Disclaimer:

With 10+ years of experience & expertise in the real estate industry, Homebazaar provides end-to-end property-buying solutions. Hundreds of 100% verified RERA-registered residential & commercial properties are listed on our website. We provide facilities like Zero brokerage, 360° virtual street view, quick site visit services, end-to-end property buying agreements & documentation guidance and low-interest home loan assistance. This helped us gain the trust of 55,000+ clients across India & sold 6,500+ homes of top reputed developers.

Page Contents [hide]

What is Will Deed Meaning?

A will deed is a legal document that, following the death of the testator (the person who makes the will), transfers ownership of the tangible property to the testator’s heirs.

It offers guidelines for partitioning and distributing property and assets to avoid future legal disputes amongst the heirs. The testator, however, retains the power to change or cancel it at any time.

The property will be conferred if the executor of the will is no longer alive, only then the property will be transferred. Although it is not necessary, it is usually a good idea to register a will to lessen the possibility of any disagreements over the distribution of your possessions.

The property taxes are not due by the person who receives the deceased’s property from the will deed.

Any inherited asset is also excluded from income tax rules, including Section 56(2), which counts particular transference of assets made with minimum or insufficient consideration as income to the recipient. This exemption covers assets received through the succession laws and those inherited through a will.

According to the Hindu succession law, there are no restrictions on a person’s power to pass his belongings to anyone to the exclusion of his lawful heirs. Islamic law prohibits Muslims from bequeathing more than one-third of their assets in a will.

Why is a Will Deed Important?

Most people don’t make a will because they assume their heir, or inheritors, will receive their property once they pass away. However, verbal agreements frequently result in later assertions that are inconsistent. You have a legal right and certainty to distribute your possessions if you have a will.

Here are some important pointers regarding the will deed:

- Will deed is a lawful tool for succession planning and estate management.

- The signatures of two witnesses, explicit intentions for an inheritance, and the ability of the testator to carry out the will are requirements for a document to be considered legally valid to transfer property or assets.

- The testator can amend or revoke the will at any time in a lifetime. It can be undone by a new will, a declaration in writing, or by destroying the existing will.

- After the testator’s passing, the will is carried out by a court request for a notice of administration or succession. This is the documentation that the executor received from the court. For the succession petition, court costs are also due.

- The will deed prevents future invasion, business setbacks, and other potential obstacles.

- Your Will takes precedence over the nomination for all other holdings, including real estate, mutual funds, bank accounts, insurance policies, etc.

- You can create a joint will. A combined Will can be created by both couples. However, such a joint WILL is only valid after both parties pass away, not while they are still alive.

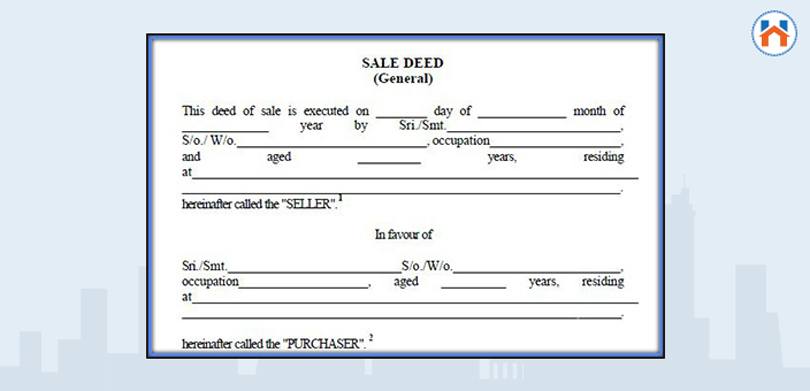

Will Deed Format in English

A will can be written for anyone that is in sound mental health. A will that was created under duress or by force will not be recognised as legal since the testator did not exercise his or her free will.

People can create a will at any point throughout their lives as long as they are at least 18 years old. A will may be written at any age and as many times as desired.

- To prepare a will deed personal details like name, address, etc are required.

- “Declaration of Date “, i.e the date the will was prepared

- You can demonstrate your free will by stating that no one has compelled you to create this will and that you are not subject to any outside pressure.

- Give the name and contact information of the executor

- Asset and Beneficiary Information

- Sign the Will after giving the foregoing information.

- Obtain at least two witnesses’ signatures on the will for it to be valid.

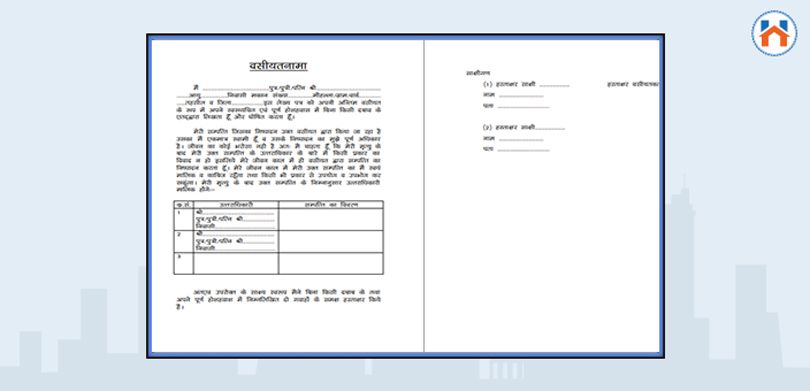

Will Deed in Hindi

The process of creating a will is one of the simplest yet most ignored tasks. Legally, you can just put down all the information about the properties or possessions on a piece of paper (Stamp paper is not required). Name the beneficiary and sign the document.

Obtain the testimony of two impartial witnesses. It is advised that your witnesses not be your will’s heirs. They shouldn’t stand to gain from your Will.

Will deeds are a powerful tool for securing bequests legitimately and establishing them while minimising the possibility of bequest disputes. When a will is performed, the proper legal counsel must be sought.

Will Deed Registration

A will deed does not have to be registered. Will registration is optional which is written under the Registration Act of 1908. The process is straightforward if you need to register a will and strengthen your last will.

For will registration, you can follow the process given below:

- A lawyer for property registration will create a will according to your instructions and mail it to you for approval.

- After the will draught has been authorised, the property registration attorney will file the will draught and a stack of supporting documents with the sub registrar’s office.

- If a document is questioned, they will call our office to resolve it.

- The property registration Lawyer will pay stamp duty online and attach a challan to the documents once it has been accepted by the Registrar.

- The completed Will document will then be made available for registration on a day that works for you.

- You must wait to get a registered will after registering. (Note that the Office of Sub-Registrar is required by law to give the final Registered Will solely to the individual who made it.)

Will Registration Fees:

The fees for registering a will for real estate are deficient. The registration of wills is exempt from stamp duty. You simply need to pay the government’s document processing fees of Rs. 20 per page.

Court Fees For Will Deed

The fees are computed using the ad valorem technique, which necessitates the probate of a portion of the estate’s value. Getting probate in cities like Chennai, Mumbai, and Kolkata is necessary. The court charges Rs 75,000 in Mumbai.

Supreme Courts Judgement on Will Deed

The Supreme Court of India recently issued a substantial and detailed judgement on granting of probate in matters of testamentary succession under the Indian Succession Act, 1925

The ruling deals with the defining and most common defence of “suspicious circumstances”, the claim that the Will is unworthy of belief to invalidate a will.

Examples of suspicious conditions include the testator’s sign being shaky or uncertain, an unequal property distribution, the unjust exclusion of the inheritance, especially the dependents, or the beneficiary taking an active or significant role in the will’s drafting.

Such suspicion, though, must be genuine and justified rather than just the imagination of a pessimistic mind.

To establish a will, a petition for the granting of probate or letters of administration is typically filed with the appropriate court.

The court asks the contending party to explain its objections to the validity of the Will after the petitioner has met the initial burden of proving the Will by demonstrating compliance with Act provisions and by naming the attesting witness(es).

The respondent now asserts that the transfer of the property as specified in the Will was not the testator’s true intention by claiming that there were suspicious circumstances surrounding the execution of the will.

Depending on the evidence and context of the case, this argument of suspicious circumstances might take on a variety of shades.

Difference Between Will and Gift Deed

A will is drafted while the testator is still alive and becomes operative upon death. According to Section 122 of the Transfer of Property Act, a gift is an uncompensated transaction of an asset or piece of property made of free will by the giver (owner of the item).

If all you wish to be assured that your assets go to the persons you select only after death and you want to use and control those assets now, you should consider giving your property away through a will. If you want to ensure a smooth succession of your possessions after your passing and allow your nominees to inherit your assets, you should consider creating a will.

However, you can only help someone who needs aid right away if you give them a present. Giving away property should only be done when essential and under certain circumstances. If you leave the majority or all of your assets to your legal heirs, you can find yourself in a sticky scenario as you get older.

FAQs

| Can will deed be challenged in court?

Yes, even a sound will be challenged in court because registration does not provide it legal sanctity or dispel doubts regarding its legality. |

| How long the will is valid after death?

Most firms maintain wills permanently, while others only keep the original wills for 50 years after they were written. |

| Who can cancel the will?

The testator has the right to revoke his will at any moment, whether it is registered or not. |

| What makes a will null and void?

The will becomes invalid if the witnesses are beneficiaries (the beneficiary’s spouse or civil partner). A testator’s will is nullified if they write one while still unmarried and then marry. |