions. To avoid such situations it is necessary to check the title clearance with due diligence.

Change of Land Use Clearance

To utilize the agricultural land for commercial or residential purposes there has to be valid Change of Land use Clearance. The process of changing the Land Use Clearance from agricultural to commercial or residential use takes time and effort. Therefore, it is beneficial to have all the Change of Land Clearance already at the time of buying land.

Zoning Risks

According to the master plan of the regional authority, certain plots may come under the reserved zones. These plots may not be used for any agricultural, residential or commercial purpose.

Liquidity Risk

Investment in the plots has liquidity risks. Meaning, It restricts you from quickly in-cash the investments. The investment in plots should is done by considering the longer investment horizons.

No Continues Cash Flows

In the case of investment in lands, there is no rental income or continuous income. The only way to get the returns is to hold the property, wait for the appreciation and sell it at the right time. So, by considering the longer investment horizons, the finances should be managed accordingly.

Longer Investment Horizons

For better returns, investment in plots needs longer Horizons. Buyers need to wait for the several years till he gets the right target appreciations. The property price appreciation depends primarily on regional development, infrastructure projects, and so on. This can take considerable time, resulting in longer investment horizons.

Encroachments

Encroachment and the disputes related to it are frequent in the case of land properties. This is especially applicable for the open lands which do not have any construction or regular use.

7. Important Documents To Check Before Buying A Plot In India

Title Deed

Title Deed indicates the legal ownership of the land. It is one of the important documents that you need to check while buying a plot. Also, duly check whether the title deed is stamped and registered at the registrar.

Encumbrance Certificate

Encumbrance Certificate indicates that the land is free from legal as well as financial liabilities. Encumbrance Certificate shows the previous property transactions. If there are no encumbrances, form 15 is issued whereas in case of no encumbrances form 16 is issued.

It is a mandatory document for real estate transactions. It is extremely important in the plot buying process as it gives a clear idea of the litigations related to the plot. Check Out: Kaveri Online Services: How To Apply For Encumbrance Certificate Online

Property Tax Receipt

Checking the Tax Receipts confirms the ownership of the property as well as gives clarity if there are any tax dues on the land property.

NA-Orders

Without NA-orders the agricultural land cannot be used for commercial or residential purposes. RERA has made it mandatory for the land property seller to disclose the NA-order if the land is used for residential or commercial purposes.

Local Body Approvals

It is important that the local government body gives approval to the plot. The approval suggests that the plot does not come into the government master plans and can be owned privately.

Release Certificate

This certificate gives the confirmation that the property is free from bank liabilities. A release certificate is important as it gives assurance to the buyers as there are no dues pending.

Stamp Duty and Registration

The previous owner of the property must have done all the formalities related to the Stamp Duty and Registration. Ensure that the title deed is registered at the registrar.

8. Loans For Buying A Plot In India

Banks and financial institutions sanction the Loan for buying the plots. Land Loan and Land plus construction loans are the two loan options you get. Generally, the maximum repayment tenure for the plot loans is 25 years. However, the land loan is sanctioned only within the municipal limits or outside the municipal limits if the allotment is done by the regional development authority.

Important Points For Loans For Buying Plot-

- The interest rates for Plot loan is almost equal to the home loans. However, some banks and financial institutions set higher interest rates for Land Loans.

- The LTV (Loan To Value Ratio) is considerably lower- Which is 70% of the property value.

- The Loan Tenure for buying the plot is lower.

- The tax Benefits on the principle amount under the 80C and o the annual interest payable as per 24 (b) are applicable only if the home is constructed on the plot. No tax expectation is applicable for the plot loans.

- There is a 2-4% prepayment penalty applicable on the prepayment of the loan.

Some of The Important Tips For Buying A Plot

Get The Construction Loan

The construction loan allows you to get the loan for the land as well as the construction. Construction loans are considered easier to obtain and help to realize the property price appreciation fully.

Large Down Payments

Making the higher Down payment increases the chances to get the land loan approved. This also ensures the lower EMIs and the net applicable interests are comparatively lower. Generally, the banks or financial institutions need at least a 20-30% down payment for the land.

Great Credit Score

Having a credit score between 700-900 is essential to obtain land loans. A credit score is a number between 300-900 which suggests the repaying capacity of the borrower. It takes into account the entire repayment history of the borrower and accordingly gives indications to the banks or the financial institutions on sanctioning the land loans.

Income and Debt Ratio

As a thumb rule, the EMI should not be more than 40% of your monthly income. Banks also consider this while leading the loans. Therefore for a better repayment structure, you should keep the EMISs below 40% of monthly income.

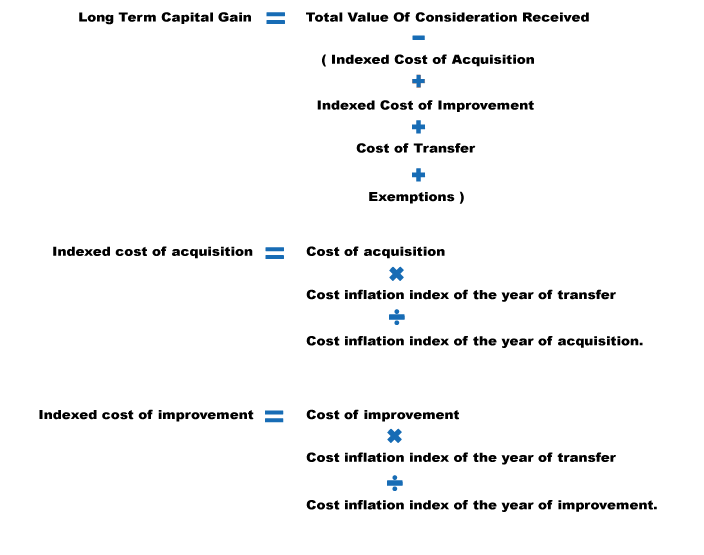

9. Computation Of The Capital Gain on Land Properties

The investment in the Land property is a longer-term investment. As there is a considerable amount of time is required for the land property to appreciate.

So, therefore, the long-term capital gain is applicable in the case of Land Properties. Long term capital gain can be calculated as-

Therefore the capital gains on the land properties depend on the following important factors-

- Purchase Price

- Selling Price

- The Hold On Period

- Land Valuation

Tax Exemptions on the Capital Gains on The Land Properties

Under Section 54 EC and Section 54F IT Act the tax benefits can be availed on the sale of the land properties.

Exemption Under Section 54 EC can be claimed by investing the capital gains on the Rural Electrification Corporation (REC) or the National Highway Authority of India (NHAI).

Also, The exemptions under section 54F you need to invest the all the net amount in-

- The purchase of residential properties within 1 year or two years after the date of original documents

- New construction of the residential property within 3 years after selling the land.

10. Step Wise Process For Buying a Plot in 2025

Step 1: Research

In this stage, you consider all the aspects involved in the investment in the plot. This involves considering the following important factors:

- Market Price Trends

- Other Real Estate Deals in The Vicinity

- Locality Research

- Growth Prospects

- Possible Returns On Investment etc.

Step 2: Property Search

You can find property-related information through Brokers or Real Estate Portals. Ensure that the information you are referring to is valid and take the decisions accordingly. The best way to compare the properties online is to use the real estate portal that has the latest digital features and provides no brokerage policy to the property buyers.

While searching the property, buyers should consider all the analyses done in the first research stage.

Step 3: Documents Check

Checking the documents is crucial while buying the land. It involves high financial involvements from the buyer for longer investment periods. So before finalizing on the land property deal check all the essential documents which including, the encumbrance certificates, NA orders, CLU certificates, title deeds, etc

Step 4: Sale Agreement

After the negotiation, the sales agreement is prepared. The buyer has to pay the advance of 10% of the agreed price. The sales agreement has all the details related to the terms and conditions, agreed price, default penalties, and important payment terms.

Step 5: Sales Deed

The buyer has to make the complete payment usually within 2-3 months The sales deeds need to be registered at the sub-registrar office along with stamp duty and registration charges.

FAQs

| Why Investment in a Plot in India is a good idea? Investment in Plot offers benefits such as higher returns, flexibility, lower maintenance cost, etc. However, a successful investment in plots comes down to the important factors responsible for the property appreciation which includes Locality, Growth of The Region, Commercial and Social Development. |

| What Is Floor Space Index (FSI)? The Floor Space Index indicates the amount of construction that can be done on a particular land. The FSI index is set by the Municipal Corporation or the regional development authority. |

| What Are the Different Methods Used for the Land Evaluation? Various methods used for the land evaluation are- Comparative Method, Extraction Method, Development Method, Allocation Method ad Belting Method. |

| What Are Important Documents To Check Before Buying a Plot In India? Title Deed, Encumbrance Certificate, Property Tax Receipt, NA-Orders, Local Body Approvals, Release Certificate, Stamp Duty, and Registration. |