Page Contents [hide]

- What is Capital Gain Tax?

- What is the 2023 Capital Gain Tax Rate?

- How Much is The Capital Gain Tax On Residential Property In India?

- How is Capital Gain Tax Calculated on the Sale of Residential Property in India?

- How Can I Avoid Capital Gains Tax on a Home Sale in India?

- How to Save Capital Gain Tax on The Sale of Residential Property in India?

- Do I Have to Pay Capital Gain Tax Immediately?

- Property Sales And Capital Gain Tax: Things Sellers Need to be Aware Of

- FAQs

What is Capital Gain Tax?

When you sell your property for more than its actual purchase price the returns are known as capital gains. On these profit returns, there is a tax applied by the government which is called a capital gains tax.

When you sell your property for more than its actual purchase price the returns are known as capital gains. On these profit returns, there is a tax applied by the government which is called a capital gains tax.

Jewellery, Stocks, bonds, valuable metals, and real estate are examples of capital assets subject to taxation.

Depending on how long you had the asset until selling it, you’ll either pay tax on the capital gains tax or not. Long-term and short-term capital gains are categorised and taxed differently.

The short-term capital gain occurs when a capital asset is sold after less than a year of ownership; this gain is taxable as normal income.

Although you may have heard, capital gains are not usually treated more favourably than other forms of income. It depends on how long you possessed such properties before you sold them.

Selling assets that have been owned for more than a year results in long-term capital gains, which are taxed at a rate of 0%, 15%, or 20%.

What is the 2023 Capital Gain Tax Rate?

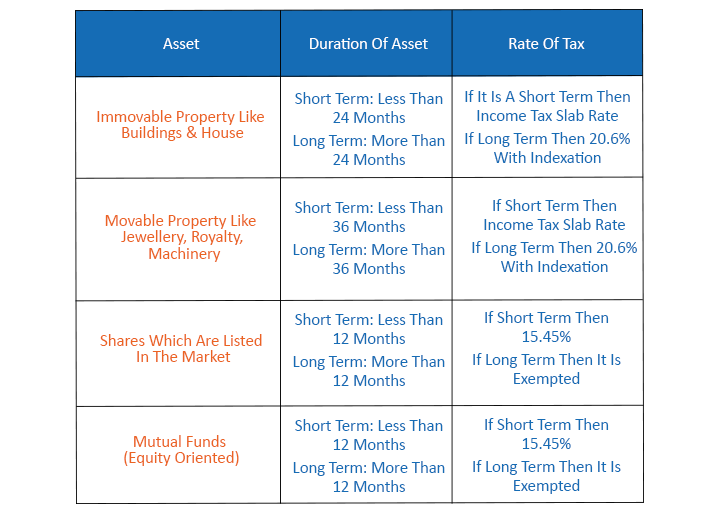

The 2022 capital gain tax rate is given in the following table,

How Much is The Capital Gain Tax On Residential Property In India?

The current capital gain rate of tax on residential property is 20% plus cess and surcharge.

The current capital gain rate of tax on residential property is 20% plus cess and surcharge.

However, an inherited property is not subject to tax implications. For instance, until the heir chooses to sell the property, ancestral property acquired as a gift from a family member is not taxed.

If the person sells the property, the long-term capital gain will be taxed in compliance with the same regulations that apply to other properties.

How is Capital Gain Tax Calculated on the Sale of Residential Property in India?

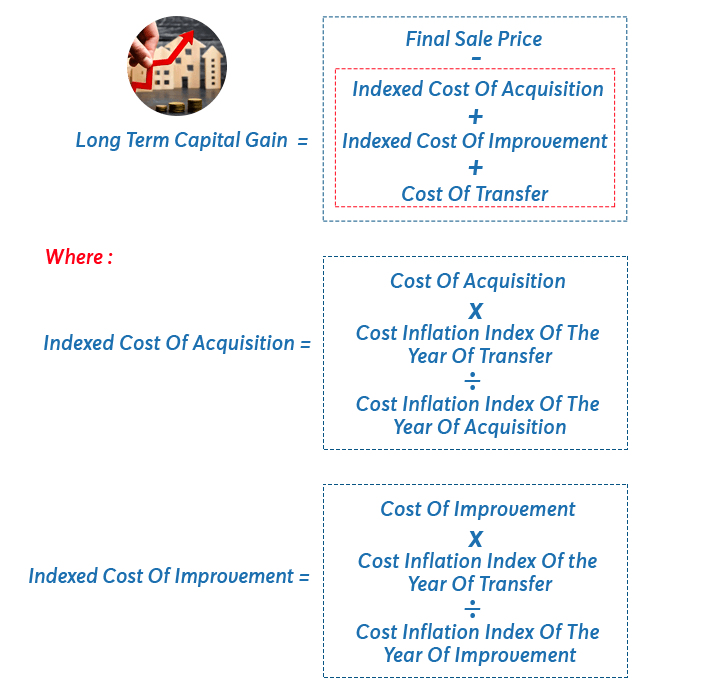

The property gain tax calculated for the sale of residential property is based on the important factors which are the final selling cost of the property, price of acquisition ( it is the asset’s value at the time the seller purchases it), improvement costs (costs a seller generates when modifying or enhancing a capital asset), Cost made during the transfer of property like registry charges, Cost of Acquisition Indexed and Improvement Indexed Cost.

The duration for which a property has been owned also affects how capital gains are calculated.

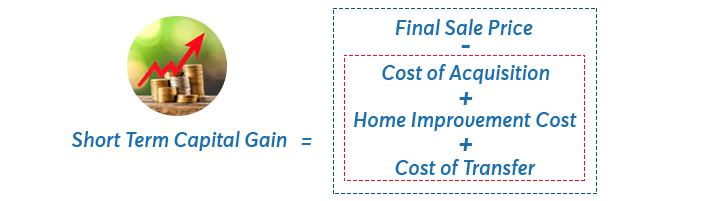

The formula for capital gain tax calculation for residential property for Short-term duration is as follows,

Short-Term Capital Gain

The formula for capital gain tax calculation for residential property for Long-term duration follows,

Long-term capital gain

How Can I Avoid Capital Gains Tax on a Home Sale in India?

How Can I Avoid Capital Gains Tax on a Home Sale in India?

One of the common questions that come to property owners’ minds when they decide to sell a property is how to avoid capital gains tax on home sales.

The answer to this question is by making a bond investment after six months of selling the property and collecting the profits.

How to Save Capital Gain Tax on The Sale of Residential Property in India?

At first glance, the gains you could realise from investment in real estate could seem promising. But if you look at the taxes on capital gains then that happiness fades away.

Here are ways from which you can save or reduce capital gain tax on residential property in India,

- Try to keep your property for more than a year. The profit from selling an item you’ve owned for less than a year is regarded as a relatively short capital gain and is subject to the Income tax slab rate. After more than a year of ownership, you can sell the same asset for a profit categorised as a long-term tax for capital gain, subject to a substantially lower tax rate of 20%.

- Manage to keep a record of all the maintenance and home improvements of the property. The foundation you have in the property can increase as a result of renovations or house repairs made over time, which can raise the property’s worth and result in less capital gain when you sell. To lower the amount of Capital Gain Tax you must pay, you can also deduct the costs related to the property being sold.

- You can put your gains in “Capital Gain Bonds” according to Income Tax Act per Section 54 EC if you do not wish to build another residential property with the capital gains from the selling of your current one or reinvest them into one.

- Another strategy which you can use is selling the property when your income is low. Your taxable income rate, which is established based on your income, determines your Capital Gain Tax rate. If at all possible, planning the timing of the transaction could reduce your tax liability. This is not a practical choice because, ideally, you’ll be enjoying a prosperous year when you wish to sell your investment.

Do I Have to Pay Capital Gain Tax Immediately?

Capital gain tax is not due until the investment is sold. This means if you decide to sell your residential property then after the complete selling procedure capital gain tax is applied.

The tax paid is equal to the profit, or capital gain, you realised between the price at which you bought the stock, real estate, or other item and the price at which you sold it.

Property Sales And Capital Gain Tax: Things Sellers Need to be Aware Of

- If you have invested in some residential project in Mumbai and for some cause, the possession is delayed then also you can still be able to claim an exemption under various provisions of the tax code.

- State government officials have established a minimum value below which a house cannot be registered. Even if you decide to sell the house for less, it will still be registered at the minimal registration value permitted in that region. Depending on the property’s valuation as established by the sub-office, the registrar’s total tax obligation will be calculated.

- The profit from the purchase will be classified as LTCG or STCG & taxed following the holding term. The exceptions under Sections 54 and 54EC will also be applicable.

FAQs

| Do you have to pay capital gains within 30 days?

According to existing regulations, taxpayers have up to least 22 months to file their taxes and pay the CGT before the self-assessment date of January 31 following the taxation year during which the disposition is made. |

| How long do you have to keep the property to avoid capital gains tax?

When this is the case, the time spent using the property as a primary residence is exempt from capital gains taxation, like the last 18 months of possession, whether or not the property is used as a primary residence during that time. |

| Do you pay capital gains tax if you have lived on the property?

You should not be liable for capital gain taxation if you choose to sell your primary house as long as you live there and haven’t rented it out or been used exclusively for commercial reasons. You must have resided in your house for the whole period you owned it to qualify for private residence relief, which exempts you from capital gains tax. |

| Do you pay capital gains on your main property?

If your home has been your primary residence for the entirety of the ownership period, you typically are not required to pay capital gain tax (CGT) on any profit when you sell. |

| What happens if you don’t pay capital gains tax?

The IRS does have the right and frequently does impose penalties and fines for your carelessness. They can pursue criminal prosecution if they can show that the action was deliberate, fraudulent, or intended to avoid paying the appropriate taxes. |