Is 2025 a perfect time to buy a new home In India?

Before this, let’s consider what can be marked as the best time to buy a house.

When the real estate prices are low, and incomes are adequate then this can be the right time to buy a house.

The prices in the real estate market fluctuate depending on supply and demand. If demand is less, prices go down. In the current economic situation, the demand for housing is not so impressive. And on the other hand supply of the housing projects is more.

Now, this leads to a high unsold inventory of the newly constructed houses. And therefore, reduce the prices of the housing units.

In 2021, the pandemic has continued the low-demand trend for housing. The overall home sale across the country dropped by 50% in the first quarter of 2021. Therefore, to boost the demand government took initiatives such as tax benefits and low home loan interest rates. Besides, the developers have been offering the best deals and discounts.

Note:

Homebazaar serves homebuyers searching for flats in India with end-to-end services like site visits, and lower-interest home loans to property registration guidance. We provide the best price options & offers for 1 to 4 BHK RERA-registered flats, villas & penthouse properties in India. To begin a smooth homebuying journey with us, fill out the form mentioned below or on the right side.

Page Contents

- Low-Interest Rates:

- Increase In Affordability:

- Subdued Housing Prices:

- Offers And Discounts:

- Tax Reliefs:

- Some Of The Main Government housing Schemes You Should Know In 2025:

- Pradhan Mantri Awas Yojana (PMAY):

- Maharashtra Housing and Area Development Authority (MHADA) Lottery Scheme:

- Delhi Development Authority (DDA) Housing Scheme:

- Tamil Nadu Housing Board Scheme (TNHBS):

- NTR Urban Housing Scheme:

- Haryana Housing Board Housing Scheme:

Low-Interest Rates:

The biggest relief to home buyers in 2025 is low-interest rates. Most of the banks are offering home loans with an interest rate of 7% or lower. It is the lowest in the last 15 years.

Moreover, some of the banks are offering lower processing fees, and no Home Loan Preclosrure charges. Here are the current interest rates from some of the top Banks.

| Bank | Interest rates |

|---|---|

| Union Bank | 6.80% |

| State Bank Of India | 6.75% |

| Bank Of India | 6.85% |

| State Bank Of India | 6.75% |

| HDFC Bank | 6.75% |

| ICICI Bank | 6.90% |

| AXIS Bank | 6.90% |

| Kotak Mahindra Bank | 6.65% |

| Canara Bank | 6.90% |

Another important development is on the Loan-to-Value Ratio (LTV) In-Home Loan. Basically, the LTV is the percentage of total property value a bank can lend you as a home loan.

The RBI has allowed banks to offer up to 90% LTV for property value of 30 Lakh, and up to 80% LTV for property value between 30-75 Lakhs.

Moreover, there are other schemes that differ from Bank to Bank.

Some of the key points Related To Home Loan Interest:

- Joint home loans can help you to get lower home loan interest rates by increasing your overall creditworthiness.

- You can transfer the home loan to another bank where the interest rates are lower. But do consider the Home Loan Preclosure charges.

- The home loan interests are lower for the salaried applicants than the self-employed ones.

- To rescue the Home Loan interest rates and the net interest payable, you can increase the down payment amount as per your suitability.

- The Home Loan prepayments can help you to reduce the EMIs and the home loan interests.

Increase In Affordability:

The affordability of buying a new house depends on the factors such as current prices trends, supply & demand, housing inventory, income, home loan interest rates.

Therefore, the affordability index can be a comprehensive indicator to suggest the right time for buying a new house.

Let’s understand some of the key points that prove the affordability of buying a house in 2024.

- The supply of housing units is more than the demand and therefore the price has been stable.

- In 2025, property prices are increasing at a much stable rate as compared to the last few years. The incomes, on the other hand, have been fairly good in comparison.

- Moreover, owing to the unfilled inventory, the developers are ready to negotiate and have offered offers & discounts to home buyers.

- The tax relaxations have increased the affordability of buying a new house in 2024.

Why 2024 is good for buying a house because this affordability may not be the same for the upcoming years. There has already upward price trend noticed in the first quarter of 2024. Moreover, the increased prices of the basic raw materials such as Steel, Cement, etc can push the property prices up.

Therefore, many buyers are taking advantage of the current affordability benefits from the existing real estate market.

Subdued Housing Prices:

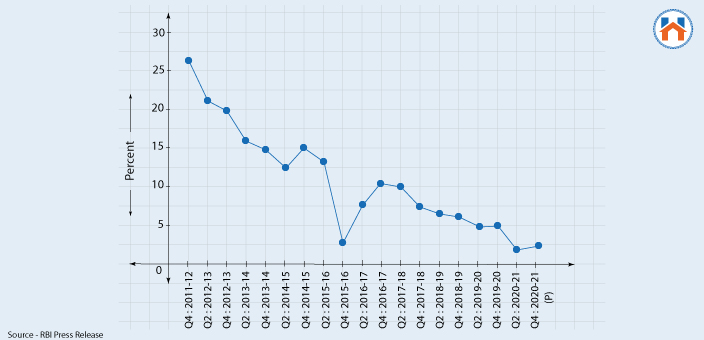

The housing prices are more or less stable. Meaning, the increase in the prices is not as significant as the previous years. The House Price Index released by the RBI for the first quarter of 2024, shows the decline in the House Price Index (HPI) index.

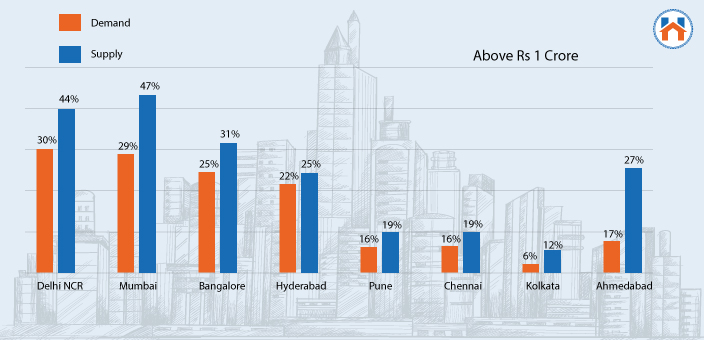

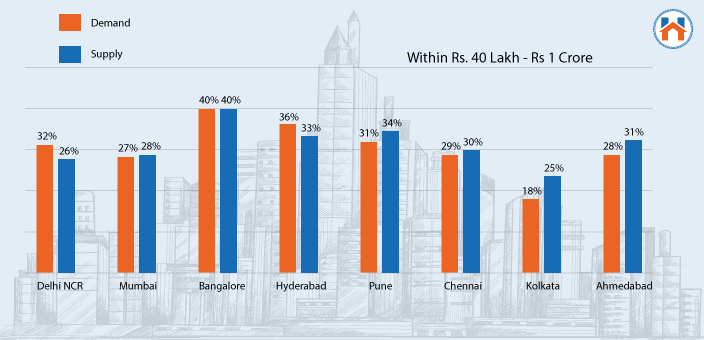

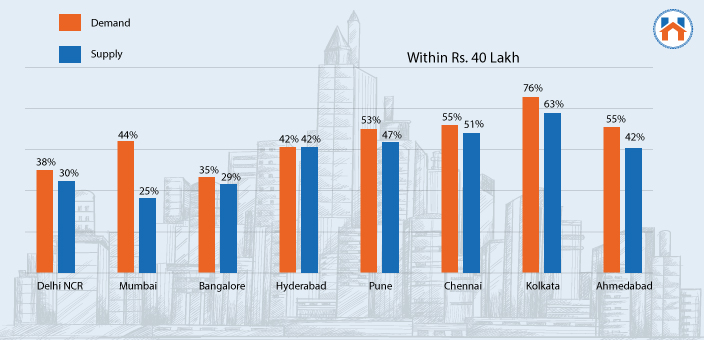

The unsold inventory has caused a major price dip in real estate properties. Even in the first quarter of 2024, the supply seems more than the demand for the key cities in India.

Supply & Demands Trends (Properties Above 1 Crore):

Supply & Demands Trends (Properties Between 40Lakh-1 Crore):

Supply & Demands Trends (Properties Within 40 Lakh):

An interesting point to note here is that the dip in the real estate market will soon show an upward trend. Therefore, buying a home in 2025 will likely give better property price appreciation and return on investment over the next few years. This is a positive indication for those who wish to invest in residential properties for resale or rental returns.

Offers And Discounts:

In 2024, the developers have been offering various schemes and discounts to their buyers. This is because of the unsold inventory and comparatively reduced housing demand.

Moreover, the builders are ready to negotiate with the buyers. Therefore, there are more chances that you might get the best deal to buy a new house in 2024 India.

The notable schemes offered by some developers are:

- Flexibility on the payments plans. Such as No equated EMIs till the possession.

- 10% booking charges and remaining at the time of possession.

- Some of the RERA-registered developers are ready to pay the stamp duty and registration charges on behalf of the buyers.

- No charges for some key amenities such as parking spaces.

- Developers are also considering giving direct cash discounts of 5-10% to the buyers.

- Some developers are offering rental payments to the buyers for the properties with a possession period of up to 1 year.

- Developers are ready to offer impressive discounts for the buyers who pay the high upfront amounts.

The offers and discounts also depend on the builder/developer. The best approach is to check out the projects which are offering the best discounts deals in your preferred locality.

Checkout the best offers and discounts

Tax Reliefs:

In Union Budget the government has provided some tax relaxation for first-time homebuyers.

If you are buying a house in 2024, you can save up to 1.5 Lakh on the annual interest payable. Provided that you are a first-time buyer and the property comes in affordable housing (market value less than 45lakh).

This is applicable till the financial year 2023-24. This means you can avail of the tax benefits up to 31 March 2022.

The government has also tax relaxation for the affordable housing projects. This may benefit the buyers by timely construction on the housing projects, reduced prices, and quality projects.

The government has been actively taking steps to boost the real estate market. And therefore the current tax relaxation can be extended for the next financial quarters.

Also, there are also smart ways to reduce stamp duty taxes in 2024. As the government has provided some relaxation for the women buyers.

Some Of The Main Government housing Schemes You Should Know In 2025:

Central and state governments launch various affordable housing schemes for the home buyers Knowing these schemes from time to time can help the property buyers to land into a perfect deal. The government generally launches these schemes to provide relaxation for the lower and middle incomes groups. However, these schemes are also coupled with the tax ad stamp duty cuts which can benefit every type of property buyer.

Therefore, let’s have look at some of the important Housing schemes offered by the central and the state government.

Pradhan Mantri Awas Yojana (PMAY):

Pradhan Mantri Awas Yojana (PMAY) aims for providing affordable housing to lower and middle incomes groups. The scheme was launched in 2015 with the target of providing homes to every Indian citizen by 2022. The scheme had two major parts- PMAY Gramin & PMAY Shahri.

The scheme had an objective to end the housing shortage in the urban as well as the rural areas.

Some Key Points of Pradhanmantri Awas Yojana:

- The PMAY schemes provide a subsidy on the Home Loan amount to the home buyers belonging to the lower or middle-income groups.

- As per the PMAY Scheme, the homebuyers are categories under different namely EWS, LIG, MIG-1, MIG-2 depending on the income. The upper limit for the loan subsidy is different for different categories.

- There is different subsidy applicable for different categories. The maximum subsidy applicable to the category is 2.67 Lakh

- The PMAY is applicable for constructing your own home or secondary market under-construction properties.

- The eligible candidates can apply for the PMAY schemes online or offline through common service centers.

Under the PMAY scheme around 50.08 Lakh houses have been completed whereas 112.95 Lakh houses have been sanctioned.

Maharashtra Housing and Area Development Authority (MHADA) Lottery Scheme:

Maharashtra Housing and Area Development Authority MHADA operates on the Lottery Basis. MHADA creates affordable housing units and allots to the people from the lower, middle, and higher incomes classes. MHADA allot a certain number of housing units in all these three categories every year.

MHADA Housing Units:

| Income Category | Range |

|---|---|

| EWS | Prices Under 20 Lakh |

| Low-income Group | Between 20-30 Lakh |

| Middle-Income Group | Up to 60 Lakh |

| Higher Income Group | Up to 5 Crore For Higher Incomes Group |

Some Of The Key Points for MHADA:

- The main eligibility criteria for MHADA is that the applicant should have the domicile certificate of the Maharastra State.

- The eligibility also depends on the income of the applicant and accordingly he gets allotted into the three different categories of EWS, LIG. MIG and HIG.

- For more benefits, you can apply for the MHADA with The PMAY scheme.

- You can apply for the MHADA online by visiting the PMAY website first. Then from there, you can select the MHADA option. While applying you need to submit some essential documents as a part of the process.

Delhi Development Authority (DDA) Housing Scheme:

Delhi Development Authority (DDA) Housing Scheme is also an official part of PMAY. DDA focuses on proving affordable housing for the Jasola, Dwarka, and Narela. The scheme is for three different incomes from EWS to the Higher Income Group.

Flats Under DDA Housing Schemes:

| Income Group | Income |

|---|---|

| EWS | 10-19 Lakh |

| Lower Income Group | 23-56 Lakh |

| Middle Incomes Group | 66-99 Lakh |

| High Income Group | 1.73 Crore |

Some Of The Key Points for DDA:

- In March 2024, DDA conducted a lottery draw for 1354 flats in Delhi. For this around

- 30,000 applications were received by the DDA. The flats were in the area such as Jasola, Dwaraka, and Magnolia.

- In 2019, the scheme offered a total of 18000 flats in Vasant Kunj and Narela region.

- The DDA Housing Scheme also offers affordable homes for widows, disabled persons, and ex-servicemen.

Eligibility:

- The applicant must belong to the specified income categories.

- The applicant should not own a house, flat, or residential plot of more than 67sqm.

- The applicant must be 21 years of age.

The application for the DDA can be done online through the official DDA website.

Tamil Nadu Housing Board Scheme (TNHBS):

Tamil Nadu Housing Board Scheme (TNHBS) provides affordable housing units to the lower and middle-income groups. TNHBS also gives reservations to the various backward communities.

The TNHBS is divided into three different divisions namely Basat Nagar Division, Trichy Housing division, Thanjauvur Housing division.

Eligibility:

- The applicant must be a native resident of Tamilnadu

- The applicant must be 21 years of age.

- The applicant or his/her family should not own a house or a plot

To apply for the TNHBS you need to submit an application to the city division or the Mofussil Unit of the respective region.

NTR Urban Housing Scheme:

In Andhra Pradesh Nandamuri Taraka Rama Rao (NTR) offers affordable homes to the lower-income groups. Under the NTR Urban Housing scheme, the applicant gets the subsidy of Rs 1.5 Lakh along with the applicable subsidy from the PMAY.

Eligibility:

- An applicant should not own a residential plot, flat, or house.

- He should not be the beneficiary of the government residential facility

- Applicant should have a white ration card and BPL.

Generally, the NTR consults different surveys to track the families that come under the NTR housing scheme. However, the applicant can apply to the NTR housing schemes through PMAY official website.

Haryana Housing Board Housing Scheme:

Haryana Housing scheme provides affordable residential as well as commercial properties for the lower and middle-income groups. The board ensures affordable housing in Haryana by running various schemes affordable housing schemes.

The Shahari Vikas Pradhikaran Scheme offers a freehold of the commercial and residential properties of other applicants with family incomes below 3 lakh. The Shahari Vikas Pradhikaran Sheme runs on a lottery basis.

Eligibility:

The Applicant must be a citizen of the Haryana State

The Applicant should not have been benefited from the Housing Board Haryana or HUDA. And should not own a flat, house, residential property.